During 2023 and 2024, the U.S. dollar flexed its muscles like never before, surging in strength driven by robust American economic growth of 2.5%, hawkish interest rate hikes by the Federal Reserve that took rates to a peak of 5.5%, and investors flocking to the safe-haven greenback amidst global uncertainties like the protracted Russia-Ukraine war and escalating US-China tensions.

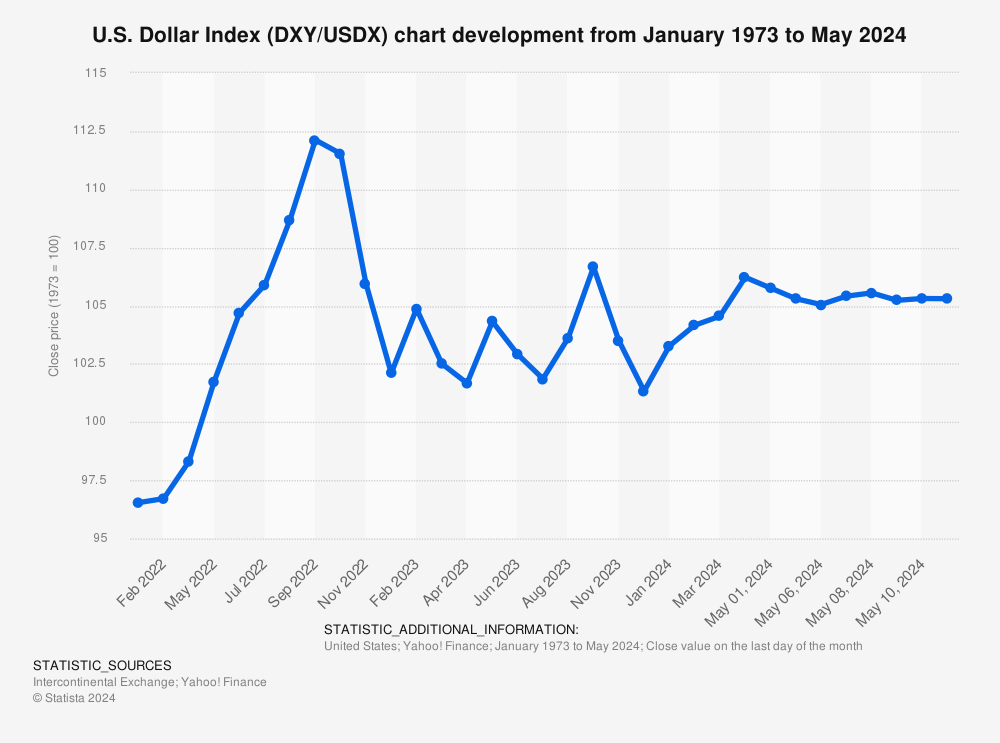

This powerhouse dollar, which saw its value climb over 15% in 2022 against other major currencies as measured by the U.S. Dollar Index (DXY), sent shockwaves through currency and foreign exchange (forex) markets worldwide.

As the greenback soared, it exerted tremendous pressure on other currency values, causing major fluctuations in the forex trading arena – one of the largest and most liquid financial markets with $7.5 trillion traded daily.

Investors found it costlier to fund risky currency carry trades and bets, while central banks watched helplessly as their foreign currency reserves lost over an estimated $1.2 trillion in value due to the stronger dollar, prompting some to diversify into other reserve currencies.

The strong dollar also had significant implications for inflation across the globe. With import prices for many countries becoming cheaper due to their currencies depreciating against the mighty dollar, this exerted downward pressure on domestic inflation rates.

However, for the United States itself, the robust dollar made imports more affordable for American consumers but also hurt exports by making U.S. goods pricier for international buyers.

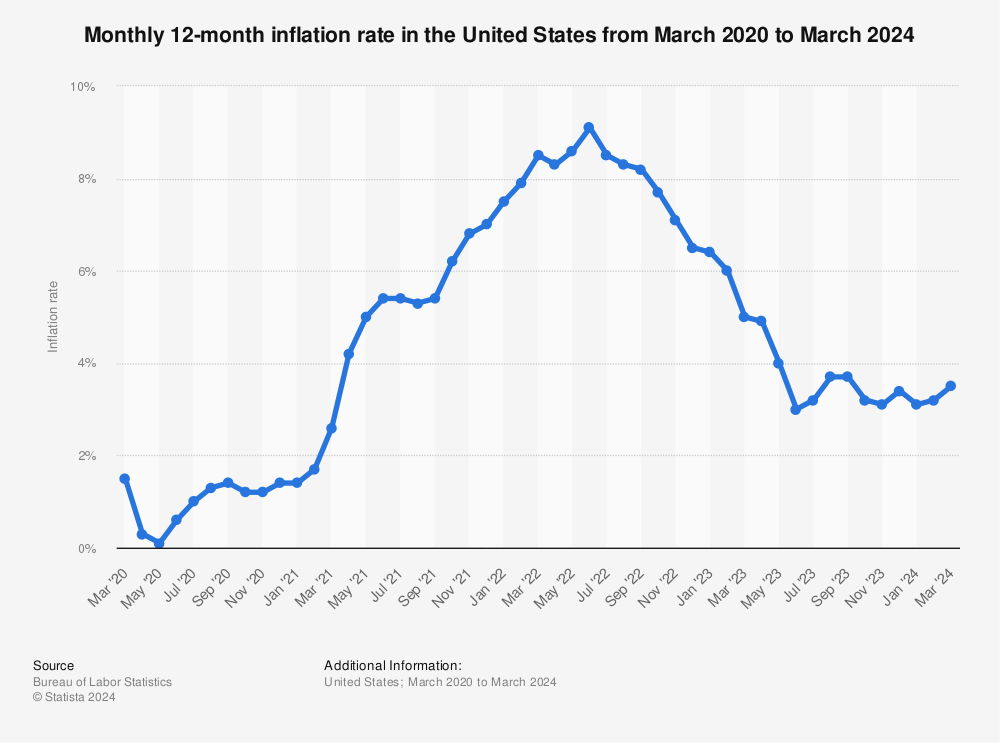

This dichotomy posed a complex challenge for the Federal Reserve in its battle against stubbornly high inflation that reached around 5-6% in 2023-2024. While the strong dollar helped ease some inflationary pressures from imports, it also risked slowing U.S. economic growth by impacting exports and corporate profits.

Central banks worldwide had to carefully weigh these dynamics when formulating their monetary policies to tame inflation without tipping their economies into recessions.

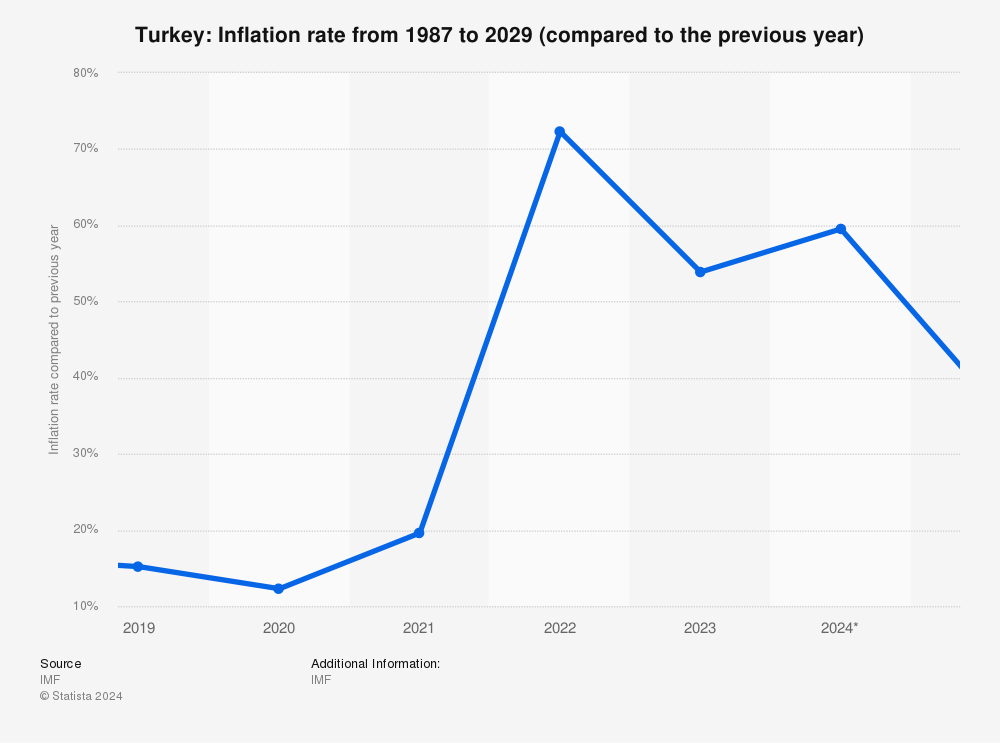

Developing economies felt the dollar’s wrath most severely. Countries like Turkey saw its embattled lira plunge over 50% against the muscular greenback, while crisis-stricken Argentina, grappling with a staggering 211.4% inflation rate, saw its peso plummet drastically in value against the soaring dollar.

Nations shackled by hefty dollar-denominated debts, like Sri Lanka and Ghana, saw their repayment costs skyrocket by billions, exacerbating economic instability and heightening default risks. Currency volatility spiked, scaring away foreign investors and triggering destabilising bouts of capital flight from troubled nations like Pakistan and Peru.

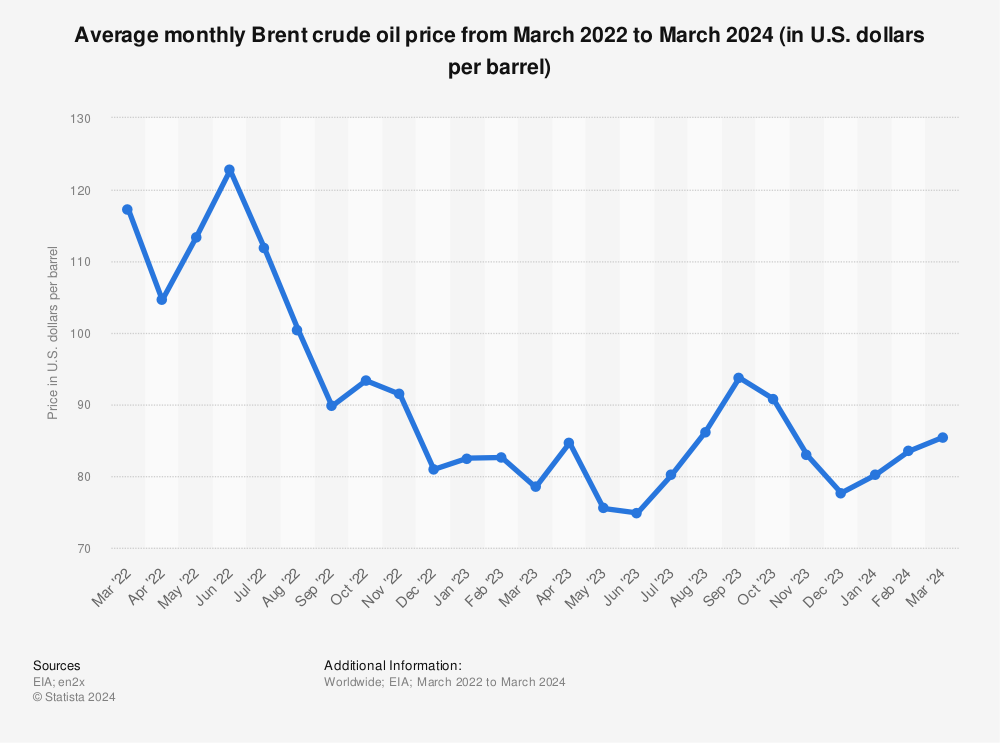

The ripple effects hit commodity exporters hard too. As the dollar surged, globally-traded commodities like oil, copper and gold became pricier for international buyers using weaker currencies, sharply denting demand.

Oil prices tumbled from over $90 to around $70 per barrel, copper fell 15%, while gold lost 10% of its value against the bullish dollar.

This battered the export revenues and economic growth of resource-rich economies like Canada, Australia, and Brazil, brutally weakening their commodity-linked currencies.

The dollar’s dominance shook up the major currency pairs favoured by traders and multinationals alike. The euro lost a staggering 7% to the relentless greenback, the British pound sterling fell 11%, while Japan’s yen plunged over 16% against the muscular dollar.

American corporations like Walmart and Caterpillar exporting goods abroad found it tougher to compete on pricing, while foreign rivals like Toyota and Volkswagen gained an edge selling their products cheaper in the lucrative U.S. market.

Global firms had to urgently review pricing strategies and currency hedging tactics to shield profit margins from these wild swings.

Some nations fired back aggressive currency interventions to preserve their export competitiveness against the almighty dollar.

The Bank of Japan spent a whopping $60 billion propping up the yen – its biggest market intervention in over two decades.

Not to be outdone, the Swiss National Bank offloaded over $100 billion in a concerted effort to curb its franc’s sharp appreciation against the euro and dollar which threatened Swiss exports. China too weakened the yuan by around 8% to bolster its exporters.

But such dramatic moves stoked fears across markets of a destructive ‘currency war’ breaking out if countries continually devalued their currencies to gain an export edge.

Predicting the dollar’s trajectory going forward remains one of the hottest debates across financial capitals.

Some economists and analysts expect the greenback’s strength to gradually cool down as major global economies stabilise and other central banks like the European Central Bank follow the Fed in aggressively hiking rates to tame inflation.

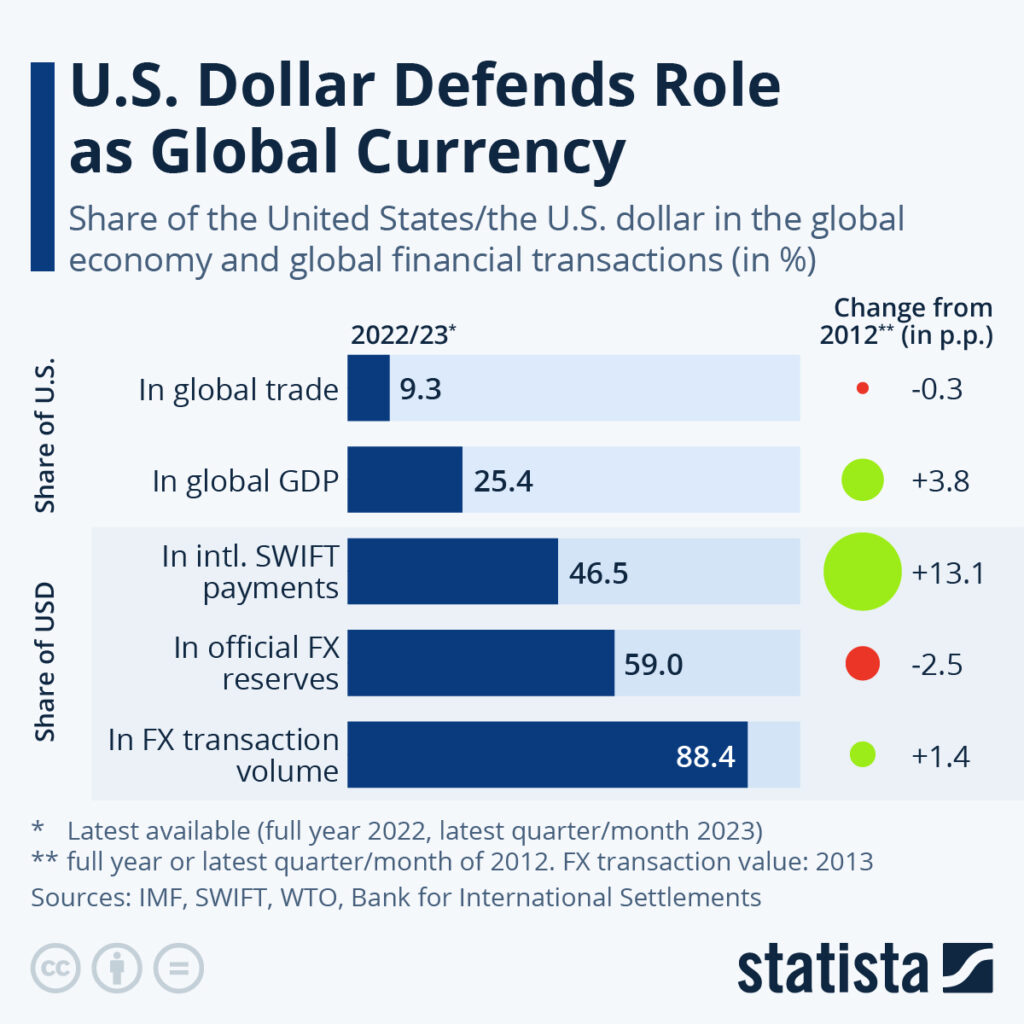

However, others point to the dollar’s entrenched role as the world’s predominant reserve currency, now accounting for 59% of global foreign exchange reserves, coupled with America’s relatively robust economic performance and attractiveness of U.S. financial markets, as powerful structural factors bolstering the greenback’s prolonged dominance.

Uncertain factors like the path of persistent inflation hovering around 5-6% across developed nations, interest rate moves by central banks, festering trade tensions, shifts in global supply chains, commodity market shocks and geopolitical flare-ups will undoubtedly keep roiling and shaping currency values going forward.

Corporations with sprawling global operations, institutional investors with cross-border exposures and individual traders will need to stay exceptionally vigilant, buttressing themselves with robust currency risk management strategies, active hedging using derivatives like futures and options, and well-diversified portfolios to safely navigate this ever-shifting landscape.

In conclusion, the U.S. dollar’s awe-inspiring muscular performance during 2023-2024 triggered an upheaval across global currencies and frenzied forex trading arenas.

While the greenback’s prolonged heavyweight status remains hotly debated, its pre-eminent position as the world’s reserve currency coupled with America’s economic and financial market strength, ensures its movements will keep reshaping international trade flows, reorienting capital shifts and whipsawing exchange rates worldwide for the foreseeable future.

Constant preparedness through prudent currency hedging, rigorous risk mitigation and coordinated international policy efforts will prove vital to weather future dollar storms that shake the global financial order.