On 12 April 2024, the price of gold shattered records, reaching a staggering USD 2,431.42 per ounce. This 30% increase year-over-year has sent shockwaves through the financial world, particularly exciting forex traders with a keen eye on this timeless asset. But what’s driving this golden phenomenon?

Gold has captivated humanity for centuries, not just for its beauty, but also for its enduring value. Throughout history, it has played a significant role in the global financial system, earning a reputation as a store of value and a hedge against inflation.

These characteristics make gold an especially attractive asset for traders during times of economic uncertainty. Here’s why:

So, what’s behind the recent surge in gold prices? Several key factors are at play:

The ongoing conflict between Russia and Ukraine has sent ripples of unease throughout the global economy. This uncertainty can push investors towards safe havens like gold, with demand for gold bars in Europe surging by 300% in the first quarter of 2024 compared to the previous year.

Fears of a recession are rising, with the International Monetary Fund (IMF) recently downgrading its global growth forecast to 3.6% for 2024. This economic slowdown can also increase demand for gold as a hedge against potential financial instability.

The Federal Reserve’s recent pivot towards a more dovish stance, hinting at potential interest rate cuts in the latter half of 2024, has impacted the gold market. In a low-interest-rate environment, gold becomes a more attractive option compared to traditional fixed-income investments that currently offer minimal returns. For instance, the yield on the benchmark 10-year Treasury note has fallen to a record low of 1.2% in April 2024.

Recent trends in physical gold demand from consumers and central banks can also influence the price. In India, the world’s largest gold consumer, demand surged by 22% in the first quarter of 2024 compared to the same period last year, driven by the upcoming wedding season and rising disposable incomes.

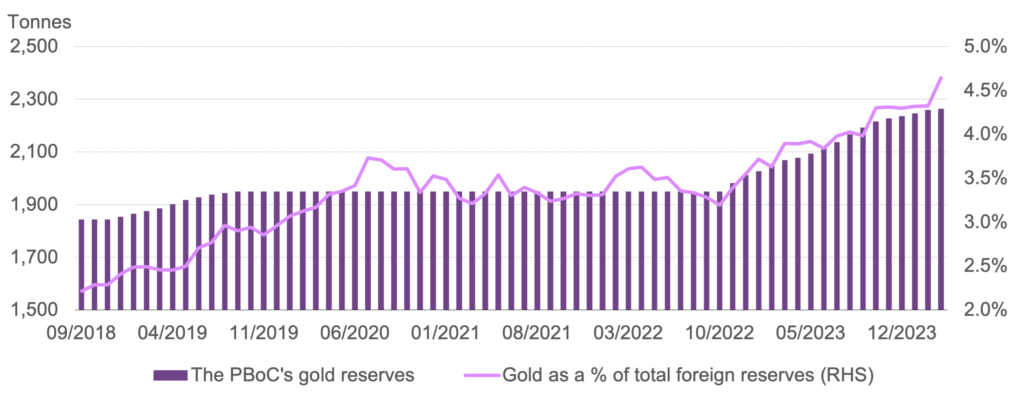

On the institutional side, central banks around the world have been net buyers of gold for the past five years. China, a major player in this trend, has been accumulating gold for years and now holds the world’s second-largest reserves, estimated at around 3,000 tons, trailing only the United States.

Their buying spree shows no signs of stopping, with reports suggesting they added a significant 150 tons to their reserves in just the first quarter of 2024. This growing appetite for gold from central banks, particularly China, could further support rising prices.

Predicting the future price of any asset is inherently challenging. Experts hold diverse opinions on the gold price outlook, with some analysts at Goldman Sachs predicting a further rise to $3,000 per ounce by the end of 2024, while others at JPMorgan Chase remain cautious, maintaining a neutral price target. Instead of chasing price predictions, focus on developing sound trading strategies based on thorough market analysis.

CFD trading allows you to participate in the gold market by speculating on price movements without physically owning the metal. VT Markets offers a user-friendly trading platform where you can trade gold CFDs.

Here are some key strategies to consider:

VT Markets also offers up to 500:1 leverage on gold, a tool that can amplify your potential profits. Leverage allows you to control a larger gold position with a smaller initial investment. For example, with 10:1 leverage, a $1,000 investment can control a $10,000 gold position. However, it’s crucial to use leverage responsibly, practicing sound risk management strategies like stop-loss orders to mitigate potential losses.

In addition to a user-friendly platform, VT Markets provides daily market analysis and valuable educational resources to help you make informed decisions and navigate the gold market with confidence. Plus, test your strategies risk-free with their demo accounts.

In conclusion, the factors driving the gold price surge are complex and multifaceted. Understanding these factors, coupled with a well-defined trading strategy and a commitment to risk management, can empower you to potentially capitalise on this golden opportunity. If you’re interested in learning more about gold CFD trading, explore the resources offered by VT Markets and take the first step towards joining the gold rush.