The global economy is a complex and ever-changing landscape. For traders, understanding the key trends shaping this landscape is crucial for making informed decisions and navigating market volatility.

As we move through 2024, several significant trends are influencing economic growth, inflation, and regional performance. By staying informed and adapting your strategies accordingly, you can position yourself for success in this dynamic environment.

While the global economy continues to recover from the pandemic, the pace has slowed in 2024. This shift necessitates a closer examination of the underlying factors influencing growth. Understanding these dynamics, such as inflation and regional disparities, becomes crucial for traders navigating the evolving economic landscape.

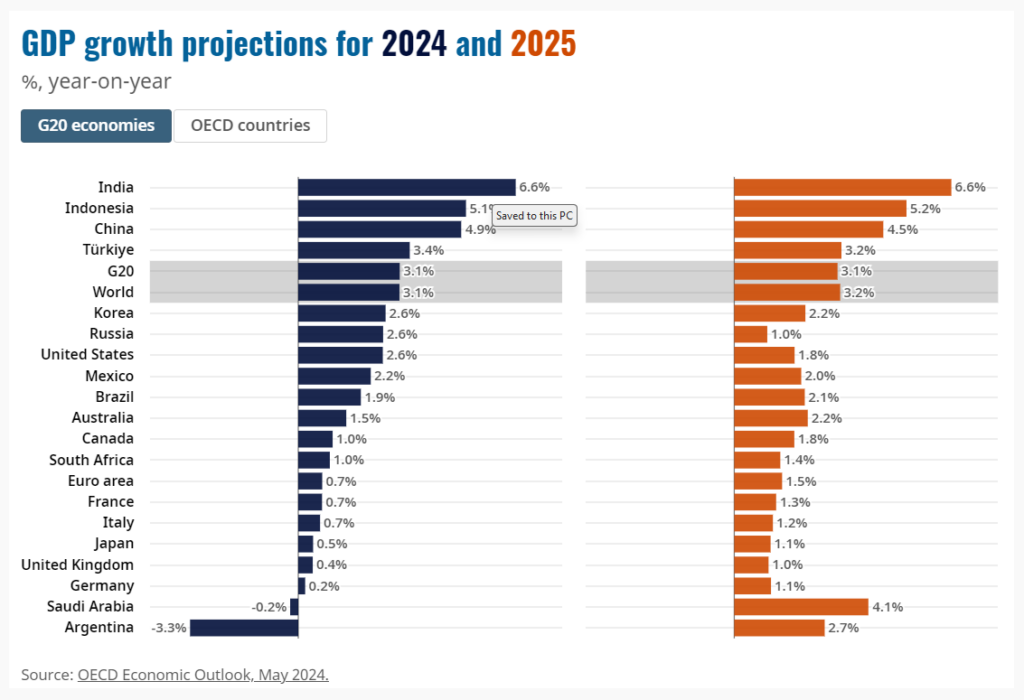

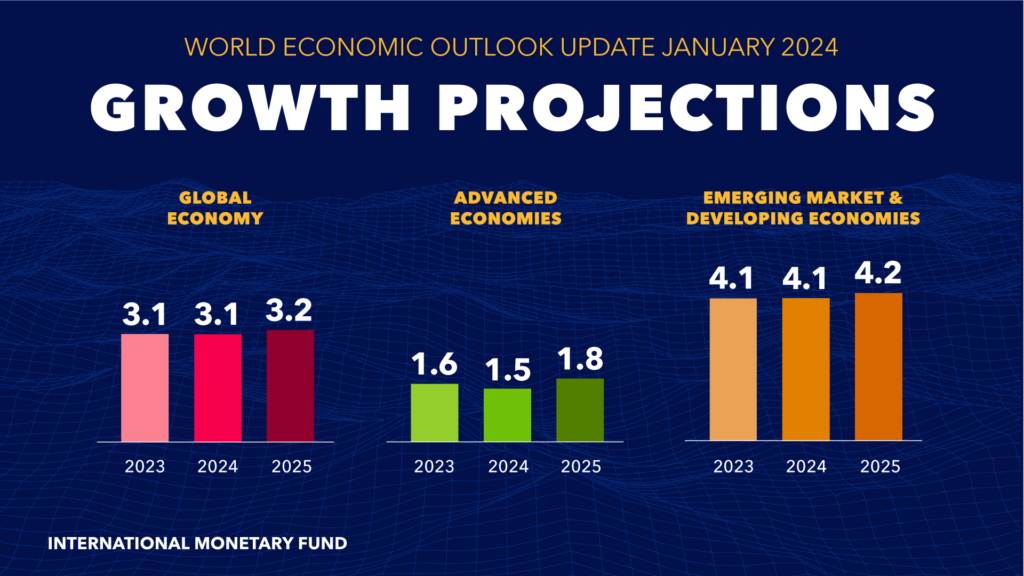

Gross domestic product (GDP), the total value of goods and services produced in an economy, is a key indicator of economic growth. Forecasts from organisations like the OECD (Organisation for Economic Co-operation and Development) suggest global GDP growth in 2024 will be around 3.2%, indicating a continuation of the post-pandemic recovery, albeit at a slower pace compared to pre-crisis trends.

Inflation, the rate of price increases, has been a major concern in recent years. While some relief is expected, with global inflation projected to decline steadily, reaching around 4.5% by 2025, this doesn’t mean traders can breathe a sigh of relief just yet.

Forecasts suggest inflation might still be around 5.8% in 2024. This is why central banks like the US Federal Reserve are likely to continue raising interest rates to curb inflation. These actions can impact borrowing costs and economic activity, so monitoring central bank announcements and economic data releases is crucial.

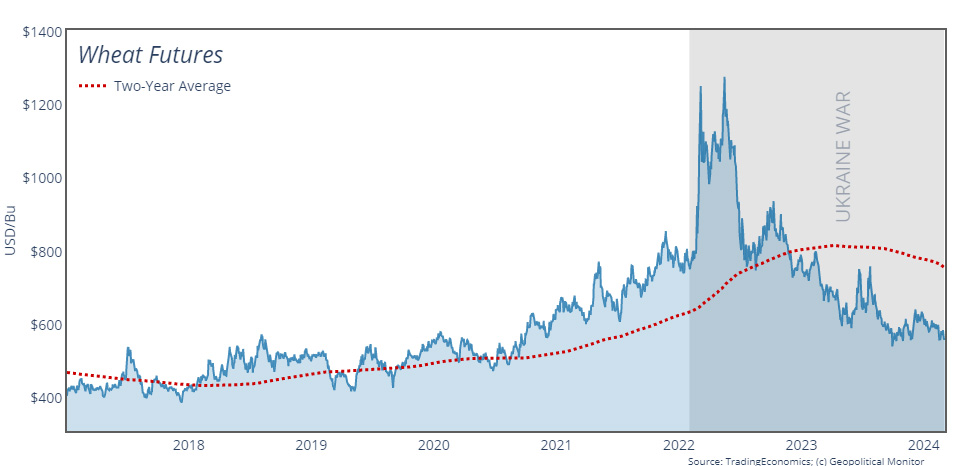

The global economic landscape is not only shaped by internal factors but also by external forces like geopolitical tensions. Escalating geopolitical tensions, like the ongoing conflict between Russia and Ukraine, can have far-reaching consequences.

Such conflicts can disrupt supply chains, causing shortages of key resources like oil and wheat, leading to price fluctuations in sectors like energy and commodities. Additionally, these tensions can trigger market volatility, impacting investor confidence and potentially leading to significant price swings in various asset classes.

Sectors potentially affected:

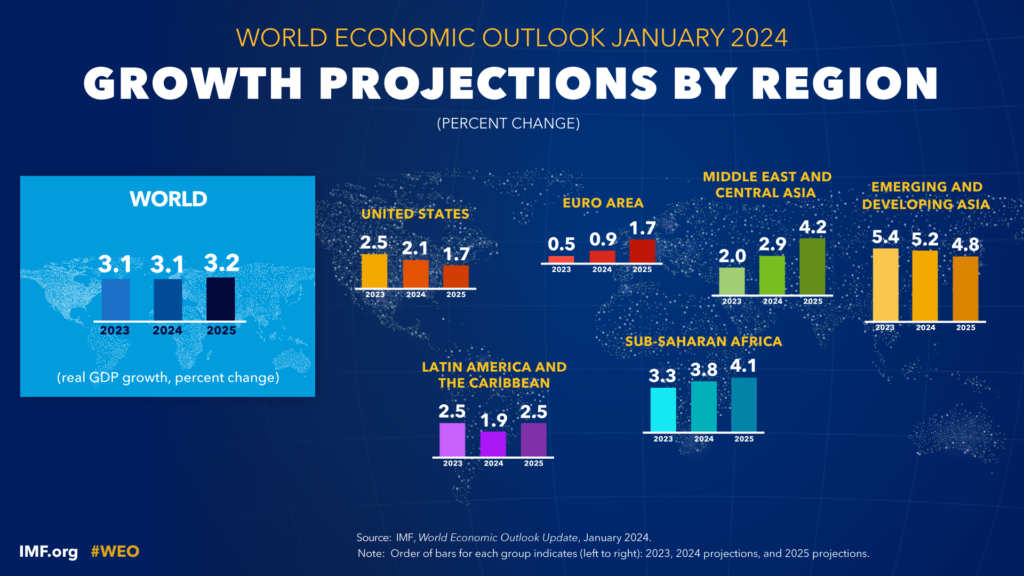

The story of economic growth in 2024 is not uniform across all regions. Developed economies, which may see a slight acceleration to around 1.8% by 2025 according to the IMF (International Monetary Fund), might outperform emerging markets.

Emerging markets, facing a projected slowdown to around 4.2%, could be negatively impacted by factors like slower growth in large economies like China, a key trading partner for many. This disparity highlights the importance of considering regional variations when making trades.

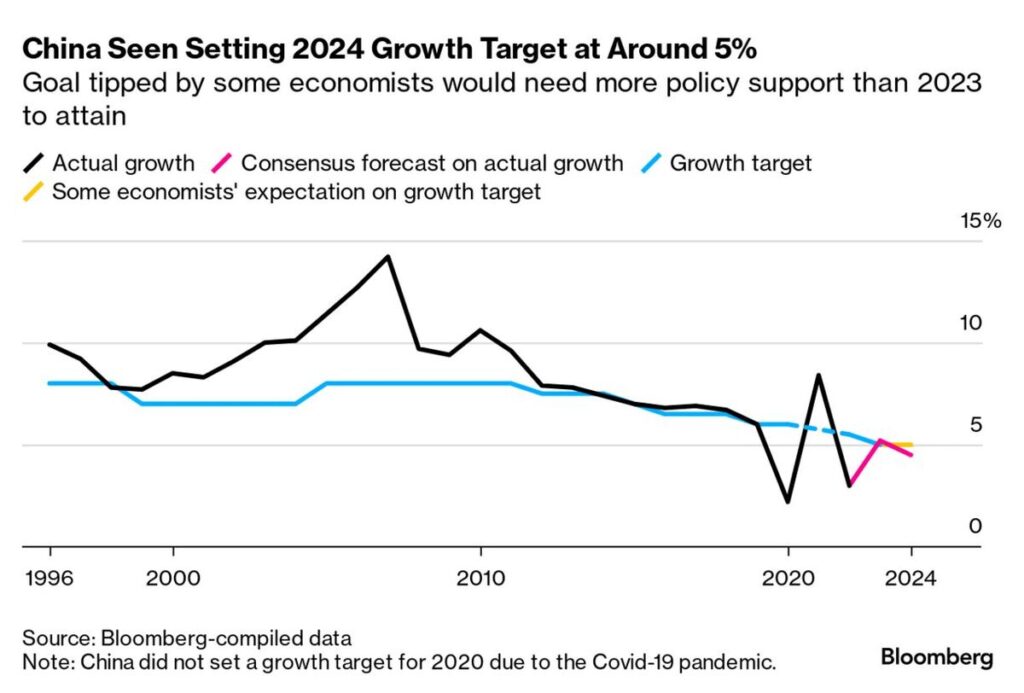

Slower growth in large emerging economies like China, a powerhouse contributing significantly to global trade, presents a unique challenge in 2024. Forecasts suggest China’s economic growth might experience a notable slowdown, potentially dipping below 5% for the year.

One major concern is the potential decline in demand for exports from other countries. China, a major importer of raw materials and finished goods, could see a decrease in these purchases as its economic activity slows. This could particularly impact economies heavily reliant on exports to China, potentially leading to job losses and decreased production in certain industries.

The interconnectedness of the global economy makes China’s slowdown a significant factor for traders to consider. By understanding the potential impact on specific industries and regions, traders can make informed decisions about their investments and potentially mitigate some of the risks associated with this emerging market challenge.

Amidst the ongoing recovery, the outlook for long-term growth appears muted. Factors such as constrained labour and capital mobility are curbing productivity gains, signalling a slower economic trajectory beyond 2025. Traders must factor this shift into their strategies carefully.

Limited movement of skilled labour and investment across borders constrains productivity and innovation potential. Forecasts, including those from the IMF, indicate that global GDP growth may stabilise around 2.5% to 3% in the years beyond 2025, compared to pre-crisis levels.

With a solid understanding of the major economic trends in 2024, you can now translate that knowledge into actionable strategies for your trading. Here are some key considerations:

In conclusion, navigating the 2024 economic landscape requires understanding key trends: modest growth, inflation decline, geopolitical tensions, regional variations, and long-term growth prospects. This knowledge empowers traders to develop informed and adaptable strategies. By staying informed, focusing on opportunities, and prioritising risk management, you can navigate market complexities and position yourself for success. Remember, continuous learning fuels informed decisions – stay curious and adapt as the economic story unfolds.