Welcome to the world of Forex trading, a dynamic marketplace where currencies are bought and sold. This market offers incredible potential for profit, but it’s crucial to understand and manage the risks that come with it.

Read more about the nature of risks and emotional discipline techniques in our previous article. In this guide, we’ll explore practical risk management strategies to help non-professional traders like you navigate the Forex market and make informed trading decisions.

Stop Loss and Take Profit Orders

In the fascinating world of Forex trading, mastering risk management isn’t just a good practice—it’s a game-changer. Let’s talk about two powerful allies in this domain: stop loss and take profit orders.

These tools are like your trading buddies, keeping you safe from sudden market changes and helping you stay on track. For anyone starting out in Forex and wanting to succeed, knowing how to use these tools is really important.

Stop Loss Orders

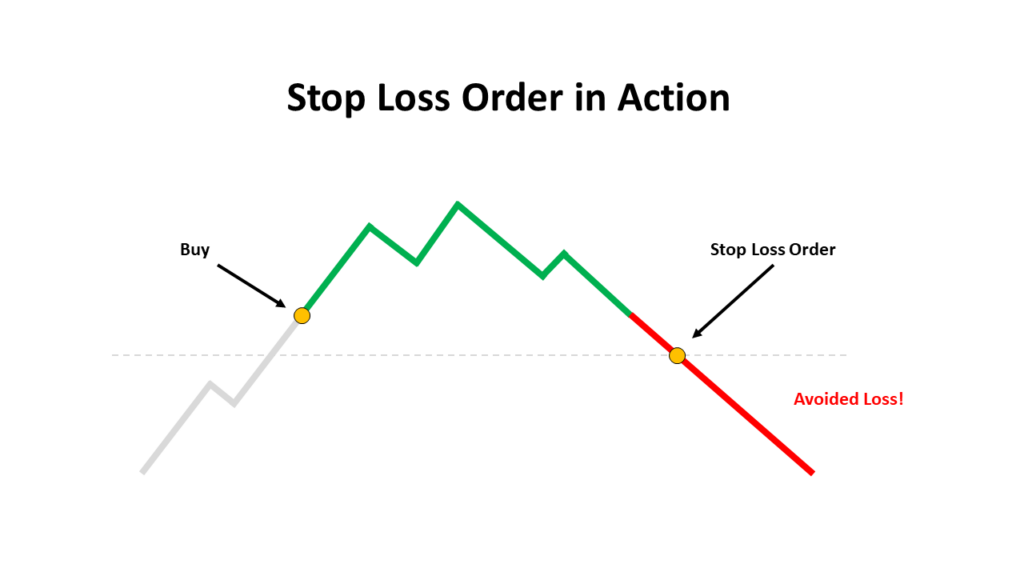

A stop loss order is a protective tool used in Forex trading to minimise potential losses by automatically closing a trade when the market moves against your position. It serves as a buffer against unexpected market shifts, providing traders with a predefined exit strategy to limit their downside.

Let’s say you enter a trade to buy EUR/USD at 1.2000. You set a stop loss order at 1.1950. If the market price drops and reaches 1.1950, your trade will automatically close, limiting your loss to 50 pips.

Take Profit Orders

A take profit order is a predefined price level at which you choose to close a portion or the entire trade to secure profits. This structured approach enables you to lock in gains, maintaining discipline in your trading strategy by closing the trade at a predetermined profit level and ensuring you secure profits before the market potentially reverses.

Continuing with the EUR/USD trade, if you set a take profit order at 1.2050, and the market price reaches this level, your trade will automatically close, securing a profit of 50 pips.

Setting Realistic Levels

When setting stop loss and take profit levels, consider a comprehensive analysis of the market, historical price data, and your risk appetite. It’s akin to planning your bike ride route based on your fitness level and preferences. Assess the market conditions, recent trends, and your trading goals to determine optimal levels.

Risk-Reward Ratio

The risk-reward ratio is a fundamental metric used in trading to measure the potential profit in relation to the potential loss for a specific trade.

Maintaining an advantageous risk-reward ratio is paramount, ensuring that the potential reward significantly outweighs the potential risk. This balance is key to bolstering the overall profitability of your trades.

The risk-reward ratio is calculated by dividing the potential profit by the potential loss for a trade:

Risk-Reward Ratio = Potential Profit / Potential Loss

Let’s say you are willing to risk $100 on a trade in the hopes of making a potential profit of $300. In this scenario, your risk-reward ratio would be 1:3. This implies that for every $1 you risk, your potential reward is $3.

A favorable risk-reward ratio helps you assess whether a trade is worth pursuing. For instance, a ratio of 1:3 indicates that you are aiming for a reward three times greater than your risk. This can guide your trade decisions and contribute to a more successful trading strategy over time.

Diversification

Diversification, in the context of Forex trading, means spreading your investments across various currency pairs or assets. This approach is aimed at reducing risk and promoting a more balanced investment portfolio.

Diversification offers a twofold advantage. Firstly, it helps to mitigate the impact of a downturn in a single currency pair. Secondly, it ensures your portfolio is not overly reliant on one particular asset, providing stability in varying market conditions.

Picture diversification like building a well-rounded meal. Just as you’d include a mix of proteins, vegetables, and grains for a balanced diet, diversifying your investment portfolio involves including different currency pairs to create a balanced financial “meal.” This strategic approach aims to minimise the overall risk and maximise potential returns.

By spreading your trades across different currency pairs, you avoid overconcentration in a single pair. Think of it as not putting all your eggs in one basket. This way, if one currency pair experiences an adverse movement, it won’t drastically impact your entire portfolio, allowing for more consistent and sustainable trading outcomes.

Using Economic Calendars

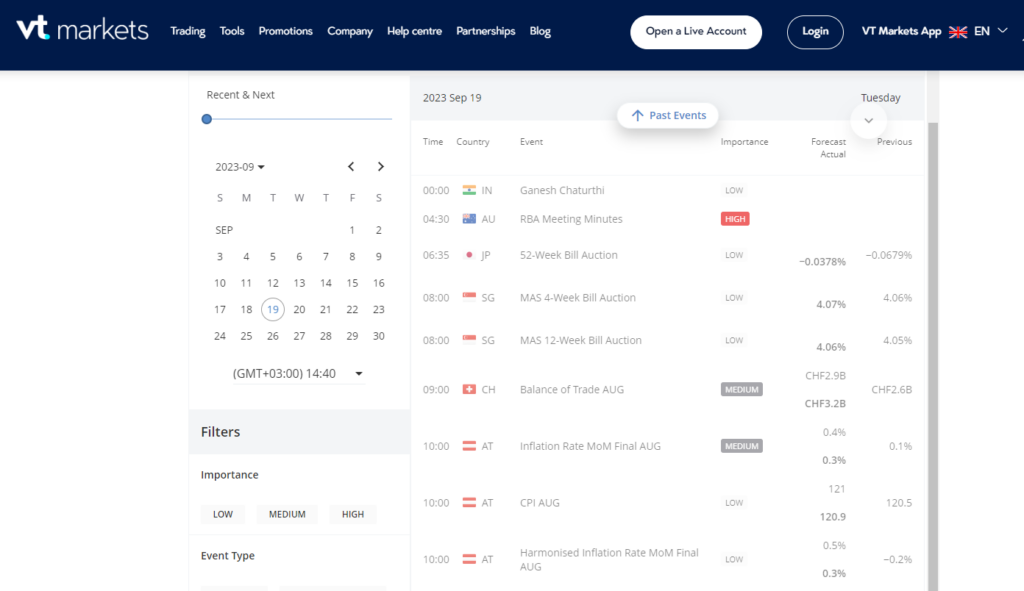

Economic calendars are valuable tools that offer crucial information about upcoming economic events and indicators that could impact the financial markets.

Leveraging the data from economic calendars allows traders to make informed decisions and adjust their trading strategy in anticipation of significant market movements driven by economic events.

Imagine you’re planning a cross-country road trip. Before you hit the road, you’d naturally check the traffic conditions, right? Similarly, in trading, economic calendars like the one provided by VT Markets serve as your traffic report for the Forex market.

They provide advanced knowledge about economic events, helping you navigate the market more effectively. By considering the economic calendar data, you can make informed decisions about when to enter or exit trades, thereby reducing the risk of being caught off-guard by unexpected market volatility.

Demo Trading

A demo trading account is a simulated trading environment that allows you to practice trading using virtual funds. The primary purpose of a demo account is to familiarise yourself with the mechanics of the market and the trading platform without risking your actual capital.

Demo trading offers a multitude of benefits. Firstly, it provides a risk-free environment for refining your risk management skills. Secondly, it allows you to experiment with different trading strategies, helping you identify what works best for you. Lastly, it can boost your confidence as you witness your virtual trades succeeding, offering a valuable learning experience.

A demo account with VT Markets offers traders a completely risk-free opportunity to hone their skills and test strategies before engaging in live trading. With virtual funds at your disposal, you can gain valuable hands-on experience in a secure environment. To open your demo account with VT Markets and embark on your risk-free trading journey, simply tap on this link: Open demo Account with VT Markets.

Risk Management Tools

Risk management tools, including position sizing calculators, play a crucial role in the trading world. These tools aid in determining appropriate position sizes for your trades based on various factors like risk tolerance, account balance, and trade specifics.

Making the most of these tools involves using them strategically to align your position sizes with your risk tolerance and trading objectives. It’s about finding the right balance that allows for potential profits while mitigating potential losses.

A position size calculator helps traders decide the appropriate trade size considering factors like risk tolerance, account balance, and stop-loss levels. By inputting these parameters, it ensures trades align with their risk strategy, facilitating informed and responsible trading decisions.

In conclusion, mastering risk management in Forex trading is a journey that requires discipline, knowledge, and continuous learning. By understanding and implementing the strategies outlined in this guide, you’ll be better equipped to navigate the Forex market while preserving and growing your investment. Always remember, successful trading is not about avoiding risks entirely, but managing them wisely to achieve your financial goals. Happy trading!