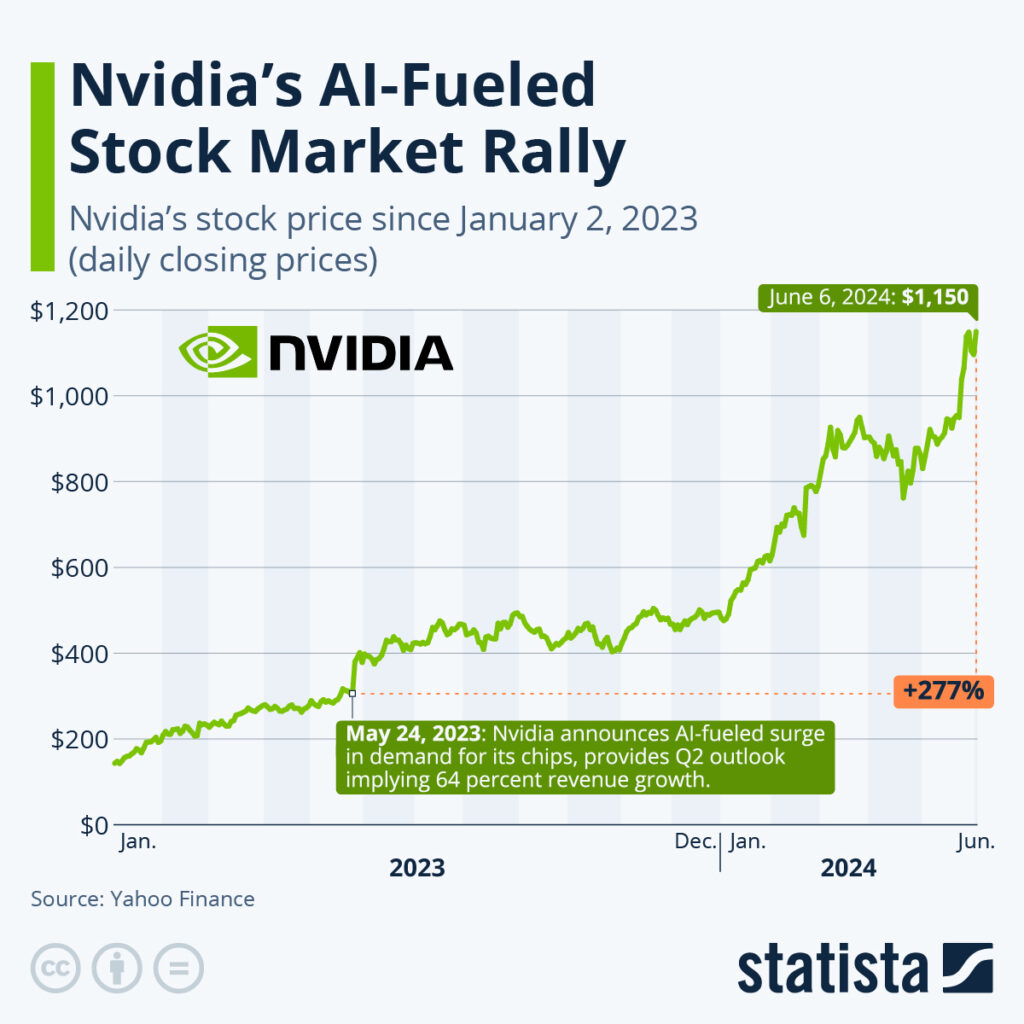

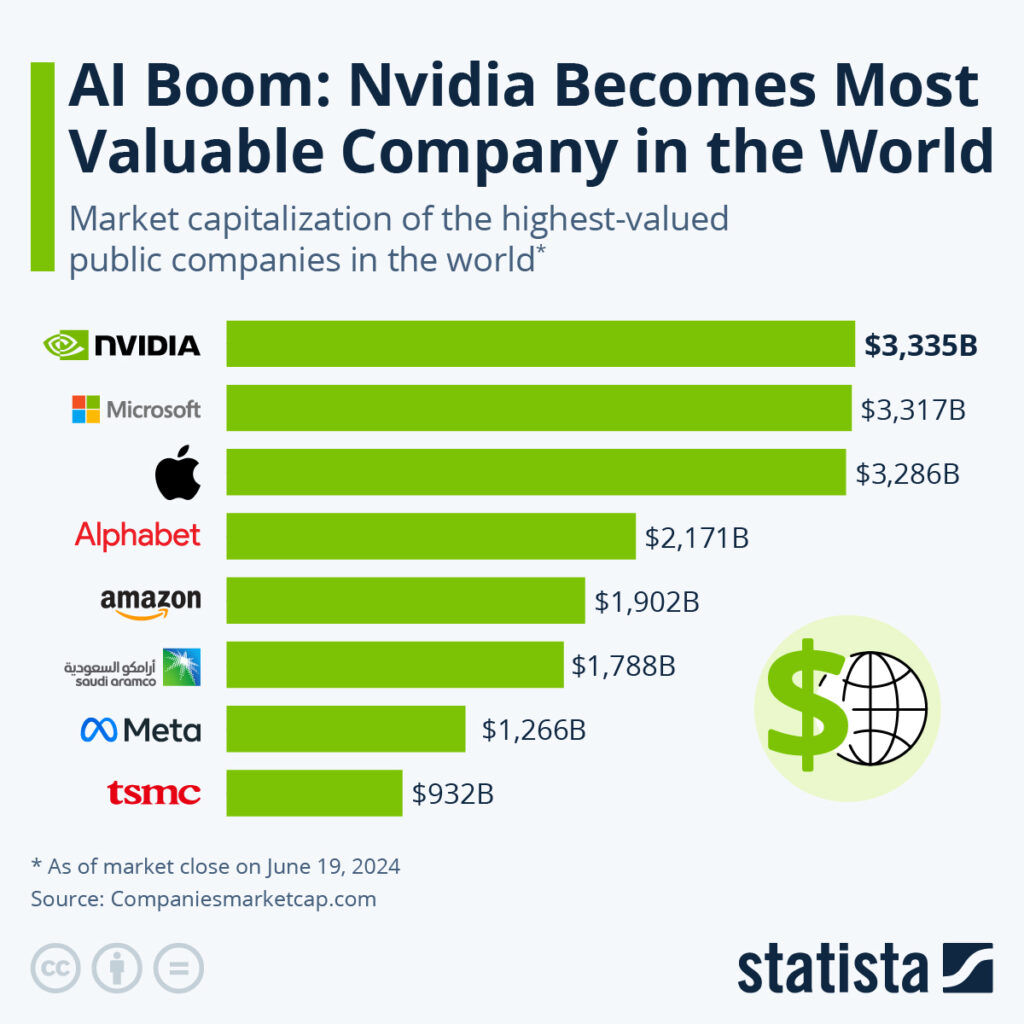

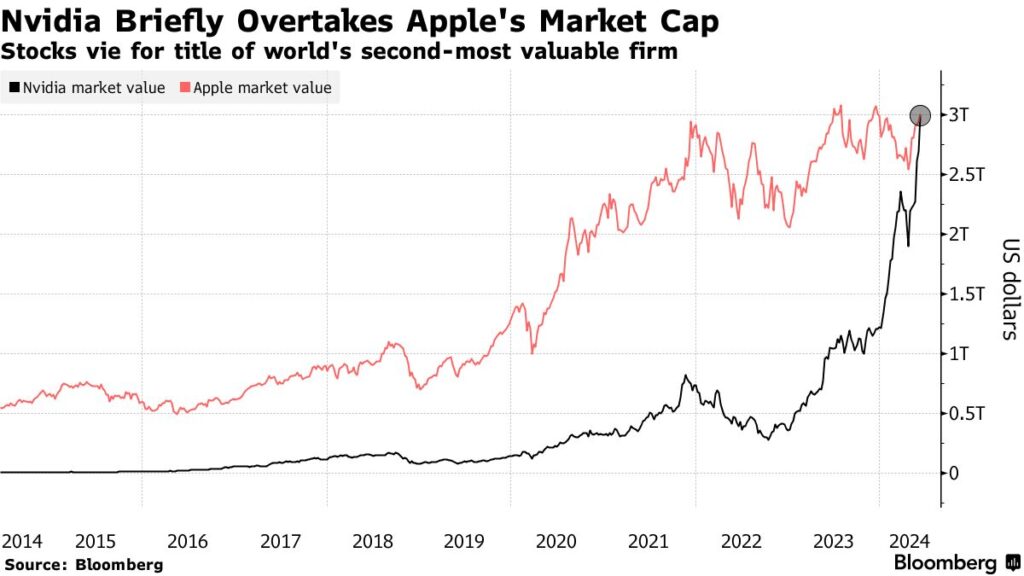

Nvidia’s stock price has been on a tear recently, surpassing the coveted USD 3 trillion market cap. This meteoric rise has captivated investors worldwide, particularly those interested in the chipmaking and artificial intelligence (AI) sectors. But what’s propelling Nvidia to such dizzying heights? Let’s delve deeper into the key factors driving this impressive rally.

At the core of Nvidia’s success lies its dominance in the Graphics Processing Unit (GPU) market. GPUs are the workhorses behind powerful gaming PCs, enabling smooth and immersive visuals. However, Nvidia’s reach extends far beyond the realm of gamers.

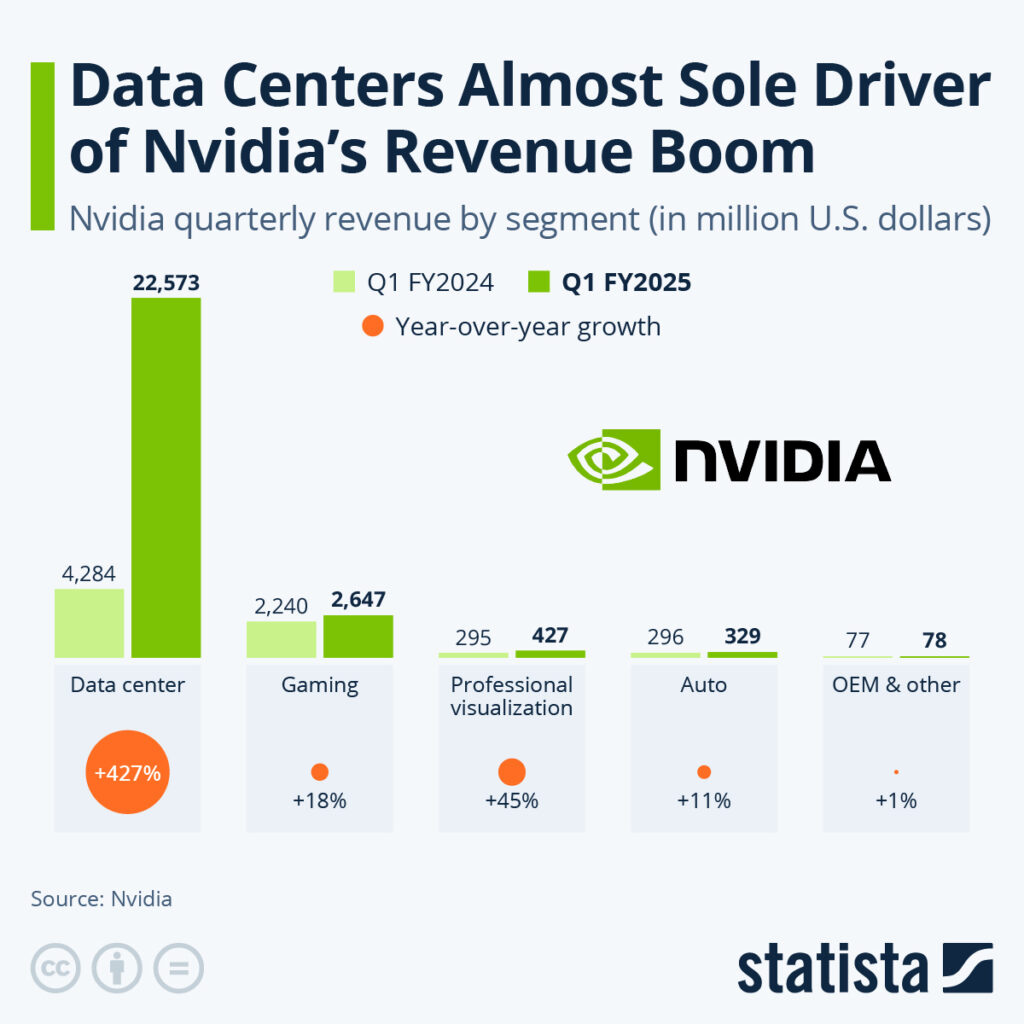

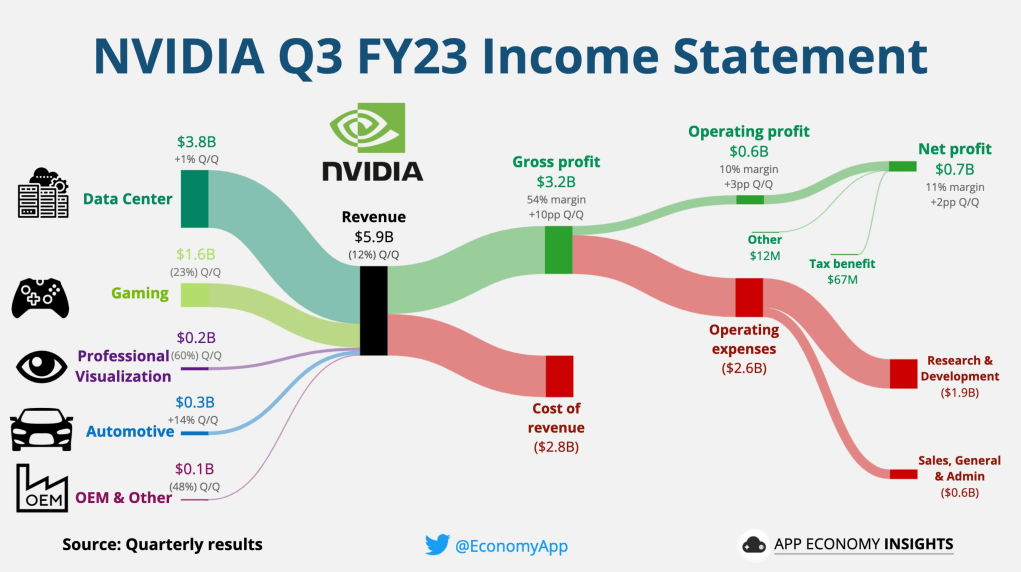

Data centres are a major driver of demand for Nvidia’s GPUs. These massive computing facilities require immense processing power to handle complex tasks like scientific simulations, financial modelling, and large-scale data analysis.

Nvidia’s GPUs excel in these computationally intensive workloads, making them the preferred choice for leading data centre operators. According to Grand View Research, the global data centre GPU market is expected to reach a staggering USD 71 billion by 2030. This growth signifies the continued reliance established markets have on Nvidia’s technology.

Artificial intelligence is another significant factor propelling Nvidia’s growth. Training complex AI models requires immense computational power, and Nvidia’s GPUs have become the gold standard for this task. These models, used in everything from facial recognition software to self-driving cars, demand immense processing capabilities that traditional CPUs struggle to provide.

A report by Precedence Research predicts the global AI business will reach a staggering USD 2.6 trillion by 2032. This vast potential in the AI sector fuels significant demand for Nvidia’s GPUs.

Nvidia isn’t resting on its laurels; it’s actively expanding into exciting new markets with immense potential.

The nascent Metaverse, a virtual world where users can interact and conduct business, heavily relies on Nvidia’s technology for rendering realistic and immersive environments. As the Metaverse evolves and adoption increases, the demand for Nvidia’s GPUs is expected to climb steadily.

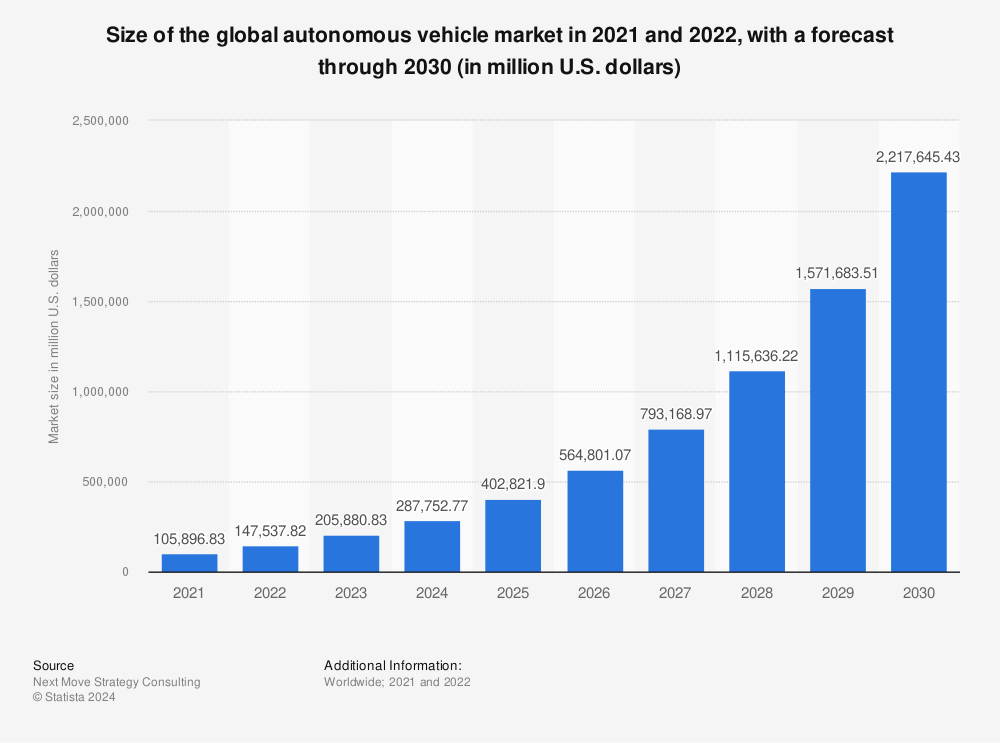

The development of self-driving cars hinges on real-time decision-making and processing massive amounts of data. Nvidia’s GPUs provide the cutting-edge processing power needed for these complex algorithms, positioning them as a key player in the autonomous vehicle revolution.

According to Next Move Strategy Consulting, the global autonomous vehicle market is projected to reach a value of USD 2.2 trillion by 2030. This projected growth signifies a significant opportunity for Nvidia in this emerging market.

Nvidia’s recent deal with Ooredoo, a telecom company in the Middle East, to bring its AI expertise to the region exemplifies its commitment to global expansion. This move not only opens new markets but also fosters wider adoption of AI technology on a global scale.

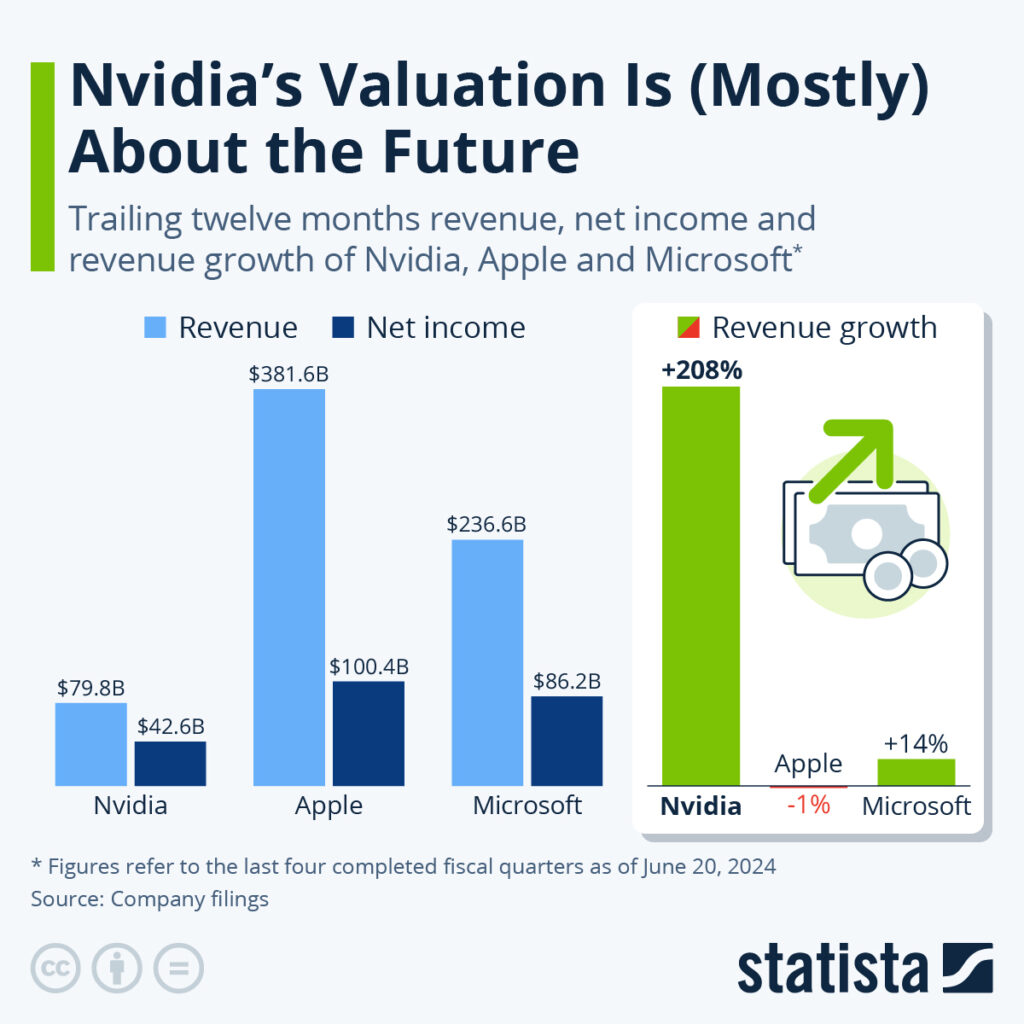

Nvidia’s financial performance has been extraordinary, with its annual revenue soaring by nearly 500% over the past five years.

The company’s data centre business has been the primary driver of this growth, now accounting for an impressive 83% of total revenue. In Nvidia’s fiscal 2024 fourth quarter, this segment experienced a staggering 409% year-on-year increase.

Looking ahead, management’s projections remain bullish, forecasting a 234% rise in total revenue for the first quarter of fiscal 2025.

This exceptional growth is fuelled by the anticipated surge in enterprise spending on data centres, as cloud service providers ramp up their infrastructure investments to meet the escalating demand for AI-related services.

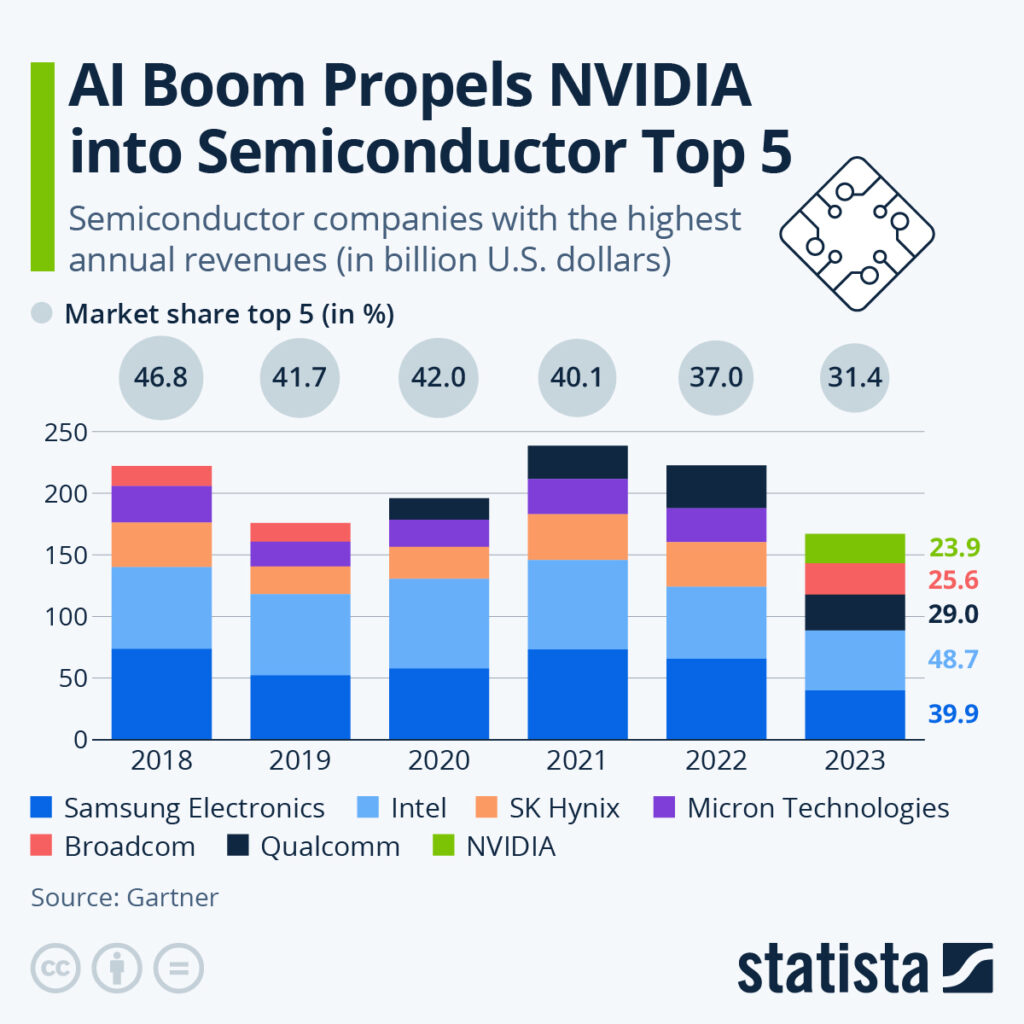

Nvidia enjoys a dominant position in the GPU market with limited competition. While rivals like AMD exist, Nvidia maintains a significant technological edge. This edge translates to higher performance and efficiency for their GPUs, making them a more attractive choice for demanding applications.

Furthermore, Nvidia’s strong research and development capabilities ensure they remain at the forefront of GPU technology. This technological lead allows them to command higher profit margins, further enhancing their financial appeal to investors.

Currently, Nvidia holds a market share of over 80% in the discrete GPU market, according to Jon Peddie Research. This dominant position allows them to dictate the pace of innovation and maintain their leadership in the GPU market.

It’s important to acknowledge that even the most promising investments carry some level of risk. While Nvidia’s future appears bright, several factors could potentially impact its stock price:

Global economic slowdown: A global economic slowdown could dampen consumer spending on electronics, impacting the demand for Nvidia’s GPUs, particularly in the gaming segment. Lower consumer spending could lead to a decrease in revenue and potentially affect the company’s growth trajectory.

Increased competition: The chipmaking industry is highly competitive, and established players like AMD are constantly innovating. Additionally, new entrants could emerge, potentially eroding Nvidia’s market share. A more competitive landscape could put pressure on Nvidia’s pricing and profitability.

Supply chain disruptions: The global supply chain continues to face challenges, and shortages of critical components could hinder Nvidia’s production capacity. This could lead to product delays, limited availability, and potentially missed revenue opportunities.

Geopolitical tensions: Trade wars, sanctions, and export restrictions can disrupt Nvidia’s global supply chain and limit its ability to reach certain markets. Geopolitical tensions can also impact investor sentiment, leading to market volatility and affecting the stock price.

In conclusion, Nvidia stands at a crossroads of immense opportunity. Powerful forces – surging demand across established and emerging markets, particularly in AI, exceptional financial performance, and a clear technological edge – have propelled them to new heights.

However, potential economic downturns, increased competition, and geopolitical uncertainties necessitate careful consideration. Will they navigate these headwinds and continue their remarkable growth trajectory? The future remains to be written. For savvy investors seeking exposure to the cutting edge of technology, Nvidia presents a compelling case. Conduct your own thorough research and consider whether Nvidia aligns with your investment goals. VT Markets offers a platform to explore potential trading opportunities in Nvidia stocks.