In the riveting world of finance, tales of triumph and turmoil are often immortalised on both the big and small screens. If you’ve been captivated by the dazzling lives of traders depicted in popular series like “Billions,” you might be intrigued to explore the real-life counterparts who have left an indelible mark on the financial landscape.

Beyond the drama and glamour of television, these master traders have reshaped markets, defied the odds, and amassed fortunes that rival even the most vivid Hollywood imagination.

Estimated net worth: $8.5 billion (2022)

Source of wealth: Hedge fund management

Known as “The Man Who Broke the Bank of England,” George Soros is a name synonymous with audacious market speculation. In 1992, Soros made a bold bet against the British pound, earning him a staggering $1 billion in a single day. His ability to foresee market trends and capitalise on them has solidified his place as one of the greatest traders in history.

Estimated net worth: $104.6 billion (2022)

Source of wealth: Investing

Warren Buffett, often hailed as the Oracle of Omaha, stands as a beacon of value investing. As the chairman and CEO of Berkshire Hathaway, Buffett’s patient and disciplined approach has seen him accumulate vast wealth over the decades. His sage advice and long-term investment strategy make him not just a trader but an iconic figure in the world of finance.

Estimated net worth: $100 million (1929, adjusted for inflation)

Source of wealth: Stock trading

The early 20th century saw the rise of Jesse Livermore, a legendary figure in stock trading. Livermore’s career was marked by astounding successes and heartbreaking losses. His uncanny ability to read market trends earned him immense fortunes, but the volatile nature of trading eventually took its toll. Livermore’s legacy is one of both triumph and tragedy, showcasing the unpredictable nature of financial markets.

Estimated net worth: $16.9 billion (2022)

Source of wealth: Hedge fund management

Ray Dalio, the founder of Bridgewater Associates, has left an indelible mark on the hedge fund industry. Known for his expertise in macroeconomic trends, Dalio’s risk management strategies have propelled Bridgewater to become one of the largest and most successful hedge funds globally. His insights into the broader economic landscape have earned him a reputation as a thought leader in the financial world.

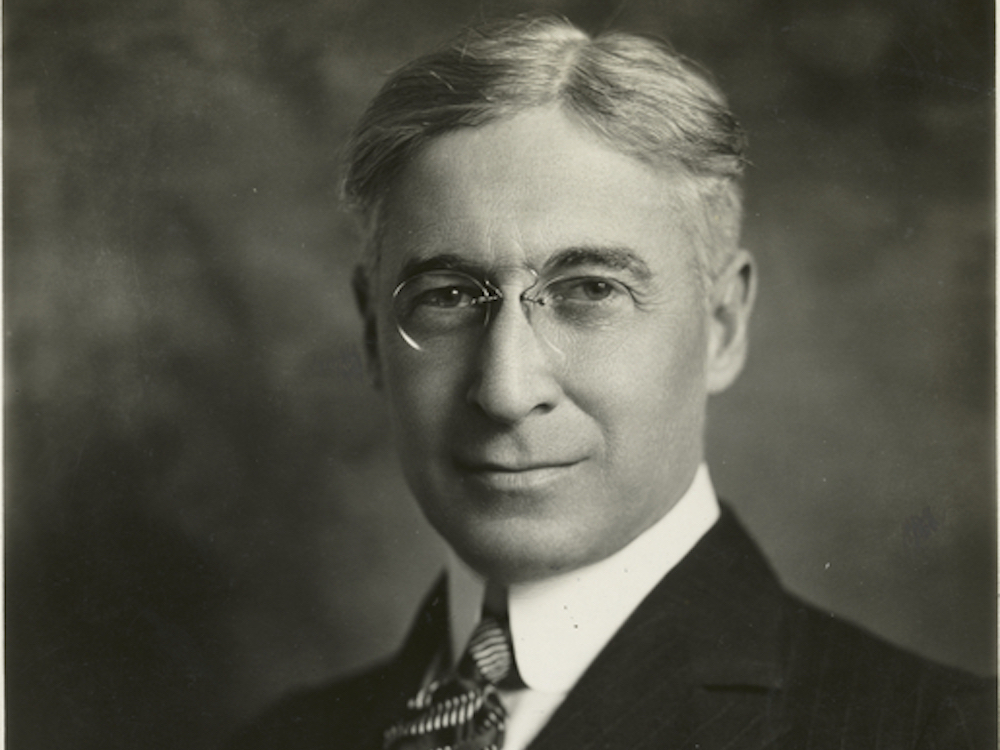

Estimated net worth: $200 million (1955, adjusted for inflation)

Source of wealth: Investing, stock trading

In the early 20th century, Bernard Baruch, a distinguished financier and trusted advisor to multiple U.S. presidents, emerged as a significant figure whose impact resonated in both financial and political spheres. His accomplishments extended beyond successful trading ventures to encompass a pivotal role in shaping economic policy, particularly during times of crisis. Baruch’s unique position at the intersection of finance and politics highlighted the depth of his influence and the critical role he played in navigating the challenges of his era.

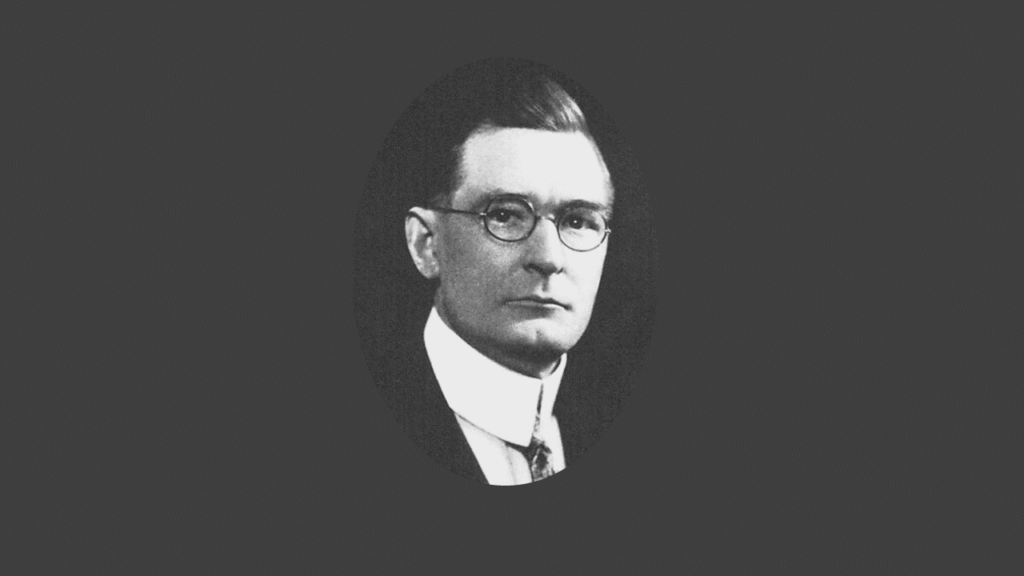

Estimated net worth: $100 million (1940, adjusted for inflation)

Source of wealth: Trading commodities, stocks, and currencies

William Delbert Gann’s contributions to technical analysis are nothing short of revolutionary. Gann’s innovative techniques, including Gann angles and the Square of Nine, have become cornerstones of market forecasting. His work laid the foundation for a more systematic approach to understanding and predicting market movements.

Estimated net worth: $200 million (2014)

Source of wealth: Trading commodities

Richard Dennis, a commodities trader, gained fame for his unconventional approach to trading. The Turtle Traders experiment, where he trained novices to become successful traders using specific rules, demonstrated the potential of systematic trading strategies. Dennis’s experiment challenged conventional wisdom and showcased the power of disciplined trading.

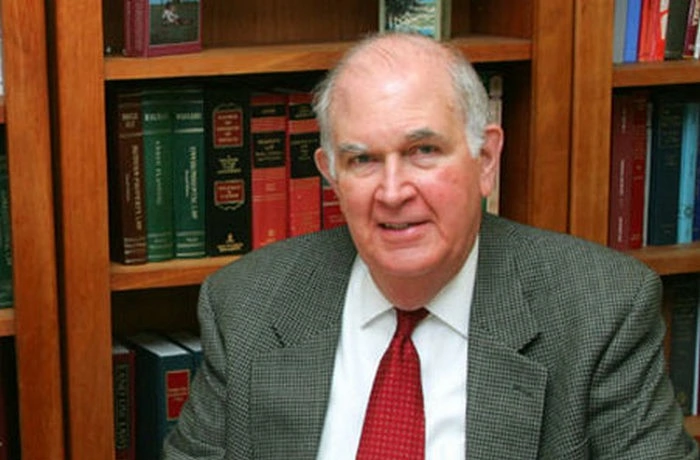

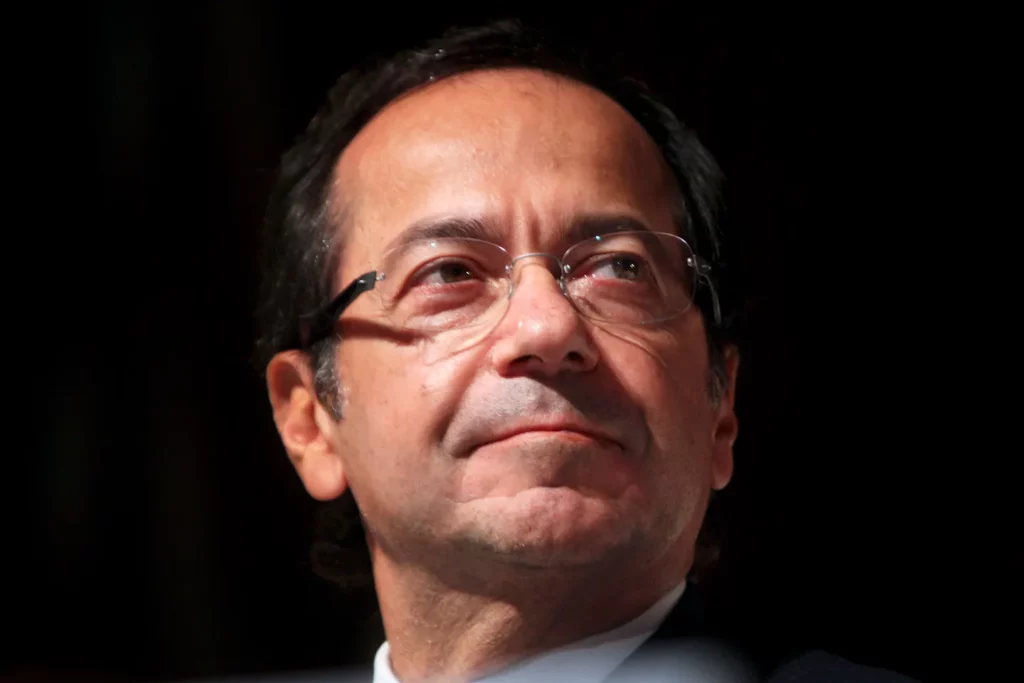

Estimated net worth: $22 billion (2022)

Source of wealth: Hedge fund management

John Paulson gained widespread recognition for his successful bets against the subprime mortgage market in 2007. His prescient moves not only protected his hedge fund from the financial crisis but also earned it billions of dollars in profits. Paulson’s strategic thinking during turbulent times highlights the importance of adaptability in the ever-changing world of finance.

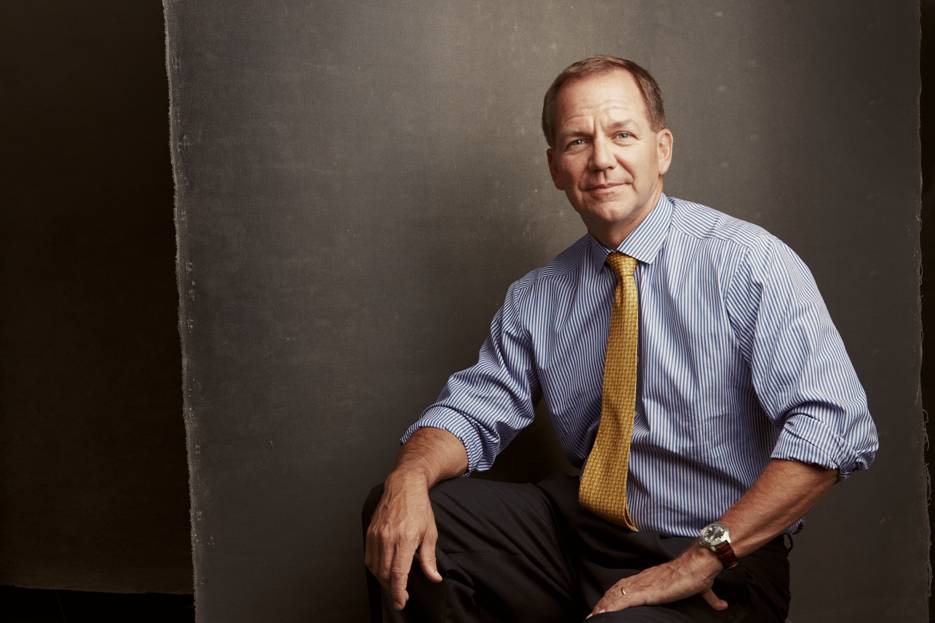

Estimated net worth: $5.5 billion (2022)

Source of wealth: Hedge fund management

Paul Tudor Jones, a pioneer in global macro trading, made a name for himself by accurately predicting the 1987 stock market crash. The founder of Tudor Investment Corporation, Jones has consistently demonstrated his ability to navigate volatile markets and capitalise on major economic shifts.

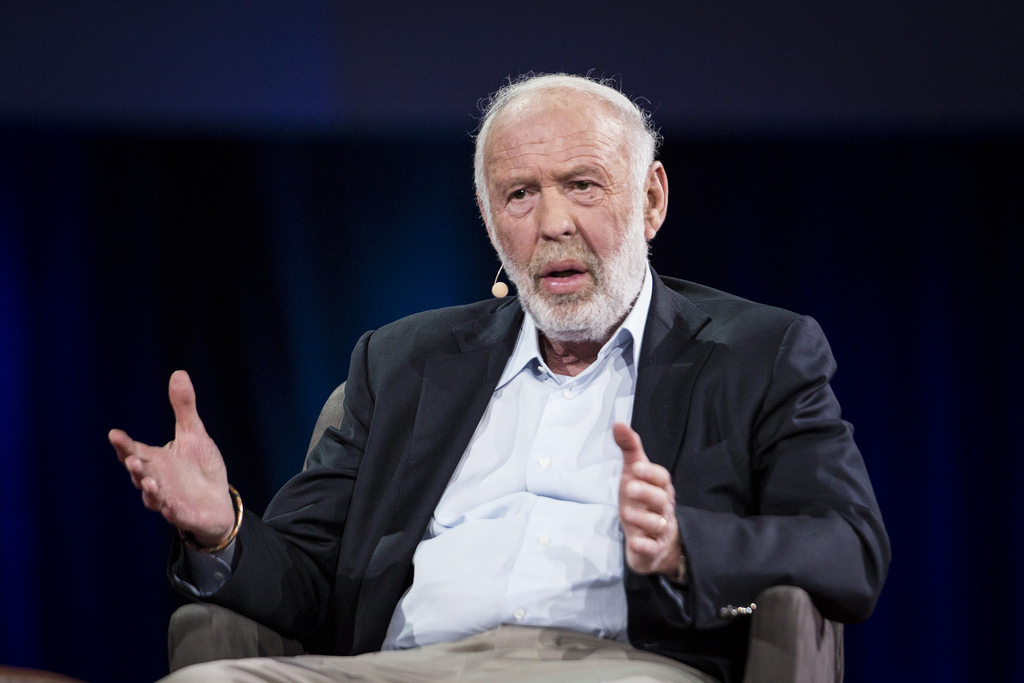

Estimated net worth: $23.5 billion (2022)

Source of wealth: Quantitative investment management

Jim Simons, a mathematician turned hedge fund manager, founded Renaissance Technologies and revolutionised quantitative trading. Simons’ success in developing complex algorithms and employing mathematical models has consistently delivered high returns, solidifying his place as a trailblazer in the world of quantitative finance.

In the intricate tapestry of financial history, master traders have crafted tales of risk, reward, and resilience – stories that caution and inspire. Beyond the allure of screens, the real magic unfolds in the strategic minds of those who conquer markets. If you’re inspired to start your own trading journey and seek outstanding results, take the first step by opening a live account with VT Markets. Just as legendary traders paved their way, this platform can be your foundation for financial success. Open your account and begin crafting your narrative in the dynamic world of trading.