As we navigate the ever-changing investment landscape, it’s crucial for investors to stay ahead of the curve and adapt to emerging trends. The year 2024 promises to be an exciting time, with new opportunities and challenges on the horizon. In this article, we’ll explore some of the top investing trends that are shaping the future of finance and guiding investment decisions.

Environmental, social, and governance (ESG) factors have become increasingly important in investment decisions, and this trend is set to continue in 2024. Investors are recognising the long-term value of companies that prioritise sustainability and ethical practices.

Companies and industries that are leading the way in sustainable practices, such as renewable energy, sustainable agriculture, and circular economy initiatives, are attracting significant investor interest.

Investors are flocking to sustainable companies like NextEra Energy, a renewable energy giant, Apeel Sciences, which develops innovative coatings to reduce food waste, and Tomra Systems, a leader in advanced recycling solutions, as they recognise the long-term growth potential and competitive advantage of embracing environmentally and socially responsible practices.

These organisations not only contribute to a better planet but also position themselves for long-term growth and competitive advantage in an increasingly eco-conscious market.

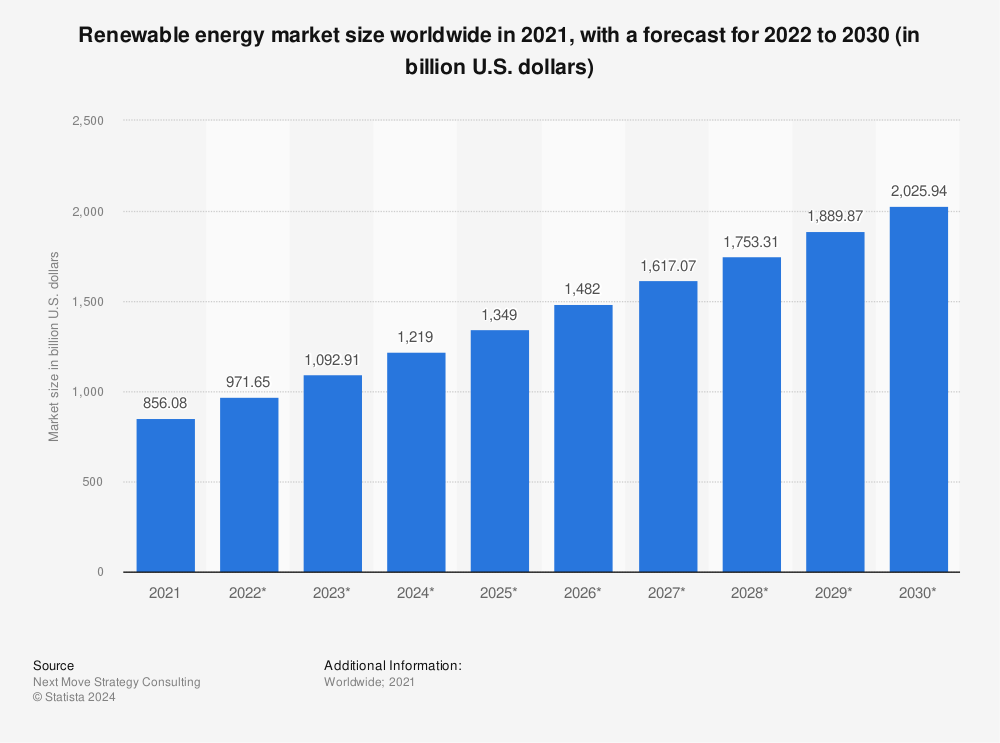

One area of particular focus within sustainable investing is the green energy and clean technology sectors. As concerns over climate change and fossil fuel depletion continue to mount, investments in renewable energy sources are expected to surge. The renewable energy market is projected to reach $1.9 trillion by 2030, with an annual growth rate of 8.6% from 2022 to 2030.

The rapid advancements in artificial intelligence (AI) and automation technologies are transforming industries across the board, creating new investment opportunities.

The global AI market is expected to grow from $58.3 billion in 2021 to $309.6 billion by 2026, at a compound annual growth rate of 39.7%.

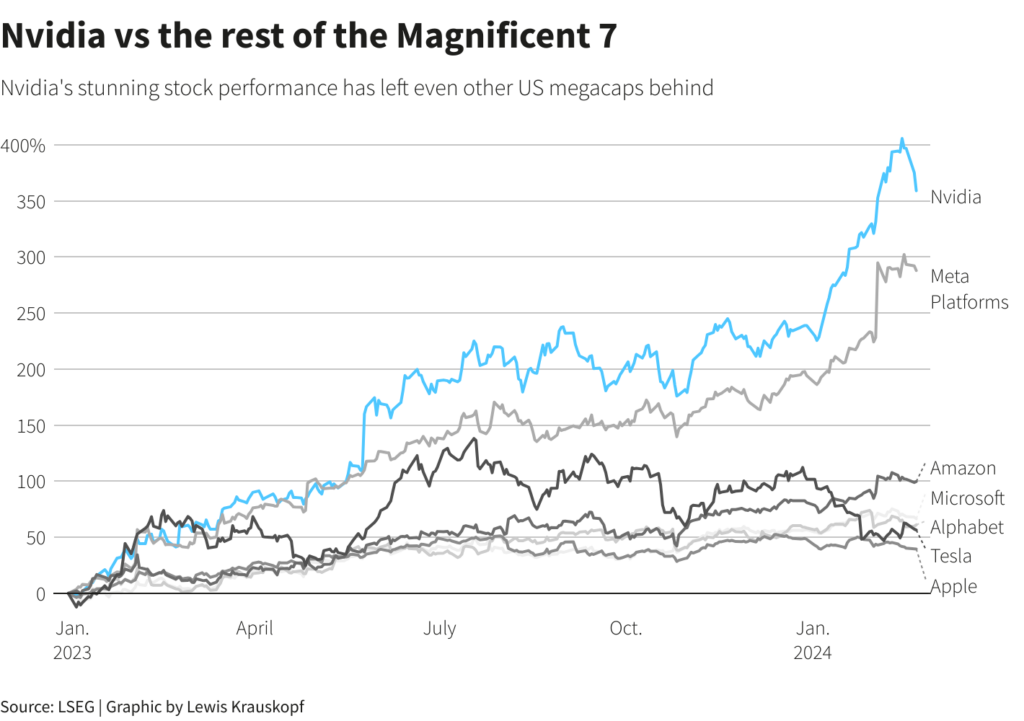

Companies that are at the forefront of developing cutting-edge AI and automation solutions, such as Google (GOOG), Microsoft (MSFT), and NVIDIA (NVDA), as well as those successfully integrating these technologies into their operations like Amazon (AMZN) and UPS (UPS), are likely to see significant growth and investor interest.

Sectors such as healthcare, finance, and manufacturing are poised to benefit greatly from AI and automation. For instance, the AI in healthcare market is projected to reach $120.2 billion by 2028, growing at the compound annual growth rate (CAGR) of 48.7% from 2021 to 2028.

However, it’s essential to address the potential risks and challenges associated with these technologies, such as job displacement and ethical considerations.

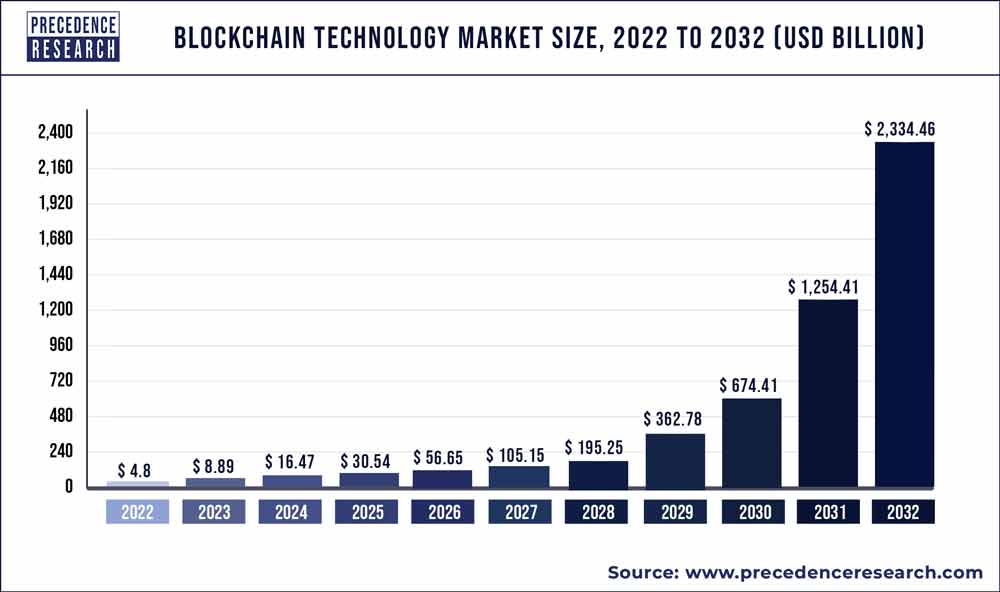

The cryptocurrency and blockchain space has gained mainstream attention, and its influence is expected to continue growing in 2024.

Investors are increasingly exploring opportunities in cryptocurrencies, blockchain-based projects, and companies developing blockchain solutions for various industries. The global blockchain market size is expected to grow from $4.9 billion in 2021 to $227.3 billion by 2028, at a CAGR of 68.4%.

While the regulatory landscape surrounding cryptocurrencies and blockchain remains evolving, the potential for disruptive innovation in areas like finance, supply chain management, and data security cannot be overlooked.

However, investors should exercise caution and conduct thorough due diligence, as this space is still highly volatile and carries significant risks.

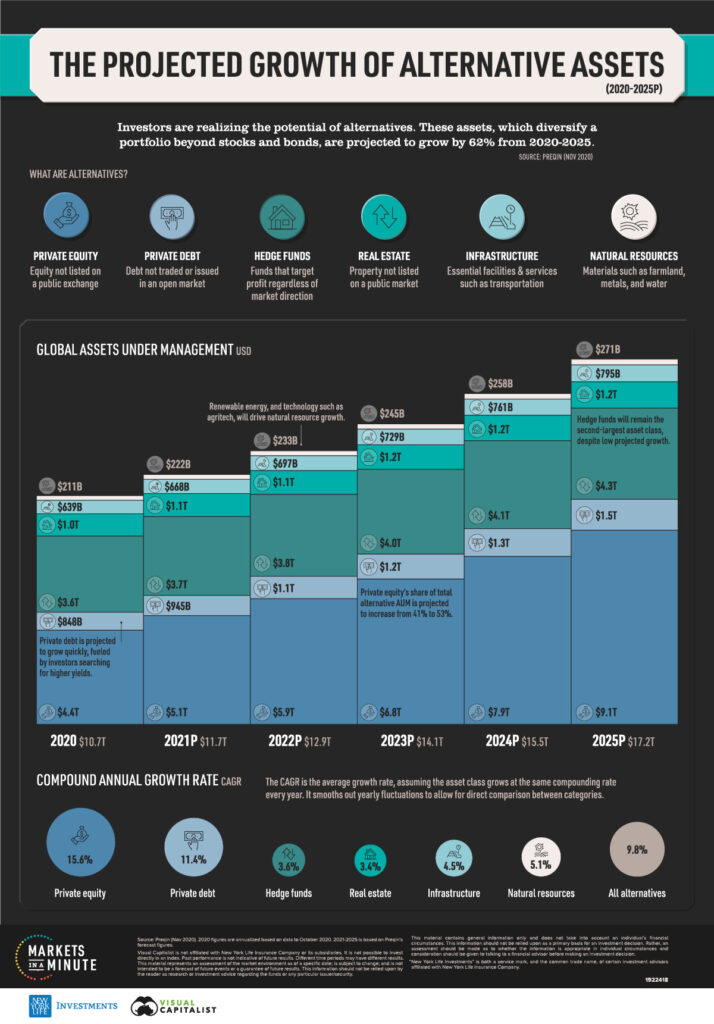

As investors seek diversification and higher returns, alternative investments, such as real estate, private equity, and hedge funds, are becoming increasingly popular.

These investments offer the potential for higher returns but also come with higher risks, illiquidity, and complexity. The global alternative investment market is expected to reach $24.5 trillion by 2026, growing at a CAGR of 12.3% from 2021 to 2026.

Within the realm of alternative investments, areas like farmland, timberland, and dividend-paying stocks are gaining traction as investors seek consistent income streams and diversification from traditional asset classes. For instance, the global dividends paid out by listed companies reached a record $1.47 trillion in 2022.

However, it’s crucial to thoroughly understand the risks and conduct rigorous due diligence before investing in alternative investments.

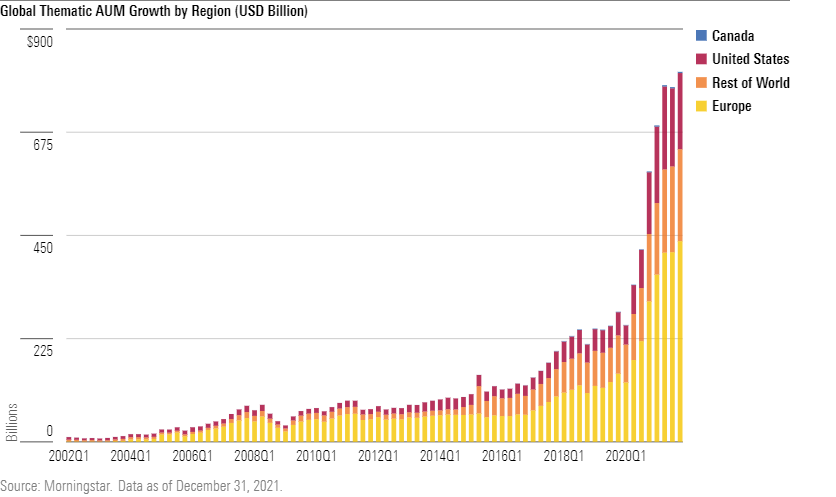

Thematic investing, where investors target specific themes or megatrends rather than traditional sectors or asset classes, is an emerging trend in 2024.

This approach allows investors to capitalise on long-term growth opportunities by focusing on themes such as healthcare innovation, cybersecurity, e-commerce, and clean energy. Data by Morningstar, a US financial services firm, show the total amount invested in thematic funds grew to $718bn in the fourth quarter of 2021, from $251bn two years earlier.

Thematic investing offers the potential for diversification across multiple sectors and the ability to participate in disruptive technologies and paradigm shifts. Popular investment themes and funds focused on these themes are expected to attract significant investor interest in the coming year.

As we navigate the investment landscape of 2024, it’s essential to stay informed and adapt to emerging trends. The trends discussed in this article – sustainable and impact investing, AI and automation, cryptocurrency and blockchain, alternative investments, and thematic investing – present both opportunities and challenges for investors.

While embracing these trends can lead to potentially lucrative returns, it’s crucial to conduct thorough research, seek professional advice, and make informed investment decisions based on individual goals and risk tolerance.

Additionally, diversification strategies, such as investing in different geographic regions or asset classes, will remain crucial for mitigating risk and enhancing overall portfolio performance. Stay proactive, stay informed, and stay ahead of the curve – these are the keys to successful investing in the dynamic and ever-changing world of finance.