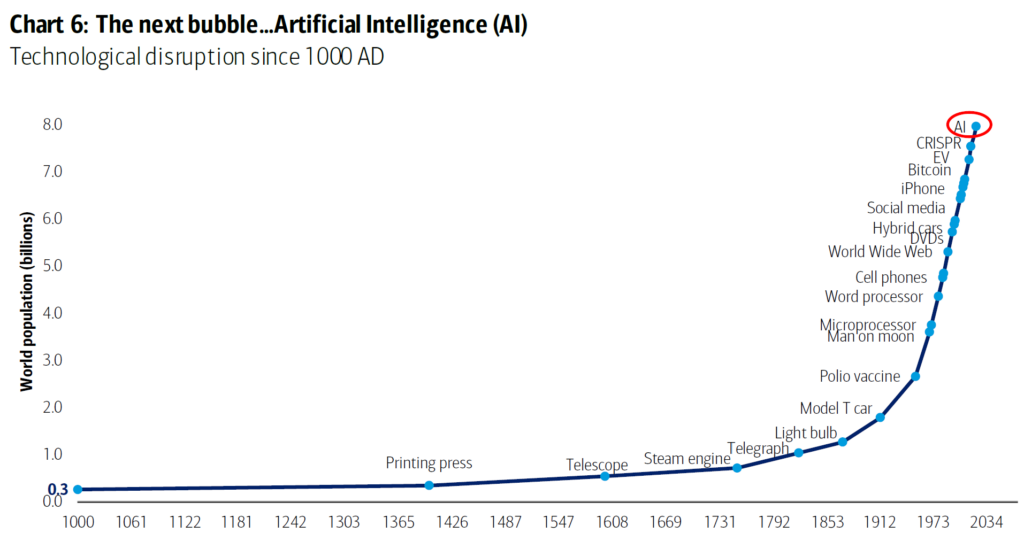

Picture yourself back in the late ’90s, a time when the Internet was just beginning to change the world. Investors were caught in a whirlwind of excitement, dreaming of fortunes to be made. Fast forward to today, and a new sensation is sweeping the investment world: Artificial Intelligence, or AI.

Much like the dot-com bubble that saw investors captivated by the internet’s promises, AI is now stealing the spotlight. What’s fuelling this AI frenzy? Innovations like ChatGPT, OpenAI’s chatbot, and the skyrocketing stocks of tech giants like Meta Platforms and Nvidia.

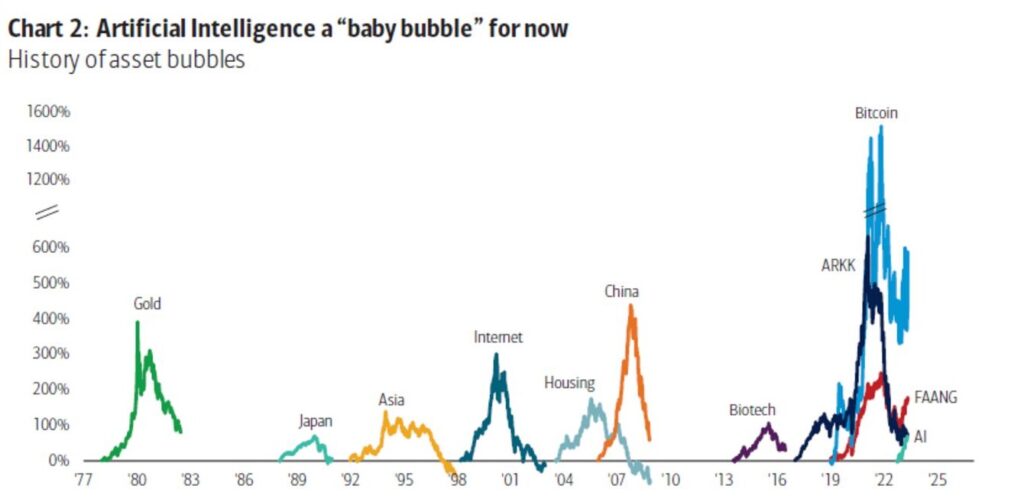

But amidst this whirlwind of excitement, there’s a whisper of caution. Some are saying that AI might be in a “baby bubble.” Bank of America is raising the alarm, warning that if the Federal Reserve makes a particular mistake, this AI investment craze could burst in a fashion reminiscent of the dot-com era.

Just as the dot-com bubble rode high on easy money and came crashing down with rate hikes, the same script could unfold with AI.

In this context, the importance of understanding economic bubbles becomes crystal clear. Whether in technology, housing, or any other sector, these bubbles all share common traits: enthusiasm, speculation, and the potential for boom or bust.

Recognising the signs and knowing when to tread carefully is essential for investors looking to ride these waves of excitement while safeguarding their financial future.

Financial bubbles are like wild surges of optimism and enthusiasm that flood through different parts of the economy, sending prices soaring to dizzying heights. These bubbles can pop up in various domains, from real estate and the stock market to cryptocurrencies. To understand them better, let’s explore some real-life examples:

Tulip Mania Bubble: In 17th-century Netherlands, “Tulip Mania” saw tulip bulbs become a craze. People believed these bulbs could be lucrative investments. Tulip prices skyrocketed to extraordinary levels, with some bulbs costing as much as houses. When the bubble burst, tulip bulb prices plummeted, leaving investors with worthless assets and financial losses.

The Dot-Com Bubble: Think back to the late 1990s when the internet was all the rage. Companies with “dot-com” in their names saw their stock prices skyrocket, driven by wild speculation. But eventually, the bubble burst, and many of these companies went bankrupt.

A financial bubble occurs when the prices of assets, such as real estate or stocks, significantly exceed their intrinsic or fundamental value due to excessive buying and investor enthusiasm. It’s a bit like a party that gets too crowded.

However, these bubbles are not sustainable, and they eventually burst, leading to a sharp decline in asset prices, which can result in financial challenges for overexposed investors.

Imagine a party that’s been going on for hours, and everyone’s having a great time. Eventually, though, it has to end. Economic bubbles are similar—they can’t last indefinitely.

Let’s explore the triggers that can bring these bubbles to a dramatic close:

These triggers can burst a bubble, and the aftermath can vary from one bubble to another. Some bubbles deflate gradually, while others can burst suddenly and dramatically, leading to significant financial repercussions for those caught in the frenzy.

Let’s follow the financial bubble evolution from the very beginning to the end. Its understanding is essential for investors looking to protect themselves from the downside of phenomenon.

The mechanism of a financial bubble typically follows a pattern:

1. Initial Optimism: It begins with a positive economic or financial development that sparks optimism among investors. This could be a new technology, a booming industry, or favorable economic conditions.

2. Increased Investment: As optimism grows, more investors start pouring their money into the asset class associated with the optimism. This increased demand drives up prices.

3. Herd Mentality: As prices rise, more investors join the bandwagon, driven by the fear of missing out (FOMO). This herd mentality further inflates prices.

4. Speculation: Speculators, who are not necessarily interested in the fundamentals of the asset but are looking to profit from price increases, become a significant force in the market. Their activity amplifies price movements.

5. Media Hype: Media coverage often fuels the frenzy, with positive stories and excessive optimism, attracting even more investors.

6. Excessive Borrowing: Many investors borrow money to invest in the rising market, further increasing demand and prices.

7. Peak Prices: Prices reach unsustainable levels, far exceeding the asset’s intrinsic value or earnings potential.

8. Warning Signs: Some informed investors and analysts begin to voice concerns about overvaluation, but these warnings often go unheeded.

9. Market Correction or Trigger: Something triggers a shift in sentiment or a realisation that prices are too high. It could be an economic event, a change in interest rates, or simply a collective realisation that prices are unsustainable.

10. Sell-off: Investors rush to sell their assets to lock in profits, and panic can set in as prices rapidly decline.

11. Bubble Bursts: The bubble bursts, and prices plummet, often causing significant financial losses for those who bought at the peak.

12. Economic Impact: The bursting of a financial bubble can have broader economic consequences, affecting consumer confidence, investment, and financial stability.

The specific triggers and characteristics of financial bubbles can vary, but this general mechanism highlights the key stages that typically occur during a bubble’s lifecycle.

Economic bubbles aren’t confined to the stock market. They can manifest in various sectors:

Stock Market Bubbles: Dot-Com Bubble

In the late 1990s, internet-related companies saw their stock prices skyrocket. Investors believed the internet would change everything, and they poured money into these companies. However, when the bubble burst, many of these companies went bankrupt, and investors lost fortunes. It’s like buying a ticket for a hot new band without realising they might be a one-hit wonder.

Real Estate Bubbles: 2008 Housing Bubble

In the mid-2000s, the U.S. housing market was on fire. People were buying homes at inflated prices, often with mortgages they couldn’t afford. When the bubble burst, home values plummeted, leading to the 2008 financial crisis. It’s like signing up for a mortgage you can’t handle because everyone else is doing it.

Commodity Bubbles: Mid-2000s Oil Price Spike

Remember when gas prices skyrocketed seemingly overnight? That was a commodity bubble. People believed oil prices would keep rising, so they bought and hoarded oil. When reality set in, prices crashed, leaving many feeling like they had overpaid at the pump.

Credit Bubbles: Subprime Mortgage Crisis (2007-2008)

Banks were lending to people who couldn’t afford to buy homes. These risky loans were bundled together and sold as investments. When people couldn’t pay their mortgages, it triggered a crisis that rippled through the entire financial system. It’s like borrowing money you know you can never repay.

In conclusion, understanding economic bubbles is like knowing when it’s time to leave the party before it’s too late. These waves of enthusiasm can be thrilling, but they can also lead to financial disaster. So, stay informed reading VT Markets’ daily market analysis, be cautious, and don’t let the excitement of a bubble carry you away. It’s a skill that can help protect your financial future.