The oil & gas industry is a cornerstone of the global economy, with its health directly impacting currency markets. As a forex trader, understanding the trends within this industry can be crucial for making informed trading decisions. This article explores the key factors shaping the oil and gas landscape in 2024, providing valuable insights for traders.

The global oil market is currently experiencing a tug-of-war between rising demand and restricted supply.

On the demand side, a post-pandemic economic rebound is expected to drive a modest increase of 1.1 million barrels per day (mb/d) in oil consumption in 2024. This growth is particularly fuelled by developing economies like China and India, where rising industrial activity is expected to lead to increased reliance on oil.

However, this positive demand outlook is countered by significant production cuts from the Organisation of the Petroleum Exporting Countries and allies (OPEC+). These cuts, amounting to around 1.5 million barrels per day, have been a major reason behind the 2023 surge in oil prices.

While US shale oil production is estimated to climb by 0.8 million barrels per day in 2024, it’s unlikely to fully offset the cuts from OPEC+, keeping a floor under prices in the near term. It’s important to note that a potential increase in supply from OPEC+ exceeding pre-pandemic levels in 2025 could significantly impact the price equation.

Let’s take a look at the latest data from the International Energy Agency’s (IEA) March 2024 Oil Market Report.

In a positive surprise, global oil demand is forecast to rise by a higher-than-expected 1.7 million barrels per day (mb/d) in the first quarter of 2024 (1Q24). This upward revision is attributed to an improved economic outlook for the United States and increased bunkering activity (fuelling ships).

However, the IEA still expects overall demand growth to slow throughout the year, from 2.3 mb/d in 2023 to a revised estimate of 1.3 mb/d in 2024.

World oil production is projected to fall by 870 kb/d in 1Q24 compared to 4Q23. This decline is due to heavy weather-related shutdowns and new production curbs implemented by the OPEC+ alliance. Despite the initial drop, OPEC+ production is still expected to increase in 2024, albeit at a downwardly revised rate of 400 kb/d.

With the revised forecasts, global oil stocks are now expected to increase by 800 kb/d to 102.9 mb/d in 2024. This indicates a potential rise in global oil inventories throughout the year.

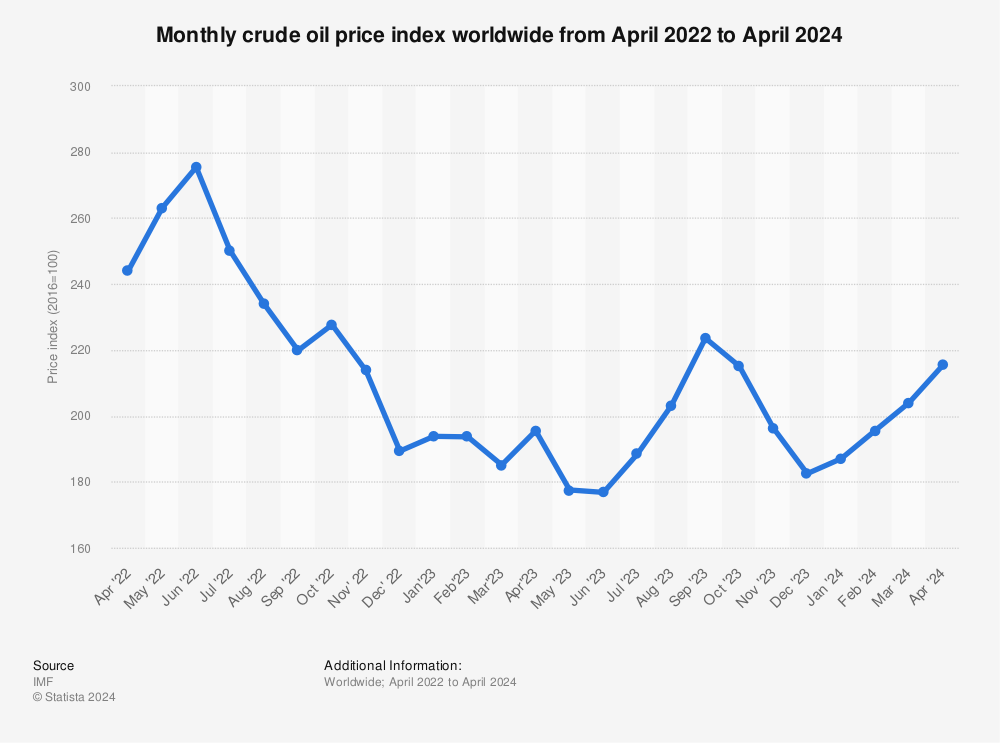

Oil prices have experienced a significant climb in recent times, hovering around $90 per barrel compared to the lows of $60 per barrel seen in 2020. Due to the current supply-demand imbalance, analysts initially expected prices to remain elevated throughout 2024, with a potential reach of $100 per barrel.

However, a more nuanced picture is emerging. As of May 22nd, 2024, the price of West Texas Intermediate (WTI) crude oil sits at $77.91 per barrel according to Macrotrends. This suggests a price increase of around 9% for 2024 so far, with significant volatility throughout the year. The highs have reached $87.01 per barrel, but prices have also dipped as low as $70.38 per barrel.

Unforeseen circumstances can significantly impact prices. A global economic downturn could decrease demand and lead to a price correction. Conversely, major oil discoveries or disruptions in supply due to geopolitical events could cause prices to surge. Closely monitoring these developments remains crucial for traders navigating the oil market.

While the initial forecasts anticipated prices reaching $100 per barrel, current market conditions suggest a more moderate price range with ongoing volatility.

Beyond the immediate price dynamics, several key trends are shaping the long-term outlook of the oil & gas industry.

Firstly, there’s a rising tide of mergers and acquisitions (M&A) activity. Strong cash flows, buoyed by high oil prices, and renewed investor confidence are driving this trend. Industry experts predict a 20% increase in M&A deals in 2024 compared to 2023, as companies consolidate to gain market share and improve operational efficiencies.

This consolidation could also lead to increased bargaining power with service providers, potentially impacting the overall cost structure of the industry.

Secondly, decarbonisation efforts are gaining significant traction. Oil and gas companies are increasingly investing in carbon capture technologies, with a projected global market size of $8.6 billion by 2025. These technologies aim to capture carbon emissions from power plants and industrial facilities, preventing them from entering the atmosphere.

Additionally, hydrogen production, a clean-burning alternative fuel, is attracting significant investments, with a projected market value of $18 billion by 2024. This focus on sustainability could influence long-term demand for traditional oil and gas.

While the transition to a low-carbon economy may take time, it’s a trend that traders should be aware of, as it could have a significant impact on the industry’s future.

Finally, advancements in technologies like generative AI are playing a role in optimising exploration, production, and logistics. These advancements are estimated to unlock an additional 5% of global oil reserves and could potentially lead to increased efficiency and cost reductions within the industry.

AI can be used for tasks like analysing seismic data to identify potential drilling sites, optimising well placement, and even predicting equipment maintenance needs. By leveraging these technologies, oil and gas companies can potentially operate with greater efficiency and profitability, even in a lower-carbon future.

In conclusion, the oil and gas industry in 2024 presents a complex landscape for forex CFD traders. Understanding the interplay between demand, supply, industry trends, and potential geopolitical disruptions is crucial for making informed trading decisions. By staying updated on market developments, employing technical analysis effectively, and maintaining a disciplined risk management approach, traders can navigate the oil market with greater confidence.