The Euro, symbolised by ‘€’, stands as a significant entity in the global economic stage. Initially conceived to enhance economic unity within Europe, its impact now stretches far beyond the confines of the European Union (EU).

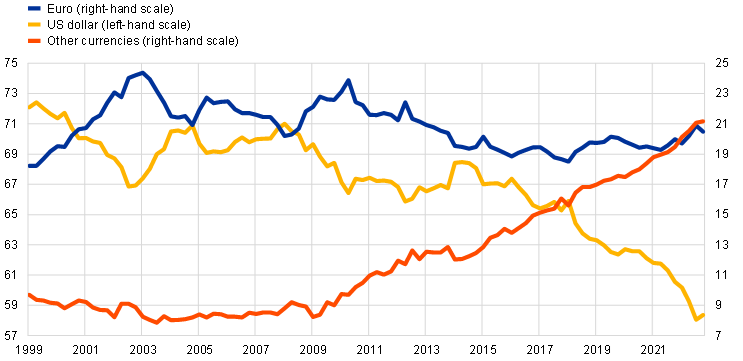

The Euro stands as the world’s second most vital currency. Its presence and influence are substantial, consistently comprising an average share of nearly 20% across various indicators of international currency usage.

In this article, we will delve into the historical evolution of the Euro, its far-reaching implications on international trade, its revered status as a reserve currency, and its pivotal role in promoting economic stability and integration.

Moreover, we’ll explore its sway over financial markets and its intricate role in shaping geopolitical dynamics. Looking ahead, we will adopt a forward-thinking perspective, considering potential trajectories that could define the Euro’s role on the global stage.

Understanding these possible developments is vital, as it equips us to anticipate and adapt to the evolving dynamics of the global economy.

The Euro’s inception and journey through time have been pivotal in shaping the economic landscape of Europe and beyond. Let’s delve into the key stages that mark this historical evolution.

The Euro’s story begins with the signing of the Maastricht Treaty in 1992, which laid the groundwork for the Economic and Monetary Union (EMU). The treaty aimed to foster economic integration among European nations, a crucial step towards establishing a unified currency and a more tightly-knit economic community.

The vision set by the Maastricht Treaty came to life on January 1, 1999, when the Euro was introduced as an electronic currency for banking and financial transactions. This virtual beginning was a steppingstone towards creating a seamless financial landscape within the Eurozone.

Taking a leap forward, the Euro transitioned from the digital realm to the physical world on January 1, 2002, with the introduction of Euro banknotes and coins. This marked a significant milestone, underlining the successful integration of numerous European economies under a singular currency.

This historical journey showcases the deliberate and strategic steps taken to unify Europe economically and integrate its nations into a cohesive entity. The evolution from a treaty to a tangible currency demonstrates the vision and determination of the European nations to embrace a united economic destiny.

The Euro’s impact on international trade is significant and diverse. Presently, the Eurozone represents approximately 15% of global trade, a figure comparable to the United States, albeit slightly lower compared to when the Euro was first introduced. This decline in the Euro’s share is attributed to China’s rise rather than a decrease in extra-Euro area trade, which has remained robust.

As the official currency of the Eurozone, encompassing 19 EU countries, the Euro removes the necessity for frequent currency conversions. This simplification streamlines cross-border trade, reducing transaction costs and facilitating financial transactions within the Eurozone.

The Euro’s stability, wide acceptance, and low volatility make it a popular choice for trade beyond the Eurozone, simplifying trade with non-Eurozone entities. Utilising the Euro for international trade reduces risks associated with fluctuating exchange rates, ensuring stable transactional value and a secure cross-border trade environment.

The Euro’s status as a reserve currency underlines its stability and significance in the global financial landscape. In 2022, its share in global foreign exchange reserves increased to 20.5%, emphasising its importance.

Being on par with major currencies like the US dollar, Japanese yen, and British pound sterling, the Euro maintains a prominent position as a reserve currency.

Global central banks and institutions hold significant reserves in Euros, providing liquidity and stability during economic fluctuations or financial crises, thus bolstering the global financial ecosystem. Furthermore, the Euro’s role as a reserve currency influences exchange rates and monetary policies worldwide, impacting trade and financial market dynamics.

The Euro’s impact on economic stability and integration in the Eurozone is fundamental. Under the guidance of the European Central Bank (ECB), the Eurozone maintains a unified monetary policy. This coordination ensures a consistent approach to managing inflation, interest rates, and money supply, promoting economic stability and predictability.

The Eurozone strengthens stability by encouraging fiscal discipline among member nations. The Stability and Growth Pact establishes fiscal guidelines, promoting responsible budgeting, debt control, and prudent financial management. This disciplined approach bolsters confidence in the Euro and supports long-term economic stability.

By establishing a single currency, the Eurozone mitigates exchange rate risks and uncertainties associated with multiple national currencies. This stability is attractive to investors and businesses, encouraging investments and fostering economic growth across the Eurozone.

The Euro significantly influences global financial markets. Its exchange rate fluctuations against major currencies – US dollar, Japanese yen, and British pound sterling – impact trade, investment, and capital flows.

The European Central Bank (ECB) is central to Eurozone monetary policy, making decisions on interest rates, quantitative easing, and other monetary tools that directly affect the Euro’s value and, consequently, financial markets.

Economic indicators from Eurozone countries, covering GDP growth, unemployment rates, inflation, and manufacturing data, offer crucial insights into the region’s economic health, shaping market sentiment and impacting traders’ perceptions of the Euro’s strength.

The Euro’s movements have a ripple effect across various asset classes, impacting commodities, equities, and bonds. This correlation is vital for investors aiming to manage portfolios and diversify their investments effectively.

The Euro’s role extends beyond the economic realm, exerting a significant influence on geopolitical dynamics.

One historical example of this influence can be seen in the aftermath of the 2008 global financial crisis. The prominence and strength of the Euro bolstered the European Union’s stature on the global stage during a time of economic upheaval. This example illustrates how the Euro impacts geopolitical landscapes.

The Euro provides the Eurozone with significant global economic leverage. Its status as a major reserve currency enhances the region’s economic influence and ability to participate in international economic decision-making.

The Euro’s significance influences diplomatic relations between the Eurozone and other nations. It shapes negotiation dynamics, trade dialogues, and strategic alignments, as the Euro’s strength impacts the bargaining power and perceived stability of the Eurozone in international interactions.

The Euro’s prominence influences the foreign policy strategies of Eurozone countries. Economic considerations linked to the Euro often guide foreign policy decisions, aligning them with broader economic goals and priorities.

The Euro, currently the world’s second-largest reserve currency following the US dollar, is at a turning point. Let’s break down potential scenarios that could shape its development and influence economics, geopolitics, and institutional frameworks.

Scenario 1: Business As Usual

Imagine the Eurozone countries continue with their current approach. Each country independently manages its money, lacking a unified strategy. This could lead to fluctuations in how money moves in and out of the Eurozone.

Scenario 2: Fiscal Union

Another possibility is that Eurozone countries decide to collaborate more closely on financial matters. They establish rules to stabilise their individual economies first. However, this could pose challenges and necessitate substantial changes. While it could strengthen the Euro, it’s not guaranteed.

Scenario 3: Minimum Model

In this scenario, countries commit to maintaining stability domestically and not constantly assisting each other during financial hardships. They agree on adaptable plans to assist during challenging periods. This might result in a strong and stable Euro, albeit potentially less influential on a global scale.

Scenario 4: Enhancing Attractiveness

The concept here is to make the Euro more appealing to a global audience. This could be achieved by introducing more secure and appealing Euro-based investments. However, this could be complex, especially if certain major countries face financial difficulties, prompting significant alterations.

You might wonder about the significance of these scenarios. Understanding the future is vital because the Euro is a major player in the global financial landscape. Its influence impacts us all, albeit indirectly.

The aim of experts and policymakers is to position the Euro as a strong and dependable currency on the global financial stage. However, determining the best path forward remains a work in progress. Striking the right balance is crucial to ensure the Euro is potent, stable, and beneficial for everyone involved.

Ultimately, the Euro’s future role will depend on how effectively Eurozone countries collaborate and manage their finances. It’s akin to a vast jigsaw puzzle, and everyone is diligently striving to find the perfect fit. The decisions made in the coming years will shape the Euro’s trajectory, impacting economies and individuals across the globe.