Forex trading is a global market that operates 24 hours a day. And it is important to know the best times to trade in order to maximise your profits.

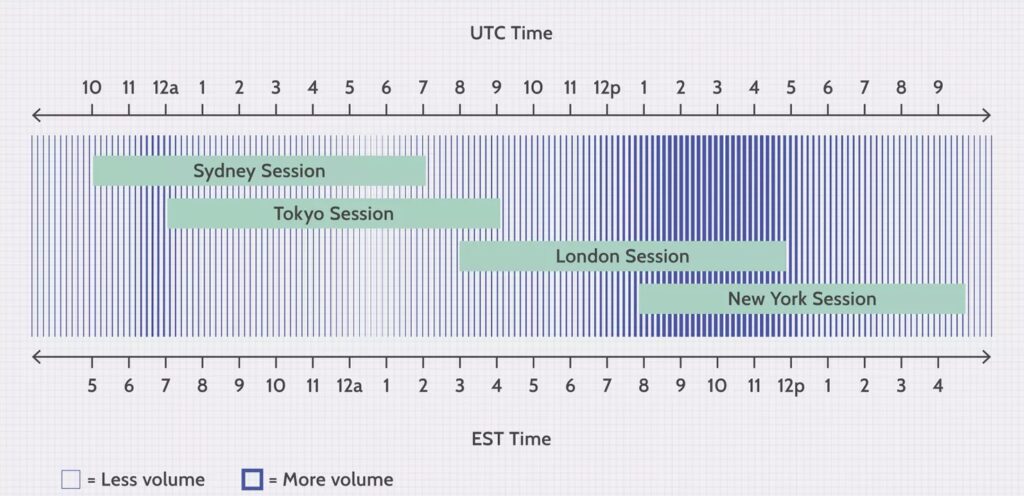

The Forex market can be divided into four major trading sessions: the Sydney session, the Tokyo session, the London session, and the New York session.

The Forex market opens in New Zealand on Monday morning, while it is still Sunday in most parts of the world. The market operates continuously from Monday to Friday, and there are no formal closing times during the week.

As one region’s Forex market closes, another region’s market opens or is already open, resulting in overlapping trading periods, which are often the most active times in Forex trading.

Apart from weekends, there are only two public holidays when the Forex market remains closed worldwide: Christmas and New Year’s Day.

You should be aware that the opening hours of the Forex market may vary in March, April, October, and November due to different countries’ daylight savings schedules. This is an important consideration if you plan to trade during those times.

Traditionally, the Forex market has had three main trading sessions that traders tend to focus on instead of trading all day and night. This is referred to as the “Forex 3-session system”, which includes the Asian, European, and North American sessions, also known as Tokyo, London, and New York.

Tokyo session

The Tokyo session starts at 12:00 am GMT. Japan is the world’s third-largest Forex trading centre. During the Asian session, around 20% of all Forex trading volume occurs.

Economic data from Australia, New Zealand, China and Japan are released early in the session, and this could provide an excellent opportunity to trade news events.

The Tokyo session’s moves could set the tone for the rest of the day, and traders in later sessions often evaluate what strategies to take in other sessions

London session

London’s strategic location benefits from its time zone, as its morning overlaps with late trading in Asia, and its afternoon overlaps with New York City. 43% of all Forex transactions happen in London.

The London session is also known as the “European” trading session. Other major financial centres such as Geneva, Frankfurt, Zurich, Luxembourg, Paris, Hamburg, Edinburgh, and Amsterdam are also open during this time.

Most trends begin during the London session and continue until the beginning of the New York session.

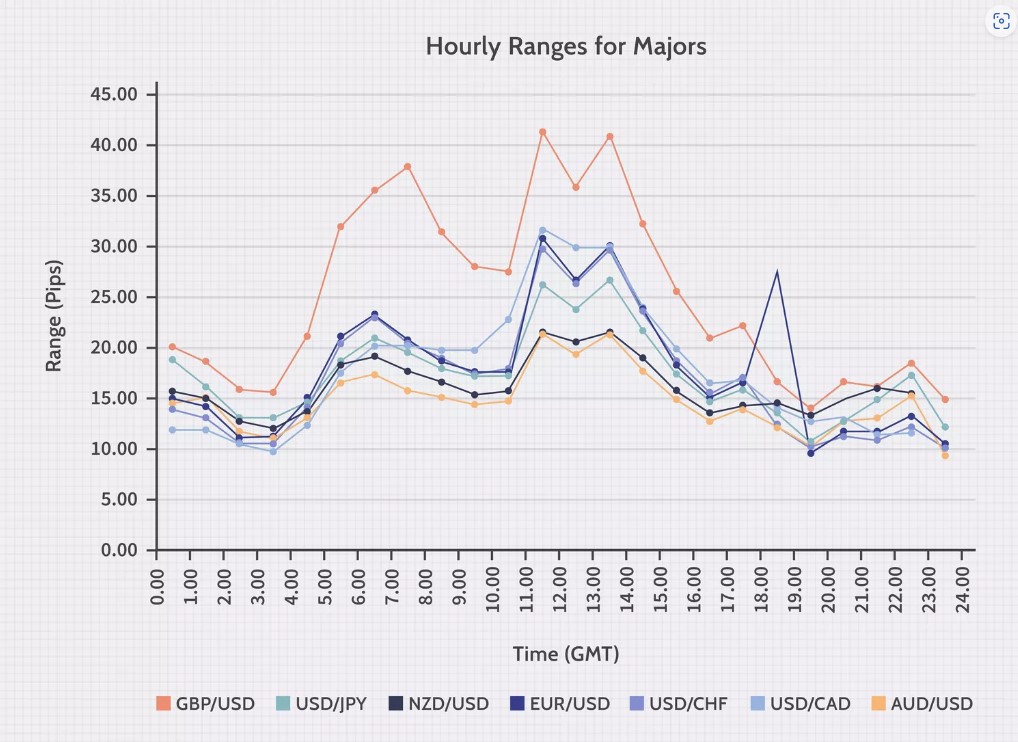

Due to the high volume of transactions, the London session is typically the most volatile, making almost any pair tradable. However, sticking to the major pairs (EUR/USD, GBP/USD, USD/JPY, and USD/CHF) is generally best due to their tight spreads.

New York Session

The US session begins at 8:00 am EST (12:00 pm GMT). New York is responsible for about 17% of all Forex transactions.

This session is also referred to as the “North American” trading session, as major financial centres like New York, Toronto and Chicago in North America are open at the same time.

Economic reports are usually released at the start of the New York session, with 85% of all trades involving the dollar. Hence, significant US economic data releases can move the market.

During the US and European markets’ simultaneous opening, abundant liquidity allows traders to virtually trade any pair. During the afternoon US session, volatility and liquidity tend to drop when European markets close.

So, when is the best time to trade forex?

According to the analytical reports, the most favourable trading time is around 10 am and 3 pm London time (10 am NY time) when there is optimal liquidity. This is the busiest time of day when traders from London and New York engage in trading, and it can be affected by news reports from the US, Canada, and Europe.

Additionally, this is the time when the WM/Refinitiv Spot Benchmark Rate is set, also known as the “London fix”. Banks and financial institutions use it as a reference point for daily currency exchange rates. For traders, there may be a surge in market activity before the fixing time that abruptly disappears exactly at the fixing time.

In general, it is recommended to trade in the middle of the week when the most action occurs. Fridays are generally busy until 04:00 pm GMT, and then the market becomes quiet until it closes at 9:00 pm GMT.