Imagine a surging river breaking through resistance, signifying a breakout. The river then pauses, creating a pullback, an opportunity for traders to join the journey. And as the river continues its relentless course, momentum intensifies.

In this article, we’ll unravel the secrets of Breakout Pullback Continuation trading, empowering you to seize opportunities and embark on a path to consistent profitability.

Before embarking on this exciting journey, let’s take a moment to grasp the core components that underpin Breakout Pullback Continuation trading. To better understand the concept, we will use bright metaphors again.

Picture a breakout as a magnificent bull charging through a sturdy gate or a defiant bear smashing through an impenetrable barrier. It represents a momentous shift in market sentiment, as the price of a currency pair surges past a significant level of support or resistance, paving the way for potential profits.

But wait, there’s more! Just as the dust settles and the crowd catches its breath, a pullback occurs. It’s like a quick pause in the action, a moment of respite before the next act unfolds. The price retraces, regrouping its forces, and offering traders a golden opportunity to join the fray at an advantageous price. It’s a chance to hop on the bandwagon, ready to ride the market’s untamed energy.

And the story doesn’t end there! Continuation is the grand finale, the climax of this thrilling tale. It’s when the initial trend reasserts itself with renewed vigour, propelling the price skyward or plunging it into the depths. This is where traders can witness their fortunes grow, as they skilfully ride the relentless momentum, capturing substantial profits.

Breakout Pullback Continuation trading seamlessly weaves these elements together, creating a tapestry of opportunity for traders of all levels. Whether you’re a wide-eyed beginner, eager to dip your toes in the Forex market’s turbulent waters, or a seasoned pro, seeking fresh tools to augment your arsenal, this technique promises a world of potential.

Breakout Pullback Continuation trading demonstrates its true strength in specific market scenarios. Let’s explore these situations.

Volatile Markets

Imagine a market that resembles a wild rollercoaster, with rapid price movements and shifting trends. In such volatile conditions, Breakout Pullback Continuation trading thrives. It provides traders with a structured approach to navigate the turbulence and seize profitable opportunities amidst the chaos. This technique excels in capturing the explosive price movements that occur during these market fluctuations.

Major News Events

When major news events take centre stage, the Forex market experiences a surge of activity and heightened volatility. It’s like a dazzling meteor shower that captivates traders’ attention. Breakout Pullback Continuation trading is particularly adept at capitalising on these moments. By effectively identifying breakout levels and pullbacks following the news announcements, traders can ride the waves of volatility and potentially reap substantial profits.

Riding Strong Trends

Picture a seasoned surfer riding a massive wave, skillfully harnessing its power. Breakout Pullback Continuation trading offers traders the ability to spot and ride strong trends in the market. It allows them to identify the moments when a trend asserts itself and catch the momentum for potential significant gains. By aligning with the market’s prevailing direction, traders can capitalise on the sustained price movement and maximise their profits.

Market Conditions Where Breakout Pullback Continuation May Not Be Ideal

While Breakout Pullback Continuation trading possesses the power to conquer many market conditions, it’s crucial to acknowledge its limitations. Like a ship struggling against the tides, this technique may not be the most suitable approach in all circumstances.

Ranging markets, where price meanders sideways without clear direction, can pose challenges for Breakout Pullback Continuation trading. False breakouts and pullbacks become frequent, making it difficult to identify profitable opportunities. Similarly, choppy price action and low volatility can dampen the effectiveness of this technique.

During such testing times, alternative strategies, such as Range trading or Mean Reversion trading, can prove fruitful for traders seeking solace from market turbulence.

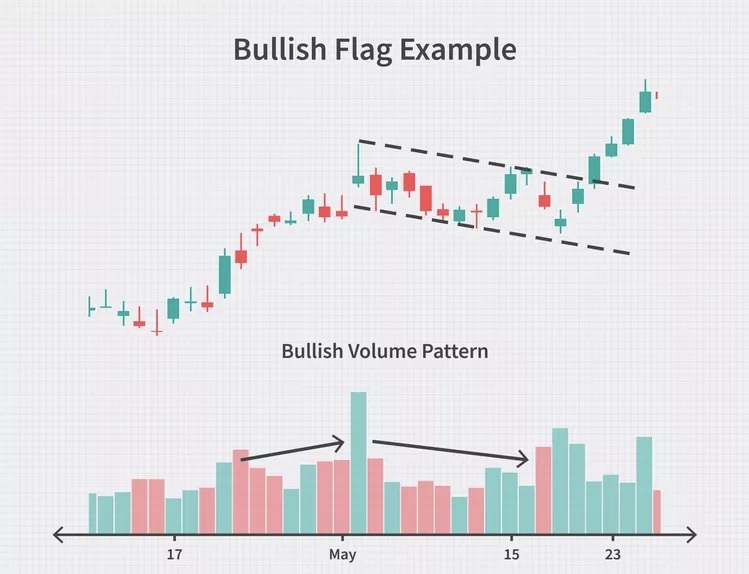

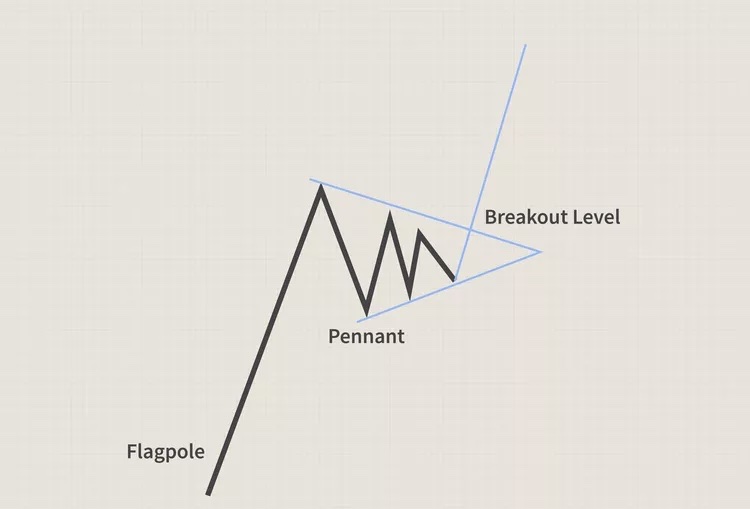

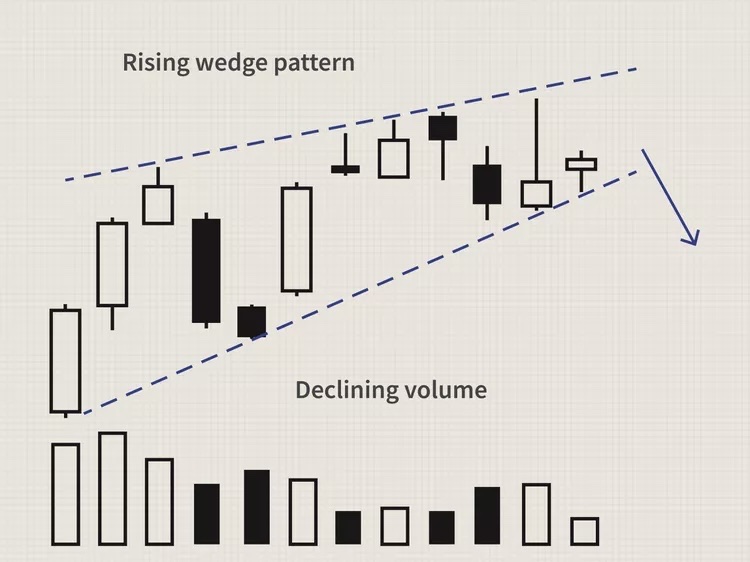

Let’s explore the common patterns associated with Breakout Pullback Continuation trading.

By recognising and understanding these common patterns, traders can effectively identify potential breakout and continuation opportunities, enhancing their decision-making process and increasing the likelihood of successful trades.

While Breakout Pullback Continuation trading possesses its own merits, traders often supplement their analysis with technical indicators to confirm their trading decisions. These indicators act as valuable tools, providing additional insights and enhancing the overall accuracy of the strategy.

Breakout Pullback Continuation (BPC) trading offers both benefits and considerations. Let’s explore them concisely.

Pros:

Cons:

To maximise your success in Breakout Pullback Continuation trading, consider the following practical tips.

In conclusion, Breakout Pullback Continuation trading offers a systematic approach to capturing profitable opportunities in Forex. Understanding core concepts, identifying patterns, and using technical indicators are key factors to succeed. Integrating other strategies ensures adaptability. Practice diligently and embrace the potential for consistent profitability with BPC trading.