Imagine you’re an adventurous traveller exploring the stunning landscapes of Iceland. As you stand at the edge of a mighty waterfall, you witness the sheer force and unstoppable energy of the rushing water. This captivating sight is similar to the world of Forex trading, where understanding and harnessing momentum can lead to remarkable financial opportunities.

In this article, we will delve into the exciting realm of Momentum trading—a technique that can empower non-professional traders to ride the waves of market trends and capture profits. Whether you’re a novice or experienced trader, Momentum trading can be a game-changer in your Forex journey.

Just like the roaring waterfall, Momentum trading revolves around identifying and following the direction of strong market trends. By strategically entering trades during periods of significant momentum, traders aim to profit from the rapid price movements that occur.

But why is Momentum trading so significant for non-professional traders? Well, it offers a simplified approach that doesn’t require an in-depth understanding of complex financial analysis. Instead, it relies on recognising and capitalising on the market’s natural rhythm—a rhythm that even newcomers can grasp and benefit from.

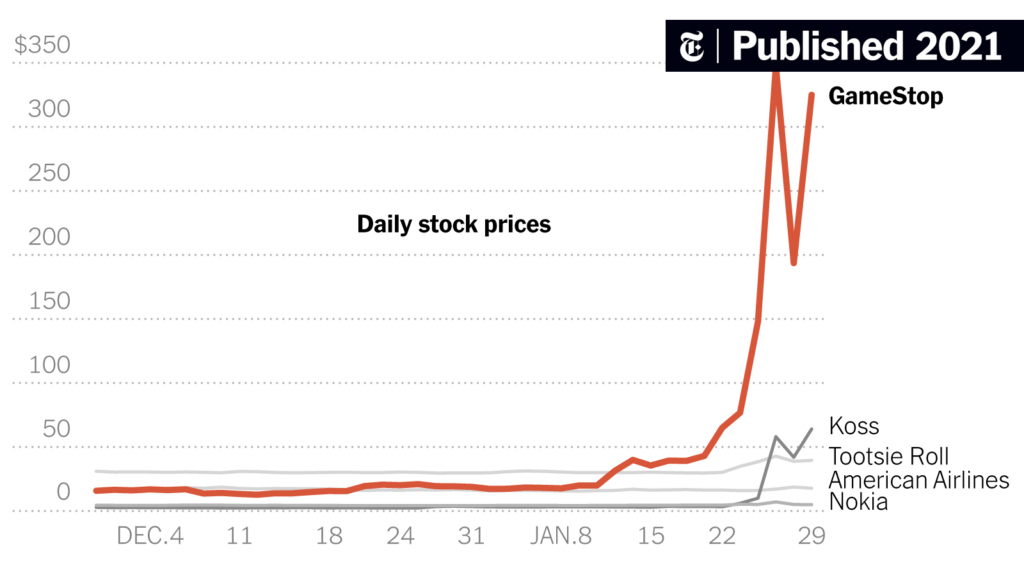

Let’s look at another real-life example to better understand this concept. Imagine you’re following the stock of a tech company that has just released a groundbreaking new product. The buzz surrounding this product creates a surge in investor interest, driving the stock price upward.

As a Momentum trader, you recognise this momentum and quickly enter the market, aiming to ride the wave of the rising stock price.

By closely monitoring the market and identifying strong trends, you can seize opportunities for quick profits. The key is to follow the direction of price momentum and exit the trade before the momentum subsides.

In this example, let’s say the stock price continues to climb rapidly over the next few days, propelled by positive news and increasing investor demand. As a Momentum trader, you’re in sync with the market dynamics and decide to exit the trade, locking in your profits at the peak of the momentum. By capturing rapid price movements and making timely trades, you increase your chances of success in Momentum trading.

Remember, a Momentum trader must be vigilant and adaptable in the market. Analysing market trends, identifying opportunities, and timing your trades are crucial skills that can be developed with practice and experience.

Momentum trading shines brightest during market breakouts and significant news events. Let’s say a major central bank announces an unexpected interest rate hike. This news triggers a surge in market activity and creates a strong momentum-driven trend. As a Momentum trader, you promptly identify this opportunity, enter the market, and ride the wave of the price movement to maximise your gains.

When it comes to Momentum trading, several key factors play a significant role in your success. Let’s dive into these factors:

By considering these factors and incorporating them into your trading strategy, you can enhance your chances of success in Momentum trading. Remember, practice and experience will further refine your skills as you navigate the dynamic world of Forex trading.

Momentum trading offers exciting opportunities for traders to capitalise on strong market trends and generate profits. However, it’s essential to understand the advantages and disadvantages to make informed trading decisions. Let’s explore the pros and cons of Momentum trading.

Pros:

Cons:

Technical indicators like the Relative Strength Index (RSI) and Moving Average Convergence Divergence (MACD) are valuable tools in Momentum trading.

Let’s consider the RSI indicator – a popular tool used to identify overbought or oversold conditions in a market. If the RSI indicates that an asset is overbought, it suggests that the price has risen too quickly, and a potential reversal may occur. Armed with this knowledge, you can make informed decisions and enter or exit trades accordingly.

Fundamental analysis is also crucial. Let’s say a country’s economic data reveals a significant decline in unemployment rates. This positive fundamental factor could contribute to strong market sentiment and propel price momentum in the respective currency pairs.

To excel in Momentum trading and maximise your chances of success, it’s important to follow certain guidelines and implement effective strategies. Here are some key tips to consider.

Discipline and Trading Plan:

Risk Management:

Proper Money Management:

Combine Strategies:

Learn from Real-life Examples:

Continuous Education and Adaptation:

By following these tips and incorporating them into your trading approach, you can improve your performance and increase your chances of success in Momentum trading.

In conclusion, by understanding and utilising Momentum trading technique, you can take advantage of strong market trends and potentially increase your trading profits. Keep exploring, learning, and adapting to the ever-changing Forex market. With the right mindset, discipline, and ongoing education, you’ll be equipped to make smart moves and ride the waves of Momentum trading towards your financial goals. Get ready to make your mark in the exciting world of Forex trading!