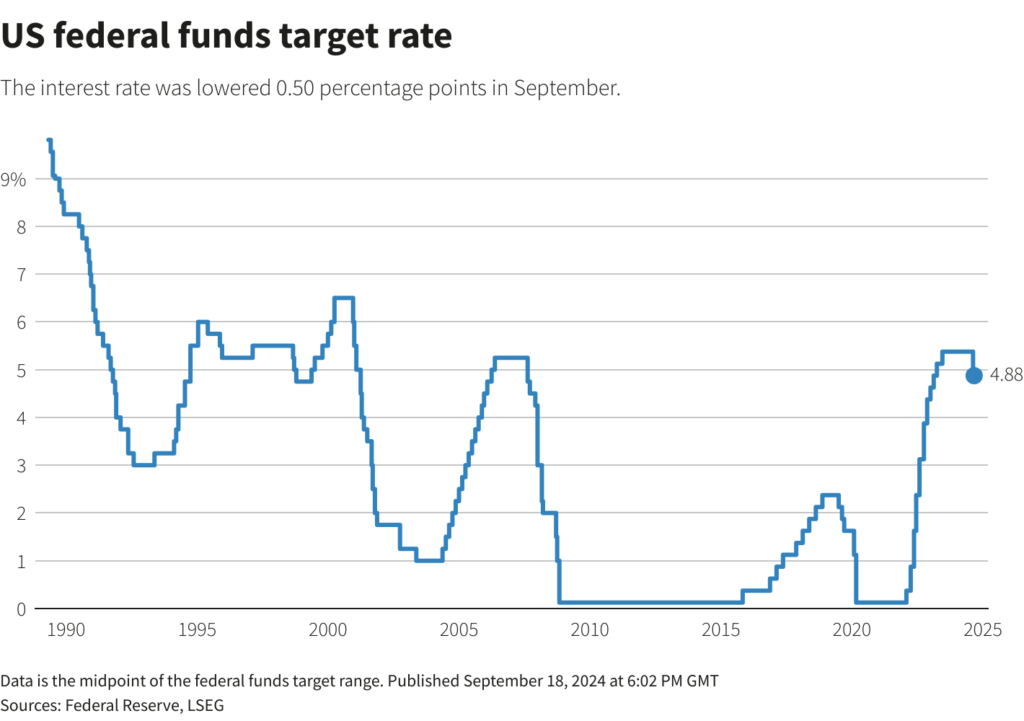

The Federal Reserve’s recent decision to cut interest rates by 50 basis points could make or break your trading strategy.

On 18 September 2024, the Fed lowered the federal funds rate, adjusting the target range to between 4.75% and 5%. Whether you’re invested in stocks, bonds, or even cryptocurrencies, this move affects how you should approach the market.

In this article, we will break down the immediate and long-term impacts across different markets and provide actionable tips to help you navigate these changes.

The federal funds rate is the interest rate at which banks lend money to each other overnight. By adjusting this rate, the Federal Reserve aims to influence broader economic conditions. The recent 50-basis-point cut signifies the Fed’s intent to stimulate economic growth and combat potential recessionary pressures.

Historically, rate cuts have often led to increased market activity. For instance, the series of rate cuts in 2001 and 2008 initially spurred stock market rallies, though these were tempered by concurrent economic challenges. Understanding these patterns can provide valuable context for interpreting current market movements. But how does this play out across different financial markets today?

A Fed rate cut typically weakens the US dollar, as lower interest rates reduce the attractiveness of dollar-denominated assets. This can strengthen major currency pairs like EUR/USD and GBP/USD, while emerging market currencies may also appreciate, benefiting countries with dollar-denominated debts.

For forex traders, a weaker USD creates opportunities to trade stronger currencies like the Euro or Yen. However, since the forex market is highly influenced by global economic conditions and geopolitical events, it’s crucial to monitor these trends alongside the rate cut.

Stock markets generally react positively to rate cuts, as lower borrowing costs can enhance corporate profits and spur economic growth. Sectors like technology, real estate, and utilities often benefit; for instance, real estate firms may capitalise on cheaper financing to boost stock values.

However, financial stocks, especially banks, might struggle due to reduced profit margins, as lower rates narrow the spread between loan and deposit interest. If you’re holding financial stocks, it may be wise to reassess your position.

Keep in mind that stock market reactions can be unpredictable. If the rate cut was anticipated, it may have already been “priced in,” limiting immediate effects. Additionally, factors like slowing GDP growth or rising inflation could lead to a quick reversal of any gains.

In the bond market, yields and interest rates move inversely. When the Fed cuts interest rates, bond yields typically fall, driving up the price of existing bonds. This is because older bonds with higher yields become more attractive compared to newly issued ones at the lower rate.

If you already hold bonds, their market value may rise. Corporate bonds, particularly those with higher ratings, may see yield spreads narrow, reflecting the reduced risk of default in a low-rate environment. On the other hand, new bond buyers will face lower returns.

Investors often flock to bonds during times of uncertainty, driving yields even lower in what’s called a “flight to quality.” As a result, you should consider balancing your portfolio between bonds and other assets to manage risk.

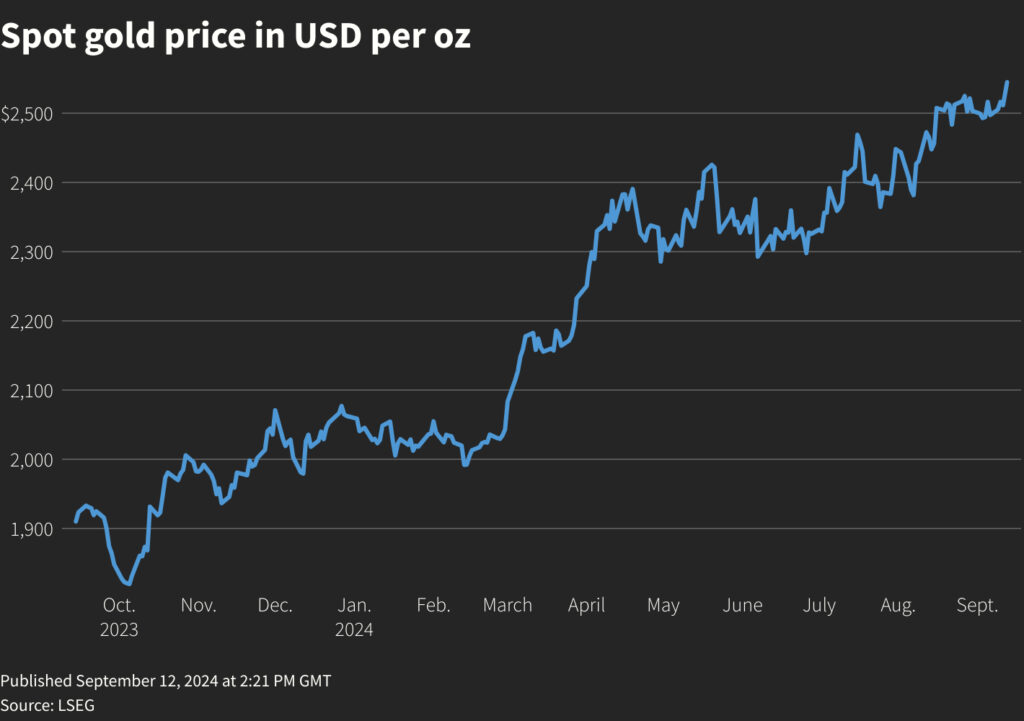

Commodities, particularly gold, often rise in response to rate cuts. Gold is considered a safe-haven asset, and lower interest rates reduce the opportunity cost of holding non-yielding assets like precious metals. This could push gold prices higher.

Other commodities may also benefit if the rate cut successfully stimulates economic growth. For example, increased industrial activity might boost the demand for metals like copper and steel.

However, the relationship between interest rates and commodity prices isn’t always straightforward, as factors such as global demand, supply chain disruptions, and geopolitical events can play a significant role.

The cryptocurrency market’s reaction to rate cuts can be mixed. Lower rates may encourage risk-taking, drawing investors to high-risk assets like cryptocurrencies. Conversely, rate cuts can signal economic instability, prompting risk-averse investors to avoid volatile assets like Bitcoin and Ethereum.

Bitcoin, known as “digital gold,” might gain from its perceived ability to hedge against inflation, especially amid fears of rising prices from loose monetary policy. However, the crypto market is highly unpredictable and influenced by various factors, so exercise caution.

While short-term market movements often grab headlines, the long-term effects of a Fed rate cut can have significant consequences:

Navigating market changes after a Fed rate cut can be challenging. Here are five key strategies:

1. Diversify: Spread investments across stocks, bonds, commodities, and currencies to minimise risk.

2. Monitor indicators: Keep track of inflation, GDP growth, and employment data for economic insights.

3. Use stop-loss orders: Protect against sudden movements by setting stop-loss orders, like 2% below your entry point.

4. Time your trades: Identify as a short-term or long-term investor and adjust your focus accordingly.

5. Stay disciplined: Avoid emotional trading; stick to your strategy during volatility.

The Fed’s recent rate cut will significantly impact financial markets, but each economic situation is unique. While historical patterns provide insight, staying informed and adapting your strategies is crucial.

Now is the time to review your portfolio and make adjustments to align with the new economic landscape. Whether you’re investing in stocks, bonds, forex, or commodities, a diversified approach will enhance your confidence.

Start now by opening a live account with VT Markets to navigate this evolving market landscape.