The euro plummeted to parity with the US dollar in July 2022 for the first time in 20 years, as Russia’s actions in Ukraine sparked fears of an energy crisis in Europe.

This dramatic shift in one of the world’s most traded currency pairs showed how geopolitical events can trigger seismic shifts in currency markets, affecting everyone from large institutional investors to casual forex traders.

Let’s explore the intricate relationship between geopolitics and currency values, and learn how to navigate these often turbulent waters.

A currency’s value reflects market confidence in a country’s economic and political stability—much like a nation’s share price. When confidence is high, the currency strengthens; when it drops, the currency weakens.

This is why “safe-haven” currencies like the Swiss franc and US dollar attract traders during global uncertainty, similar to how investors turn to gold during stock market volatility.

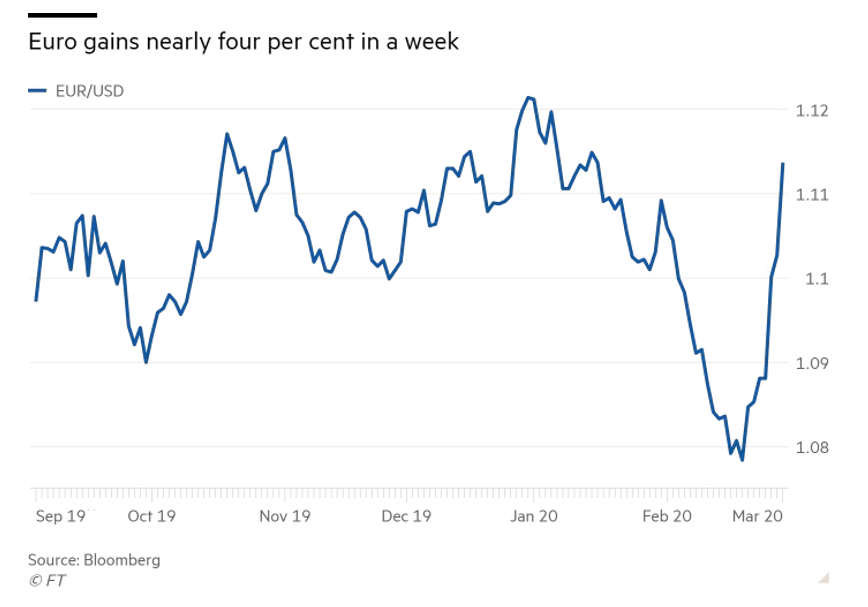

The US dollar often strengthens in crises due to its reserve currency status. For instance, during the early COVID-19 panic in March 2020, the dollar index surged, pushing EUR/USD from 1.15 to below 1.07 in two weeks.

Political events also impact currencies, especially in emerging markets. Currencies like the Turkish lira or Brazilian real fluctuate more than the euro or yen due to smaller economies and reliance on foreign investment.

For example, when Turkey’s President Erdoğan dismissed the central bank governor in March 2021, the lira lost 15% of its value against the dollar in a single day.

Elections and political changes

Major elections in leading economies can cause significant currency movements, especially when the outcome is unexpected.

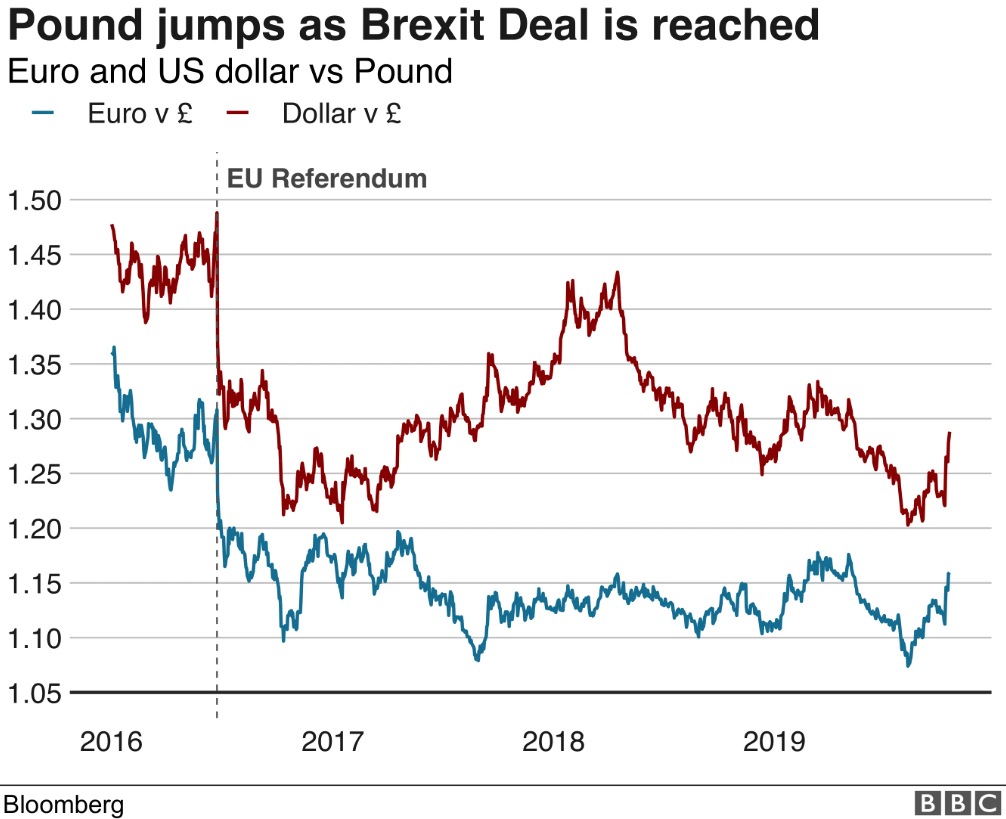

The 2016 Brexit referendum provides a perfect case study. When the leave vote won, the pound sterling crashed from 1.50 to 1.32 against the dollar in just six hours – the biggest single-day drop in its history.

Years later, every major development in UK-EU negotiations continued to cause sterling fluctuations, with GBP/USD moving between 1.20 and 1.43 based on deal prospects.

Similarly, the 2017 French presidential election significantly impacted the euro. When Emmanuel Macron emerged as the likely winner over the Eurosceptic Marine Le Pen, EUR/USD rallied from 1.07 to 1.12 in just two weeks.

International conflicts

Military conflicts and trade disputes can dramatically affect currency values. The Russia-Ukraine war provides multiple examples.

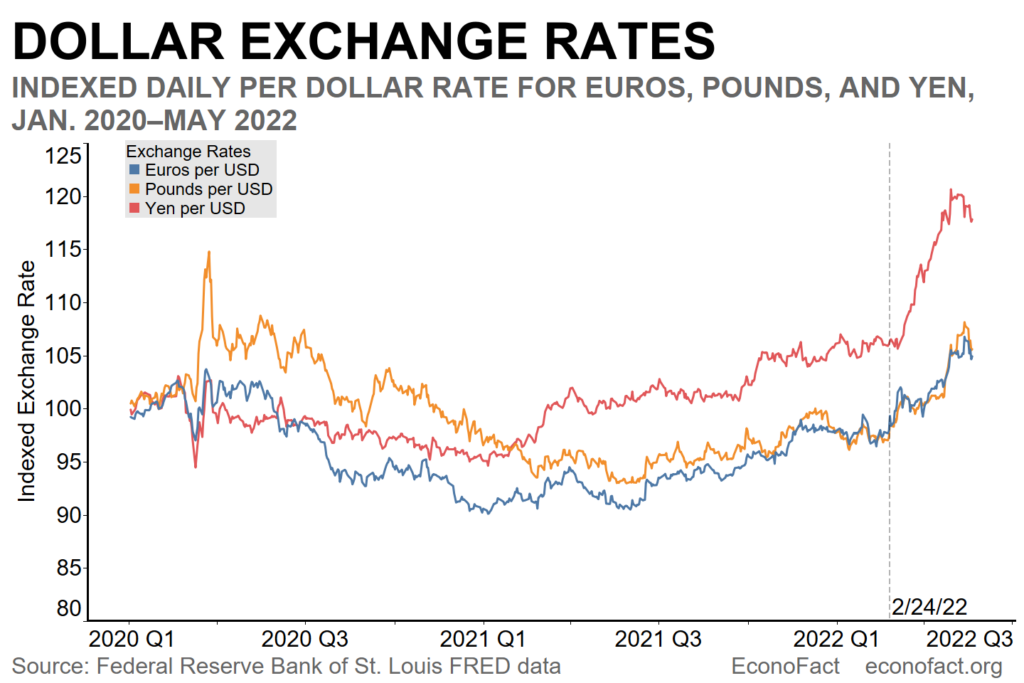

When Russia began its military operations, the euro dropped sharply due to Europe’s energy dependence on Russia. The EUR/USD pair fell from 1.13 to 1.00 over several months, reflecting concerns about European economic stability.

Trade disputes can have equally significant effects. During the 2019 US-China trade war, the yuan weakened beyond 7 per dollar, leading to volatility across all major currency pairs.

The Australian dollar, often seen as a proxy for Chinese economic health due to Australia’s strong trade ties with China, fell from 0.73 to 0.67 against the US dollar during this period.

Economic policy decisions

Political decisions frequently influence monetary policy and currency values. When the European Central Bank (ECB) announced negative interest rates in 2014 – a politically controversial decision – the euro fell from 1.40 to 1.20 against the dollar over three months.

Similarly, when the Swiss National Bank unexpectedly removed its euro peg in 2015, the Swiss franc surged by nearly 30% against the euro in minutes.

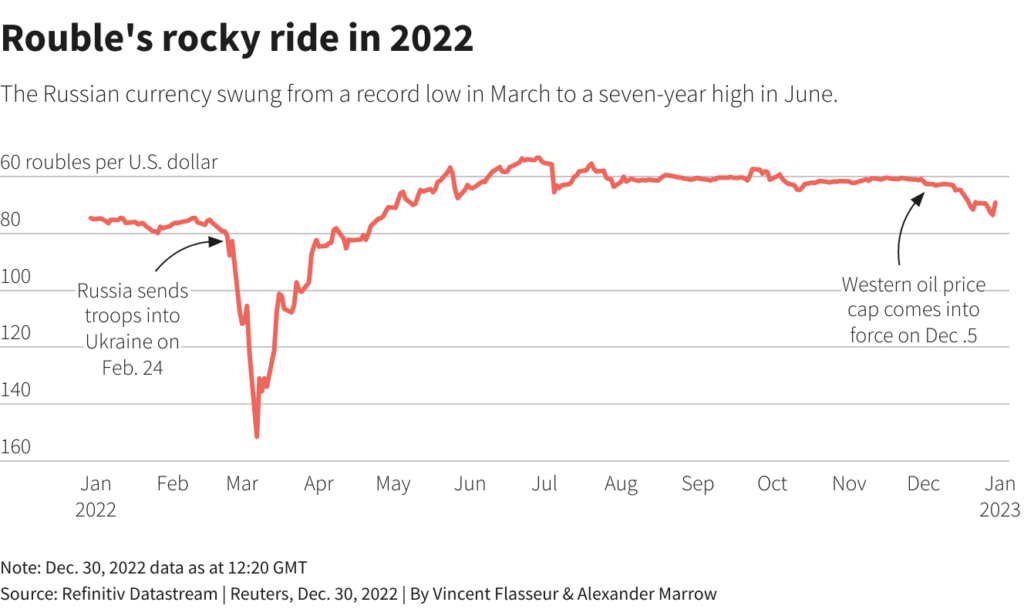

Sanctions can also dramatically impact currencies. After Western nations imposed sanctions on Russia in 2022, the rouble initially lost 40% of its value.

Conversely, major trade agreements typically strengthen currencies – when the EU and Japan signed their free trade agreement in 2019, both the euro and yen strengthened against the dollar.

For traders, monitoring geopolitical events requires a systematic approach. Here’s how to stay ahead:

Follow reliable news sources focusing on global politics and economics. The Financial Times, Reuters, and Bloomberg are excellent starting points.

Set up specific news alerts for countries whose currencies you trade regularly. For major pairs like EUR/USD or GBP/USD, following central bank communications and major political developments in both regions is essential.

Watch for warning signs like increasing political tensions, upcoming significant votes, or escalating international disputes. These often precede major currency movements.

However, don’t just react to headlines – consider the broader context and potential long-term implications. For instance, markets often price in expected election outcomes weeks before the actual event.

Risk management becomes particularly crucial during politically volatile periods. Consider reducing position sizes or setting wider stops to account for increased volatility.

For major currency pairs, typical daily movements of 0.5-1% can expand to 3-5% during significant political events. Sometimes, staying out of the market entirely during major political events might be the wisest choice.

Let’s consider how a trader might approach a developing situation.

Imagine you’re trading EUR/USD, and a major ECB policy meeting coincides with significant EU political developments. Here’s a sensible approach:

1. Research the potential policy changes and their likely market impact.

2. Monitor political statements from key EU leaders and ECB officials.

3. Reduce position sizes to account for potential volatility.

4. Set stops wider than usual – perhaps 2-3 times your normal stop distance.

5. Consider using options to hedge your exposure.

6. Wait for the initial market reaction to settle before making new trading decisions.

In conclusion, geopolitical events will always influence currency markets, but understanding these relationships helps traders make better decisions. Remember that no political event occurs in isolation – it’s the combination of various factors that ultimately determines currency movements. Stay informed, manage your risks carefully, and always consider the broader context of any political development before making trading decisions.

Ready to put this knowledge into practice? VT Markets provides you with all the necessary tools, market data, and news feeds to help you navigate currency markets during major geopolitical events. Open your live trading account today and start trading with confidence.