Energy commodities are like the unsung heroes behind our everyday routines, quietly driving the world forward.

Imagine this: the energy in a single gallon of gasoline can power a bicycle for two weeks straight. Now, let’s think big—when you flip a light switch, charge your phone, or start your car, you’re tapping into the huge energy sources that keep our modern lives running.

Now, here’s the eye-opening part: every day, a massive 100 million barrels of oil are used around the world. Wrap your head around that number—it fuels millions of homes, keeps countless vehicles on the move, and supports industries making everything from clothes to gadgets. This unending demand is what makes energy trading so captivating.

In this guide, we’ll dive into the nitty-gritty of energy trading, making the confusing stuff simple and highlighting the tactics used by smart investors to navigate this ever-changing market. Whether you’re trying to improve your trading skills or expand your investments, this guide is here to give you the knowledge you need to make good choices. Join us as we explore the energy trading world, breaking down its complexity to uncover the amazing potential hidden in energy resources—one barrel at a time.

Energy Commodities

Think of commodities as the building blocks of the global economy—the things that make everything tick. We can split them into two main groups: hard commodities and soft commodities. And each of these groups has its own little subdivisions:

Among these, energy is the real star. It’s super popular to trade because it’s what keeps our world spinning. Imagine if there was no energy—we’d be stuck without transportation, phones, computers, and all sorts of machines. That’s why energy trading is a big deal for investors like you.

On the global stage, we have both renewable and non-renewable energy sources. These are things we can trade all over the world:

The world of energy trading is a dynamic space where the exchange, buying, selling, and predictions about energy commodities unfold across the global financial stage.

Through these interactions, benchmarks for the value of different commodities are set, influenced by a dance of factors that tug at the balance between supply and demand. Traders, guided by their predictions of energy price shifts, jump into or wrap up trading positions accordingly.

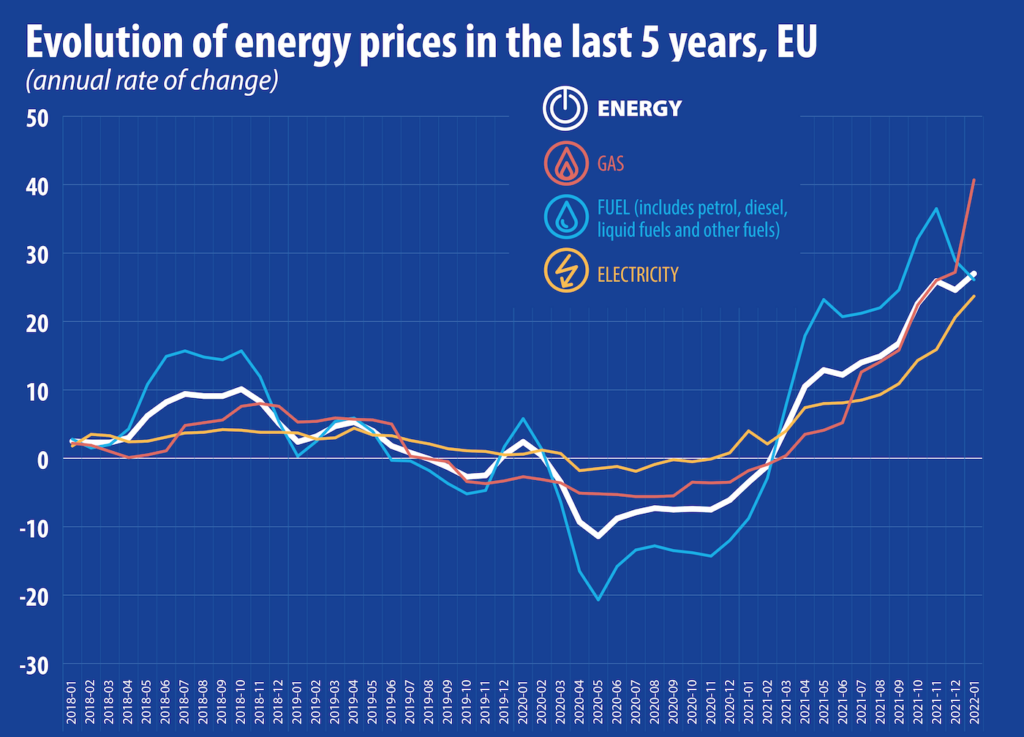

When we dig into the factors driving the rollercoaster of energy prices, a few key points come to light:

Navigating the energy trading market offers a multitude of paths for investors to explore, each with its distinct advantages and intricacies. Let’s embark on a journey to uncover these diverse approaches:

Physical Commodities Trading

One route involves direct engagement with tangible energy commodities such as oil, natural gas, or heating oil. This entails buying and selling the actual materials. However, this path is often less chosen by individual traders due to the challenges associated with logistics and storage.

Energy Stocks

Another avenue is investing in the stocks of energy companies. For instance, purchasing shares in major oil corporations lets you indirectly partake in the shifts of the energy market itself.

Derivatives Trading

Derivatives like energy CFDs (contracts for difference) and spread betting provide a way to speculate on energy price movements without having to own the underlying assets. These tools offer flexibility and the potential for gains in both upward and downward markets.

Energy ETFs

Exchange-traded funds (ETFs) are like investment bundles that group together energy-related stocks. This strategy grants you diversification by allowing you to invest in a broader slice of the energy market without needing to handpick individual stocks.

Energy commodity markets are known for their high volatility, offering opportunities for short-term gains and often serving as a safe haven for investors in uncertain times.

To begin trading energy stocks, commodities, or ETFs, consider practicing in a risk-free environment. VT Markets provides an obligation-free demo account, allowing you to simulate opening and closing positions. With 90 days to explore, you can learn about energy trading dynamics and understand how factors affect prices, including oil CFDs and energy company stocks.

In addition to monitoring price charts and trends, a robust energy trading strategy includes staying informed about breaking energy commodity news. Keeping up with the latest developments impacting the energy sector and reading expert analyses is crucial.

Remember, trading energy stocks may require in-depth analysis, as stock movements don’t always directly mirror commodity prices. VT Markets offers daily market analysis to help you gauge the impact of breaking news on your portfolio.

Ready to trade energies in a user-friendly live trading environment? VT Markets can have you up and running, opening your first position in just minutes. Create your live trading account today and explore the potential opportunities the energy market holds to elevate your portfolio.