Let’s say you are a Forex trader who is interested in trading the EUR/USD currency pair. You know that the European Central Bank (ECB) is scheduled to announce its interest rate decision tomorrow. The ECB’s interest rate decision is a major event that can have a significant impact on the value of the euro.

Using fundamental analysis, you can assess the potential impact of the ECB’s interest rate decision on the EUR/USD currency pair. If you believe that the ECB is likely to raise interest rates, you might expect the euro to appreciate in value. Conversely, if you believe that the ECB is likely to keep interest rates unchanged, you might expect the euro to depreciate in value.

By understanding the potential impact of the ECB’s interest rate decision, you can make a more informed decision about whether to buy or sell the EUR/USD currency pair. This is fundamental analysis use example.

Fundamental analysis is a method used by Forex traders to understand the true value of a currency pair based on economic, financial, and geopolitical factors. By understanding these factors, traders can make more informed decisions about when to buy or sell currencies and other assets.

Fundamental analysis is based on the idea that the price of a currency is ultimately determined by its underlying value. This value is influenced by a variety of factors, including:

Economic indicators

Central bank policies

Geopolitical events

The overall mood of traders towards a currency pair can also have a significant impact on its value. If traders are bullish on a currency pair, they are more likely to buy it, which can drive up its value. Conversely, if traders are bearish on a currency pair, they are more likely to sell it, which can drive down its value.

For example, a positive economic report, such as better-than-expected employment data, can boost investor confidence in a country’s economy, leading to increased demand for its currency.

Fundamental analysis can be used to inform both short-term and long-term trading decisions. However, it is more commonly used for long-term trading, as it takes time for fundamental factors to have a significant impact on currency prices.

To use fundamental analysis, traders need to track economic data releases, central bank announcements, and other geopolitical events that could impact currency values. They can then use this information to assess the underlying value of a currency pair and make trading decisions accordingly.

For example, if a country’s GDP growth is strong, it is likely that its currency will appreciate in value. This is because a strong economy is seen as being more stable and attractive to investors. Conversely, if a country’s GDP growth is weak, its currency is likely to depreciate in value.

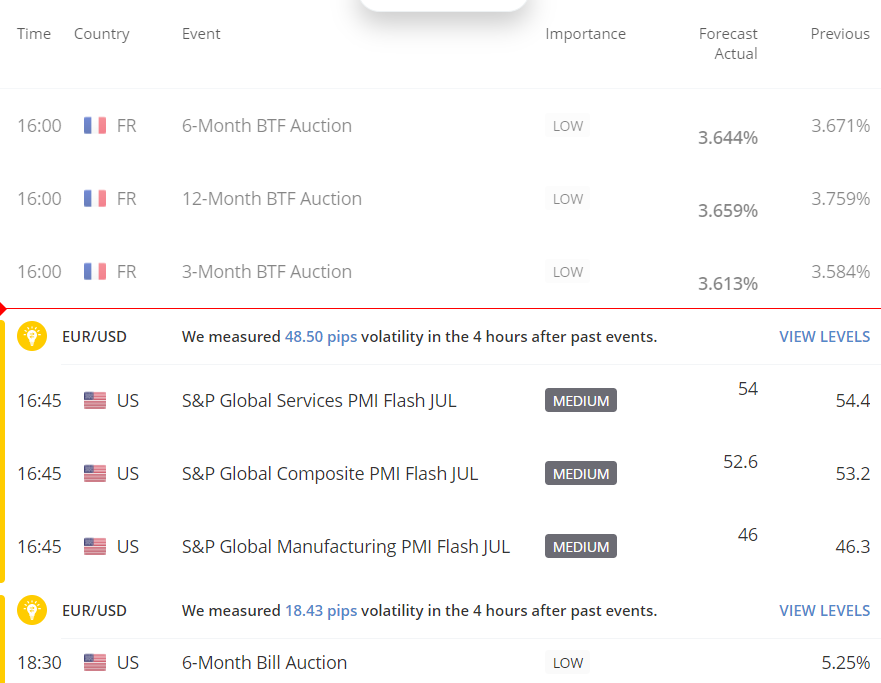

One of the most important tools for fundamental analysis is the economic calendar. This is a schedule of upcoming economic events and news releases that could impact currency pairs. The economic calendar is a valuable tool for traders because it allows them to stay informed about upcoming events and make informed trading decisions.

The economic calendar typically includes information about the following:

VT Markets offers a user-friendly economic calendar that is accessible to beginners. The calendar is easy to navigate and provides clear information about upcoming economic events. It also includes an “importance” rating, which helps traders gauge the potential effect of an event on the market.

Additionally, you can use a daily market analysis by VT Markets that can be a valuable tool for fundamental analysis. The Daily market analysis provides an overview of the key economic events and geopolitical developments that could impact currency values. It also includes a technical analysis section that provides insights into the short-term trends in currency prices.

Pros:

Cons:

In conclusion, fundamental analysis is a valuable tool for Forex traders who want to make informed trading decisions. However, it is important to remember that fundamental analysis is not the only factor that influences currency prices. By combining fundamental analysis with other trading tools, you can make more informed and confident trading decisions.