The election of Donald Trump to the US presidency brings with it significant uncertainty and excitement for traders across the globe. Trump’s economic policies, which often emphasise deregulation, tax cuts, and protectionist stances, can cause considerable shifts in financial markets.

Traders need to understand how Trump’s victory might impact key assets. In this article, we’ll explore these potential impacts and provide practical insights for those navigating market fluctuations during this time.

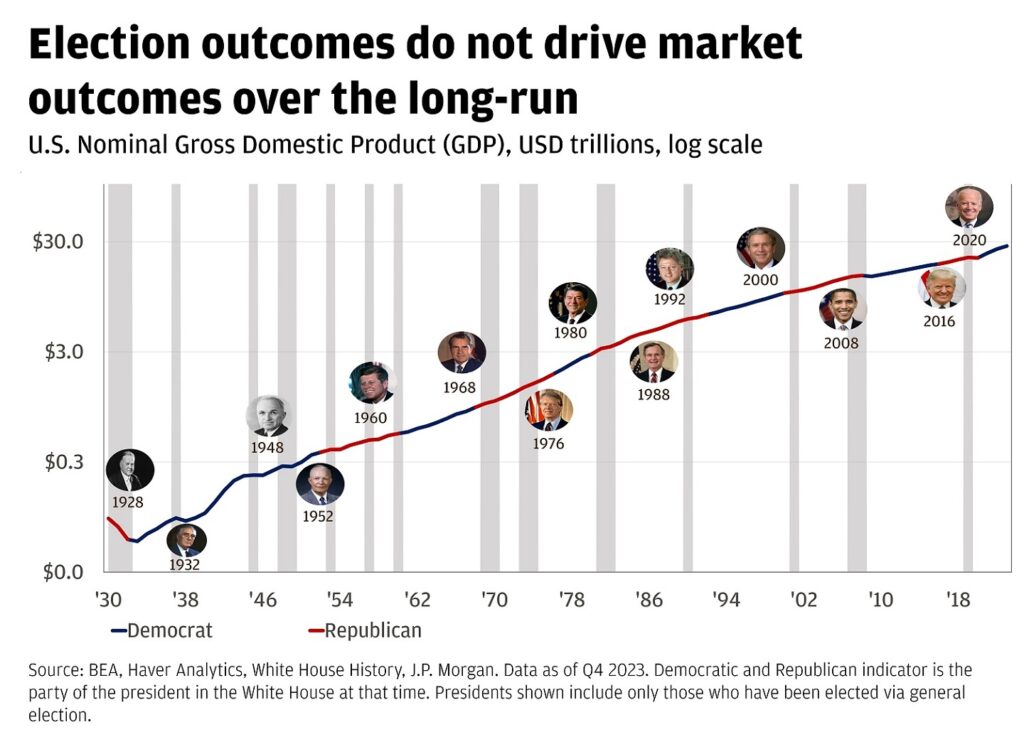

While it is tempting to make sweeping predictions following the results of a presidential election, historical trends show that the effects of such events are typically short-lived.

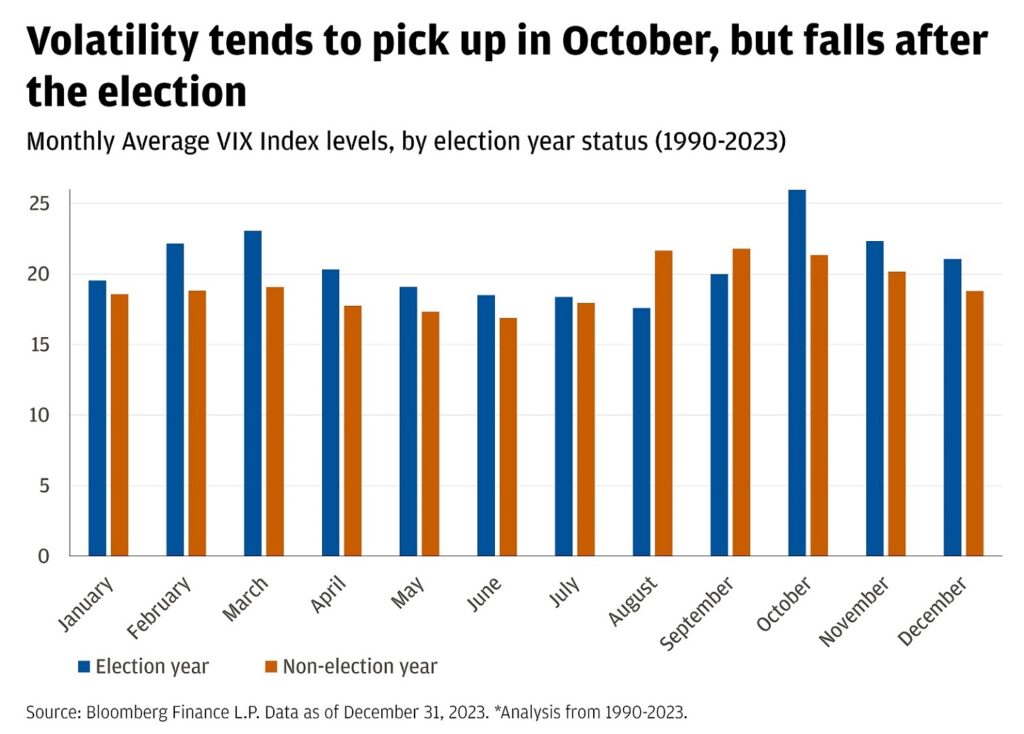

Looking back at past elections, we can see that while volatility often spikes immediately after the election, it’s the long-term changes that matter more.

For instance, during Ronald Reagan’s presidency, regulatory changes significantly impacted industries like telecommunications and energy, while George W. Bush’s tax cuts reshaped the corporate landscape.

However, both of these shifts unfolded gradually, and their immediate effects were tempered by broader economic trends.

Practical insight: Traders should avoid reacting impulsively to immediate market fluctuations following the election. Instead, they should consider historical patterns and focus on long-term fundamentals to make informed decisions.

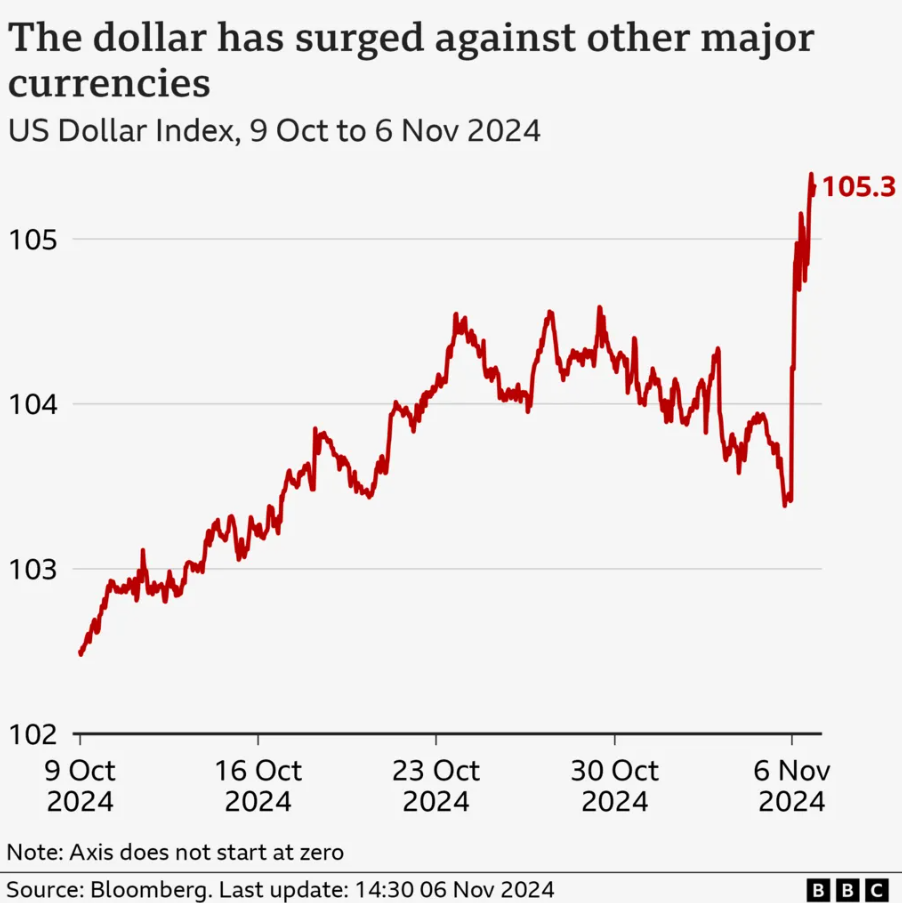

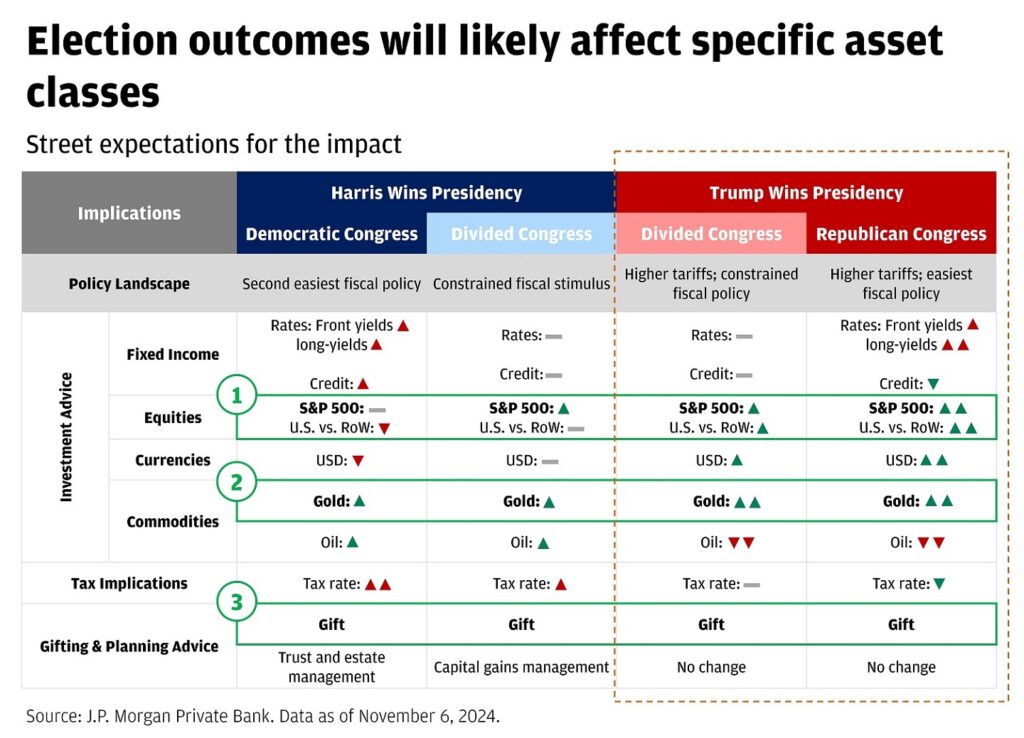

One of the first noticeable effects of Trump’s victory has been a rise in the US dollar. Following the election, the dollar gained approximately 1.65% against major currencies such as the yen, euro, and pound, driven by expectations of increased economic growth.

Trump’s policies, including his tax cuts and plans for infrastructure spending, are seen as catalysts for potential growth, which could lead to further appreciation of the USD.

Trump’s “America First” trade policy, with a focus on tariffs and reduced import dependency, could also strengthen the US dollar. By pushing for a reduction in trade deficits, Trump’s administration may foster a more robust dollar.

Practical insight: A stronger USD can make dollar-denominated assets more expensive for foreign buyers, impacting demand for certain commodities, particularly in emerging markets. Traders should consider the potential risks and opportunities that come with fluctuations in the value of the dollar.

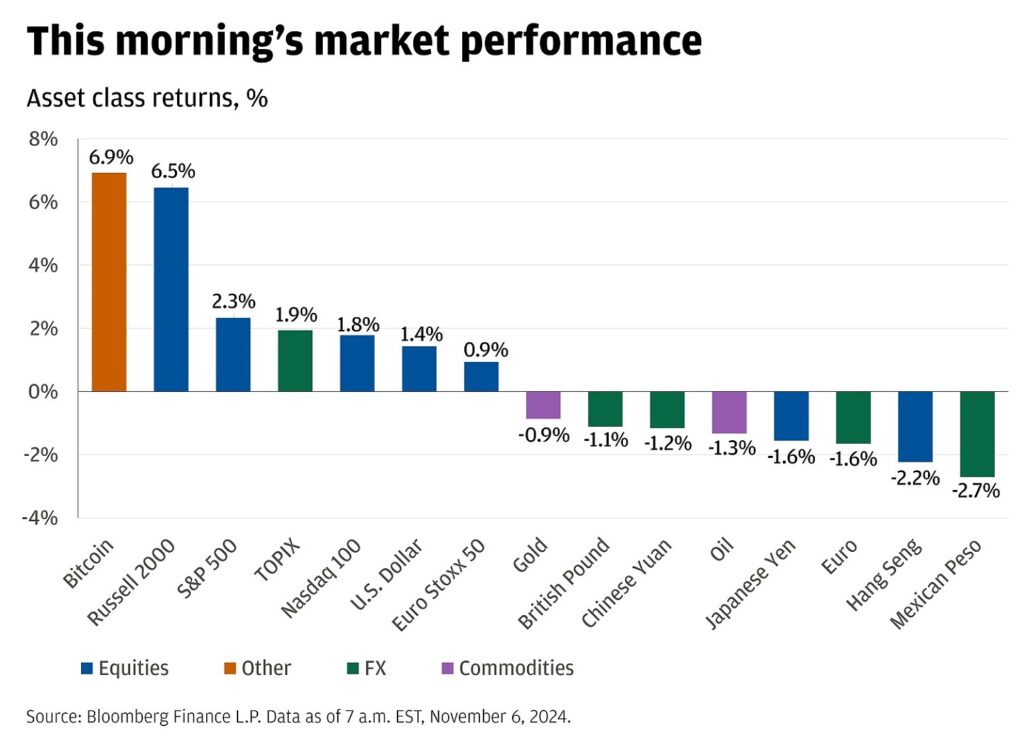

In the immediate aftermath of Trump’s victory, the stock markets responded with optimism. US stocks hit record highs, with the S&P 500 futures rising 2.3% and small-cap stocks surging 6.5%.

This was driven by the expectation of continued pro-growth policies, including the extension of tax cuts. However, global reactions have been more mixed.

While the FTSE 100 index in the UK rose initially but closed slightly down, major European indexes, the German Dax and French CAC 40, closed down by 1.14% and 0.51%, respectively.

In contrast, Japan’s Nikkei 225 rose 2.6%, while China’s Shanghai Composite Index fell 0.1% and Hong Kong’s Hang Seng dropped 2.23%.

Sector-specific impacts were also evident, with Tesla shares jumping over 14% in pre-market trading on anticipation of reduced regulation, while clean energy stocks saw sharp declines amid expectations of reduced government support.

Practical insight: Traders should consider sectors that are likely to benefit from Trump’s policies, such as energy and manufacturing. However, caution is advised in sectors that may be negatively impacted by protectionist measures, such as clean energy.

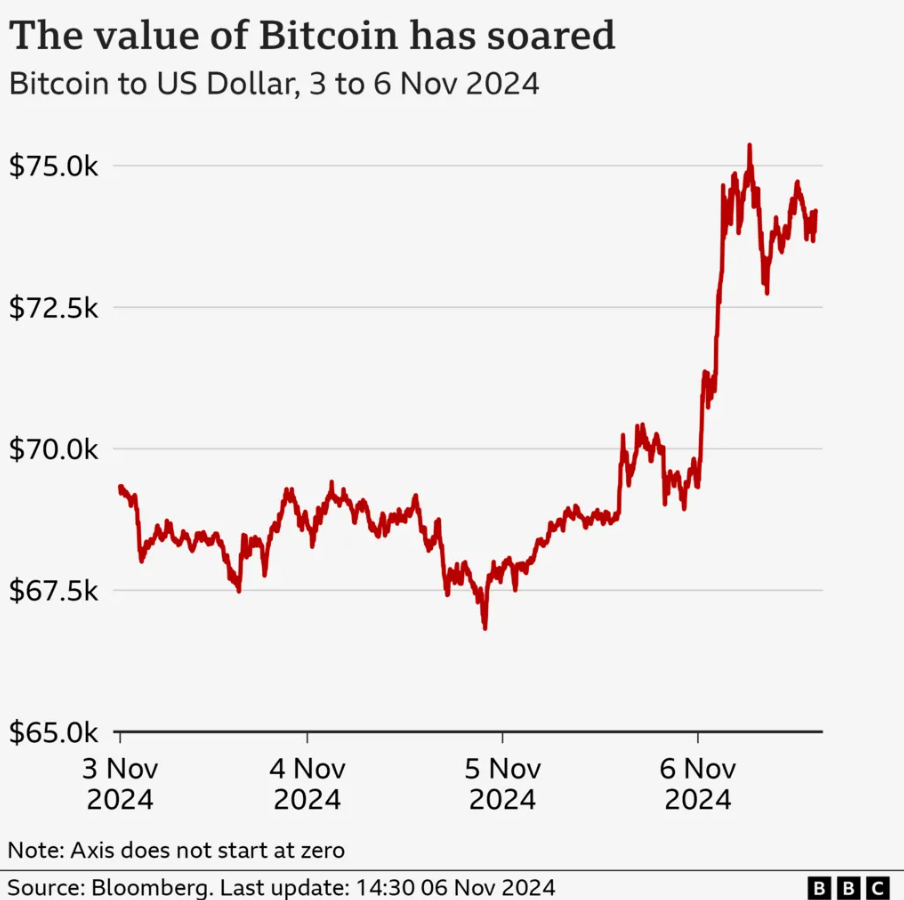

Another key asset that saw a notable reaction to Trump’s election is Bitcoin. Following the election, Bitcoin surged to a new all-time high of USD 75,999.04.

This increase is partially attributed to Trump’s vocal support for cryptocurrencies, with many traders viewing Bitcoin as a hedge against potential USD volatility and government interference.

Bitcoin’s appeal lies in its status as a decentralised digital asset, independent of traditional financial institutions and government control. As Trump’s administration may push for more regulation in some sectors, Bitcoin and other cryptocurrencies might emerge as a more attractive alternative for those seeking to diversify their portfolios.

Practical insight: Traders looking to capitalise on Bitcoin’s rise should be mindful of its inherent volatility. While it can offer substantial gains, Bitcoin can also experience rapid price swings, making it suitable for those with a higher risk tolerance.

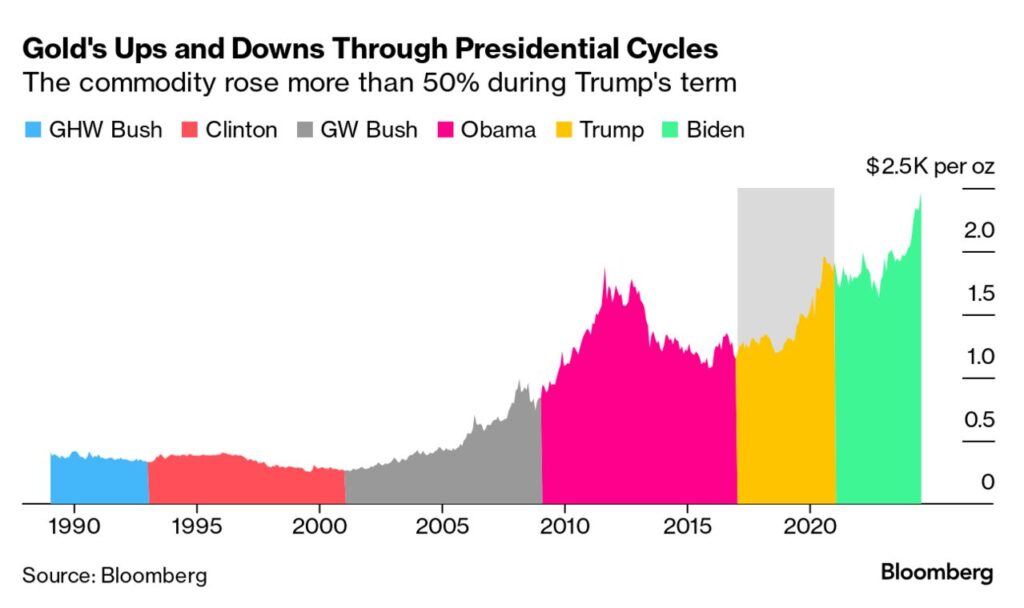

Gold, traditionally seen as a safe-haven asset during times of economic uncertainty, faced a decline following Trump’s election.

The price of gold dropped by 0.8% to USD 2,744/oz, as investors shifted their focus from precious metals to stocks and the strengthening USD.

Typically, gold has an inverse relationship with the USD—when the dollar strengthens, the demand for gold often diminishes. As Trump’s policies are expected to favour economic growth and strengthen the dollar, the appeal of gold as a safe-haven asset may diminish.

Practical insight: For traders, it might be wise to reconsider gold’s role in their portfolios, especially in the short term. While gold remains a valuable asset in times of broader market uncertainty, its appeal may diminish during periods of economic optimism.

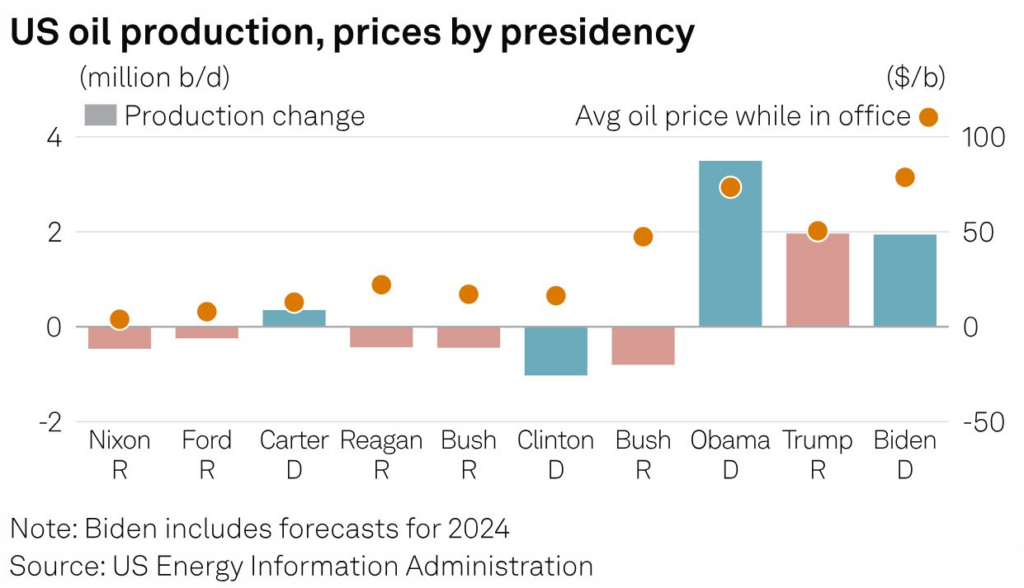

Trump’s energy policy, which focuses on increasing domestic oil production and reducing reliance on foreign oil, has had a noticeable impact on global oil prices.

Following his election victory, oil prices saw a 1.25% decline to USD 74.50/barrel as markets adjusted to the expectations of higher US production.

Trump’s promise to “drill baby drill” suggests that the US could become even more self-sufficient in energy production, which would impact both global supply and demand.

While oil prices may remain lower in the short term due to increased supply, there is a possibility that oil prices will stabilise as markets adjust to Trump’s policies.

Practical insight: Traders should be aware of the fluctuations in oil prices and the potential impact of Trump’s pro-oil stance. Although prices may dip in the short term, oil stocks could benefit in the long term from reduced regulatory burdens and increased production.

Looking ahead, Trump’s policies will likely continue to influence financial markets in both expected and unexpected ways.

While markets may see initial volatility, traders can expect to see opportunities in sectors such as energy, manufacturing, and technology, which are likely to benefit from Trump’s regulatory changes.

However, volatility will remain a key feature, as trade wars, changes in tariffs, and other policy adjustments could have significant, unpredictable impacts on the market.

Practical insight: Traders should remain informed and adapt their strategies to evolving market conditions. Diversifying their portfolios, staying informed on economic indicators, and avoiding knee-jerk reactions to short-term fluctuations can help them navigate this uncertain period.

Trump’s win presents both opportunities and challenges for traders. The key to success lies in understanding the long-term impacts of his policies on the financial markets and avoiding impulsive decisions based on short-term volatility.

By focusing on fundamentals, diversifying portfolios, and staying informed, traders can capitalise on the shifts in the market while managing the risks associated with a Trump presidency.

To get started trading in this dynamic market environment, open a live account with VT Markets today and access their range of trading tools and educational resources.