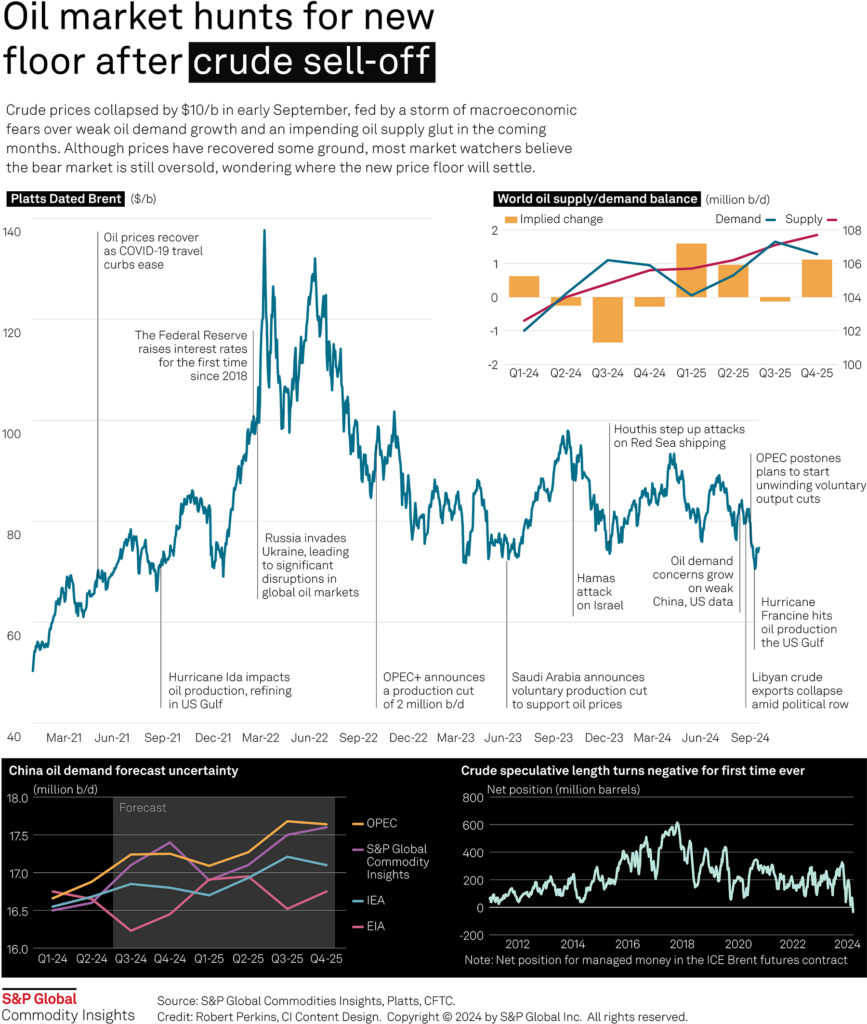

As of October 2024, the oil market remains highly volatile, with Brent crude futures dipping 0.8% to USD 76.58 per barrel, and West Texas Intermediate (WTI) down 0.5% at USD 73.24 per barrel. These fluctuations reflect a delicate balance of supply, demand, and economic uncertainty, particularly influenced by geopolitical tensions in the Middle East and a weak global economic outlook.

Recent swings in the market, such as a sharp increase in US crude inventories by 5.8 million barrels—far exceeding the expected 2 million—have placed downward pressure on prices. Meanwhile, OPEC+ production strategies and escalating Middle East tensions have fuelled price instability.

In this dynamic environment, understanding the forces behind these price movements is crucial for traders looking to navigate the market. This article delves into the latest trends, key factors influencing oil prices, and what lies ahead.

Understanding the key drivers of oil prices is essential for any trader. On the supply side, OPEC+ production decisions remain a critical factor. The group’s recent agreement to delay a planned oil output increase of 2.2 million barrels per day (bpd) has provided some support to prices. However, growing production from non-OPEC countries is putting downward pressure on prices.

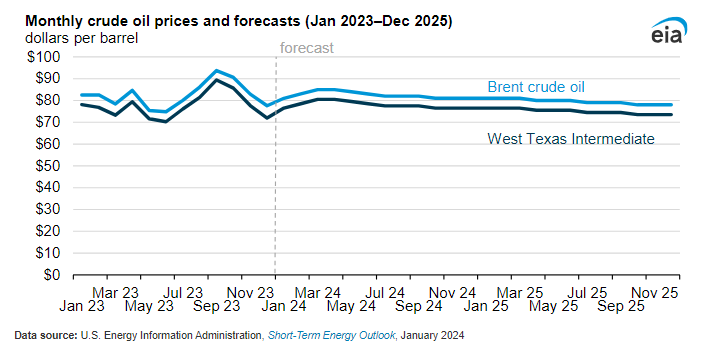

Demand-side factors are equally important. The US Energy Information Administration (EIA) has downgraded its demand forecast for 2025 due to weakening economic activity in China and North America. This has contributed to bearish sentiment in the market.

Geopolitical tensions, especially in the oil-rich Middle East, can cause rapid price movements. Speculation of a strike on Iran is estimated to be worth about USD 5 a barrel in the current market price. Natural disasters, like hurricanes affecting US oil infrastructure, can also disrupt supply and impact prices. For example, Hurricane Milton’s approach to Florida caused about a quarter of fuel stations to sell out of supplies, temporarily supporting crude prices.

Lastly, market speculation and positioning play a crucial role. Currently, there’s a record number of short positions in the market, which could lead to price volatility if these positions are unwound rapidly.

Looking ahead, oil price forecasts for 2025 vary. Citi expects prices to average around USD 60 per barrel if no further OPEC+ cuts are made. Traders from Gunvor and Trafigura foresee a range of USD 60-70 per barrel, mainly due to weak demand from China and global oversupply.

However, UBS projects Brent could rise above USD 80 per barrel, citing tight supply despite lower demand from China. These mixed forecasts reflect ongoing uncertainty, with institutions like the EIA predicting US oil demand at 20.5 million bpd in 2025, slightly below earlier expectations. OPEC and IEA forecasts also show divergence, highlighting the unpredictability of market conditions.

Global oil production has reached record highs. The IEA estimates supply will grow by 770,000 bpd this year, reaching a total of 103 million bpd, with further growth expected in 2025. Leading producers like the US, Canada, Guyana, and Brazil are driving this increase. Additionally, spare production capacity, particularly in the Middle East, adds potential for further supply if needed, potentially putting more pressure on prices.

While oil consumption continues to rise globally, the demand outlook varies by region. Asia’s emerging economies are leading the increase in demand, but long-term growth could be constrained by the shift toward electric vehicles and renewable energy, limiting oil’s future demand growth.

1. Stay informed about OPEC+ decisions: OPEC+ meetings can significantly impact oil prices. Keep track of announcements regarding production levels to anticipate market movements.

2. Monitor US crude inventory reports: The weekly reports from the Energy Information Administration (EIA) provide insights into supply and demand. Sudden changes in inventory can cause immediate price fluctuations, so be aware of expectations versus actual figures.

3. Use reliable news sources: Follow reputable news outlets to stay updated on geopolitical events and economic developments affecting the oil market. Avoid making decisions based on unverified information or rumours.

4. Utilise technical analysis tools: Leverage tools like moving averages and RSI (Relative Strength Index) to identify potential entry and exit points. This can enhance your ability to make informed trading decisions.

5. Assess your risk tolerance: Understand your risk tolerance and set stop-loss orders to manage potential losses effectively. This helps protect your capital while allowing for participation in the market.

6. Create a trading plan: Develop a clear trading plan outlining your strategies, goals, and risk management rules. This will keep you disciplined and focused.

The current oil market presents both risks and opportunities. The potential for price volatility means traders need to be vigilant and prepared for rapid market movements. Key indicators to watch include OPEC+ compliance with production quotas, US shale oil production figures, and economic data from major oil-consuming countries.

It’s crucial to remember that oil prices can be influenced by factors beyond simple supply and demand dynamics. Geopolitical events, currency fluctuations, and broader market sentiment can all play a role in price movements.

For instance, the EIA has lowered its forecasts for oil prices, now expecting US crude oil to average around USD 76.91 per barrel in 2024, a 2.4% cut on its prior forecast, while Brent prices are expected to average USD 80.89 per barrel this year, 2.3% lower than the previous forecast.

The oil market remains a challenging but potentially rewarding arena for non-professional traders. By understanding the key factors influencing prices, staying informed about market developments, and adopting a disciplined approach to trading, it is possible to navigate these turbulent waters successfully. Remember, in the world of oil trading, knowledge truly is power.

If you are ready to apply what you have learned, consider opening a live account with VT Markets. Their platform provides the tools and resources to help you trade oil confidently, potentially capitalising on market movements. Success in oil trading comes from continuous learning and careful risk management. Stay informed and trade wisely.