Imagine you are at the grocery store, and you notice that the prices of many items have increased compared to your last visit. While this might be a frustrating experience for you as a consumer, it’s also a valuable data point for traders and investors who closely monitor inflation trends.

One of the key indicators they rely on is the Personal Consumption Expenditures (PCE) Price Index, a measure of the prices paid by consumers for goods and services in the United States.

As a forex trader, you are constantly on the lookout for economic indicators that can influence market movements and provide trading opportunities. One such indicator is the PCE Price Index, closely watched by the Federal Reserve as a gauge of inflation.

Grasping the nuances of this index can give you valuable insights into the central bank’s monetary policy decisions and their potential impact on currency and commodity markets.

The PCE Price Index is a measure of the prices paid by consumers for goods and services. It is calculated and published by the Bureau of Economic Analysis (BEA), and it serves as one of the key inflation indicators closely monitored by the Federal Reserve.

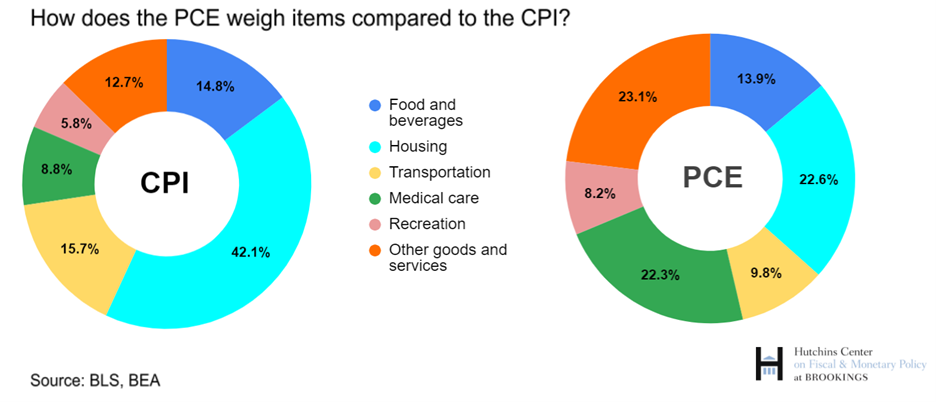

Unlike the more widely known Consumer Price Index (CPI), the PCE Price Index includes a broader range of consumer spending, including healthcare and housing services.

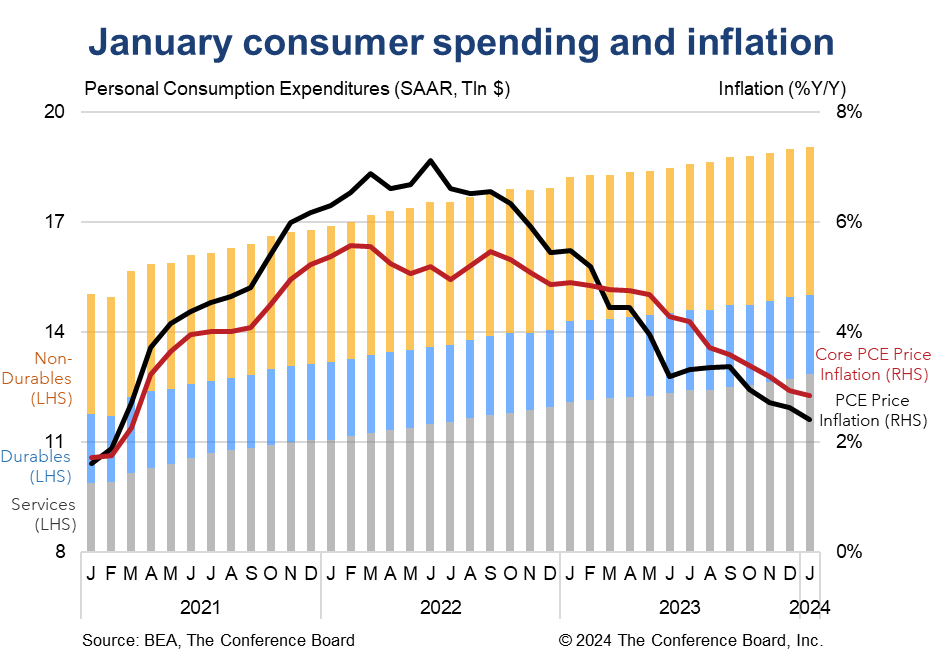

The PCE Price Index is used to calculate inflation by tracking the percentage change in the prices of the basket of goods and services over time.

Specifically, the BEA compares the cost of this basket in the current period to the cost of the same basket in a base period. The percentage change in the cost represents the rate of inflation or deflation.

For example, if the basket costs USD 100 in the base period and USD 102 in the current period, the PCE Price Index would show a 2% increase, indicating an annual inflation rate of 2%.

This inflation rate is then used by policymakers and investors to gauge the overall price level changes in the economy.

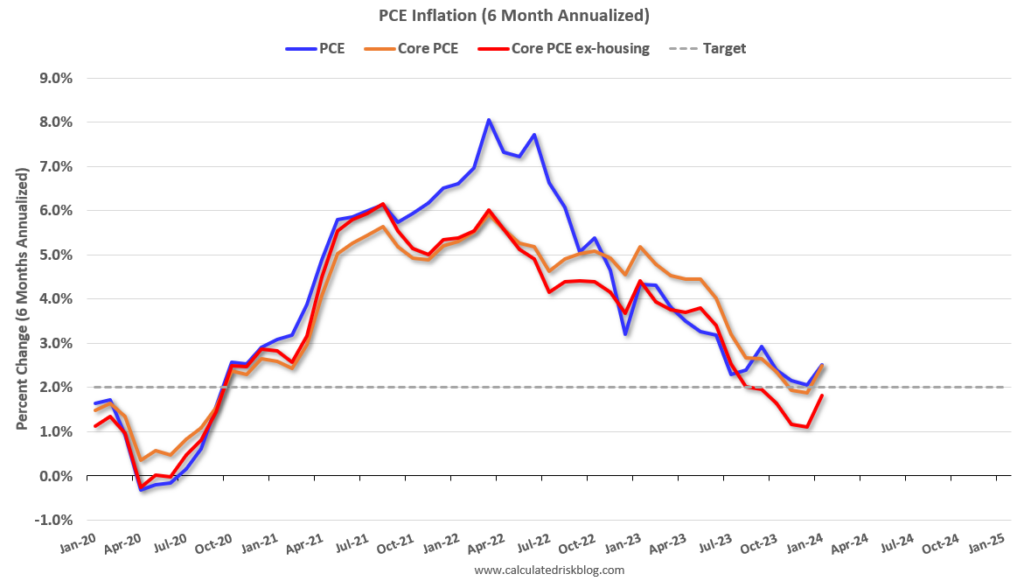

The PCE Price Index is also divided into headline and core measures. The headline index includes all goods and services, while the core index excludes volatile food and energy prices.

The core PCE is often considered a better measure of underlying inflation trends, as it filters out temporary price fluctuations caused by factors such as changes in energy prices.

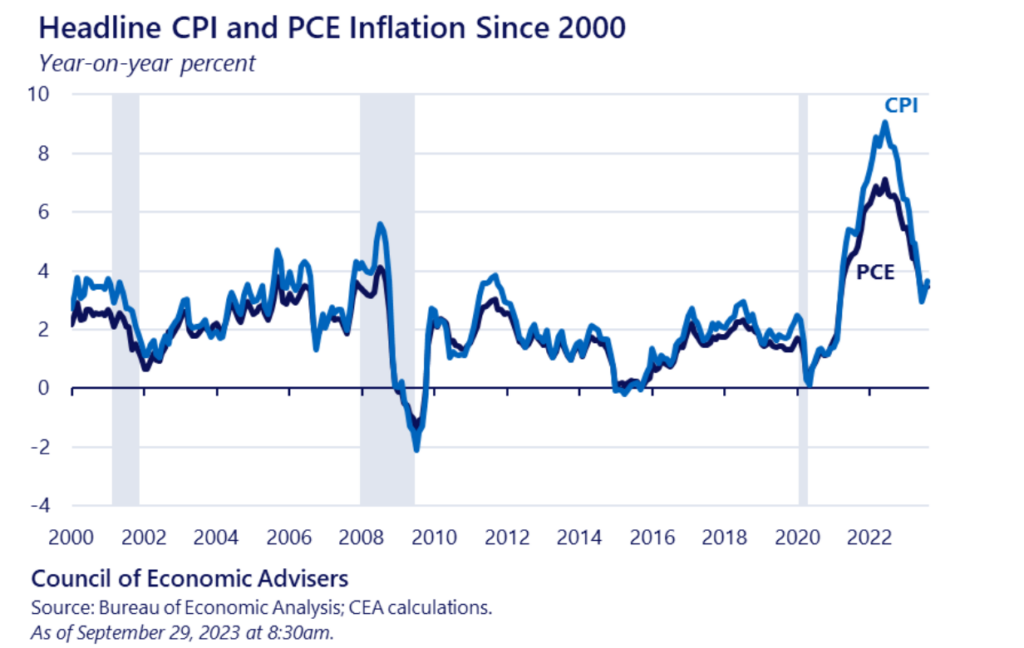

There are several important indices used to measure inflation in the United States, each with its own methodology and focus.

Some of the commonly cited inflation measures include the Producer Price Index (PPI), which tracks prices at the wholesale level, the Import Price Index, monitoring inflation for imported goods, and the Employment Cost Index, focusing on changes in labour costs.

However, the two most widely followed and influential inflation gauges are the Personal Consumption Expenditures Price Index and the Consumer Price Index. While both the PCE and CPI indices measure inflation, there are several key differences between the two.

The CPI is based on a different basket of goods and services, uses different weightings, and does not account for substitution effects, where consumers switch to cheaper alternatives when prices rise.

In contrast, the PCE Price Index is preferred by the Federal Reserve as its primary inflation gauge due to its broader coverage of consumer spending, including services like healthcare and housing. Additionally, the PCE Price Index captures substitution effects, reflecting how consumers adapt their spending patterns as prices change.

Furthermore, the PCE Price Index’s methodology is designed to account for changes in consumer preferences over time. The index is adjusted to reflect shifts in consumer behaviour, ensuring that it remains an accurate measure of inflation as spending patterns evolve.

This dynamic approach enhances the index’s relevance and reliability in capturing the true cost of living.

As a forex trader, you can use the PCE Price Index to anticipate potential changes in monetary policy by the Federal Reserve.

The Fed closely monitors the PCE Price Index as part of its dual mandate of maintaining price stability and maximising employment.

If the PCE Price Index shows that inflation is rising above the Fed’s target rate (typically around 2%), it may signal that the central bank will tighten monetary policy by raising interest rates. Conversely, if inflation remains persistently low, the Fed may consider lowering interest rates or implementing other stimulative measures.

Changes in interest rates can have a significant impact on currency and commodity markets. Higher interest rates tend to strengthen a currency, making it more attractive for foreign investors, while lower rates can weaken a currency’s value.

Similarly, changes in interest rates can influence the demand for commodities, as they affect the cost of carrying inventories and the overall level of economic activity.

By closely monitoring the PCE Price Index and its implications for monetary policy, traders can position themselves to take advantage of potential market movements. For example, if the PCE Price Index data suggests that the Fed is likely to raise interest rates, traders may consider going long on the U.S. dollar or shorting commodity positions.

The PCE Price Index is a crucial inflation indicator that provides valuable insights into the Federal Reserve’s monetary policy decisions. By understanding how the index is calculated, its advantages over other measures, and its impact on interest rates and market movements, forex and CFD traders can incorporate this information into their trading strategies.

Staying up-to-date with PCE Price Index data releases and analysing the potential implications for monetary policy can help traders identify potential trading opportunities and manage their risk more effectively. As with any economic indicator, it’s essential to combine the PCE Price Index analysis with other technical and fundamental factors to make informed trading decisions.