The world of investment is experiencing a seismic shift, with artificial intelligence (AI) emerging as the driving force that is radically transforming traditional stock market paradigms. As 2024 draws to a close, the S&P 500 has reached a remarkable milestone, climbing to a record high of 6,001.35 with a year-to-date gain of 25.8%.

Amidst global economic challenges including high inflation, supply chain constraints, and geopolitical tensions, AI stands out as a beacon of innovation and potential growth, offering investors a promising avenue for strategic investment.

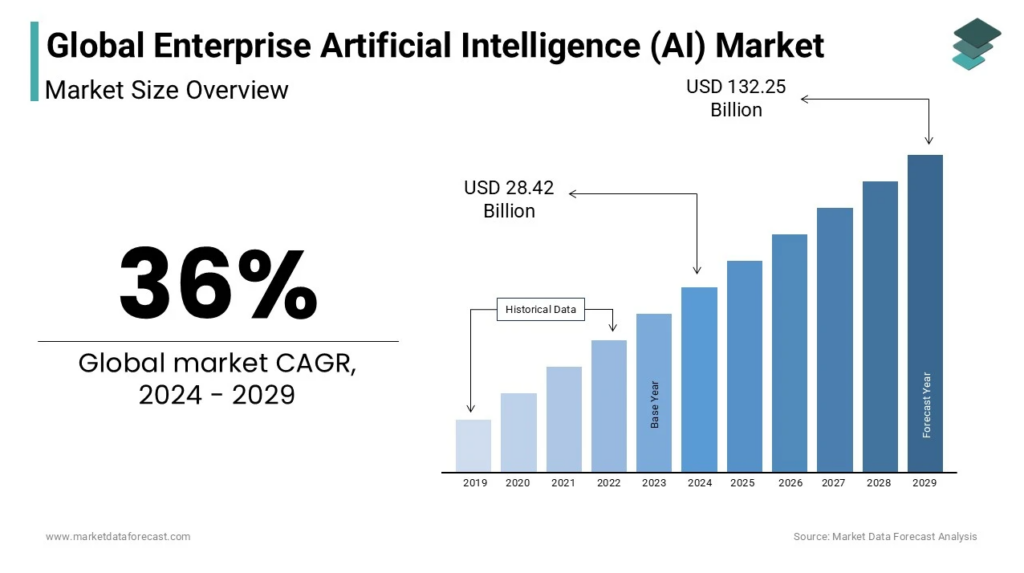

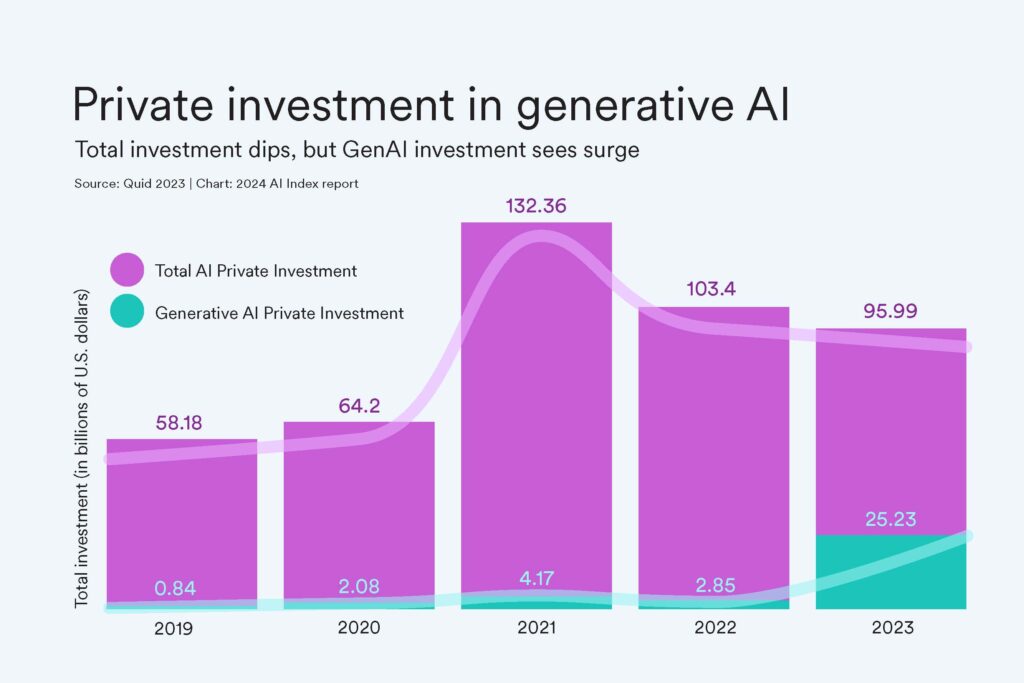

The investment world is experiencing a critical transition from AI speculation to substantive results. According to recent market research, global AI investment has surged to an estimated 200 billion USD in 2024, with venture capital firms and tech giants pouring unprecedented resources into the sector.

Investors are no longer satisfied with mere promises; they demand tangible evidence of AI’s value creation. Financial experts are calling this the “show me” moment for technology companies, where the focus has shifted from potential to actual revenue generation and strategic implementation.

A comprehensive analysis by McKinsey reveals that AI could potentially contribute up to 4.4 trillion USD annually to the global economy. This staggering figure underscores why investors are increasingly bullish about AI-related investments. The sector has seen a remarkable 67% increase in funding compared to the previous year, with semiconductor and cloud computing companies leading the charge.

This scrutiny comes at a time when technology giants are investing heavily in AI infrastructure. Cloud computing behemoths like Amazon, Microsoft, and Google are pouring billions into data centre expansions, AI chips, and research and development.

Industry estimates suggest that these companies have collectively invested over 50 billion USD in AI infrastructure in 2024 alone. The key question remains: how much incremental AI-related revenue are these investments generating?

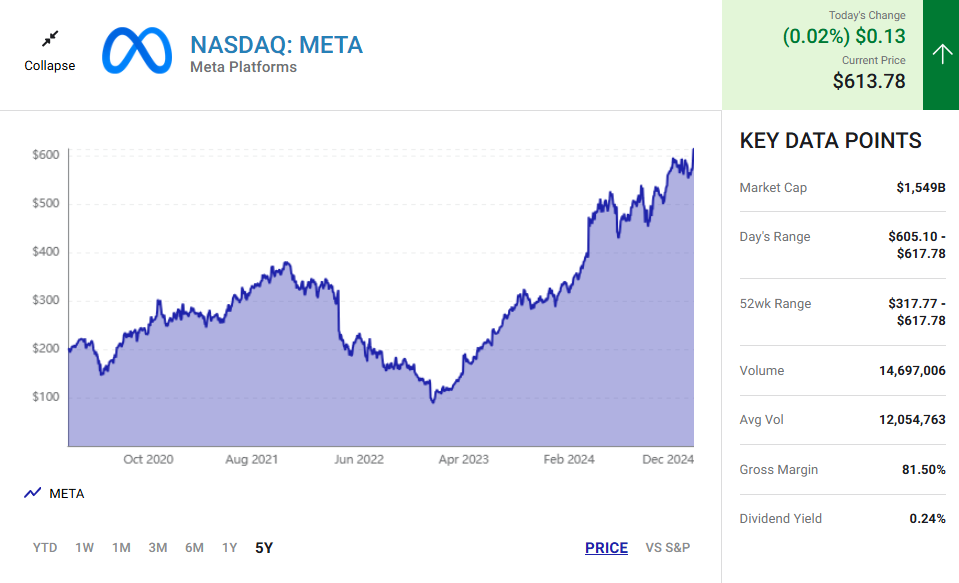

Meta Platforms represents a compelling case study in AI-driven transformation. With a market capitalisation of 1.5 trillion USD, the company has leveraged artificial intelligence to revolutionise its core business model. Its AI-powered recommendation systems have demonstrably increased user engagement, with Facebook seeing an 8% rise and Instagram a 6% increase in user interaction.

More impressively, over one million advertisers now utilise Meta’s generative AI tools, boosting ad conversions by 7%. The company’s strategic hire of Clara Shih from Salesforce to head a new “Business AI” group underscores its commitment to AI innovation. The company’s AI assistant has already reached 500 million monthly active users, positioning itself as a potential global leader in conversational AI.

The open-source Llama AI model has seen extraordinary growth, with downloads reaching 350 million by August 2024 – a tenfold increase from the previous year. Meta is actively working on Llama 4 models, training them on massive GPU clusters, signalling a long-term commitment to AI development.

Financially, Meta presents a robust investment opportunity, with double-digit revenue growth and a healthy balance sheet boasting 70.9 billion USD in cash against 28.8 billion USD in debt. The stock has gained an impressive 62% in 2024, making it an attractive option for investors.

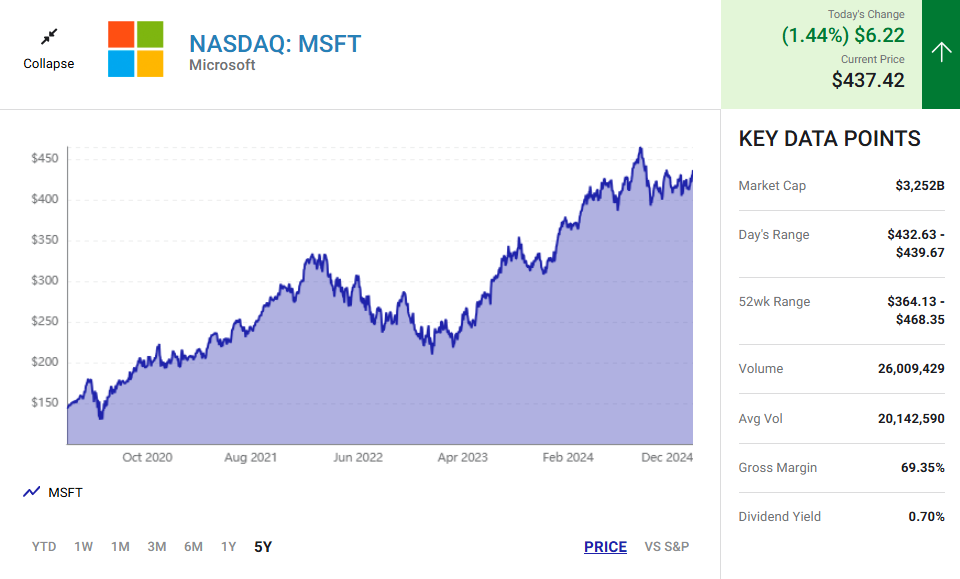

Microsoft continues to be a powerhouse in the AI ecosystem, its 13-billion-USD partnership with OpenAI proving transformational. The technology giant’s AI business is projected to cross 10 billion USD in annual revenue, making it the fastest-growing segment in the company’s history.

Azure cloud services have grown by 33% year-on-year, with AI services contributing significantly to this expansion. However, the company faces challenges with data centre capacity constraints, which have tempered growth expectations.

The company’s Microsoft 365 Copilot has gained substantial traction, with nearly 70% of Fortune 500 companies now utilising the service.

Despite some concerns about Azure’s revenue growth, Microsoft’s comprehensive approach to AI – spanning hardware, software, models, and frameworks – presents a compelling investment narrative. The stock has gained 12% in 2024, reflecting both challenges and opportunities in the rapidly evolving AI market.

Micron Technology offers a different perspective on AI investment, focusing on the critical infrastructure that powers artificial intelligence. As a key provider of high-performance memory for data centres, Micron is strategically positioned in the AI ecosystem.

The high-bandwidth memory (HBM) market is expected to explode from 4 billion USD in 2023 to 25 billion USD by 2025, with Micron targeting a 20-25% market share. The company’s technological advancements, including transitions to advanced DRAM and NAND technologies, make it an intriguing option for investors.

Notably, Micron’s HBM chips are already sold out until 2025, providing exceptional revenue visibility and predictability. This demand underscores the critical role of memory technology in AI infrastructure.

The AI landscape continues to evolve rapidly. Software companies are increasingly pivoting towards AI agents, while semiconductor firms continue to outperform in AI-related investments. The market is witnessing a shift from AI model training to AI application inference, opening new avenues for technological innovation.

Ready to capitalise on cutting-edge investment opportunities? Open a live trading account with VT Markets today and position yourself at the forefront of emerging technological investments. With our advanced trading platforms and expert market insights, you can seamlessly translate these AI market trends into potential trading strategies.

Investors should remain cautious yet optimistic. The AI market is not without challenges, including regulatory scrutiny, potential capacity constraints, and the ongoing question of monetisation. The potential appointment of an “AI czar” under the new administration could further reshape the regulatory landscape.

As we approach 2025, the AI stock market presents a landscape of unprecedented opportunity. Meta, Microsoft, and Micron demonstrate how companies are not just adopting AI but fundamentally reimagining their business models. For investors willing to conduct thorough research and maintain a strategic approach, the AI sector offers exciting prospects for growth and innovation.

While past performance does not guarantee future results, these companies showcase the potential of strategic AI implementation. Diversification, careful analysis, and a long-term perspective remain key to navigating this dynamic investment landscape.