As 2024 draws to a close with remarkable gains—the S&P 500 up 30% and the Nasdaq soaring 35%—investors are naturally wondering what 2025 might bring. With artificial intelligence reshaping industries, interest rates in flux, and a post-election landscape ahead, the coming year promises to be fascinating for market watchers. Whether you are a casual investor or managing your retirement savings, understanding what might lie ahead can help you make more informed decisions.

The market’s journey since 2022 tells an important story. After a challenging 2022 that saw nearly 20% decline due to rising interest rates, markets bounced back impressively with a 24% gain in 2023, followed by 2024’s stellar performance.

This pattern reminds us of a crucial truth: markets move in cycles, alternating between growth and downturns.

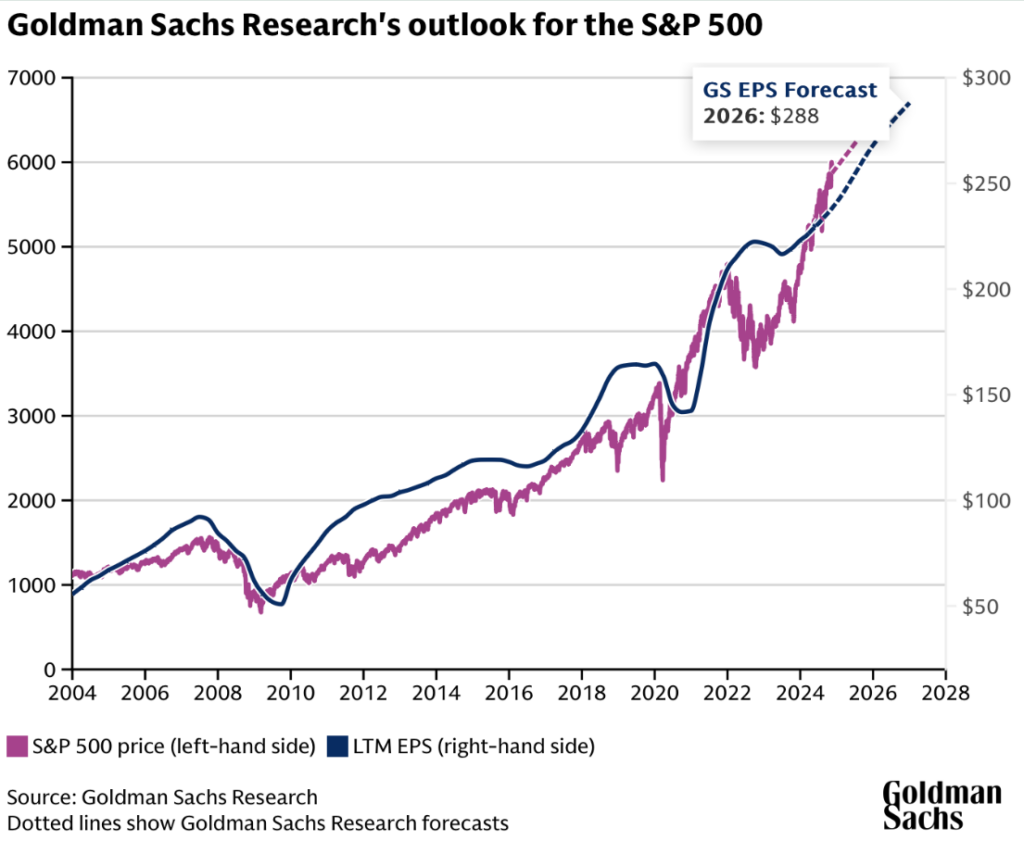

However, history suggests we should temper our expectations for 2025. Consecutive years of 20%-plus gains are relatively rare, having occurred only three times in market history. While this doesn’t guarantee a downturn, it suggests we might see more modest returns ahead.

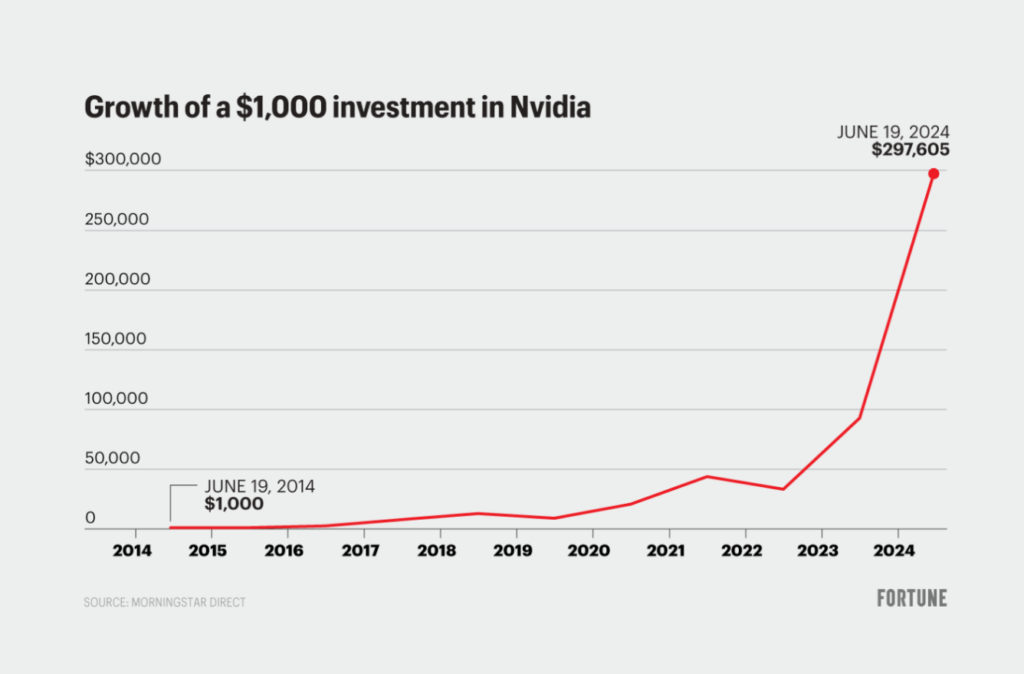

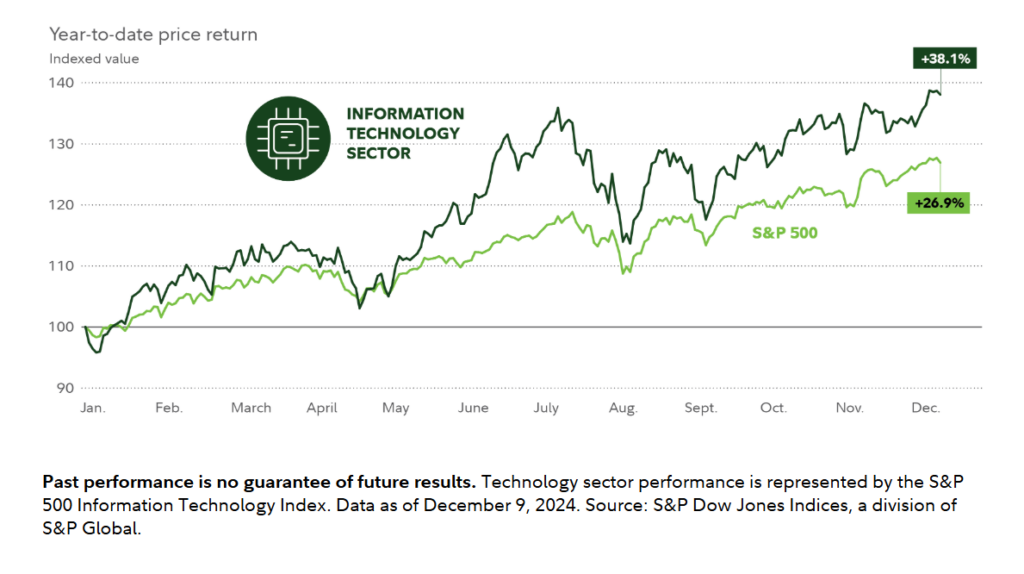

The most transformative force shaping markets is artificial intelligence. Much like automobiles in the 1920s revolutionised society, AI is fundamentally changing how businesses operate.

Companies like Nvidia, which saw its stock rise 178% in 2024, exemplify this trend. AI investments are expected to grow at a 29% compound annual growth rate through 2028, creating opportunities across various sectors.

Interest rates and inflation will continue playing crucial roles. After seeing inflation fall below 3% in summer 2024, the Federal Reserve began lowering rates. Analysts expect three more rate cuts in 2025, which typically supports stock prices.

However, the spectre of persistent inflation hasn’t completely vanished, and the Fed’s actions will largely depend on economic data.

Global factors add another layer of complexity. China’s economic challenges might dampen demand for Western exports, while emerging markets in India and Africa show promising growth potential.

These dynamics create a mixed but interesting landscape for international investors.

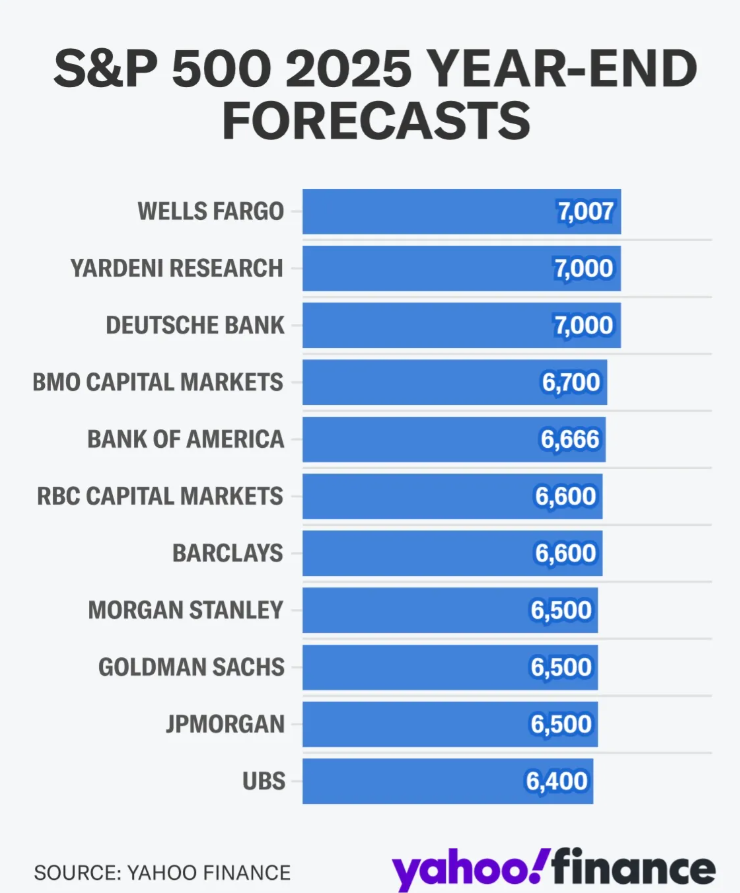

Wall Street strategists offer varying predictions for 2025. Conservative estimates suggest the S&P 500 might end the year between 5,557 (a 5% decline) and 6,435 (a 10% gain). More optimistic forecasts point to 7,000, representing a 20% increase. Morgan Stanley, known for its measured outlook, predicts a 7% rise to around 6,500.

The technology sector shows particular promise, with AI spending projected to double between 2024 and 2028. This growth isn’t limited to AI—cloud computing, 5G networks, and cybersecurity are all expanding rapidly.

Market leaders in high-performance computing and semiconductor manufacturing are seeing unprecedented demand, particularly from data centres and AI applications.

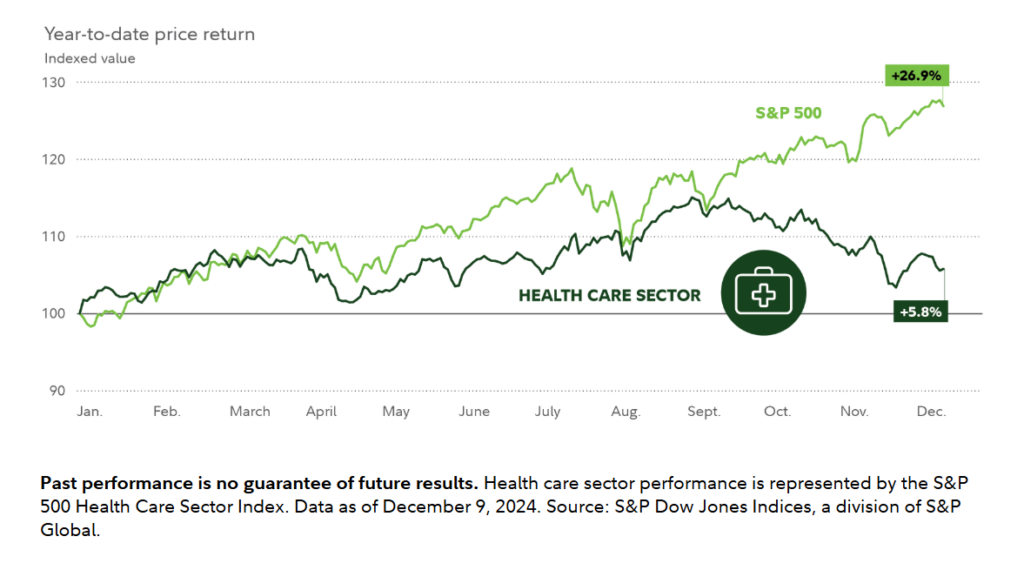

Healthcare’s projected 7% annual growth through 2027 stems from three main factors: improved cost efficiencies through technology adoption, higher reimbursement rates, and new revenue streams from digital health solutions. Companies combining traditional healthcare with technological innovation are especially well-positioned.

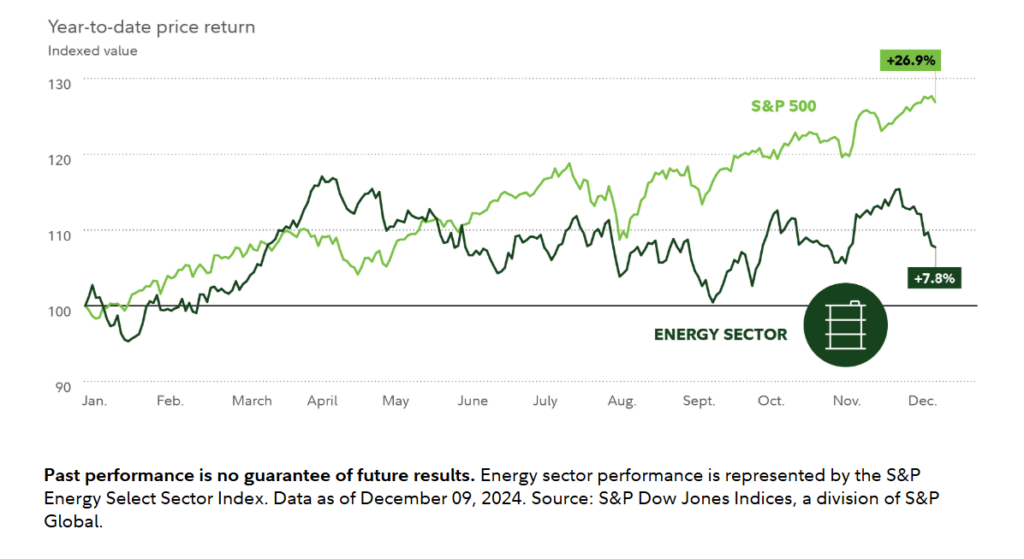

The energy sector offers a balanced opportunity across both traditional and renewable sources. While fossil fuel demand remains strong, driven partly by AI technologies’ power requirements, renewable energy sources are seeing accelerated adoption.

This creates what analysts term a “barbell opportunity”—investors can benefit from both traditional energy stability and green energy growth potential.

These sectors might see additional benefits if interest rates decline in 2025, as lower borrowing costs could fuel further innovation and expansion.

Several potential challenges could impact market performance in 2025.

The aftermath of the US presidential election might bring policy changes affecting trade relationships and corporate regulations. Ongoing geopolitical tensions, including conflicts in Ukraine and the Middle East, could disrupt global trade and commodity supplies.

Market valuations present another concern. The S&P 500’s forward price-to-earnings ratio remains above its 20-year average, suggesting stocks might be relatively expensive. This makes strong corporate earnings growth crucial for sustaining current price levels.

Some analysts, including Peter Berezin, chief global strategist at BCA Research, warn of potential sharp declines, with the S&P 500 possibly dropping to 4,450. While this represents a more pessimistic scenario, it reminds us of the importance of preparing for various outcomes.

Given this complex landscape, how should ordinary investors approach 2025?

First, diversification remains crucial. Consider spreading investments across different sectors and asset classes. The “barbell strategy” suggested by Morgan Stanley—combining both high- and low-risk assets—might be worth considering.

Technology and healthcare sectors offer growth potential, but don’t overlook traditional sectors that might benefit from economic changes. Environmental, Social, and Governance (ESG) investments continue gaining popularity, particularly in renewable energy and sustainable technologies.

For those holding cash or high-yield bonds, consider adjusting your strategy as interest rates decline. However, maintain some defensive positions given the potential for market volatility.

While 2025 might not match 2024’s exceptional returns, it offers interesting opportunities for patient investors. The continuing AI revolution, changing interest rate environment, and evolving global economy create various paths for potential growth.

Successful investing isn’t about capturing every market move but staying committed to a well-structured strategy aligned with your goals. Markets have consistently rewarded patient investors who maintain discipline through different cycles, whether 2025 brings modest gains or temporary setbacks.

As you navigate the evolving market landscape, ensure your strategy is tailored to your objectives and circumstances. Open a live account with VT Markets today to access the tools and insights that can help you seize opportunities and stay ahead in the journey toward achieving your investment goals.