In gardening, a hedge serves as a natural barrier, protecting delicate plants from harsh winds and environmental stresses. Similarly, in the investment world, hedging strategies protect portfolios from economic uncertainties.

As market volatility continues to challenge investors in 2025, with the VIX index averaging 25% higher than its historical mean, two assets stand out as potential safe havens: the time-tested gold and the revolutionary Bitcoin. But which one offers better protection for your investment garden?

Gold’s reputation as a store of value spans millennia, and its appeal persists even in our digital age. Central banks worldwide continue to accumulate gold reserves, with holdings reaching 38,000 tonnes in 2024 – the highest level since the 1970s.

China and Russia lead this trend, having increased their reserves by 15% and 12% respectively in the past year. This institutional backing provides a solid foundation for gold’s status as a hedge against economic uncertainty.

The precious metal’s enduring value stems from its unique characteristics. Unlike fiat currencies, which can be printed at will, gold’s supply increases by only about 1.5% annually through mining, representing approximately 2,500-3,000 tonnes per year.

This natural scarcity helps maintain its value, particularly during inflationary periods. During the 2023 banking crisis, gold prices surged from USD 2,075 to USD 2,385 per ounce while traditional markets faltered.

However, gold isn’t without its drawbacks. Physical storage requires secure vaults and insurance, typically costing 0.5-1.5% annually. Moreover, gold generates no passive income, unlike dividend-paying stocks or interest-bearing bonds.

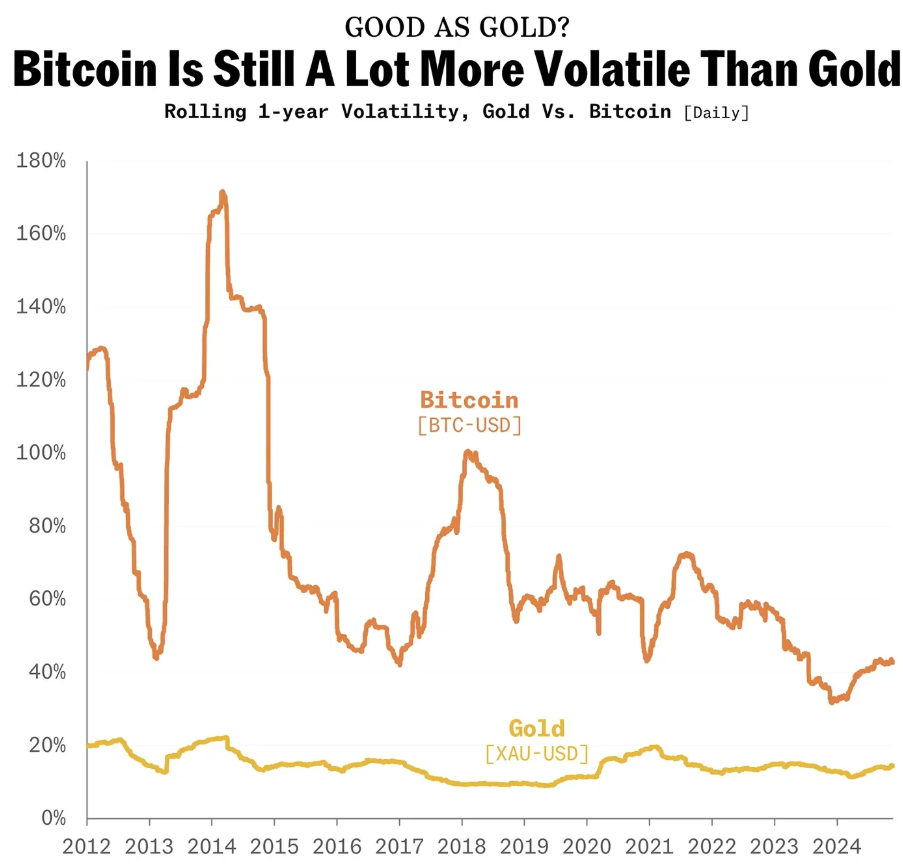

Despite these limitations, its price stability, with historical volatility of around 15% annually, continues to attract conservative investors.

Bitcoin has emerged as the digital era’s answer to gold. With its mathematically enforced cap of 21 million coins (of which 19.6 million are currently in circulation), Bitcoin offers programmatic scarcity that even gold can’t match.

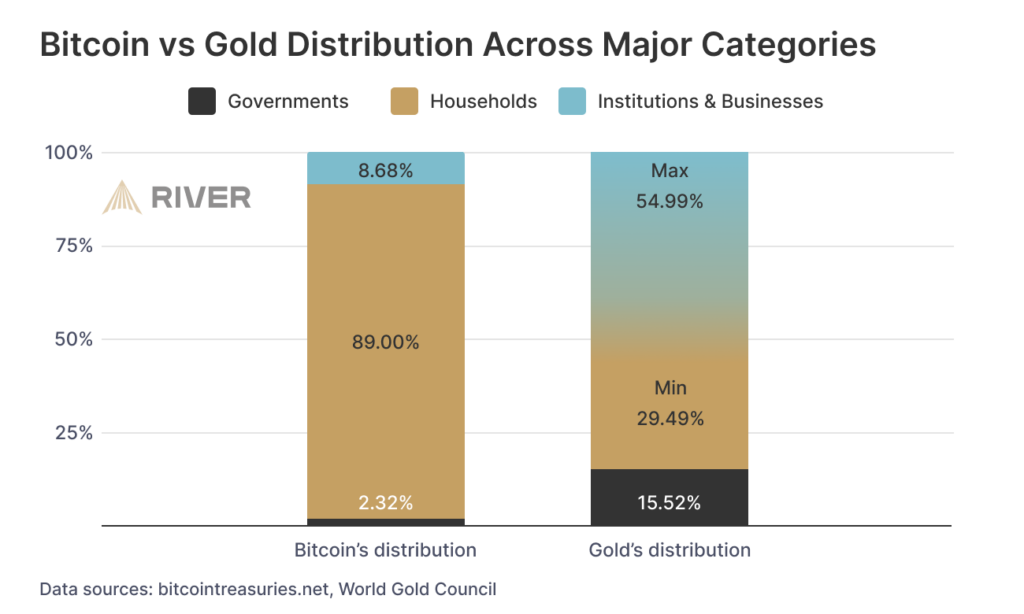

This fixed supply, combined with increasing institutional adoption – including USD 56 billion in institutional holdings by 2024 – has strengthened Bitcoin’s position as a hedging instrument.

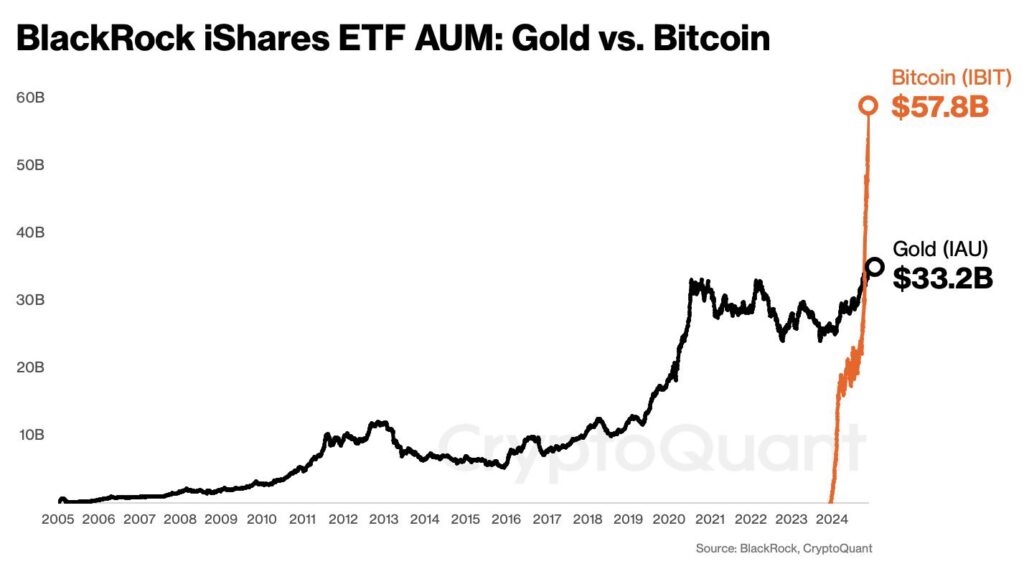

Modern investors can access Bitcoin through various means, from direct ownership via cryptocurrency exchanges to regulated ETFs, which now manage over USD 35 billion in assets. The asset’s 24/7 trading availability and near-instant global transferability provide advantages that traditional assets can’t match.

However, this accessibility comes with heightened volatility – Bitcoin’s average annual volatility stands at 65%, with price swings of 10% in a single day not uncommon.

Understanding how these assets behave during market stress reveals their true hedging potential.

During the March 2023 banking crisis, gold demonstrated its traditional safe-haven role, maintaining a -0.4 correlation with the S&P 500.

Bitcoin, initially falling with the broader market, quickly rebounded and outperformed both gold and equities in the recovery phase, gaining 45% in just six weeks.

Currency devaluations tell a particularly interesting story. When the Turkish lira depreciated by 30% in late 2024, both gold and Bitcoin served as effective hedges for local investors. Gold prices in lira terms rose by 35%, while Bitcoin surged by 85%, though with daily volatility exceeding 12%.

Interest rate changes affect these assets differently. Gold typically shows an inverse relationship with real interest rates (-0.7 correlation) – as rates rise, gold often falls.

Bitcoin’s relationship with interest rates remains less predictable, showing a weak correlation of -0.2, suggesting greater independence from monetary policy decisions.

The investment landscape for both assets is evolving rapidly.

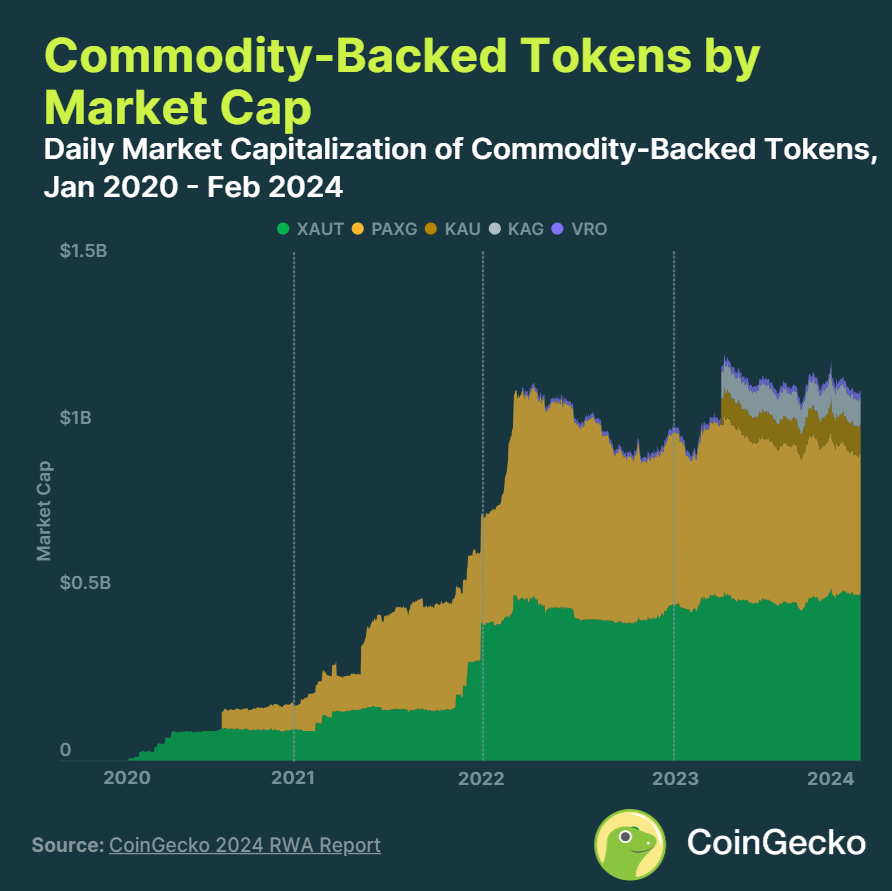

Gold-backed digital tokens have democratised access to precious metals, with platforms like Kinesis and Paxos processing over USD 15 billion in tokenised gold transactions monthly. These services allow investors to own fractional amounts without physical storage concerns, with transaction fees as low as 0.15%.

Bitcoin’s technological advancement continues through the Lightning Network, which now processes over 1 million transactions per day at costs below USD 0.01 per transaction.

Layer-2 solutions like Arbitrum and Optimism have addressed scalability challenges, processing up to 4,000 transactions per second while maintaining security. These improvements have made Bitcoin more practical for everyday transactions while preserving its hedging capabilities.

Modern trading platforms now integrate both assets seamlessly, allowing investors to manage their hedging strategies through single interfaces.

Some platforms even offer automated rebalancing between gold and Bitcoin based on market conditions, with management fees ranging from 0.25% to 0.75% annually.

Your choice between gold and Bitcoin (or a combination) should consider several factors:

1. Investment horizon: Gold suits long-term, stable hedging needs, with historical annual returns of 7-9%, while Bitcoin offers potential for higher returns (averaging 40% annually since 2015) with higher risk.

2. Technical comfort: Bitcoin requires understanding digital security and wallet management, with an estimated 20% of all Bitcoin lost due to poor security practices.

3. Portfolio size: Smaller portfolios (under USD 50,000) might benefit from Bitcoin’s growth potential, while larger ones might prefer gold’s stability.

4. Risk tolerance: Consider gold for steady protection and Bitcoin for growth-oriented hedging.

Both gold and Bitcoin offer unique advantages as hedging instruments in 2025’s complex market environment. Gold provides time-tested stability and institutional backing, while Bitcoin offers technological innovation and growth potential.

Many successful investors now employ both, typically allocating 5-10% of their portfolio to gold and 1-3% to Bitcoin, creating a balanced hedging strategy that combines the wisdom of the old with the potential of the new.

With VT Markets, you can trade both gold and Bitcoin seamlessly, taking advantage of market opportunities in real time. Whether you’re looking for stability or growth, VT Markets provides the tools and platform to help you navigate market volatility with confidence.

Start hedging your portfolio today—open a live account with VT Markets and trade gold and Bitcoin with ease.