Time is of the essence in the global pursuit of sustainability, and Latin America stands as a key player in shaping a greener, more environmentally responsible future. The potential of this region to take centre stage as a worldwide leader in the production and export of commodities vital for the transition to cleaner energy cannot be underestimated.

Latin America’s abundance of natural resources is nothing short of astonishing. With vast reserves of minerals like lithium, copper, nickel, and cobalt, the region is an essential provider of the building blocks for batteries and renewable energy technologies, which are at the core of the global clean energy revolution.

The demand for these resources, driven by the ever-increasing need for electric vehicle batteries, solar panels, and wind turbines, continues to surge, and Latin America holds the key to driving this vital transition.

However, Latin America’s contribution to the global commodities market doesn’t stop at hard minerals. The region is a major player in the agricultural commodities sector. Staples such as soybeans, corn, and sugar are not only crucial for global food security but also integral to the production of sustainable biofuels. In a world where reducing carbon emissions is a priority, Latin America’s agricultural sector plays a pivotal role in supporting cleaner energy alternatives.

Projections from the Inter-American Development Bank are nothing short of extraordinary. They indicate that Latin America’s exports of “green commodities” have the potential to reach a staggering $1.5 trillion by 2050, representing a fivefold increase from current levels.

This growth is more than just impressive figures; it has the power to generate millions of new jobs, infuse energy into local economies, and foster sustainable development across the entire region. It’s a chance for both financial success and positive change that’s too substantial to ignore.

The world stands at the precipice of a momentous transformation in energy generation and consumption. The clean energy revolution, propelled by technological innovations and a growing environmental consciousness, is reshaping our relationship with power production.

At the vanguard of this transition lie solar, wind, and electric vehicle technologies, which are not only altering our perspectives on energy but also driving a remarkable upsurge in the demand for specific critical metals.

The global clean energy market is on a trajectory of exponential growth, with predictions of soaring from $2.1 trillion in 2021 to a staggering $6.5 trillion by 2030. This extraordinary expansion is underpinned by the sustained adoption of clean energy solutions, rendering it one of the most promising sectors for investment and economic expansion.

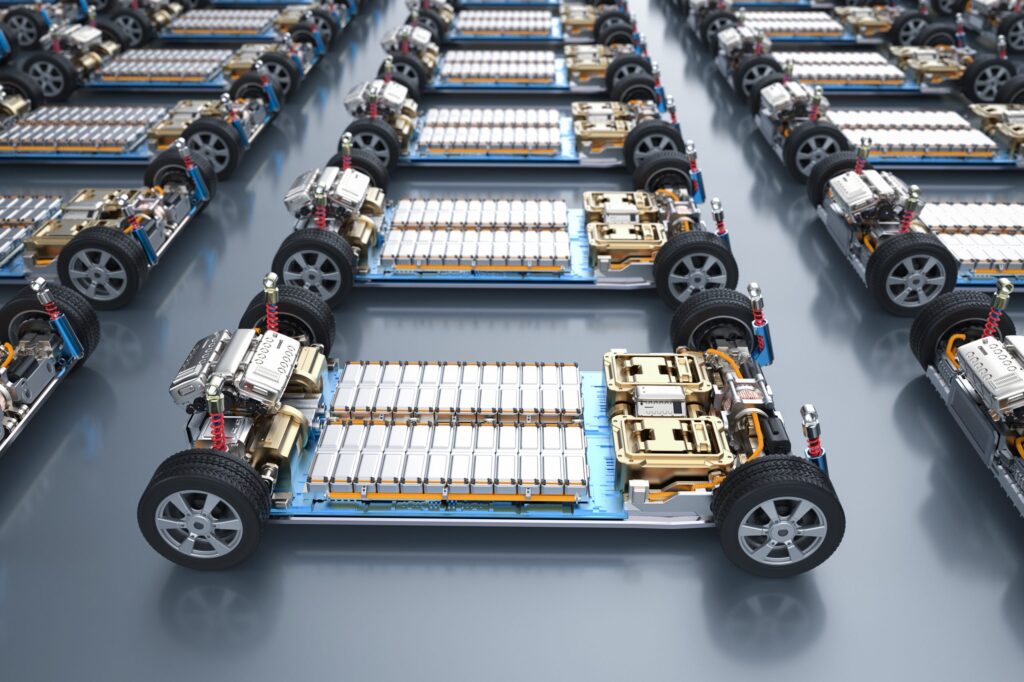

As we observe the widespread embrace of solar panels, wind turbines, and electric vehicles, the demand for critical metals has reached unprecedented heights. These metals, including lithium, cobalt, and rare earth elements, lie at the heart of these pioneering technologies.

Lithium-ion batteries, in particular, have emerged as the preferred power source for electric vehicles, portable electronics, and renewable energy storage solutions, leading to a skyrocketing demand that has reverberated through the global commodities market.

Latin America commands an astounding share of the world’s known lithium and cobalt reserves, boasting over 60% of lithium reserves and more than 40% of cobalt reserves. This abundant wealth places the region in a position of paramount importance in guaranteeing the supply of these critical metals vital for fuelling the clean energy revolution.

In this era of transformation, Latin America emerges as a pivotal player, possessing substantial reserves of the critical metals essential for powering the clean energy revolution. The region’s wealth of resources positions it as a central hub for providing the raw materials required for this global shift towards sustainability, encompassing extensive lithium deposits and significant cobalt and rare earth element reserves.

Copper, often referred to as the “metal of the future,” with its remarkable conductivity, holds an indispensable role in electrical and electronic applications and renewable energy technologies. Latin America, in this context, stands as a global leader in copper mining, underscoring its dominance and the far-reaching implications this holds for the global clean energy movement.

Furthermore, in the realm of lithium, a crucial component in electric vehicle batteries, Latin America’s significance takes centre stage. As the global adoption of electric vehicles continues to gain momentum, the region’s extensive lithium resources become pivotal in sustaining the shift towards cleaner transportation solutions and energy storage.

With projections indicating that electric vehicle sales are set to reach 10 million units in 2023, escalating to a remarkable 40 million units by 2025, Latin America’s role in supplying the requisite resources for this electrifying revolution becomes even more pronounced.

At this pivotal juncture, Latin America’s status as a powerhouse of critical metals holds global implications. As the clean energy revolution gains momentum, these abundant resources will not only drive economic growth in Latin America but also play a significant role in the worldwide transition towards a greener and more sustainable future.

In the world of commodities, soft commodities often remain overshadowed by their harder counterparts, yet they play a vital role in the global market. Soft commodities comprise various agricultural products, cultivated and harvested rather than mined. These essentials include coffee, cocoa, sugar, cotton, and more, serving as daily necessities and underpinning international trade.

These agricultural commodities are not only pivotal for sustaining global food security but also find versatile applications in various industries. Traders looking to broaden their commodities portfolio must grasp the dynamics of this sector.

Latin America emerges as a prominent player in this domain, boasting a climate and fertile soils well-suited for cultivating these crops.

In the realm of coffee, Latin America’s dominance is indisputable. The region contributes over 40% of the world’s coffee supply. Brazil, in particular, holds the crown as the world’s leading coffee producer, with a share exceeding 30% of global coffee output. As global coffee consumption is poised to grow by 2% annually in the coming decade, Latin America is poised to meet this escalating demand, cementing its position as a leader in coffee production.

Shifting to cocoa, Latin America produces about 20% of the world’s cocoa. Nations like Ecuador and the Dominican Republic, the fifth- and sixth-largest cocoa producers globally, are renowned for their high-quality cocoa beans. With global cocoa consumption expected to grow by 3% annually over the next decade, Latin America’s role as the world’s primary cocoa producer is pivotal, ensuring a steady supply to the global chocolate and confectionery industries.

Latin America’s sugar production also commands attention, contributing more than 25% to the world’s sugar supply. Brazil, the world’s largest sugar producer, accounts for over 20% of global production. Notably, Mexico, Colombia, and Argentina are key contributors to the world’s sugar production. As global sugar consumption is projected to grow by 1% annually in the next decade, Latin America’s significance in sugar production and export is set to rise.

In the cotton industry, Latin America plays a substantial role, producing about 15% of the world’s cotton. Brazil ranks as the second-largest cotton producer globally, after India, while countries like Argentina, Paraguay, and Colombia significantly contribute to this sector. With global cotton consumption forecasted to grow by 1.5% annually over the next decade, Latin America’s stature as a major cotton producer and exporter underscores its role in the global textile and fashion industries.

The future holds promise for Latin American soft commodities, driven by the expected global population growth to 9.7 billion by 2050. As demand for food and agricultural products surges, market trends point to ample room for expansion and innovation.

Beyond the spotlight on critical metals, Latin America’s mineral wealth offers diverse trading prospects.

Silver

Latin America ranks as the world’s largest silver producer, contributing about 50% of the global silver output. Leading silver producers within the region include Mexico, Peru, and Argentina. Silver’s industrial and investment applications make it an adaptable choice for traders exploring this versatile commodity.

Tin

Latin America further solidifies its position as the world’s third-largest tin producer, accounting for more than 15% of global tin production. Notable contributors to this sector are Bolivia, Peru, and Brazil. Latin America’s role in tin production is vital for the global electronics and manufacturing industries.

Nickel

The region also holds the title of the world’s fifth-largest nickel producer, contributing over 10% to global nickel production. Brazil, Cuba, and Mexico stand out as leading nickel producers within the region. With diverse applications spanning stainless steel to batteries, nickel offers traders opportunities in a pivotal industrial commodity.

The region claims the title of the world’s fourth-largest oil producer, accounting for over 10% of the global oil output. Key countries leading this industry in Latin America are Brazil, Venezuela, Mexico, and Colombia.

Latin America’s strategic significance in the global oil market is evident through its substantial oil reserves, estimated at over 330 billion barrels. These reserves rank second only to the Middle East, underscoring the region’s vital role in global energy supply.

Anticipating an expansion in production, Latin America is expected to increase its output by over 1 million barrels per day by 2030. This growth exemplifies the region’s dedication to meeting global energy demands and adapting to the evolving dynamics of the oil industry.

Successful LATAM commodity trading demands vigilance in observing critical factors: geopolitics, environmental rules, and technological advances. Understanding these elements is key to thriving in the dynamic commodities market.

In conclusion, Latin America’s immense potential as a commodities market powerhouse is undeniable. Forex traders have a unique opportunity to participate in this growth story – simply open a live account with VT Markets and start trading. However, success in the LATAM commodities market requires careful research, risk management, and a keen understanding of the region’s evolving dynamics. As Latin America charts a course towards a greener and more prosperous future, traders who venture into this market have the potential to secure substantial rewards.