Imagine buying your favourite electronics and noticing the price has jumped by 20%. Why? Donald Trump’s tariffs on imports might be to blame.

Tariffs are taxes on imported goods, designed to protect domestic industries or address trade imbalances. But they can ripple through financial markets, affecting stock prices, currency values, and investment decisions, no matter where you live.

Understanding these impacts is crucial to navigating market volatility. This article demystifies how Trump’s tariffs influence markets to help everyday investors make informed decisions.

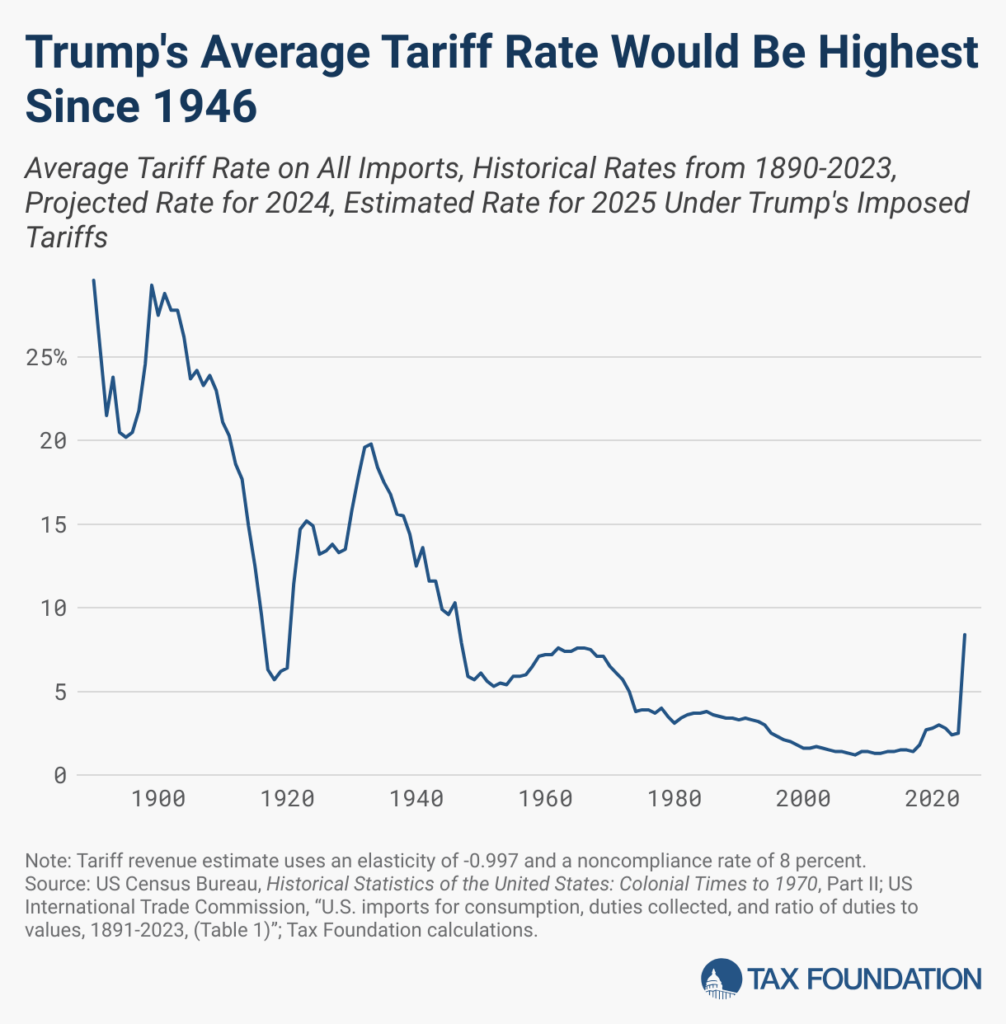

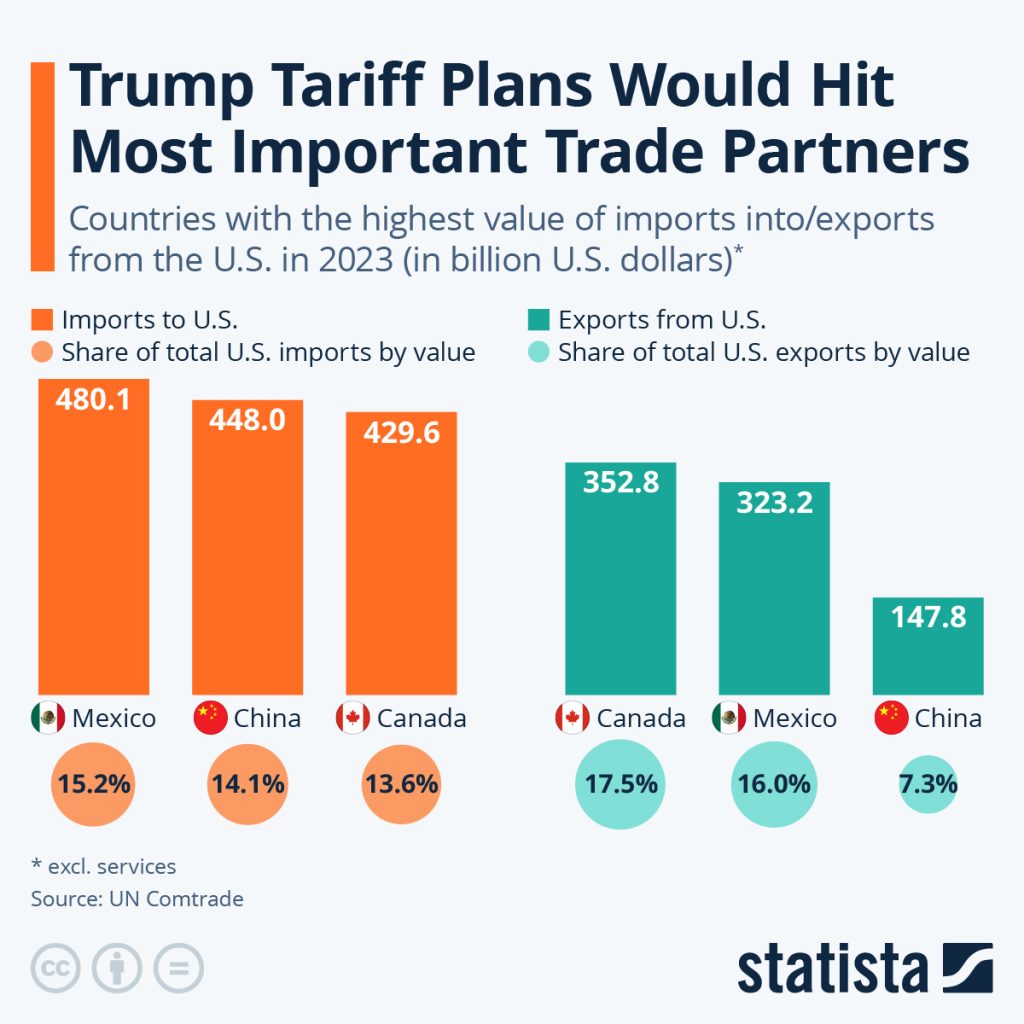

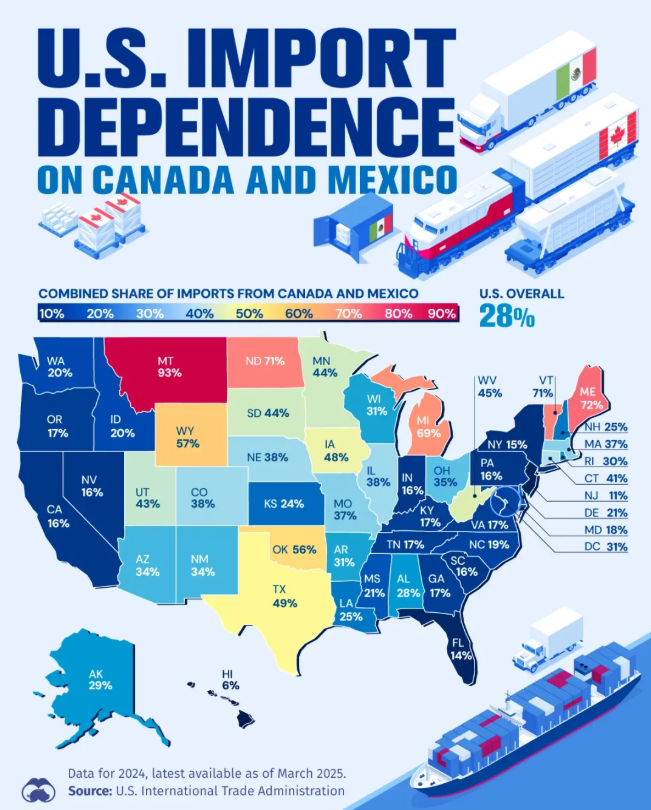

A tariff is like a toll fee on goods coming into a country. Trump’s tariffs, for example, slapped a 25% tax on imports from Canada and Mexico, and an extra 10% on Chinese goods, with threats of up to 60% on all Chinese imports.

These measures aim to boost US manufacturing, reduce trade deficits, and tackle issues like immigration or drug trafficking. But they can spark trade wars, where countries retaliate with their own tariffs on US goods, affecting economies worldwide.

When tariffs hike up costs, companies and consumers feel the pinch, and markets react—sometimes wildly. For instance, a 25% tariff on Mexican imports could raise the price of cars made with Mexican parts, impacting consumers and businesses globally.

Tariffs directly impact companies by increasing costs for businesses relying on imported goods, squeezing profit margins.

The US imported over 8 million cars and light trucks in 2024, with more than half from Mexico or Canada.

Trump’s 25% tariffs on these imports, set for April 2, 2025, could raise car prices by USD 3,000 per vehicle, hurting automakers’ profits and stock prices.

Even domestic manufacturers like Ford, despite sourcing most steel from the US, rely on suppliers with international materials, making them vulnerable to price hikes.

Best Buy, a US electronics retailer, warned shoppers of price increases due to tariffs on Chinese goods, with shares dropping 13% in a day, affecting investors worldwide.

Certain sectors, like automotive, tech, and retail, are particularly exposed. Tariffs also create uncertainty, spooking investors across markets.

When US inflation cooled to 2.9% in February 2025, S&P 500 futures rose 0.5%. But trade war fears, sparked by 25% steel and aluminium tariffs effective March 12, 2025, sent stocks tumbling, with declines in the S&P 500 and FTSE 100.

For practical steps, check if companies in your portfolio rely on imports, especially autos. Look for tariff-related news in their quarterly reports, no matter which market you’re invested in. Staying informed can help you anticipate stock price movements and adjust your strategy.

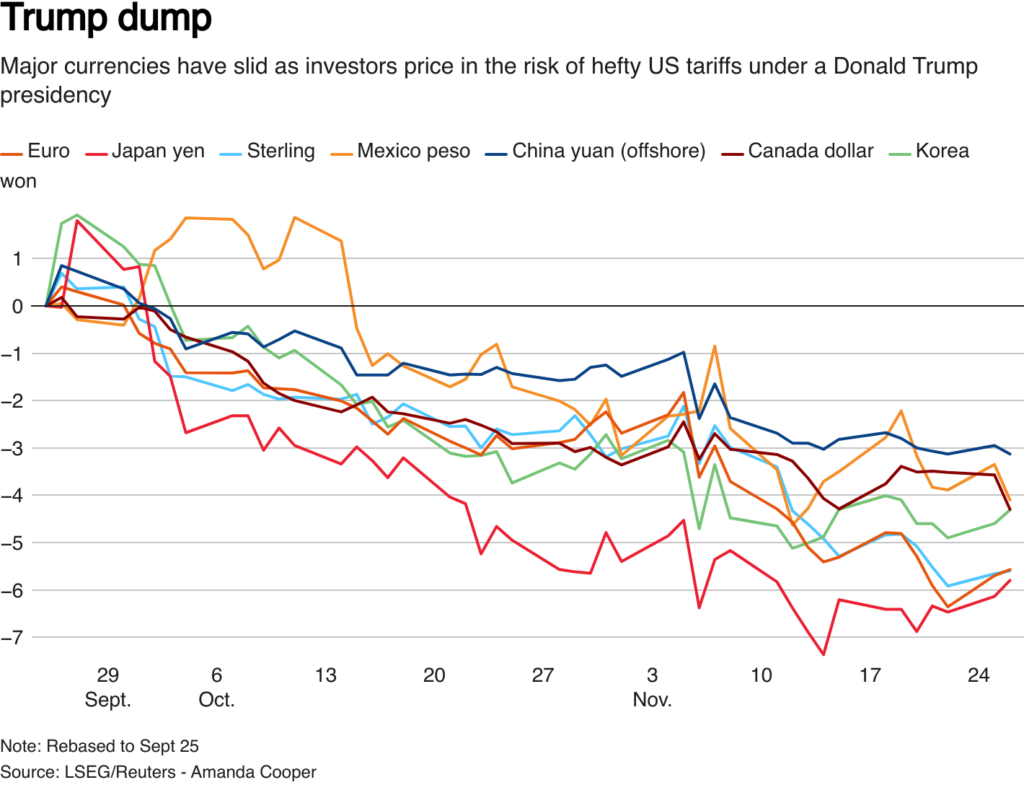

Tariffs often strengthen the US dollar as investors expect higher inflation and interest rates. After Trump’s tariff announcements, the dollar rose on expectations of tighter monetary policy, making US exports cheaper but imports pricier.

This shift affects other currencies—if tariffs slow trade, borrowing costs may rise globally, pressuring foreign currencies. In January 2025, the euro weakened after US bond yields climbed due to tariff fears.

For forex traders and US stockholders, dollar strength is key. A stronger dollar can boost US investments but hurt exporters abroad. For instance, a European exporter may struggle as their goods become costlier in the US.

Watch central bank actions and economic data to track currency trends. Diversifying across currencies can help hedge against tariff-driven volatility.

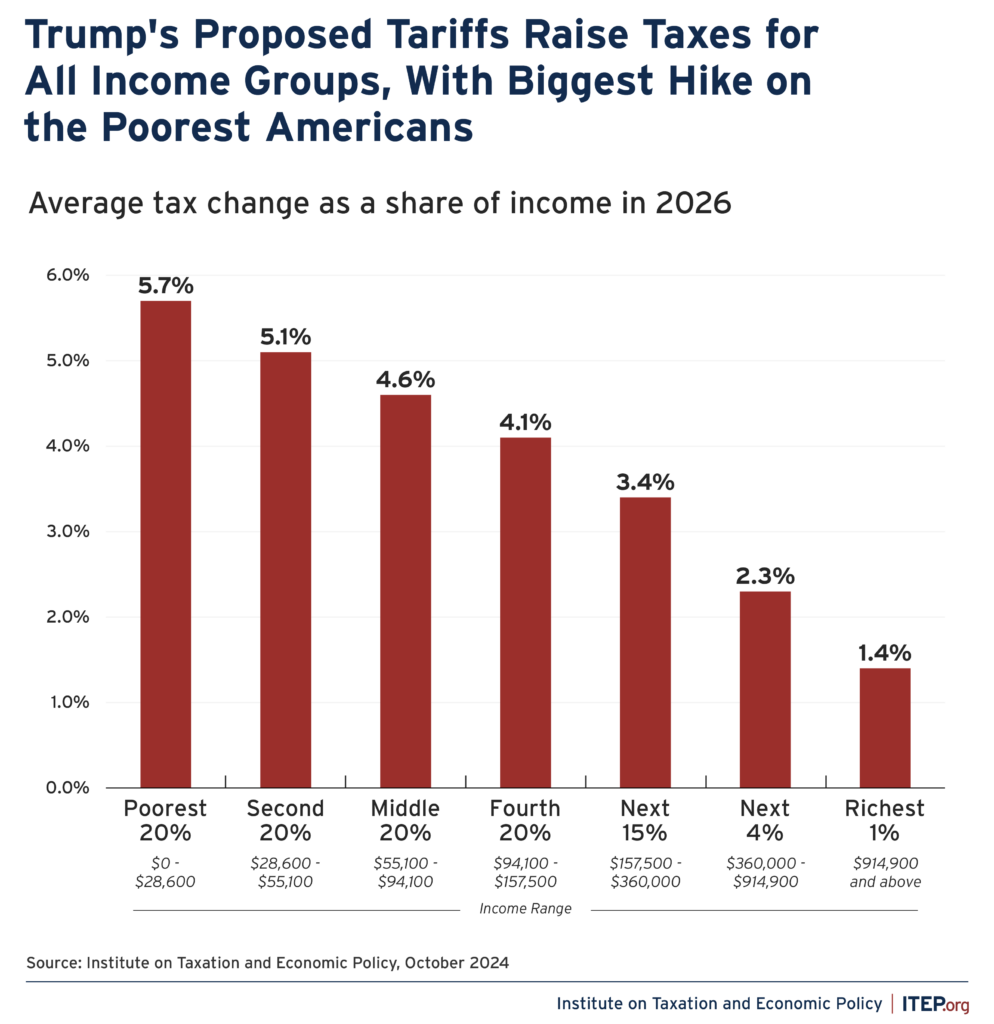

Tariffs can drive inflation, impacting consumers and investors worldwide.

In February 2025, US inflation cooled to 2.9% from 3.1%, but Trump’s 25% tariffs on steel, aluminium, and autos could raise car prices by USD 3,000, renewing inflation fears.

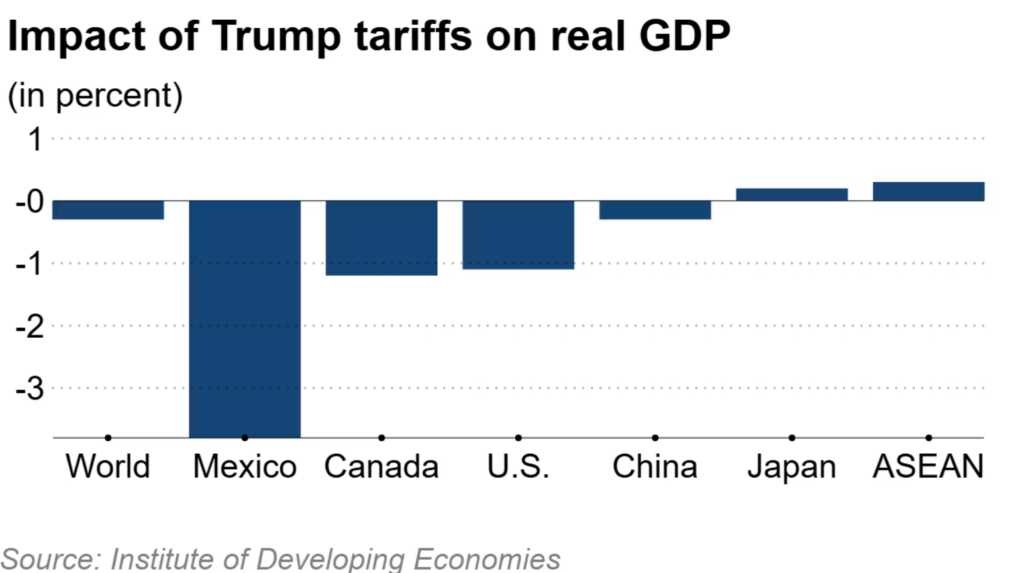

Higher inflation may force the Fed to delay rate cuts or hike rates, increasing borrowing costs globally. The IMF warns tariffs could shrink global GDP by 0.5% by 2026.

To protect your investments, consider bonds or defensive stocks like utilities, which tend to perform well during inflation spikes. Monitor CPI data and central bank moves to stay ahead of rate changes.

Understanding how tariffs shape inflation and interest rates can help you make smarter investment decisions.

Canada, Mexico, and China have hit back with tariffs on US goods, slowing global trade.

On March 13, 2025, Canada imposed 25% tariffs on USD 20.8 billion of US goods, from steel to computers.

The EU followed with tariffs on USD 28.4 billion of US products, like bourbon and motorbikes, effective April 1, 2025.

China threatens tariffs on US aircraft and agricultural products, potentially costing US farmers USD 6.7 billion annually.

These retaliatory measures escalate the trade war, complicating trade talks between major economies like the EU and China or straining relations with the US.

Trump’s planned reciprocal tariffs on April 2, 2025, and threats of 60% tariffs on Chinese goods could divert US goods to other markets, flooding them and hurting local firms. The IMF warns of a 0.5% global GDP reduction by 2026.

For investors, monitoring trade news is essential. Diversify investments across regions to hedge against trade war risks. Consider emerging markets less exposed to US tariffs, as they might offer stability.

By spreading your investments, you can reduce the impact of tariff-driven disruptions and protect your portfolio from global economic slowdowns.

Trump’s tariffs can shake up stock prices, currency values, and inflation, with ripple effects for investors worldwide. While tariffs create uncertainty, informed decisions can protect your portfolio, no matter where you invest. Stay updated on tariff news, diversify your investments, and focus on long-term goals.

Ready to take control of your trading journey? Open a live account with VT Markets to access global markets and stay ahead of volatility. Remember, markets often overreact initially but stabilise over time. By understanding tariffs, you can turn market volatility into opportunity, wherever you are.