As the 2024 US presidential election approaches, investors are wondering how this pivotal event might affect their portfolios. With candidates presenting diverse economic platforms and the media amplifying every twist and turn of the campaign, it’s natural to feel concerned about potential market volatility.

This article aims to provide a clear perspective on how the 2024 election could impact the stock market, offering insights for individual investors navigating these uncertain waters.

While elections can indeed cause short-term market fluctuations, it’s crucial to remember that long-term market trends are primarily driven by economic fundamentals. Understanding this relationship can help you make more informed investment decisions during this election cycle and beyond.

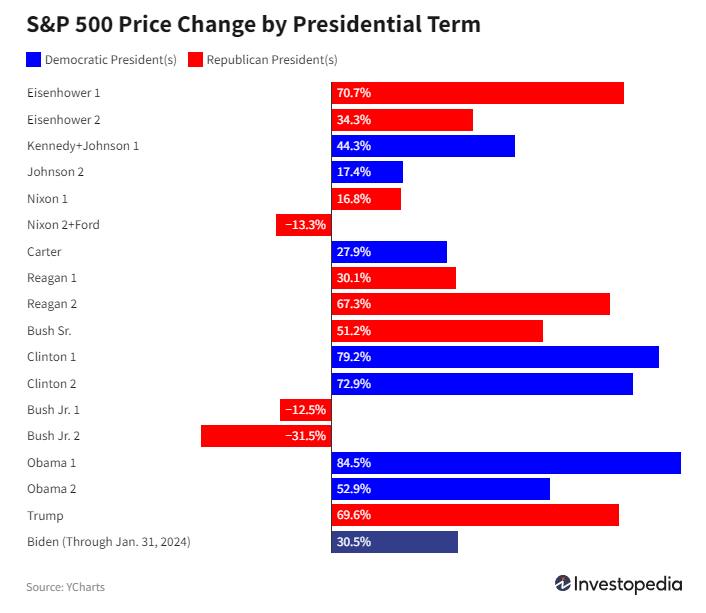

Looking back at previous election cycles provides valuable context for what we might expect in 2024.

Election years have typically been favourable for the US stock market. Since 1960, the S&P 500 Index has increased in nearly every election year, with the notable exceptions of 2000 and 2008 due to the dotcom bust and the great financial crisis, respectively. In the three election years since 2008 — 2012, 2016, and 2020 — the benchmark index has risen by at least 10%.

During the 2016 election, markets initially reacted negatively to Donald Trump’s unexpected victory but quickly rebounded, with many sectors seeing significant gains in the following months.

The 2020 election, occurring amidst the global COVID-19 pandemic, saw increased volatility leading up to Election Day, followed by a rally as Joe Biden’s win became clear and vaccine developments boosted economic optimism.

It’s worth noting that pre-election market predictions often miss the mark. For instance, many analysts in 2016 predicted a market downturn if Trump won, which didn’t materialise as expected. This serves as a reminder that while historical data is relevant, it’s not definitively predictive of future market behaviour.

The 2024 campaign has already demonstrated its potential to spark market volatility. We’ve seen sharp movements in response to major campaign events, debates, and shifts in polling data.

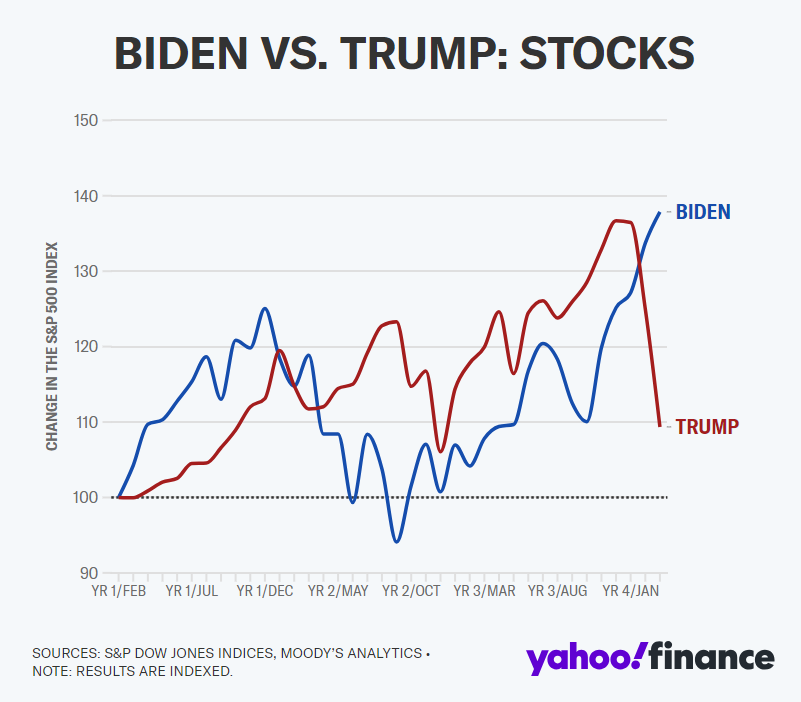

For example, since Biden’s poor debate performance on 27 June, the S&P 500 has risen approximately 1.5%. During the same period, the tech-focused Nasdaq has surged around 3%, and the Dow Jones Industrial Average has gained 1%.

These modest increases across the major stock indexes align with a slight uptick in the likelihood of a Trump victory in the upcoming November election.

This kind of volatility stems from several factors:

1. Uncertainty about future policies of major candidates.

2. Emotional reactions of investors to campaign rhetoric.

3. Media coverage amplifying market sentiment.

4. Speculation about potential winners and their impact on various sectors.

Certain sectors are particularly sensitive to election outcomes due to potential policy changes. In 2024, we’re seeing this play out in several key areas:

Healthcare: The contrasting healthcare policies of the major candidates have led to fluctuations in healthcare stocks. Proposals ranging from expanding the Affordable Care Act to implementing a “Medicare for All” system have caused uncertainty in this sector.

Energy: The stark contrast between candidates supporting renewable energy expansion and those advocating for traditional fossil fuel industries has created a seesaw effect in energy stocks throughout the campaign.

Technology: With increased focus on data privacy and antitrust concerns, tech stocks have reacted to various regulatory proposals put forth by the candidates.

Defence: Different military spending proposals have influenced defence contractor stocks, with fluctuations corresponding to changes in candidates’ polling numbers.

The sectors most affected by a Biden win include renewable energy, electric vehicles, healthcare, infrastructure, technology, and consumer goods. For a Trump win, the impacted sectors are fossil fuels, aerospace and defence, real estate, traditional infrastructure, technology, finance, and telecommunications.

While the election dominates headlines, it’s crucial to remember that long-term market performance is more heavily influenced by fundamental economic factors such as GDP growth, unemployment rates, inflation, and global economic conditions. The actual impact of election results often proves less significant over time than initially anticipated.

For instance, regardless of who wins in 2024, factors like ongoing global supply chain restructuring, technological advancements, and demographic shifts will continue to shape market trends well beyond the election cycle.

Given the potential for election-related market volatility, here are some practical tips for traders:

1. Maintain a long-term perspective: Don’t let short-term election noise derail your long-term investment strategy.

2. Diversify your portfolio: This can help mitigate risks associated with potential policy changes affecting specific sectors.

3. Avoid emotional decision-making: Try not to make investment choices based solely on campaign rhetoric or short-term market movements.

4. Focus on your financial goals: Your personal financial objectives should guide your investment decisions more than election outcomes.

5. Stay informed, but don’t overreact: While it’s important to understand candidates’ economic policies, avoid making drastic portfolio changes based on campaign promises alone.

It’s important to understand that while presidents can influence economic policy, their power is not absolute. Congress plays a significant role in shaping fiscal policy, and the Federal Reserve operates independently to manage monetary policy.

The Fed, in particular, has historically worked to maintain economic stability during political transitions. Its decisions on interest rates and other monetary tools can have a more immediate impact on markets than many presidential policies.

As we navigate the 2024 election season, it’s natural to feel concerned about potential market impacts. However, history shows that while elections can cause short-term volatility, long-term market trends are driven by broader economic factors.

Stay informed about the candidates’ economic policies, but avoid making hasty investment decisions based on campaign rhetoric or short-term market fluctuations. Instead, focus on your long-term financial goals, maintain a diversified portfolio, and remember that the U.S. economy and stock market have shown resilience through many election cycles.

By keeping these principles in mind, you can approach the 2024 election—and its potential market impacts—with greater confidence and a clearer perspective.