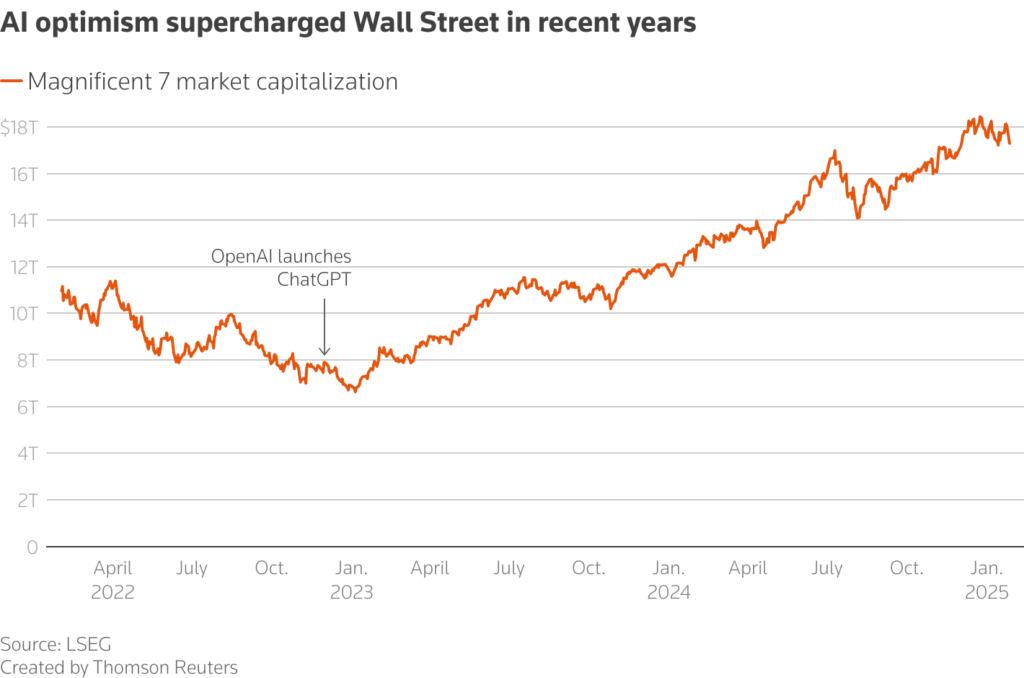

The tech world was stunned when Nvidia, the leading AI chip manufacturer, lost an unprecedented USD 600 billion in market value in a single day—the largest one-day loss in US stock market history.

This seismic shift was triggered by the emergence of DeepSeek, a Chinese AI company, alongside former President Donald Trump’s announcement of a massive USD 500 billion AI infrastructure project called Stargate.

The Nasdaq Composite dropped 612 points (3%), while the S&P 500 fell 1.5%, highlighting the broad impact of these developments on the technology sector.

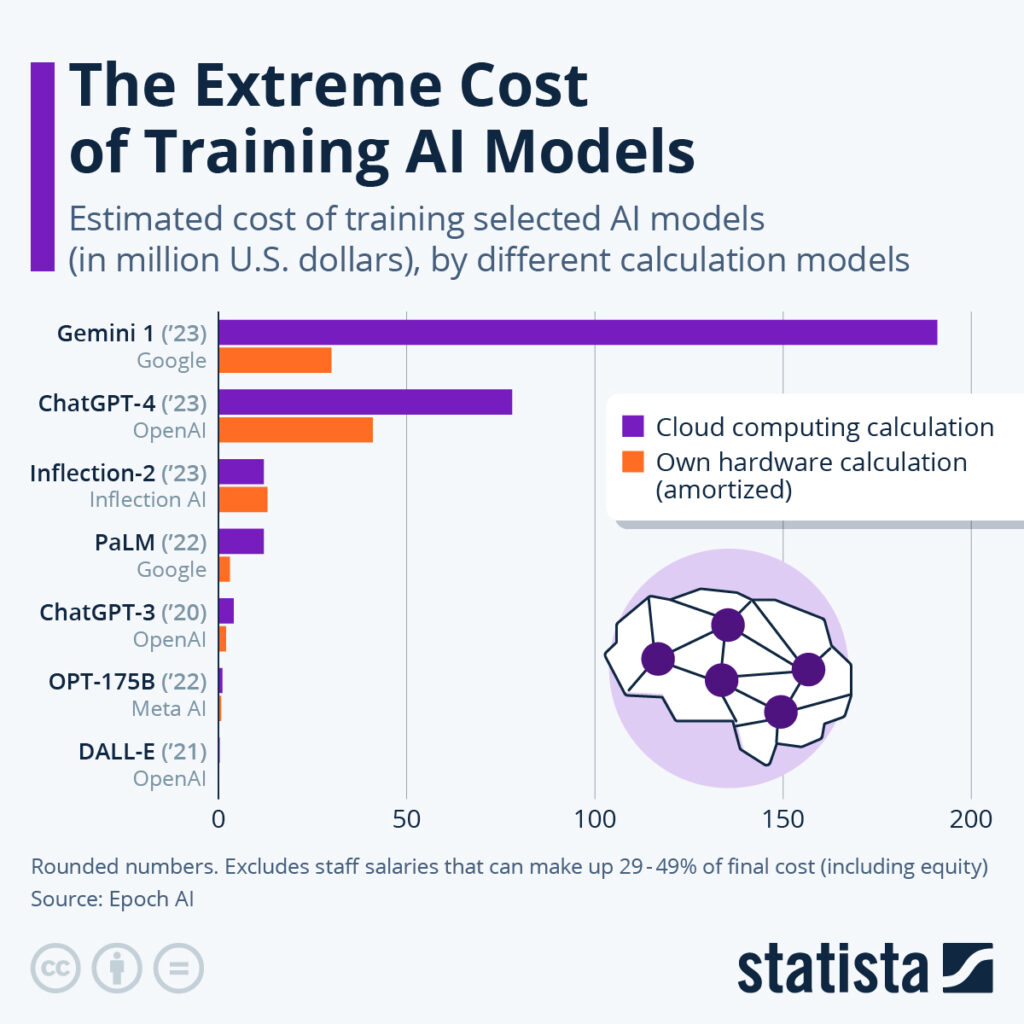

DeepSeek burst onto the scene by becoming the most downloaded free app on Apple’s US App Store, but its impact goes far beyond app rankings. The company claims to have developed its AI model for just USD 6 million, compared to the estimated USD 100 million to USD 1 billion spent by competitors like Anthropic.

This dramatic cost difference sent shockwaves through the market, pushing Nvidia’s value from USD 3.5 trillion to USD 2.9 trillion, dropping it to third place behind Apple and Microsoft.

However, industry experts urge caution about these cost claims. Elon Musk suggests DeepSeek likely has access to substantial resources, including an estimated 50,000 Nvidia chips acquired before export restrictions.

The company’s founder, Liang Wenfeng, manages an USD 8 billion hedge fund called High-Flyer, indicating deeper financial resources than initially reported. DeepSeek operates with a lean team of fewer than 140 people, primarily recruiting PhD students from elite Chinese universities rather than experienced engineers.

The immediate market reaction affected multiple sectors. Beyond Nvidia’s decline, ASML fell 6%, Broadcom dropped 17%, and energy companies like GE Vernova and Vistra saw declines of 21% and 28% respectively. Even Japanese AI-related firms weren’t spared, with the Nikkei 225 index falling 1.4%.

The Stargate project represents America’s response to these challenges, with an initial USD 100 billion investment scaling up to USD 500 billion.

The initiative brings together tech giants OpenAI, Oracle, and SoftBank, focusing on building massive AI infrastructure. The centrepiece includes a million-square-foot facility in Texas, marking the beginning of a nationwide data centre network.

Beyond job creation (100,000 new positions), the project addresses critical infrastructure needs. Industry leaders have highlighted the increasing demand for data centres, chips, electricity, and water resources to sustain AI growth. Sam Altman, OpenAI’s CEO, has described Stargate as the “most important project of this era.”

For investors, these developments signal several key shifts in the technology sector:

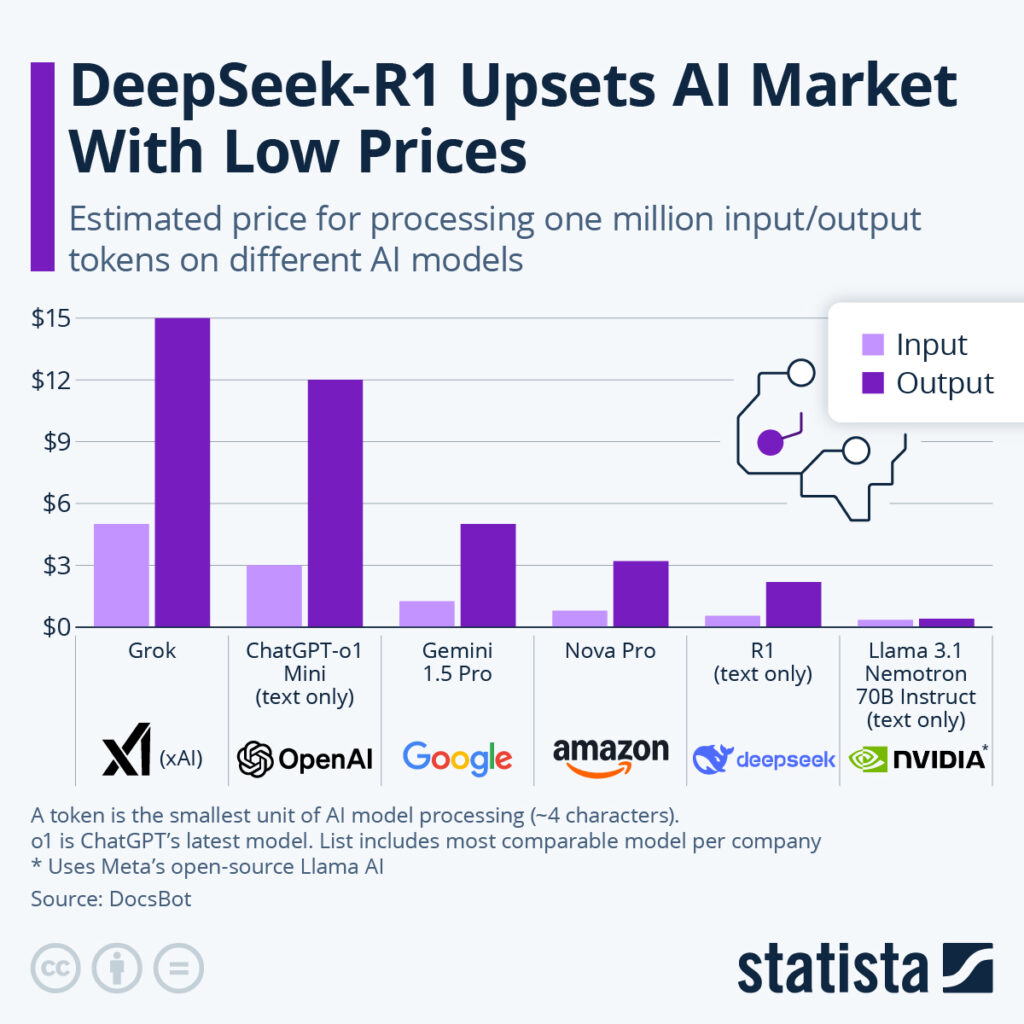

1. AI development costs: DeepSeek claims to use just 2,000 specialised chips compared to an estimated 16,000 chips for leading US models, challenging traditional cost assumptions.

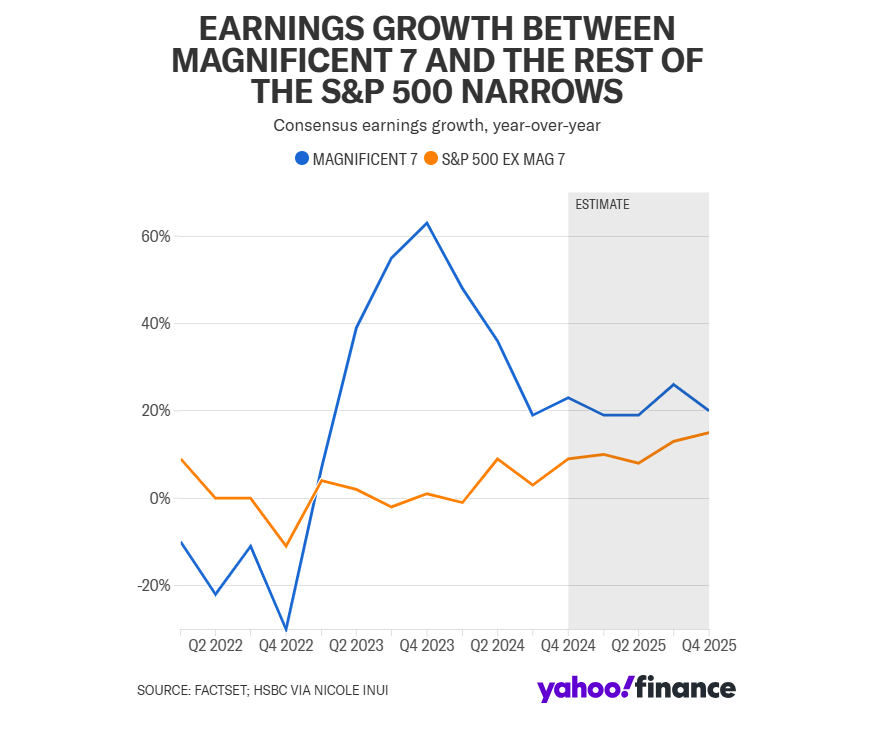

2. Semiconductor industry: While Nvidia remains dominant, concerns have emerged about chip supply. SK Hynix, a crucial supplier of high-bandwidth memory chips, has raised concerns about demand trends, while Taiwan Semiconductor expects to double its AI-related revenue.

3. Infrastructure players: KeyBanc has adjusted Nvidia’s 2026 data centre revenue target to USD 185 billion from USD 200 billion, reflecting changing market dynamics.

4. Cloud computing: Microsoft’s significant role as 13% of Nvidia’s fiscal Q1 revenue highlights the interconnected nature of the AI ecosystem.

Investors should consider several risk factors:

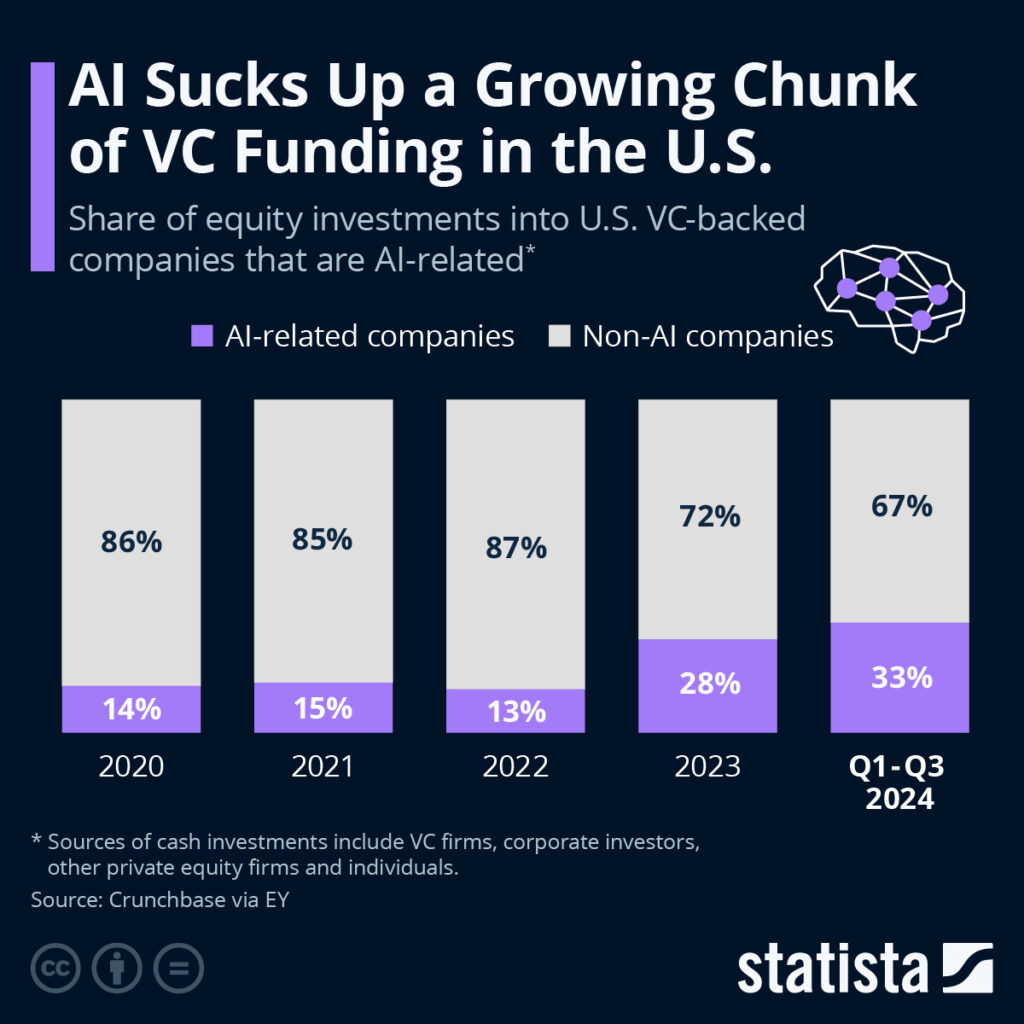

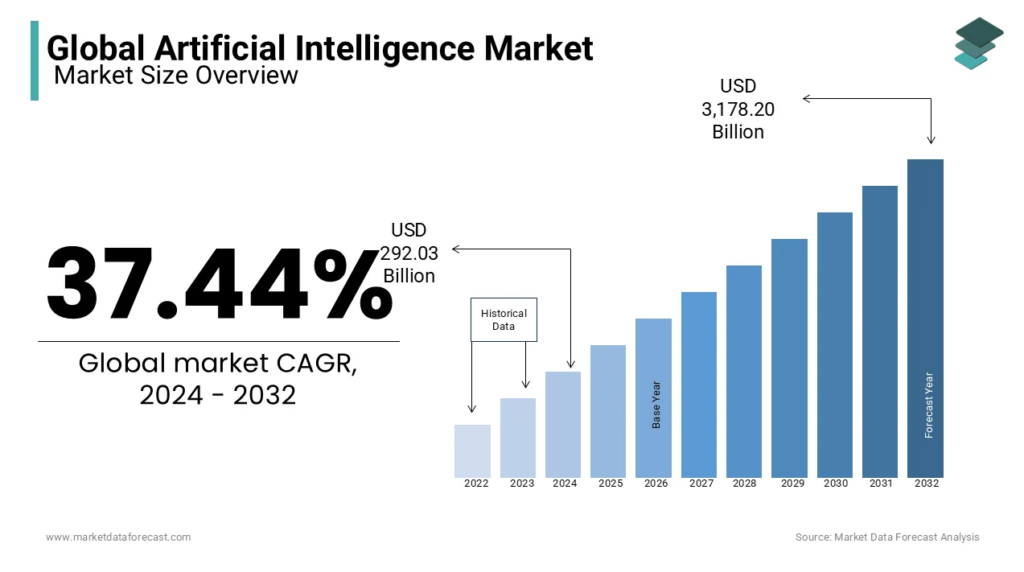

The AI revolution is reshaping the broader technology sector in several significant ways:

1. Shifting power dynamics: The traditional dominance of US tech giants is being challenged by efficient, low-cost competitors. Companies like DeepSeek demonstrate that innovation can come from unexpected places, forcing established players to rethink their strategies.

2. Infrastructure revolution: Data centre development is becoming as crucial as software development. The industry is seeing a massive shift towards sustainable, energy-efficient infrastructure solutions, particularly as AI power consumption concerns grow. UBS analysts predict this will create new opportunities in green tech and energy management systems.

3. Democratisation of AI: Lower development costs are making AI more accessible to smaller companies and startups. This trend could lead to:

4. Market restructuring: The tech sector is moving away from pure software plays toward integrated hardware-software solutions. Companies that can offer complete AI implementation packages, from chips to applications, are likely to gain advantages.

5. Talent market changes: With companies like DeepSeek successfully operating with smaller, specialised teams, the industry is seeing a shift in hiring practices. The focus is moving towards highly skilled specialists rather than large development teams.

For investors, several strategies merit consideration:

1. Diversification: Look beyond chip manufacturers to include companies throughout the AI value chain, including infrastructure providers and energy companies.

2. Timeline management: UBS analysts predict strong Q4 and fiscal Q1 results for the sector, but suggest monitoring Blackwell chip yields and revenue growth.

3. Risk assessment: Consider the impact of potential tariff increases (2-5% per month) and regulatory changes on international tech investments.

4. Market indicators: Watch data centre construction rates, chip shipments (particularly the transition to Blackwell chips), and energy consumption patterns in tech hubs.

These developments suggest we are entering a new phase in AI investment, where efficiency and infrastructure take centre stage. Investors should maintain a balanced approach, considering both the opportunities and risks in this rapidly evolving sector.

To capitalise on emerging trends in AI and beyond, open a live account with VT Markets today and access a world of investment opportunities.