In simple terms, commodities are the raw materials that are harvested, collected, and processed into everyday goods and services used by humans.

Unlike stocks or bonds, commodities are physical materials and goods. Trading commodities can be potentially profitable due to their price fluctuations, but they also carry more risk compared to bonds and the stock market. Successful commodities trading requires specialised knowledge and staying informed about the market.

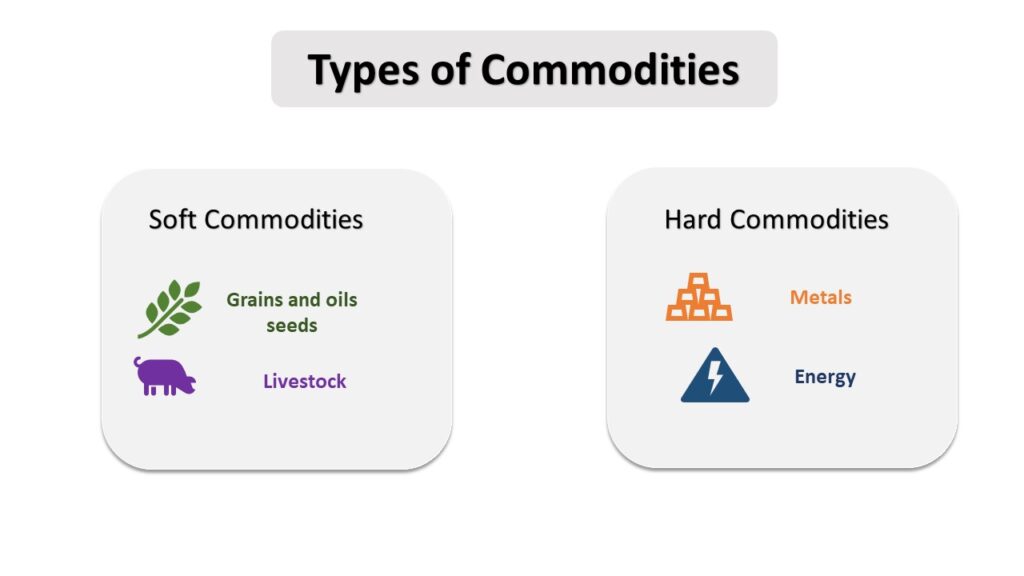

Before you start trading commodities, you’ll need to choose which commodity you’re interested in. They are typically divided into two categories.

hard commodities, soft commodities

Commodities trading is one of the oldest forms of trade and is the original basis for what modern investing has become today. The process might have started with farmers negotiating prices for their goods outside of harvest time, but these days, wanting to trade commodities involves a more sophisticated process.

When it comes to trading commodities, there are several options to consider:

Futures contracts allow investors to buy and sell commodities at a predetermined future price. Profits can be made from the difference between the agreed price and the actual price when the contract expires. However, this approach is based solely on price changes and does not involve the physical goods themselves.

Some commodities can be physically acquired by investors. However, this option is typically reserved for high-value commodities like precious metals, as it can be more costly compared to other investment methods.

Trading commodities stocks allows investors to gain exposure to the commodities market through companies producing the assets. The relationship between commodity prices and stock prices can vary, and it’s essential to understand the underlying principles of each company.

Exchange traded funds (ETFs) offer an opportunity to diversify your portfolio by holding a basket of commodities. ETFs aim to mimic the price movements of the underlying commodities, but they may not always perfectly reflect the actual market conditions.

To trade commodities successfully, it’s crucial to consider various factors that can influence the market:

Commodities trading offers unique opportunities but also carries higher risks. Many investors choose to allocate a portion of their portfolio to commodities trading, typically around 20%. This helps balance risk and potential gains while diversifying their investment portfolio.

If you’ve been following a commodities market, buffing up on your knowledge of political and environmental factors that might affect it and reading expert insights from financial journalists, you may be eager to open a commodity trading account. At VT Markets, we offer beginner-friendly and globally recognised trading platforms in a user-friendly interface, so you can trade commodities using a transparent and trusted forex trading environment that’s totally secure.

Want to know more about how we’ve designed our systems to meet the needs of clients? Get in touch and we’ll help you with anything you need, from choosing your account type to managing your investment size and leveraging the right commodities trading options to suit you.