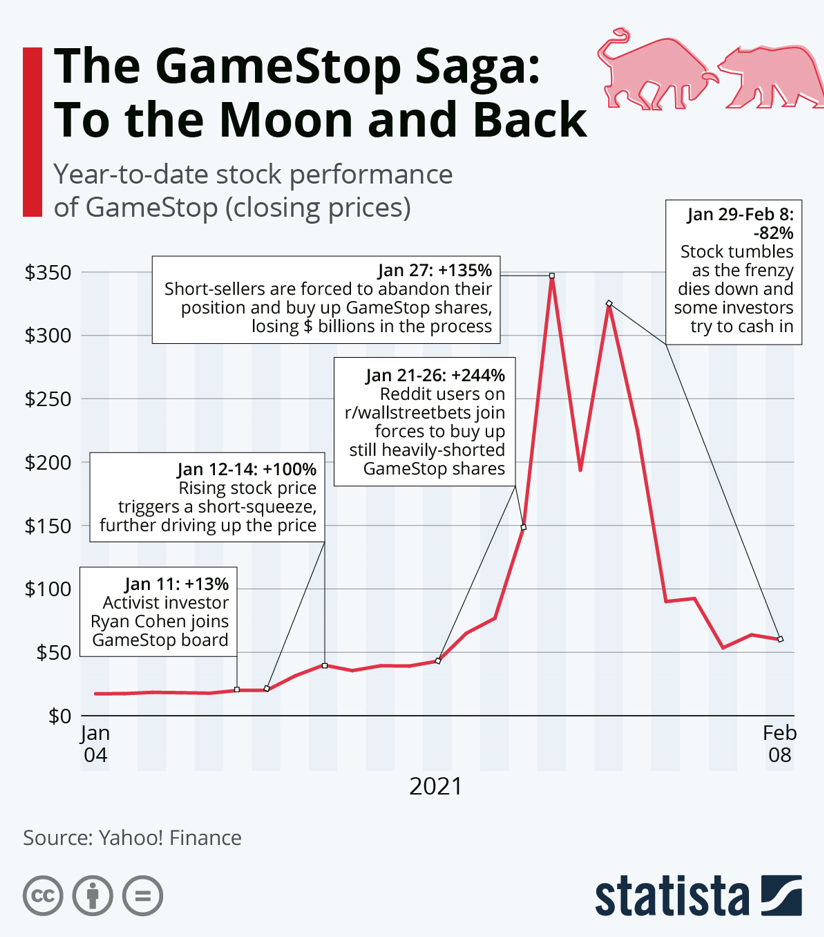

In January 2021, an unlikely group of Reddit users orchestrated one of the most extraordinary events in stock market history.

Members of the WallStreetBets subreddit, a community of retail investors, identified GameStop as a heavily shorted stock and coordinated their efforts to drive up the price. What followed was a massive short squeeze that sent GameStop’s stock soaring, inflicting billions in losses on major hedge funds that had bet against the company.

The power of this collective action on social media captivated the world, demonstrating the growing influence of online platforms on stock market trends. For traders, understanding this phenomenon is crucial in navigating the ever-evolving trading landscape.

GameStop, a struggling brick-and-mortar video game retailer, had been heavily shorted by hedge funds who believed the company was headed for bankruptcy.

With the rise of digital game downloads and competition from online retailers, GameStop’s business model appeared outdated, and its stock price had plummeted. Hedge funds capitalised on this by taking massive short positions, betting that the company’s shares would continue to decline.

The WallStreetBets subreddit, known for its irreverent humour and bold trading strategies, had been discussing GameStop’s potential for months. As more users joined the conversation, a coordinated effort emerged to purchase GameStop shares and call options, driving up demand and squeezing out short sellers who had bet on the stock’s decline.

The concept of a short squeeze is simple: as a stock’s price rises, short sellers who had borrowed and sold shares are forced to buy them back at higher prices to cover their positions, creating a feedback loop of rising demand and prices.

In GameStop’s case, this dynamic played out on an unprecedented scale, propelled by the collective buying power of the Reddit army.

By the end of January 2021, GameStop’s stock had skyrocketed from around USD 20 to an intraday high of USD 483, representing a staggering 2,300% gain.

While some Redditors walked away with life-changing profits, major hedge funds like Melvin Capital and Citron Research suffered massive losses.

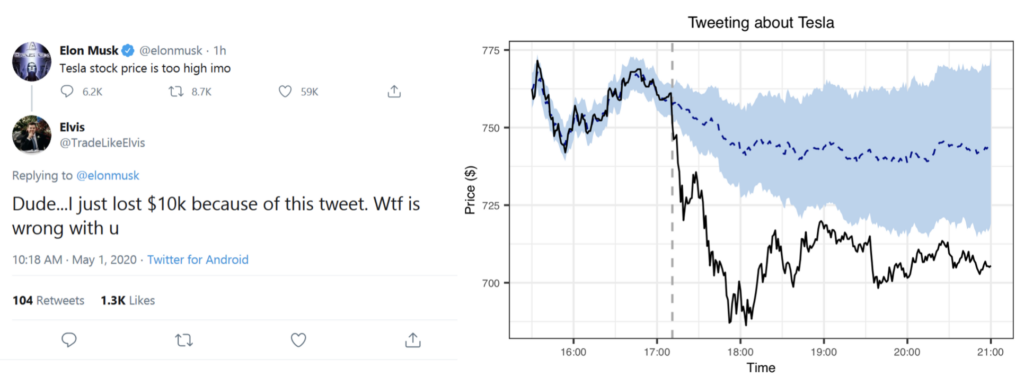

Beyond coordinated retail investor efforts, individual social media personalities can significantly influence market sentiment and stock prices. Elon Musk, the CEO of Tesla and a prolific Twitter user, has demonstrated this power time and again.

In May 2020, Musk tweeted that Tesla’s stock price was “too high,” causing the company’s shares to plummet by over 10% in a single day.

Conversely, his tweets promoting Dogecoin, a cryptocurrency started as a joke, have repeatedly driven up its value, showcasing the ability of influential figures to move markets with mere social media posts.

Other examples abound, from celebrities like Kylie Jenner’s tweet causing a $1.3 billion drop in Snapchat’s market value to President Donald Trump’s tweets affecting everything from tech stocks to oil prices. The influence of these social media personalities on market sentiment is undeniable.

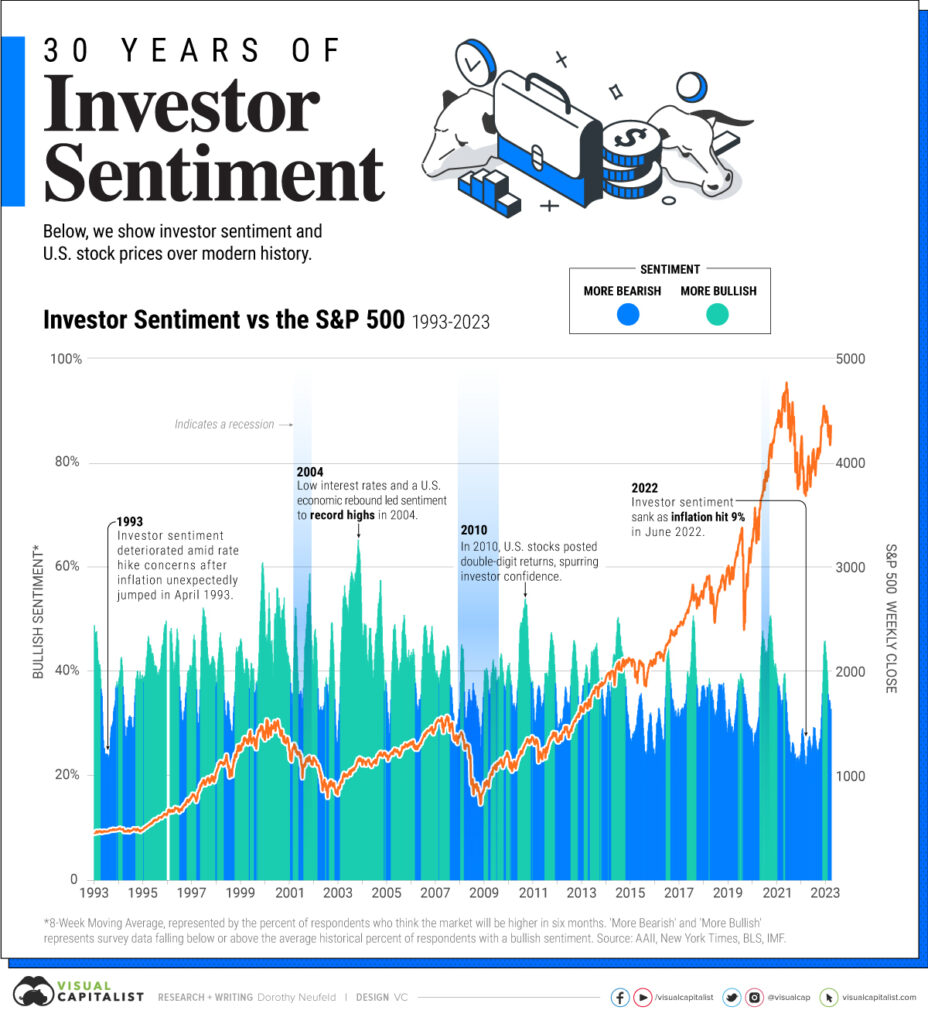

As social media’s impact on the stock market grows, algorithmic trading systems are increasingly incorporating sentiment analysis from online platforms.

These algorithms extract emotional and sentiment data from posts, tweets, and other social media content, using natural language processing and machine learning techniques.

By analysing the sentiment expressed on social media, these algorithms can quickly identify emerging trends and make trading decisions based on the collective mood of online communities.

For example, an algorithm may detect a surge of positive sentiment around a particular stock and initiate buy orders accordingly.

While this approach offers the potential for rapid response to market shifts, it also carries risks. Relying solely on sentiment analysis can lead to overreactions or decisions based on inaccurate or manipulated social media information.

The GameStop saga and the growing influence of social media on stock prices have raised concerns among regulators about the potential for market manipulation.

Efforts are underway to monitor and mitigate the spread of false or misleading information that could unfairly manipulate stock prices.

In 2021, the U.S. Securities and Exchange Commission (SEC) issued statements warning investors about the risks of relying on social media for investment advice and expressing concerns about the potential for market manipulation through online platforms.

However, regulating social media’s impact on the stock market is a complex challenge. Distinguishing genuine market sentiment from coordinated manipulation can be difficult, particularly when the line between legitimate investor discussions and deliberate misinformation is blurred.

Beyond the practical effects on stock prices, social media can also exert psychological pressures on investors, particularly inexperienced traders.

The fear of missing out (FOMO) on a potential opportunity is a powerful force, often leading individuals to make impulsive and ill-advised financial decisions.

During the GameStop frenzy, many retail investors piled into the stock at inflated prices, driven by the fear of missing out on the meteoric gains enjoyed by early investors.

Similarly, the hype surrounding cryptocurrencies like Dogecoin has led to speculative buying frenzies fuelled by FOMO.

Maintaining emotional discipline and objective decision-making is crucial in trading, and social media’s ability to amplify market hysteria can be a significant obstacle to overcome.

While social media’s influence on stock market trends is undeniable, traders must approach this phenomenon with caution. Relying solely on social media information or being swayed by online hype can lead to costly mistakes.

Smart traders should view social media as one source of information among many, cross-checking data from multiple reputable sources and conducting thorough research and fundamental analysis before making investment decisions.

Professional advice and guidance can also be invaluable in navigating the complex and rapidly evolving social media trading landscape.

Ultimately, while social media has undoubtedly transformed the stock market, it should be just one part of a comprehensive trading strategy By understanding its influence, respecting its power, and maintaining objectivity, traders can navigate this new reality with confidence and success.