Picture this: It’s 3:00 PM in London, and whilst European markets are in full swing, a crucial Asian market has just closed for the day. The Nikkei 225, Japan’s premier stock index, has once again proven why it’s called ‘the pulse of the Asian economy’.

This powerhouse index, representing companies worth over USD 4 trillion, influences markets from Sydney to New York, creating opportunities for traders worldwide.

The Nikkei 225, often simply called ‘the Nikkei’, serves as Japan’s primary stock market indicator and ranks among the world’s most watched indices. Whether you’re a budding trader or seeking to diversify your portfolio, understanding this crucial market barometer can open doors to exciting trading opportunities in the Asian markets.

The Nikkei 225 Stock Average, launched in 1950, tracks 225 of Japan’s largest and most actively traded companies listed on the Tokyo Stock Exchange.

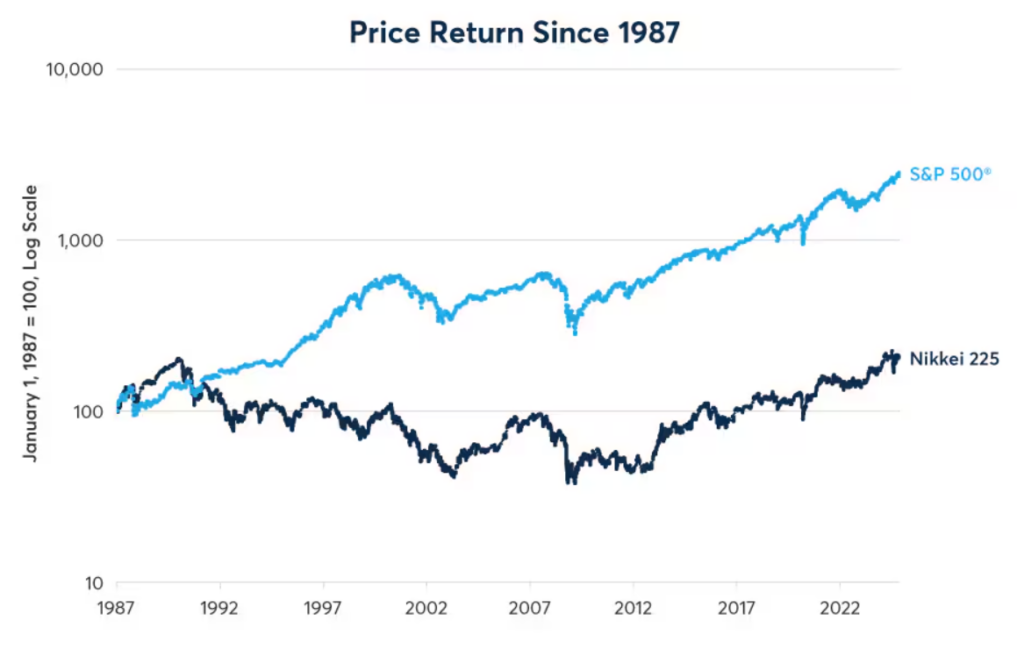

Since its inception at 176.21 points, the index has witnessed remarkable growth, reaching its historic peak of 38,957.44 in December 1989 during Japan’s economic bubble.

After a prolonged bear market in the 1990s and early 2000s, known as the “Lost Decades,” the index has shown resilience, consistently trading above 30,000 points in recent years.

Unlike most modern indices that use market capitalisation weighting, the Nikkei employs a price-weighted system, similar to the Dow Jones Industrial Average.

This means that companies with higher share prices have a greater influence on the index’s movements, regardless of their market size. For instance, Fast Retailing, the parent company of UNIQLO, carries substantial weight due to its high share price, which often exceeds USD 700 per share.

The index encompasses various sectors, with technology, automotive, and financial services playing prominent roles. Global giants like Toyota Motor Corporation, Japan’s largest automaker and a pioneer in hybrid vehicles, holds significant influence.

Sony Group Corporation, renowned for PlayStation gaming consoles and professional electronics, and SoftBank Group, a major technology investment company led by visionary Masayoshi Son, are other heavyweight constituents.

The index also includes industrial powerhouses like Fanuc, the world’s leading industrial robot manufacturer, and Mitsubishi Corporation, one of Japan’s largest trading companies.

Trading occurs during Tokyo Stock Exchange hours, from 9:00 AM to 3:00 PM Japan Standard Time (midnight to 6:00 AM GMT), with a lunch break between 11:30 AM and 12:30 PM JST (2:30 AM to 3:30 AM GMT).

This unique trading schedule, including the midday break, reflects Japan’s traditional business customs while allowing for crucial overlap with other Asian markets.

Several key factors drive the Nikkei’s movements.

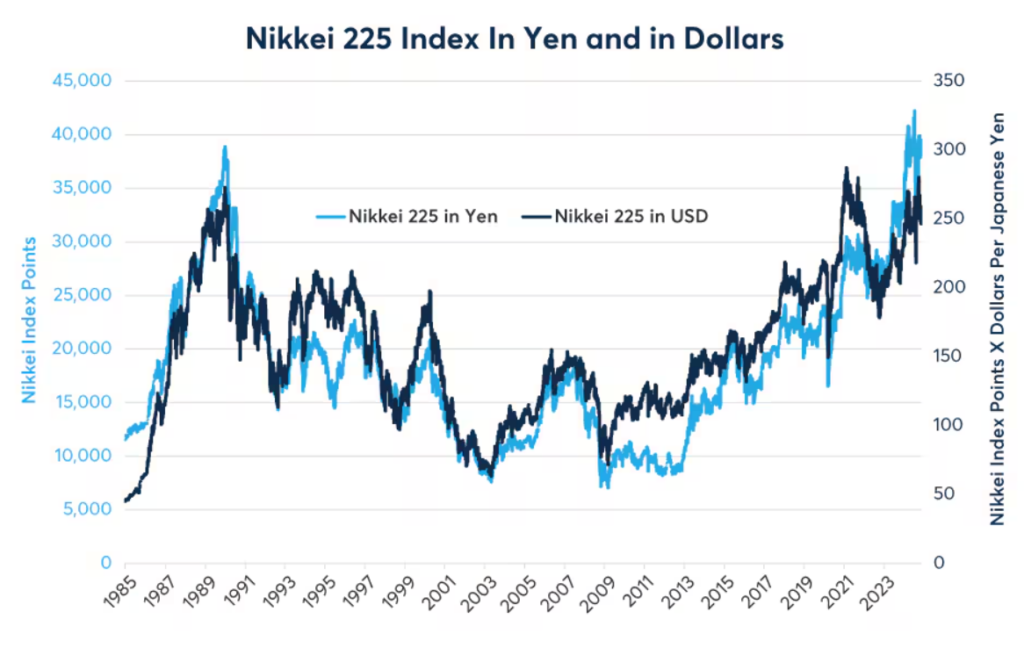

The Japanese yen’s value significantly impacts the index, particularly because many constituent companies are export-oriented. A weaker yen typically benefits exporters by making their products more competitive abroad and increasing the value of overseas earnings when converted back to yen.

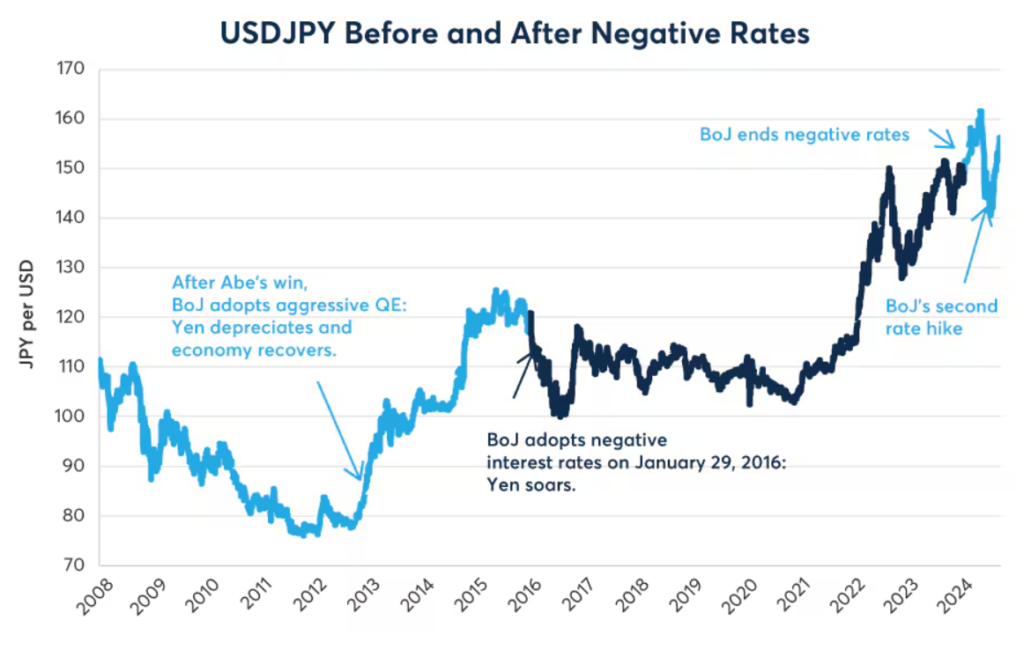

The Bank of Japan’s monetary policies play a crucial role. Interest rate decisions, quantitative easing measures, and other policy changes can trigger substantial market movements.

Japan’s unique corporate culture, characterised by strong business groups called keiretsu and lifetime employment practices, also influences market behaviour.

Global economic conditions significantly affect the index. As many Nikkei companies operate internationally, factors like US-China trade relations, global technology demand, and international commodity prices can cause considerable fluctuations.

Additionally, Japan’s demographic challenges, including an ageing population and declining workforce, create both challenges and opportunities that impact market movements.

While several methods exist to trade the Nikkei 225, Contract for Difference (CFD) trading has become increasingly popular among retail traders.

Through VT Markets, traders can access two main CFD products: the JPN225ft (Nikkei Future) and the Nikkei225 (Nikkei Index Cash CFD in JPY). These instruments offer significant advantages for active traders, including lower capital requirements and the ability to trade both rising and falling markets.

The key difference is in costs: Future CFDs (JPN225ft) have wider spreads but no overnight charges, ideal for longer-term trades. Cash CFDs (Nikkei225) offer tighter spreads but incur daily swap rates, making them better suited for day trading.

Alternative trading methods include Exchange-Traded Funds (ETFs), such as the iShares Nikkei 225 ETF, which provide good liquidity and are ideal for long-term buy-and-hold investors. However, they lack leverage and short-selling features.

For institutional and experienced traders, futures contracts on the Osaka and Chicago Mercantile Exchanges offer high liquidity and standardised contracts, requiring larger capital and expertise. Options on Nikkei futures enable hedging and directional strategies but demand advanced derivatives knowledge.

For most retail traders, CFDs balance accessibility, cost-effectiveness, and flexibility. With features like guaranteed stop-loss orders and adjustable position sizes, CFDs through regulated brokers provide a practical way to trade the Nikkei 225 while managing risk.

Success in trading the Nikkei requires understanding its unique characteristics.

The index often shows strong technical patterns, with key support and resistance levels frequently respected. Moving averages, particularly the 50-day and 200-day, serve as important technical indicators that many traders follow.

Risk management becomes particularly important given the index’s volatility and the yen’s influence. Setting appropriate stop-losses and position sizes helps protect against adverse movements.

For European traders, the time difference means major moves often occur overnight, making it essential to use proper order types and risk controls.

Staying informed about Japanese economic data releases, Bank of Japan meetings, and global market developments helps anticipate potential market moves.

Regular review of companies’ earnings reports, particularly those of heavily weighted constituents, can provide valuable trading insights.

The Nikkei 225 presents exciting opportunities for traders who understand its unique characteristics. Despite challenges like time zones and market complexity, these can be managed with research and a solid strategy. CFD trading offers a flexible way to trade the Nikkei 225. Success relies on risk management, market knowledge, and disciplined use of tools like stop-loss orders.

Ready to trade the Nikkei 225? VT Markets provides competitive spreads, professional platforms, and educational resources. Open a live account today or start with a demo account to practice risk-free.