Imagine watching your forex trade soar one minute, only to plummet the next—welcome to volatility! It’s the heartbeat of the markets, those rapid price swings that can leave your head spinning.

In 2024 alone, the forex market saw daily swings averaging 0.8% on major pairs like USD/JPY, with spikes hitting 2.5% during big news days, according to Bloomberg data. Now, in 2025, with Bank of England rate decisions looming, crypto regulations shifting, and global tensions simmering, volatility is set to keep us on our toes.

But here’s the good news: you don’t need to be a City whiz to handle it. This article will show you how to protect your funds, manage the chaos, and even profit from the storm—no PhD in finance required. Ready to take control? Let’s dive in.

Volatility isn’t just random noise—it’s the market reacting to the world around it. Picture this: in January 2025, a surprise US jobs report sent USD/GBP tumbling 2% in a matter of hours. That’s volatility in action—big moves, fast.

So, what drives it? Economic news, like US inflation figures or central bank announcements, can jolt forex pairs like USD/GBP or USD/JPY. Geopolitical shocks, say a trade spat between major powers, might spike oil prices overnight. Market mood plays a huge role too—remember when Elon’s tweets sent crypto into a tailspin?

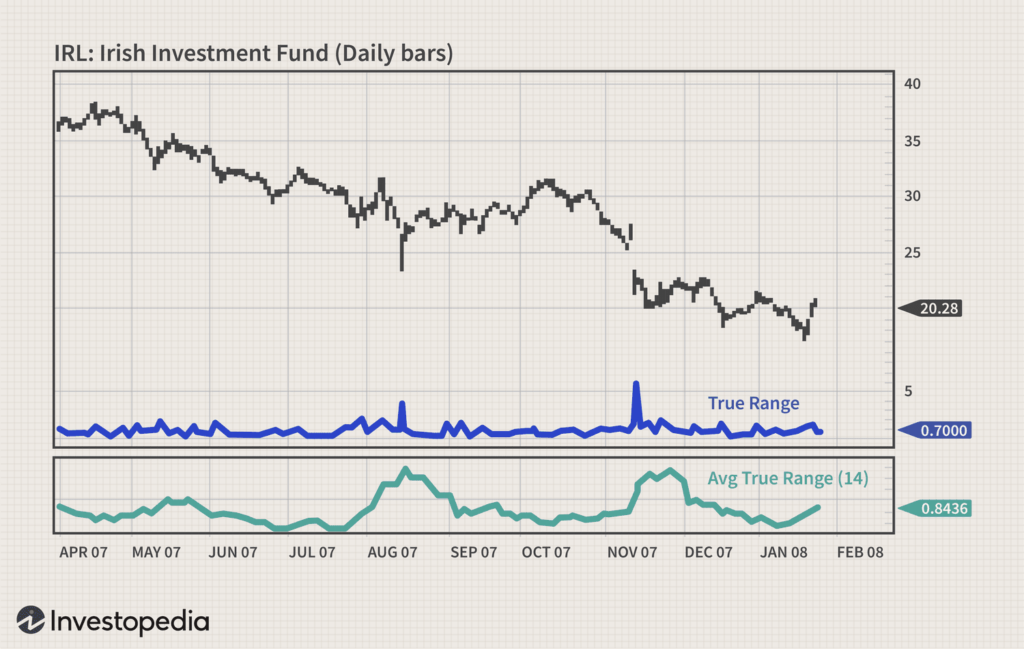

Spotting volatility means reading the signs. The Average True Range (ATR) is a handy tool—think of it as a ruler for price wiggles; a bigger ATR signals a wilder ride.

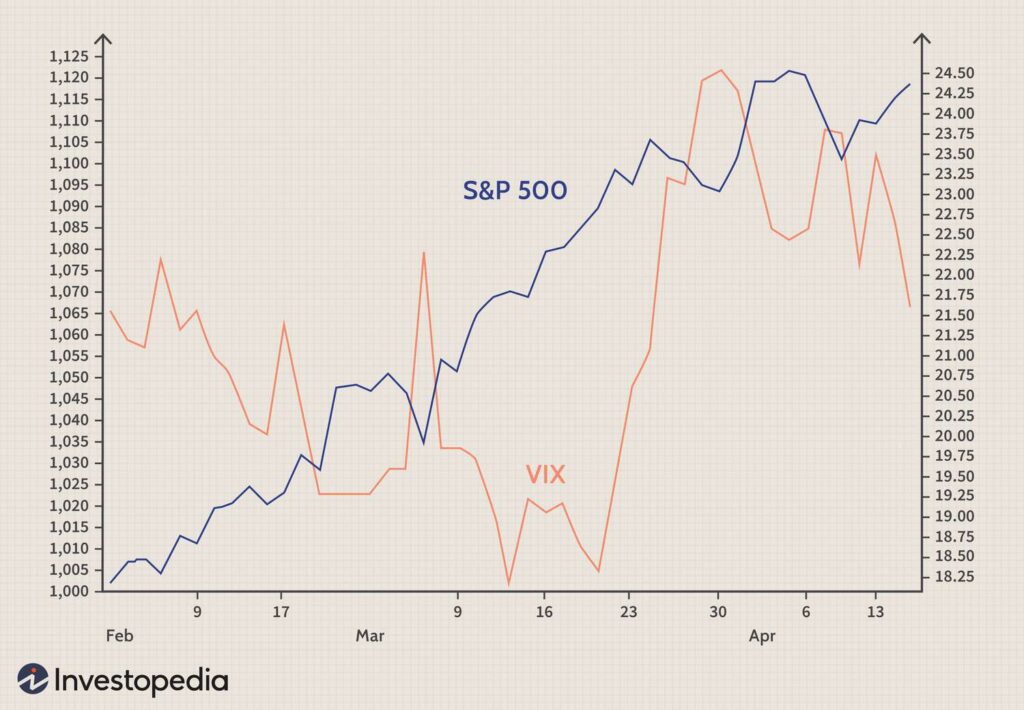

The Volatility Index (VIX), dubbed the “fear gauge,” tracks US stock market jitters—when it spiked to 38 during the 2020 crash, markets shuddered globally; a jump above 20 in 2025 could ripple into forex and crypto.

Sentiment indicators add another layer. The Commitment of Traders (COT) report, released weekly by the US CFTC, shows how big players like hedge funds are betting—e.g., in late 2024, a surge in short USD positions hinted at a looming drop. Even social media buzz can tip you off—traders on X flagged a Bitcoin dip in early 2025 before it hit.

Check VT Markets’ economic calendar too—rate decisions or jobs data often hint at choppy waters. It’s not chaos; it’s a puzzle you can learn to read with the right clues.

Volatility can feel like a rollercoaster, but you don’t have to ride it blind. Here are three practical strategies to keep your account safe when the markets get stormy—plus a real-world lesson to tie it all together.

First, position sizing. Risk only 1–2% of your account per trade—it’s like wearing a seatbelt. With a USD 1,000 account, a USD 20 loss on a shaky USD/JPY trade won’t sink you, leaving room to recover. Risk USD 200 instead, and one bad day could wipe you out. In volatile times, like when USD/JPY’s 14-day ATR hit 150 pips in late 2024, small positions kept traders afloat.

Next, stop-loss orders. These are your trapdoor, automatically exiting a losing trade before it spirals. Say EUR/USD dips—place a stop below a support level, like 1.2500. A trader once dodged a USD 50 hit when Bitcoin crashed USD 500 in an hour, thanks to a well-placed stop. Set it wisely—too tight, and you’ll exit too soon; too loose, and you are exposed.

Then there’s hedging. It’s betting both ways to soften the blow. Going long on gold? Short USD/JPY to balance a dollar surge. A trader in 2024 hedged a long USD/CAD position with a short oil trade during a supply scare—volatility hit, but their losses stayed small. These aren’t fancy tricks—they are your safety net, keeping you in the game no matter how wild things get.

Here is the fun part: volatility isn’t just a threat—it’s your chance to shine. With the right moves, you can turn those wild swings into profit. Let’s look at a couple of tactics.

Scalping is like nabbing quick wins during big moves. Picture a Bank of Canada rate cut—USD/CAD spikes, and a trader makes USD 30 in minutes by jumping in and out fast. It’s high-energy, but perfect for news-driven volatility. Just keep your wits about you—speed matters.

Then there’s breakout trading. When prices smash through key levels, you ride the wave. In February 2024, BTC/USD broke USD 50,000—traders who jumped in saw it climb to USD 52,000 in days.

Spot these breaks with Bollinger Bands—lines on your chart that show when prices are stretched. EUR/USD hit the upper band once and dropped—a quick USD 25 profit for a trader who sold at the peak. These tactics thrive on volatility’s energy, turning chaos into cash if you time it right.

So, there you have it—from sizing trades to riding breakouts, you’ve got the tools to tame volatility. It’s about staying calm, sticking to your plan, and not letting panic steer the ship. Whether you are dodging losses with a stop-loss or scalping a quick win, these strategies can turn a stormy market into your playground.

Want to put them to the test? Start with VT Markets’ demo account—practise without risking a penny. Feeling ready to trade for real? Open a live account with VT Markets and trade the storms with confidence—it’s your next step to mastering the markets.

Because here is the truth: markets may rage, but with these tricks up your sleeve, you’ll be the one in control, ready to navigate whatever 2025 throws your way.