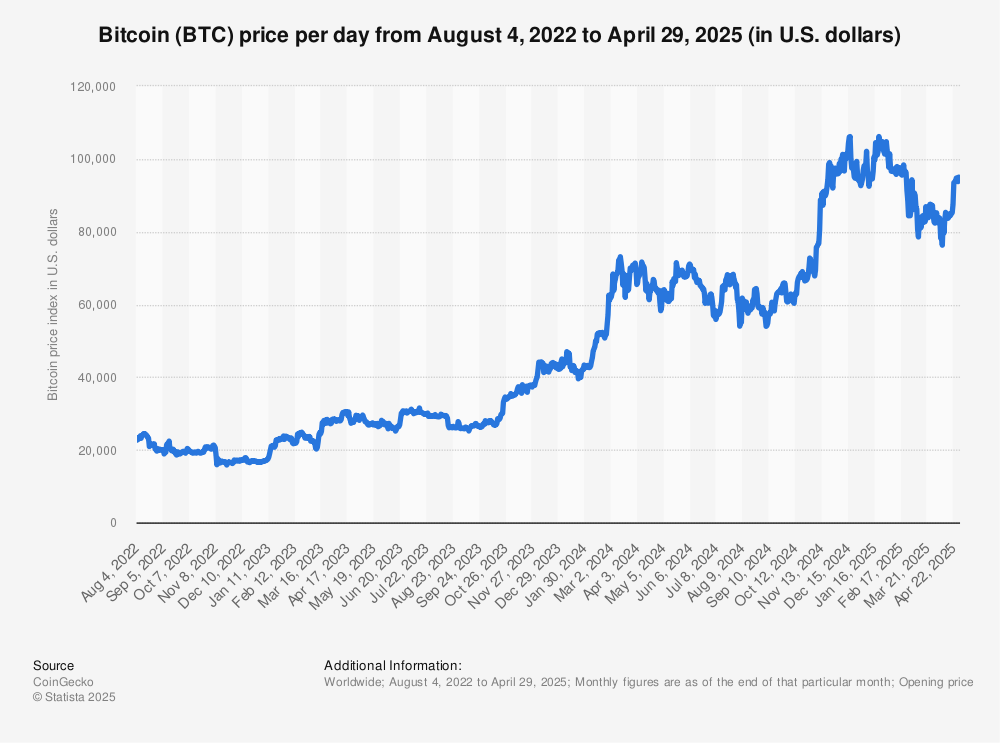

In April 2025, as global markets shuddered under the weight of escalating US-China trade tensions and President Trump’s aggressive tariff announcements, gold prices soared past USD 3,300 per ounce, cementing its status as a beacon of stability. Meanwhile, Bitcoin, often dubbed “digital gold,” surged 23% amid the chaos.

These are prime examples of safe-haven assets—investments that hold or gain value when markets turn turbulent. For traders, understanding and trading these assets can be a lifeline in volatile times, protecting portfolios from steep losses or even yielding profits.

Safe-haven assets are investments that investors flock to during economic or geopolitical uncertainty. They are prized for their low volatility, high liquidity, and ability to retain value when stocks or riskier assets falter. Think of them as lifeboats on a stormy sea—while other investments may sink, these keep your portfolio steady.

Here are the most common safe-haven assets:

These assets act as a hedge, balancing losses in riskier holdings like stocks or emerging market currencies. For retail traders, they offer a way to safeguard wealth or capitalise on market fear.

Markets turn turbulent when uncertainty spikes—think geopolitical conflicts, trade disputes, or economic slowdowns.

In April 2025, Trump’s announcement of 145% tariffs on Chinese imports triggered a global sell-off, with the S&P 500 dropping 4% in a week. Investors, seeking shelter, poured capital into safe-haven assets, driving up their prices.

This flight to safety is a hallmark of investor behaviour. When confidence in stocks or fiat currencies erodes, assets like gold or the Swiss franc become go-to havens.

For instance, as US Treasuries faltered in 2025—losing their safe-haven allure due to tariff-related instability—gold and Bitcoin stole the spotlight. Gold hit record highs, while Bitcoin’s 23% rally underscored its growing role as a hedge against uncertainty.

However, safe havens aren’t immune to short-term dips. Gold, for example, briefly fell 5% in 2025 due to margin calls during peak volatility.

Still, their long-term stability makes them a powerful tool for traders. By trading safe havens, you can protect your capital or profit from market fear, turning turmoil into opportunity.

Trading safe-haven assets doesn’t require a finance degree—just a clear strategy and discipline. Here is a step-by-step guide to get started, tailored for non-professional traders:

Step 1: Choose your asset

Select a safe-haven asset based on your trading style and market conditions:

Step 2: Analyse market conditions

Stay ahead by monitoring news and technical signals:

Step 3: Manage risk

Protect your capital with disciplined risk management:

Step 4: Diversify

Don’t put all your eggs in one basket. Combine safe havens (e.g., gold and the Yen) with other assets to balance risk and reward.

Safe-haven assets are not a magic bullet. Even gold can be volatile short-term, as seen in its 5% dip during 2025’s margin call frenzy. US Treasuries, once a bedrock, lost appeal amid tariff-driven uncertainty. Over-relying on safe havens can also mean missing growth opportunities in calmer markets.

Trading costs are another factor. CFDs and ETFs carry fees, and high leverage can amplify losses if markets move against you. Emotional trading—panic-buying gold at peak prices, for instance—often leads to poor decisions.

To stay safe, stick to a trading plan, use stop-losses, and rely on trusted platforms like VT Markets for market insights and tools.

In a world of market uncertainty, safe-haven assets like gold, the Swiss franc, and even Bitcoin are your anchors. As 2025’s trade war turmoil showed, these assets can protect your portfolio or deliver profits when stocks falter. By choosing the right asset, analysing market signals, and managing risk, you can navigate volatile markets with confidence.

Ready to take control? Start exploring safe-haven trading with VT Markets’ demo account to practise risk-free, or dive into the educational resources to sharpen your skills. For those eager to trade live, open a live account with VT Markets today and access powerful tools to trade gold, forex, and more. In turbulent times, safe-haven assets are your edge—trade them wisely to stay ahead.