The stock market can be a daunting place, especially when headlines are filled with warnings of a possible recession. For traders, the volatility of the market can feel overwhelming, leading to decisions driven by fear rather than strategy.

However, understanding the underlying factors at play can help you make informed choices, even in uncertain times. This guide aims to simplify the complex dynamics of the current market and provide you with practical advice to navigate these choppy waters confidently.

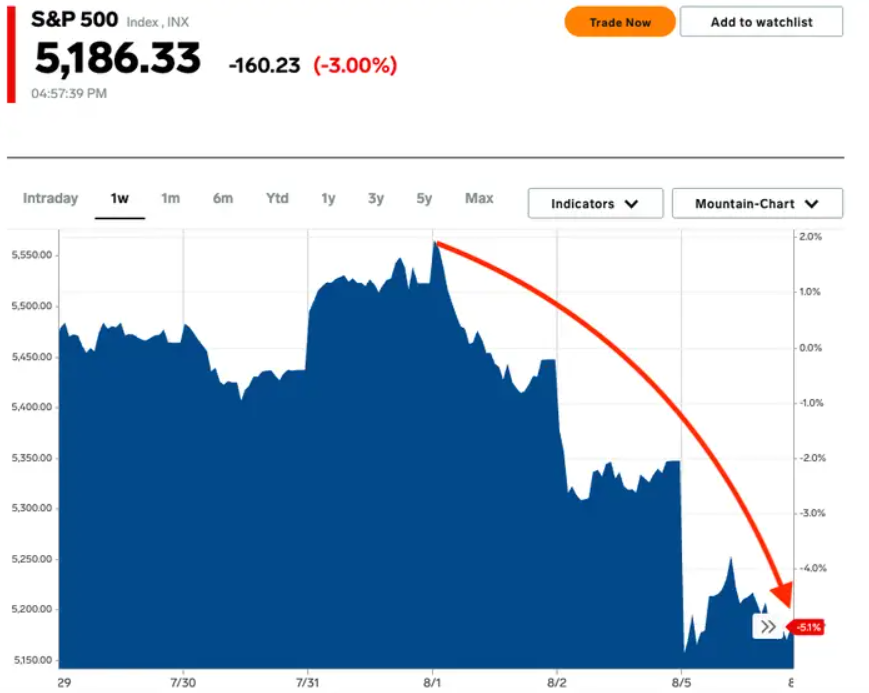

The stock market has recently experienced significant fluctuations, with major indices like the S&P 500 dropping over 4% in a single week and the NASDAQ falling more than 5% in July 2024. This volatility has left many investors on edge, driven primarily by growing concerns about an impending recession.

Rising interest rates, with the Federal Reserve increasing rates to a range of 5.25% to 5.50%, coupled with persistent inflation above 3%, and global economic challenges, have all contributed to this sense of uncertainty.

The Fed’s aggressive stance on controlling inflation through rate hikes has exacerbated these fears, as higher borrowing costs threaten to slow economic growth and hurt corporate profits.

However, it’s essential to recognise that market downturns are not uncommon and can often serve as a necessary correction, where overvalued stocks adjust to more reasonable levels. The Dow Jones Industrial Average, for instance, has seen corrections of over 10% multiple times in the past decade.

While the immediate reaction to these fluctuations might be panic, understanding that such movements are part of the market’s natural cycle can help you keep a level head.

The current market chaos is indeed a double-edged sword.

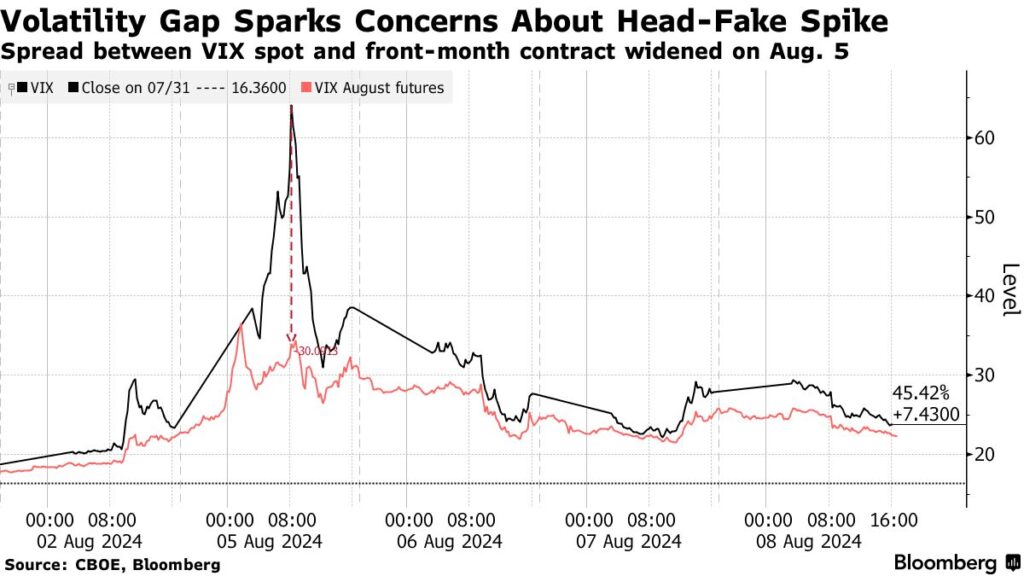

On the one hand, it reflects the uncertainty and fear that many investors feel about the economy’s future. For instance, the VIX, a measure of market volatility, surged over 30% in July 2024, highlighting the heightened anxiety.

On the other hand, some experts argue that this chaos is a “healthy correction,” where the market is realigning itself by focusing on fundamentals such as earnings growth, which has averaged around 8% annually for S&P 500 companies over the past decade.

Mark Mobius, a seasoned investor, has noted that while the recent market disruptions, such as the NASDAQ’s 7% drop in Q2 2024, may signal more economic trouble ahead, they also present unique opportunities. For traders, this perspective is crucial. It suggests that instead of getting caught up in the daily ups and downs, it’s more important to look at the bigger picture and identify areas where the market may have overreacted.

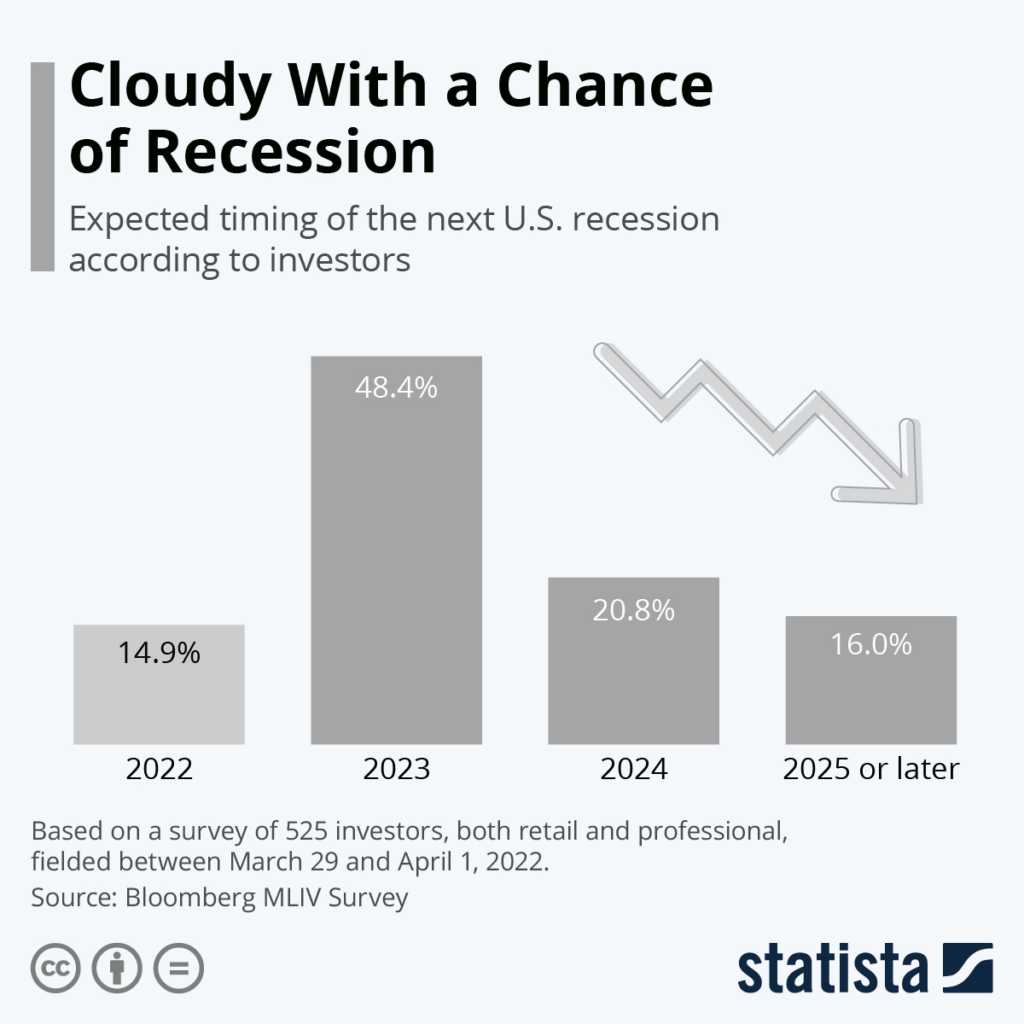

Recession fears have been a significant driver of recent market behaviour. A recession, defined as a period of economic decline typically marked by a drop in GDP, rising unemployment, and lower consumer spending, is a frightening prospect for any investor. In 2024, the U.S. economy saw GDP growth slow to just 1.2% in Q2, compared to 2.5% in Q1, raising alarms.

There are two sides to this argument. On the one hand, the signs of a potential recession are there—economic growth has slowed, inflation remains high at 3.2%, and the Federal Reserve’s monetary tightening could eventually dampen economic activity.

Mark Mobius has pointed out that the reduced money supply, which shrank by 2.3% year-over-year in July 2024, could lead to longer-term economic challenges.

On the other hand, some experts argue that the conditions for a full-blown recession are not yet in place. For instance, credit conditions remain relatively strong, with bank lending growing by 5% annually, which typically doesn’t align with the onset of a recession.

Moreover, the job market has shown resilience, with unemployment rates still low at 3.6%. For traders, this means that while it’s important to be cautious, there’s also no need to assume that a recession is inevitable.

Given the current market volatility, how should traders approach their investments? Here are some practical strategies to consider:

1. Diversification is key

One of the most effective ways to protect your portfolio during uncertain times is through diversification. By spreading your investments across different asset classes (stocks, bonds, commodities), sectors, and geographical regions, you can reduce the risk of significant losses. If one area of your portfolio underperforms, others may perform better, balancing out the overall impact.

2. Hold cash reserves

Another strategy suggested by Mark Mobius is to keep a portion of your portfolio in cash—he recommends up to 20%. This “dry powder” allows you to take advantage of opportunities that arise during market downturns, such as buying undervalued stocks. Cash reserves also provide a safety net, giving you the flexibility to make decisions without being forced to sell assets at a loss.

3. Focus on fundamentals

During volatile times, it’s easy to get caught up in market sentiment and make impulsive decisions. However, a better approach is to focus on the fundamentals of the companies you’re investing in. Look for businesses with strong balance sheets, consistent earnings, and solid growth prospects. These companies are more likely to weather economic storms and provide long-term value.

4. Patience and long-term perspective

Lastly, remember that investing is a long-term game. While the market may experience short-term volatility, history has shown that it generally trends upward over time. By maintaining a long-term perspective and not getting swayed by daily market movements, you can avoid making rash decisions that could harm your portfolio in the long run.

Navigating the stock market during uncertainty is challenging, but understanding market dynamics and adopting a strategic approach can help you make informed decisions. For a reliable trading experience, consider VT Markets, which offers a user-friendly platform, competitive fees, and tools to help you stay focused on your long-term goals. By choosing VT Markets, you can trade confidently and effectively, even amid recession fears and market chaos. Remember, success comes from staying calm and focused on your long-term investment strategy.