Imagine opening your trading app in May 2025 and watching EUR/USD plummet. Why? The US Dollar Index (DXY) surged above 100 after a US court blocked new tariffs, boosting confidence in the dollar. Traders who understood the DXY seized this opportunity to profit. Could you?

Whether you are new to trading or looking to sharpen your skills, the DXY is a powerful tool to navigate global markets. This article explains what the DXY is, why it matters, and how you can use it to make smarter trading decisions.

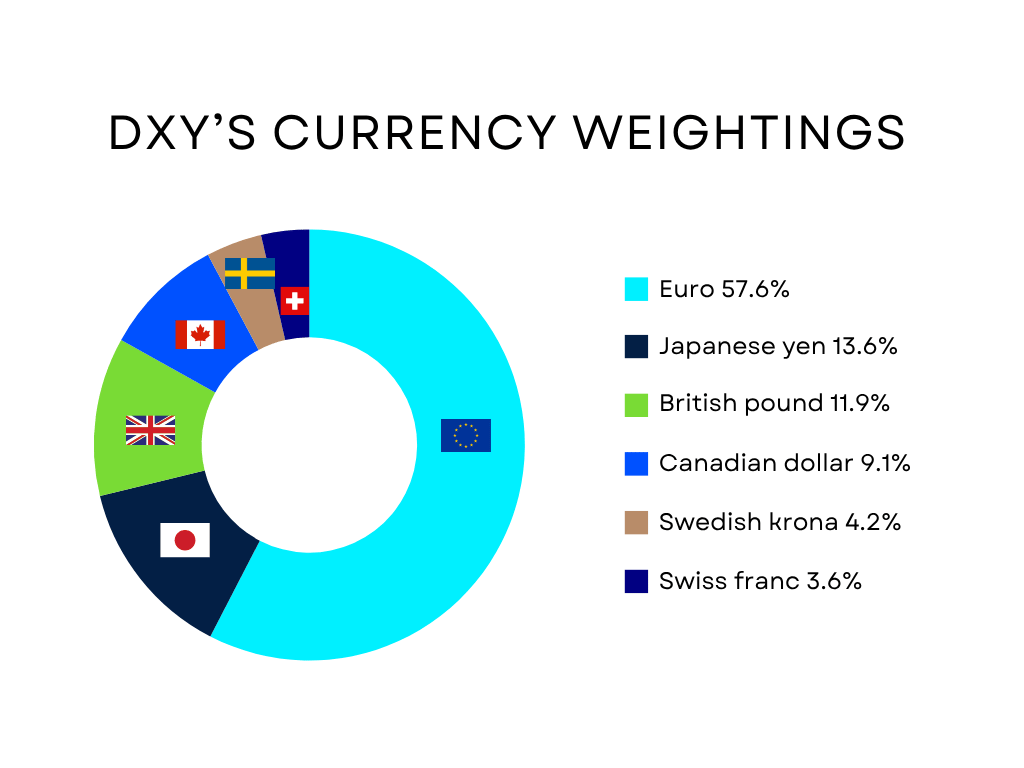

The US Dollar Index measures the US dollar’s value against a basket of six major currencies: the euro (57.6%), Japanese yen (13.6%), British pound (11.9%), Canadian dollar (9.1%), Swedish krona (4.2%), and Swiss franc (3.6%).

Think of it like the FTSE 100, which tracks a basket of stocks, but for currencies. The euro dominates due to its hefty weighting, making the DXY sensitive to Eurozone events.

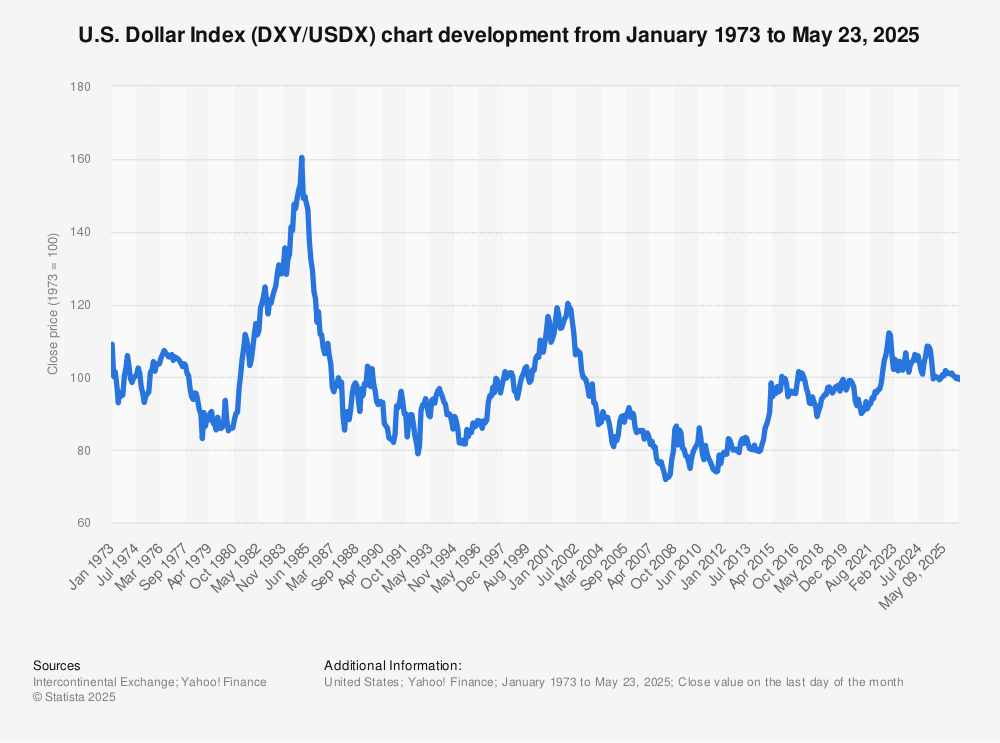

Created in 1973 by the US Federal Reserve after the Bretton Woods system ended, the DXY started with a base value of 100. When the euro launched in 1999, it replaced older European currencies in the basket.

The index uses a weighted average—like a recipe where the euro is the main ingredient—to reflect the dollar’s strength.

Myth: You can trade the DXY like a stock. Reality: It’s an index, but you can trade its movements via futures, ETFs (like the Invesco DB US Dollar Index Bullish Fund), or CFDs on platforms like VT Markets. Understanding this distinction helps beginners avoid confusion and start using the DXY effectively.

The DXY is a global benchmark because the US dollar is the world’s primary reserve currency. Its movements ripple across forex, commodities, and equities, making it a must-watch for traders.

A rising DXY signals a stronger dollar, often tied to risk-off sentiment when investors flock to the safe-haven dollar during uncertainty. A falling DXY suggests risk-on sentiment, favouring stocks or emerging markets.

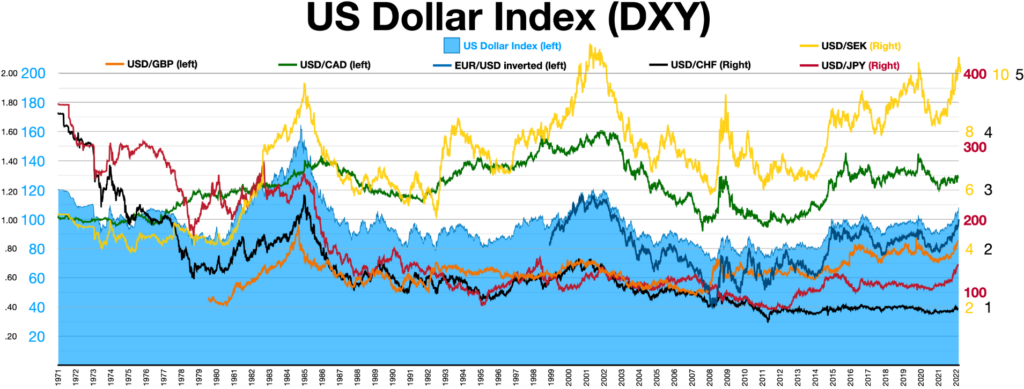

In forex, a stronger DXY weakens pairs like EUR/USD or GBP/USD (negative correlation) but strengthens USD/JPY.

For commodities, a rising DXY often lowers gold or oil prices, as they are priced in dollars. Beyond trading, a weaker DXY can boost emerging markets like India or Brazil by strengthening their currencies, making exports cheaper and attracting investors.

For example, in August 2022, the DXY surged to 108.4 after strong US jobs data signalled economic resilience. This pushed EUR/USD from 1.02 to 0.99 in days, allowing traders to profit by selling the pair.

By tracking the DXY, even beginners can anticipate such moves and make informed decisions across markets.

The DXY is a versatile tool for non-professional traders. Here’s how to use it, with practical strategies and examples:

The DXY helps confirm forex pair movements. A rising DXY suggests buying USD-based pairs like USD/JPY or USD/CAD and selling pairs like EUR/USD. In May 2025, the DXY rebounded from 98.90 support after a US court ruling blocked Trump’s tariffs, boosting dollar sentiment. Traders who bought USD/CAD saw a 1.2% gain in two days, capitalising on the DXY’s strength.

Key DXY levels signal potential reversals or breakouts. In September 2022, the DXY hit resistance at 114.8, leading to a pullback. Traders shorted EUR/USD at 0.98, profiting as it fell to 0.95. In May 2025, the 98.00–100.00 range was critical. If the DXY approaches 100.60 resistance, consider selling EUR/USD, expecting a pullback.

Use DXY futures or CFDs to hedge dollar-sensitive assets. If holding gold, which drops when the DXY rises, a DXY CFD can offset losses.

Trade DXY CFDs via VT Markets’ MetaTrader 4/5. For example, buy a DXY CFD at 99.50, targeting 100.50, with a stop-loss at 99.00 for risk management.

Risk management is crucial. Always use stop-loss orders (e.g., 1% below entry for USD/JPY trades). Practice on VT Markets’ demo account to test DXY strategies risk-free, view live DXY charts and simulate trades in a demo environment.

Several factors drive DXY movements, helping traders anticipate volatility:

For example, in May 2025, Moody’s downgraded the US credit rating, pushing the DXY to 98.70 as fiscal concerns grew, affecting USD-based pairs. Similarly, in April 2025, the European Central Bank’s surprise rate cut weakened the euro, lifting the DXY by 1.5% due to the euro’s 57.6% weighting. Use VT Markets’ economic calendar to stay ahead of such events.

The US Dollar Index (DXY) is your window into the US dollar’s strength, guiding trades in forex, commodities, and beyond. Whether you are spotting trends, hedging, or trading CFDs, the DXY empowers beginners to make smarter decisions.

With real-world examples like the May 2025 tariff ruling or August 2022’s surge, you can see its impact in action. Start tracking the DXY on VT Markets platform or practice in a demo account to build confidence.

Ready to leverage the DXY in your trading? Open a live account with VT Markets today to access MetaTrader 4/5 and trade with confidence. Explore our educational resources to keep learning! With the DXY in your toolkit, you are set to navigate global markets like a pro.