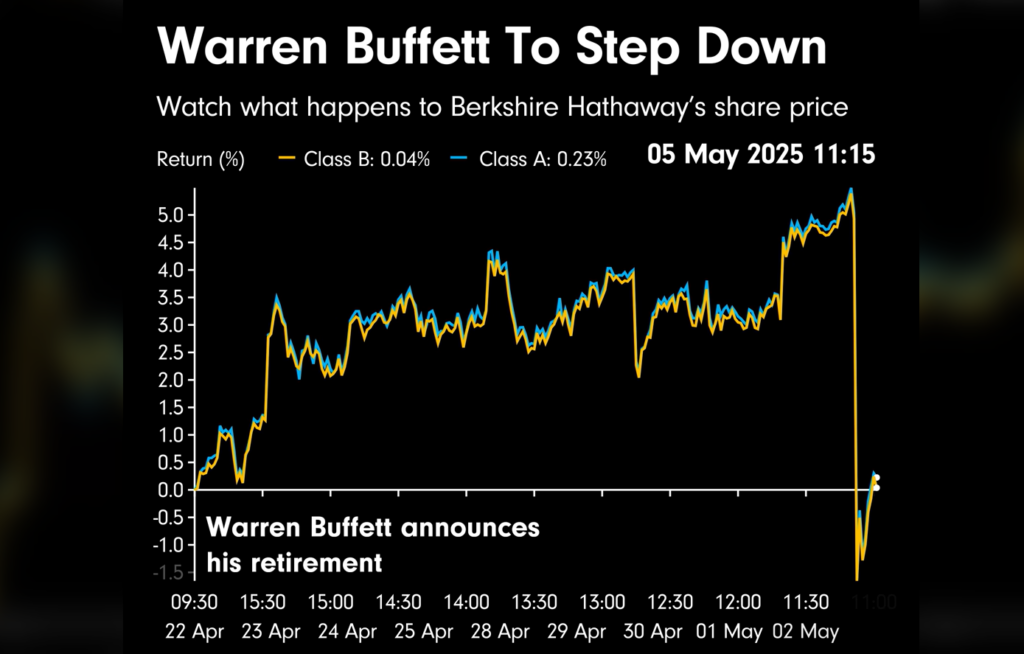

Warren Buffett, the legendary investor known as the “Oracle of Omaha,” has announced his retirement as CEO of Berkshire Hathaway at the end of 2025. This marks the end of an era for a man who transformed the investment world with his disciplined, principled approach.

For traders, Buffett’s strategies offer more than just inspiration—they provide a roadmap for success in volatile markets. In this article, we explore Buffett’s profound impact on the trading industry and share four practical lessons you can apply to your trading journey.

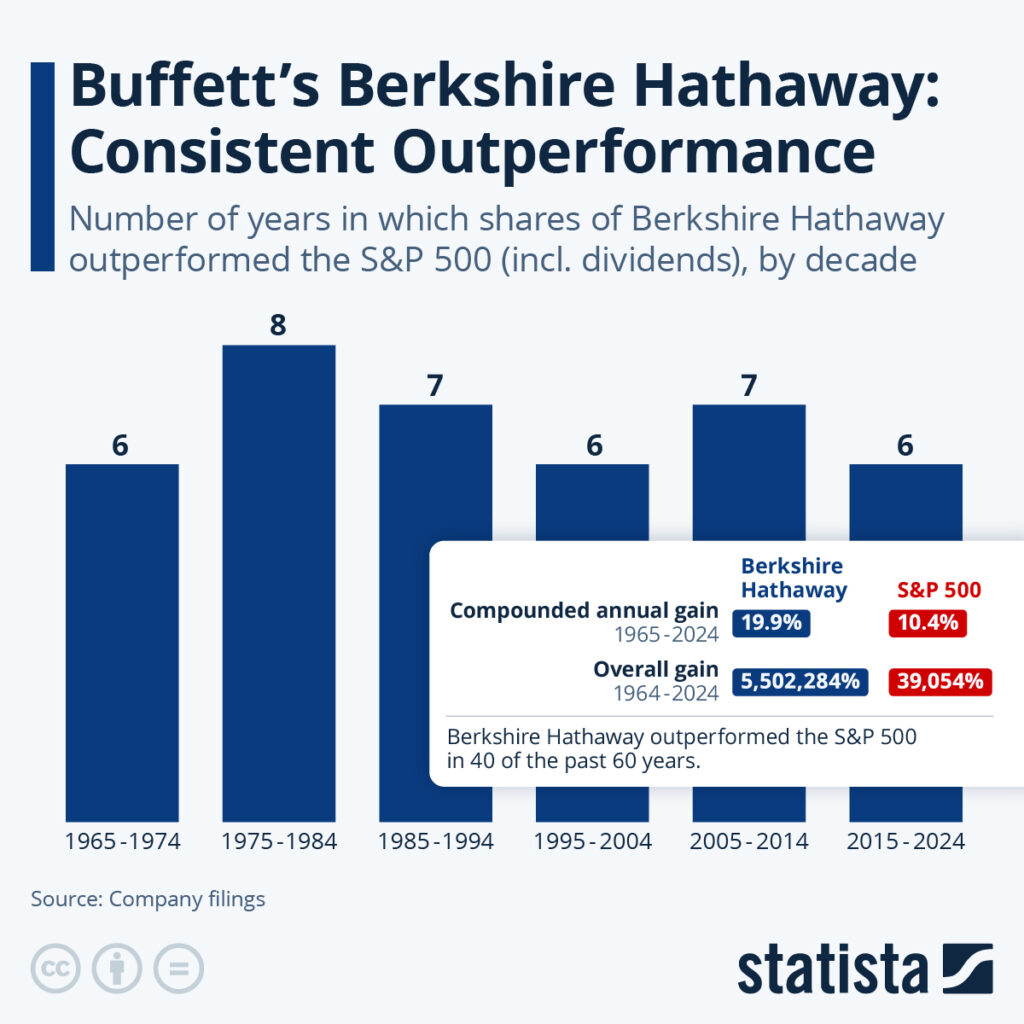

Warren Buffett’s rise from a precocious young investor to the mastermind behind Berkshire Hathaway, a USD 1 trillion conglomerate, is a remarkable tale of vision and discipline.

As a teenager in Omaha, Nebraska, he bought his first stock at age 11, sparking a lifelong passion for value investing—snapping up undervalued assets with strong fundamentals.

In the 1960s, Buffett began acquiring shares in Berkshire Hathaway, then a struggling textile firm, and transformed it into a powerhouse holding companies like Geico and See’s Candies.

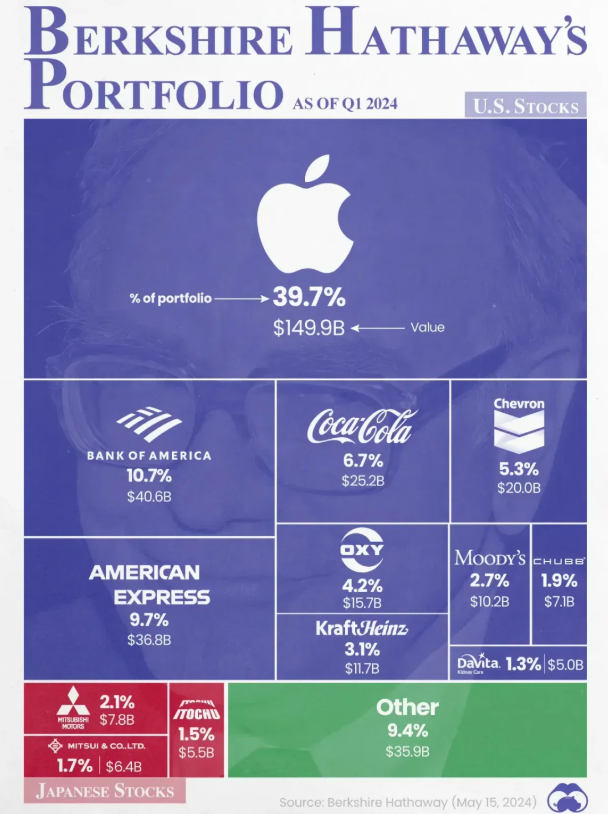

His knack for spotting quality businesses, like his decades-long investments in Coca-Cola and American Express, redefined trading by proving that patience could trump speculative frenzy.

Buffett’s influence surpasses his wealth. His witty Berkshire annual shareholder letters demystify markets, inspiring retail traders worldwide. By simplifying complex strategies, he made investing accessible.

In today’s volatile markets, his 2025 retirement underscores his timeless principles, countering quick-profit allure. His legacy is a mindset for sustainable growth. Let’s explore four lessons to build wealth confidently.

Lesson 1: Invest in what you understand

Buffett famously avoids investments he doesn’t fully grasp, a principle that kept him cautious during the dot-com bubble. He once said, “Risk comes from not knowing what you’re doing.” This wisdom is vital for traders.

Before diving into an asset, whether it’s a stock or a currency pair, ensure you understand its value and potential. For example, if you’re familiar with consumer goods, focus on companies like Unilever rather than complex derivatives.

Practical tip: Ask yourself, “Can I explain this asset’s value in simple terms?” If the answer is no, pause and research further. Platforms like VT Markets offer research tools to help you analyse companies and markets, ensuring you trade with confidence and clarity.

Lesson 2: Patience pays off

Buffett’s wealth is built on patience. His investment in Coca-Cola, held since 1988, exemplifies his long-term approach.

While markets tempt traders with quick wins, Buffett teaches that true success comes from holding quality assets over years, not days. For traders, this means resisting the urge to chase short-term trends driven by social media hype.

Practical tip: Set a 3–5-year horizon for your trades and ignore daily market noise. Think of trading like planting a tree: the real growth happens over time. Use charting tools on VT Markets to identify assets with steady growth potential, and let patience work its magic.

Lesson 3: Don’t fear market dips

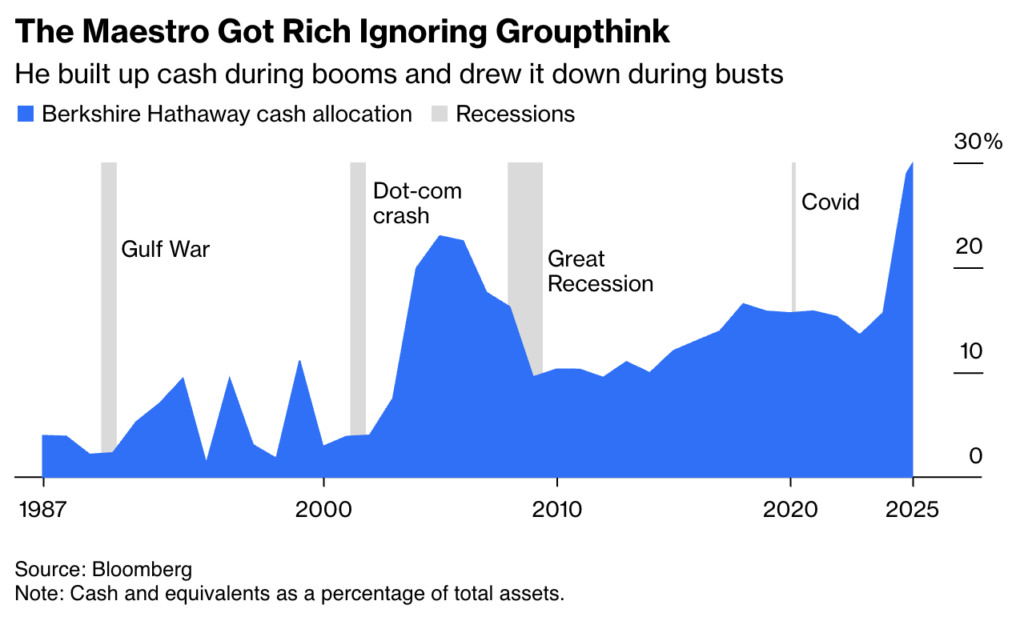

Buffett sees market downturns as opportunities, famously advising to “be greedy when others are fearful.” When quality assets drop in price due to market panic, he buys at a discount.

This mindset is a game-changer for traders. Instead of selling in fear during a dip, view volatility as a chance to acquire strong companies or currencies at bargain prices.

Practical tip: Keep a watchlist of fundamentally strong assets and act when prices fall unjustifiably. VT Markets’ platform allows you to monitor price movements and set alerts, so you are ready to seize opportunities when markets dip.

Lesson 4: Discipline over emotion

Buffett’s disciplined approach sets him apart. He avoids impulsive decisions driven by fear or greed, sticking to a clear strategy.

For traders, this means creating a trading plan with defined entry and exit points and following it, even when emotions run high. Discipline ensures you don’t overtrade or panic-sell during turbulent markets.

Practical tip: Use stop-loss orders to limit losses and allocate only what you can afford to lose. A disciplined trader is a successful trader. VT Markets’ user-friendly interface helps you set trading parameters, keeping emotions in check and your strategy on track.

Today’s trading landscape is vastly different from Buffett’s early days. Algorithmic trading, cryptocurrencies, and social media-driven trends like meme stocks dominate headlines. Yet, Buffett’s principles remain a beacon of clarity.

Understanding assets helps you navigate hyped markets, such as crypto, with caution. Patience counters the fear of missing out (FOMO) that drives impulsive trades. Discipline mitigates risks in volatile conditions, ensuring you stay focused on long-term goals.

Modern tools enhance Buffett’s timeless wisdom. Platforms like VT Markets equip you with research features, charting tools, and real-time data to apply his lessons effectively.

For example, a trader inspired by Buffett might use VT Markets to analyse a company’s fundamentals, wait for a market dip, and execute a disciplined trade with a long-term view.

By blending Buffett’s principles with today’s technology, you can build a robust trading strategy. With the right platform and mindset, you are ready to put Buffett’s wisdom into practice.

Warren Buffett’s retirement marks the end of an extraordinary chapter, but his legacy as the “Oracle of Omaha” endures. His disciplined, principled approach to investing has shaped the trading industry, proving that anyone can succeed with the right mindset.

By investing in what you understand, practising patience, embracing market dips, and staying disciplined, you can navigate markets with confidence. These lessons, distilled from decades of success, are accessible to traders, whether you are starting with a small account or aiming to grow your portfolio.

Start applying these lessons today with VT Markets’ user-friendly platform, and build a trading strategy that stands the test of time. Open a live account now to take your first step towards disciplined, Buffett-inspired trading.

As Buffett himself said, “The stock market is a device for transferring money from the impatient to the patient.” Embrace his wisdom, and let patience and discipline guide your trading journey.