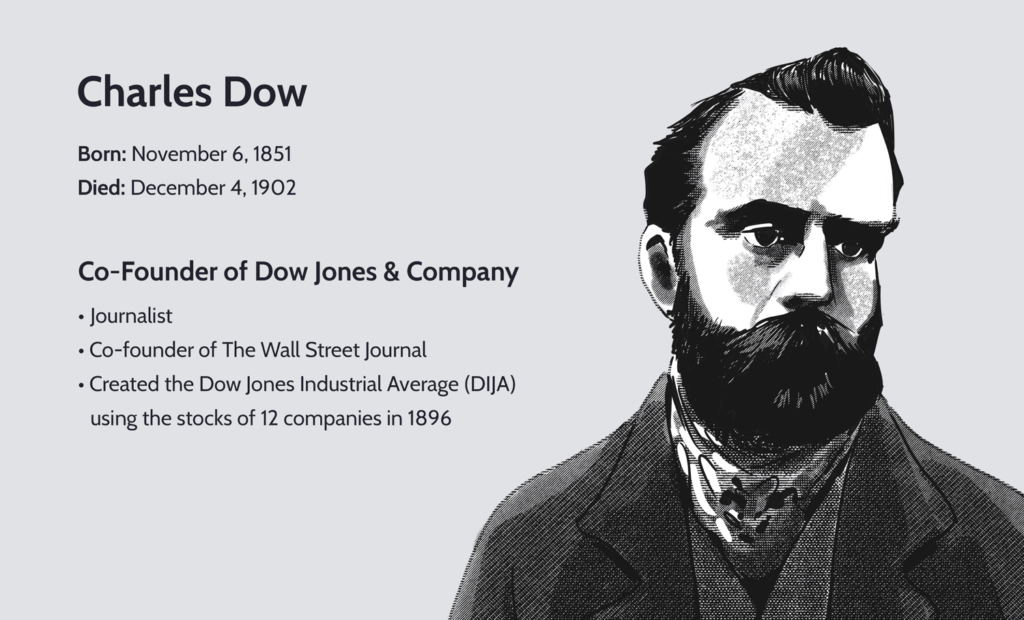

Transport yourself back to the remarkable year of 1896, a time characterised by industrial revolution and transformative economic changes. Amid the bustling streets of New York City, the brilliant mind of Charles Dow sparked an idea that would send ripples through the financial world.

With a mere selection of 12 carefully chosen companies, he crafted what we know today as the Dow Jones Industrial Average (DJIA) – a beacon of brilliance among stock indices.

Fast-forward to the present day, and these luminous indicators continue to captivate investors and economists alike. They offer a unique glimpse into a country’s economic performance, providing invaluable insights into the ever-changing global financial landscape.

If you’re interested in understanding how indices trading works, what these indices represent, and how to analyse their price movements, continue reading to explore our detailed guide.

Indices are numerical representations of the top-performing shares from a particular stock exchange. They provide a snapshot of the exchange’s major players by averaging individual stock movements, consolidating a vast amount of financial activity into a single figure.

Some of the largest indices in the world are:

Stock indices can be calculated using two distinct approaches: one involves considering the performance of the largest companies, known as a market capitalisation-weighted average. This method is employed for indices like the S&P 500, FTSE, and ASX, where the movements of high-value companies carry greater influence over the overall index.

While the majority of stock indices adopt this approach, there are exceptions, and some indices are calculated using a price-weighted average. The Dow Jones and Nikkei are prime examples of indices using this method, where shares with higher prices wield more significant sway.

Since indices represent the overall stock value of multiple top-performing companies or high-value stocks, they tend to be more volatile compared to individual company stocks, providing both trading opportunities and increased risk for traders.

Since indices are just numbers representing the performance of a group of shares on an exchange, they cannot be directly bought or sold.

Instead, traders need to choose products that mirror their performance, such as:

These products track the underlying index’s price, allowing traders to speculate on whether the index’s price will rise or fall and take positions accordingly.

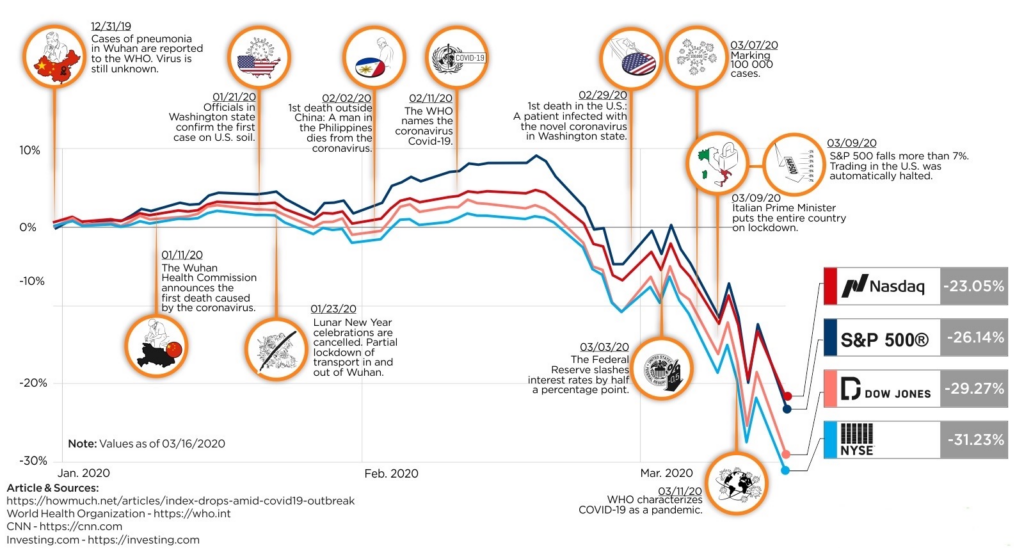

Various factors can cause index prices to rise or fall, and understanding these factors is essential for trading indices effectively. These factors include:

When trading stock indices, thorough research, a good understanding of the chosen product, and proper risk management strategies are crucial. Index CFDs are among the most popular trading products. They allow traders to profit from both rising and falling index prices by predicting the price direction accurately.

Traders can approach index CFDs in two ways: going long or going short. Going long involves buying index trading products when expecting the price to rise, while going short involves selling or closing positions when expecting a price decline. Profit or loss depends on the accuracy of the prediction and the market’s overall movement.

CFD trading involves leverage, allowing traders to open positions with a small initial deposit (margin) that represents a percentage of the total asset value. While leverage provides exposure to larger markets with less capital, it also carries the risk of incurring losses greater than the initial deposit. Traders should choose suitable strategies for their portfolios when trading CFDs.

To begin trading indices in live markets, follow these steps:

In conclusion, trading stock indices offers a window into the performance of major companies and economies worldwide. Understanding the factors influencing index prices and utilising products like index CFDs can provide traders with both opportunities and risks.

With proper research, risk management, and the support of a reliable broker like VT Markets, traders can confidently navigate the exciting world of index trading, diversify their portfolios, and hedge against market fluctuations. Happy trading!