Imagine this scenario: The stock market is experiencing wild fluctuations, cryptocurrencies are in a rollercoaster ride of ups and downs, and investors are feeling a sense of unease.

However, in the midst of this turbulence, bondholders remain unfazed, enjoying the steady and predictable returns from their bond investments.

Just like a lighthouse guiding ships to safety during a dark and stormy night, bonds can act as a reliable guiding light for investors seeking a secure harbour for their hard-earned money.

Bonds represent one of the most favoured financial assets, but if you haven’t explored their nature and functionality, you might be deterred by their reputation for complexity and limited returns.

In reality, bonds are extensively traded assets that can fortify your portfolio’s risk-return profile and provide diversification without subjecting you to excessive volatility. Although they may offer lower returns, they come with reduced risk, making them a secure option for investors. Additionally, their inverse correlation to interest rates presents lucrative opportunities for trading bond CFDs.

This article aims to provide a comprehensive breakdown of bonds, their various types available for trading, and how you can effectively integrate them into your investment portfolio to diversify beyond traditional stocks.

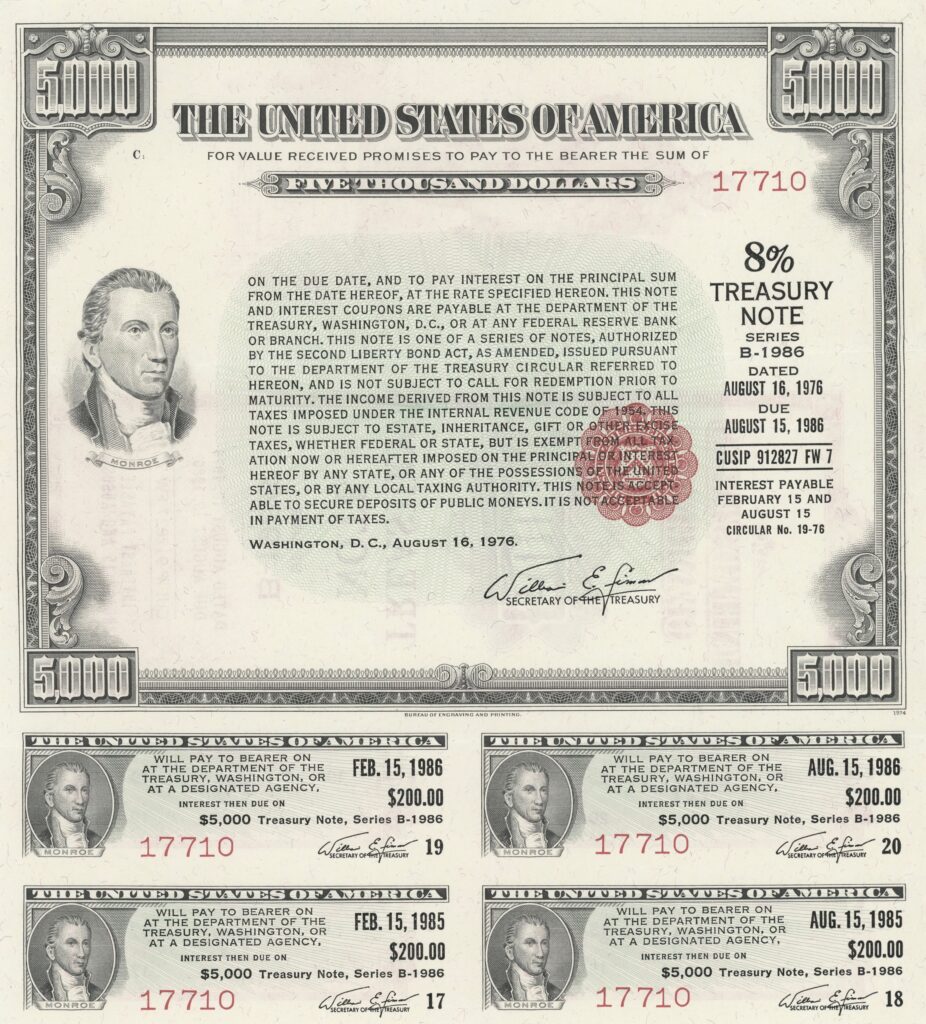

Bonds can be best described as a type of debt instrument. While individuals typically approach banks or credit unions for loans, companies and governments raise capital by seeking investors, who then become bondholders within the organisation.

These bondholders receive interest on the asset, known as a coupon rate, until the bond reaches its maturity date, at which point the initial loan amount (referred to as the principal) is repaid.

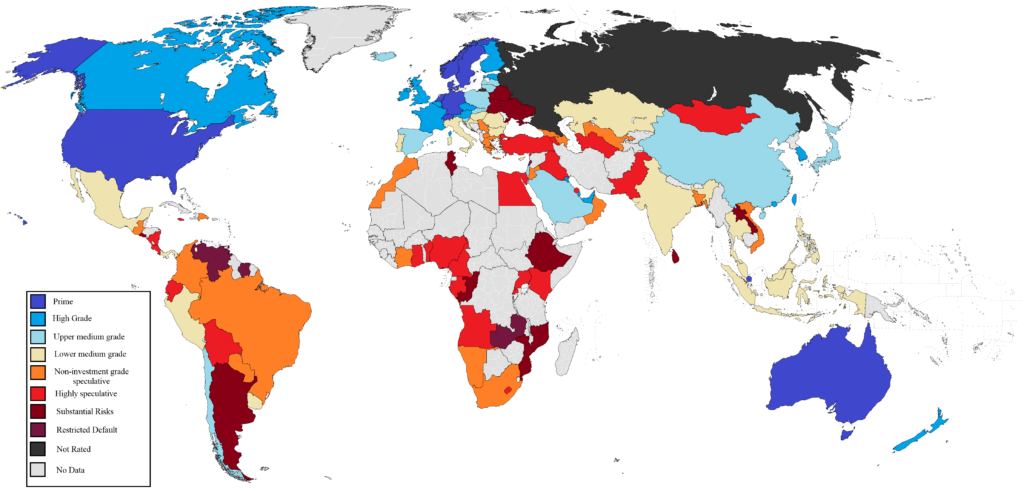

Bonds are generally considered less risky than other highly volatile assets, but they still carry certain risks related to interest rates, credit quality, defaults, and prepayments. Various types of bonds exist, issued by different organisations, companies, or institutions, and all are rated based on their investment grade.

Bonds come in two categories: secured and unsecured.

A secured bond provides protection to the bondholder by using assets as collateral, reducing the risk of issuer default. Mortgage-backed securities are an example of secured bonds.

On the other hand, unsecured bonds, also known as debentures, lack collateral and are considered riskier assets since both the interest payments and principal amount are guaranteed solely by the issuing company or organisation.

There are four main kinds of bonds:

Government bonds

Some government-issued bonds are unsecured, but they are still considered among the lowest-risk investments, particularly when coming from stable governments with a solid track record of no bond defaults. In the US, they are known as Treasuries, while in the UK, they are called gilts.

Government bonds can be issued with fixed interest rates or variable coupon payments tied to inflation. In the UK, inflation-linked bonds are referred to as index-linked gilts, while in the US, they are known as Treasury Inflation-Protected Securities or TIPS.

Corporate bonds

As the name suggests, corporate bonds are issued by corporations to raise funding. The risk level associated with these bonds depends on the size and established nature of the company.

Corporate bonds are generally riskier than government bonds, but bondholders receive more protection from loss compared to ordinary shareholders. In the event of company bankruptcy, liquidated assets are used to pay bondholders ahead of shareholders, a concept known as a liquidation preference. Corporate bonds may be secured and are rated by agencies such as Standard & Poor’s, Moody’s, and Fitch Ratings, which assess their overall investment grade.

Municipal bonds

Similar to government bonds, municipal bonds (munis) are issued by municipalities, councils, cities, and other local governments. They often come with lower interest rates and are considered less risky than some other bond types.

Municipal bonds may also appeal to investors because they are not subject to taxation in the US.

Agency bonds

Agency bonds are securities issued by government-backed enterprises or federal government departments other than the US Treasury. Mainly prevalent in the US, they can be backed by the US government, as is the case with government department-issued bonds, or not, as with those issued by government-sponsored enterprises (GSEs).

The Fannie Mae National Mortgage Association and the Freddie Mac Federal Home Loan Mortgage bonds are examples of GSE bonds.

Bonds are straightforward debt instruments that facilitate the process of lending money, known as the principal or face value, from a bondholder to a public or private institution, known as the issuer.

The issuer then repays this amount on an annual, semi-annual, or monthly basis, as specified in the bond’s terms. Upon reaching maturity, which is the bond’s expiration date, the principal is returned to the bondholder.

Being negotiable securities, bonds can be bought and sold in a secondary market, much like stocks. However, it’s essential to note that stocks and bonds function differently. While some bonds are listed on the stock exchange, the majority of bond trading occurs through Over-the-Counter (OTC) products like Contracts for Differences (CFDs), traded through brokers.

Interest rates play a significant role in determining bond prices. Generally, when interest rates rise, the demand for bonds decreases as investors seek better rates elsewhere. Conversely, when interest rates decrease, the demand for bonds rises, resulting in an increase in their prices.

Bonds possess distinct features that differentiate them from other assets and debt instruments. These include maturation and duration, credit rating, face value and issue price, and coupon rates and dates.

The prices of bonds are influenced by several key factors, including demand and supply dynamics, inflation rates, the credit rating of the bonds, and their proximity to maturity.

As we have discussed, there exists an inverse relationship between bonds and interest rates. When bond prices rise, interest rates decline, and vice versa. Consequently, the demand for bonds is contingent on prevailing interest rates, attracting investors with low interest rates or enticing them with better opportunities during higher interest rate periods. If interest rates become overly high, issuers might reduce the supply of bonds to align with demand.

Credit ratings serve as a robust indicator of a bond’s overall risk, with cheaper bonds generally carrying higher risks of default. Traders must decide how to manage this risk, and credit rating agencies offer valuable guidance in identifying bonds that represent sound investments.

As a bond matures, its price naturally gravitates back to its face value, reaching its initial loan amount. Additionally, the number of coupon payments yet to be made influences the bond’s price.

To start trading bonds, follow these steps:

In conclusion, understanding bonds and their trading process offers a stable investment option with predictable returns. Diversifying portfolios with various bond types strengthens risk-return profiles. With knowledge of bond characteristics, credit ratings, and influencing factors, we can navigate the financial world confidently. So, let’s set sail on this rewarding journey with bonds as our guiding light!