Have you ever wondered why a jobs report from the US can send the dollar soaring—or why a speech from the Bank of England governor might shake up the pound? If you are new to trading, these questions might feel like a mystery.

But here’s the good news: the markets aren’t as random as they seem. Behind every price wiggle, there is an economic story waiting to be understood.

In this guide, we’ll unpack the key economic drivers that move markets, show you how to spot them, and share practical tips to turn news into profits—all without needing a degree in economics. Ready to connect the dots? Let’s dive in.

At its core, trading is about supply and demand. When more people want to buy a currency, stock, or commodity, its price rises—and vice versa.

But what sparks that demand? Economic drivers are the answer. Think of them as the engines powering the markets. Here are three of the biggest ones every beginner should know:

1. Interest rates: The currency magnet

Imagine you are choosing between two savings accounts. One offers 1% interest, the other 3%. You’d pick the higher rate, right? Countries work the same way.

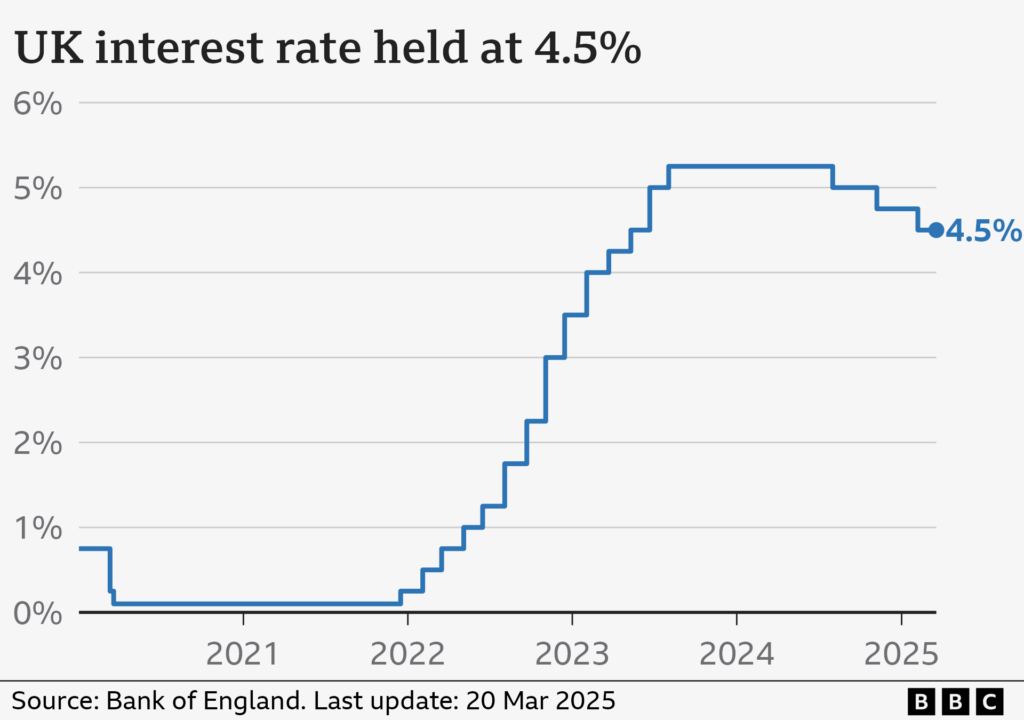

When a central bank—like the Bank of England or the Federal Reserve—raises interest rates, it’s like offering a better deal to investors. More people buy that country’s currency to park their money there, pushing its value up.

For example, if UK rates rise, the pound (GBP) often strengthens against the dollar (USD). Lower rates? The opposite happens—money flows out, and the currency weakens.

2. Inflation: The price of everything

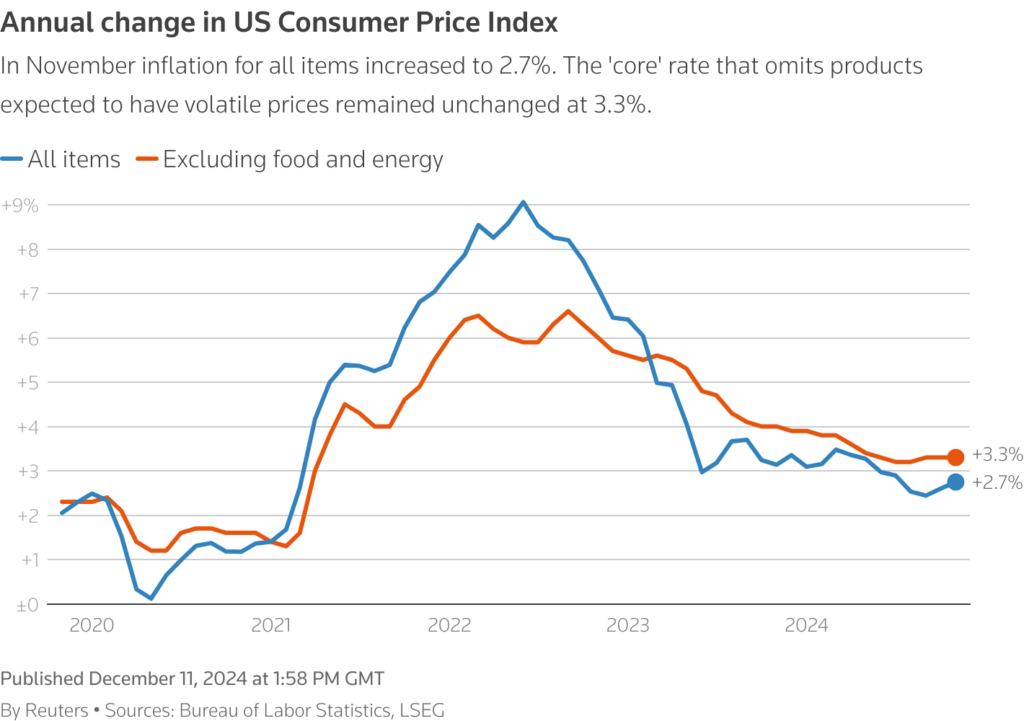

Inflation measures how fast prices for everyday things—like bread or petrol—are rising. Low inflation is a sign of a healthy economy, which can boost a currency’s value.

But if inflation spikes too high (say, 5% or more), it’s like a warning light. People worry the central bank will hike rates to cool things down, which can make markets jittery.

For traders, inflation reports—like the US Consumer Price Index (CPI)—are goldmines for predicting price swings.

3. Employment data: The jobs engine

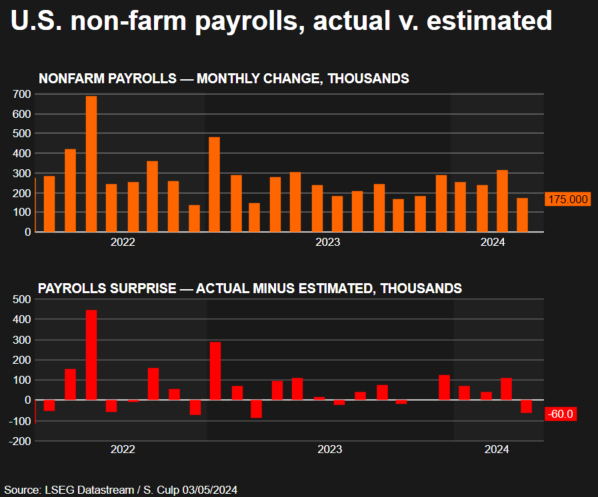

Jobs matter—a lot. When a country’s employment numbers are strong (think low unemployment or a big jump in new jobs), it signals a thriving economy. More workers mean more spending, which lifts confidence in that currency.

Take the US Non-Farm Payrolls report: if it beats expectations, the dollar often surges. Weak numbers? Traders might sell off, sending prices tumbling. It’s a simple equation with big market impact.

These aren’t the only drivers—think GDP growth or trade balances—but they are the headliners. The trick is knowing when they are coming and how to act.

So, how do you use this as a trader? You don’t need to watch the news 24/7 or decode complex reports. Start small and smart with these steps:

The key is preparation. Markets move fast when news breaks, so having a plan beats guessing every time.

Let’s see this in action with a real-world example. Meet Kim, a beginner trader with USD 500 in her VT Markets account, and Dave, who is winging it.

It’s March 2025, and the Bank of England is set to announce its latest interest rate decision. Kim checks VT Markets’ economic calendar and sees analysts expect a 0.25% hike. She knows higher rates often lift the pound, so she watches GBP/USD, currently at 1.3000.

When the hike is confirmed, the pair jumps to 1.3050. Kim buys at 1.3010 with a 0.1 lot (a small, beginner-friendly size), risking USD 10 with a stop-loss. Within hours, it hits 1.3060—Kim closes her trade, pocketing USD 25 after spreads. Not bad for a day’s work!

Dave, meanwhile, has no clue. He is randomly trading EUR/USD, oblivious to the UK news. When GBP/USD spikes, he’s caught off-guard as EUR/USD dips (the dollar strengthens too). Dave loses USD 30 before he even knows why.

The difference? Kim used an economic driver; Dave didn’t.

This isn’t fiction—it happens every month. In February 2025, a surprise US jobs report added 300,000 jobs, sending USD/JPY up 100 pips in a day. Traders who knew were ready; those who didn’t got burned.

Economic drivers might sound big, but they are your key to smarter trading. Start with one, like interest rates, and grow from there. These events are predictable, unlike market noise.

VT Markets’ tools—economic calendar, real-time news, and charts—keep you informed, while a demo account offers risk-free practice. Ready for more? Open a live account with VT Markets to turn news into profits with the same great tools.

So, next time an interest rate decision or jobs report hits, don’t just nod. Check the calendar, pick a pair, and act. The markets are talking—will you listen?