Want to trade smarter in 2025? Economic calendars are your secret weapon. These tools flag market-moving events—like Federal Reserve rate calls or US jobs data—that can spark big price swings.

VT Markets’ economic calendar makes it easy for beginners to stay ahead, no economics degree needed. With US-China trade talks and central bank moves driving volatility, now’s the time to learn. Think of it as your trading GPS for 2025’s wild markets.

This guide covers what economic calendars are, how to use VT Markets’ tool, smart trading strategies, and pitfalls to dodge. Let’s dive in!

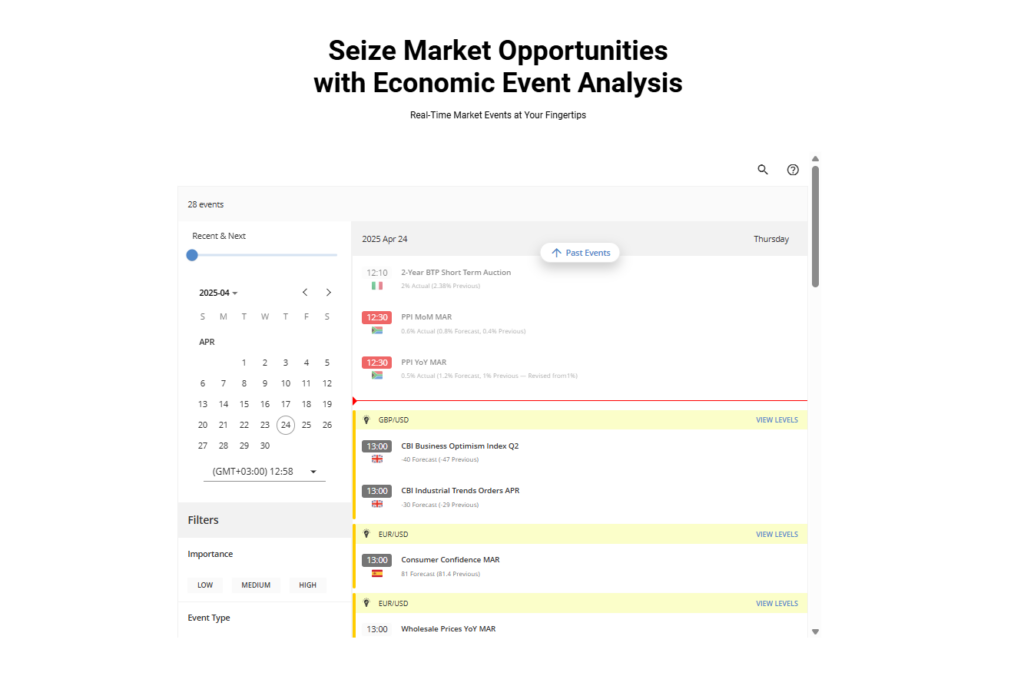

An economic calendar is a schedule of events that shake financial markets, such as interest rate decisions, inflation reports, and employment figures. Each entry lists the event’s name, date, time, affected currency, and impact level—high, medium, or low. For example, a US non-farm payrolls report, marked high-impact, can jolt USD pairs like USD/JPY.

In 2025, calendars are essential. US-China trade tensions, with tariff talks sparking currency swings, demand attention. Central banks, like the Federal Reserve and Bank of England, are tackling inflation, with recent US policy debates adding fuel. Emerging markets, like Australia’s AUD, tie to China’s moves.

Economic calendar keeps you prepared. For instance, a trader spotting a high-impact US CPI release might brace for USD/JPY volatility, planning trades to avoid rash decisions.

Accessing a reliable economic calendar is easy with VT Markets. Our free calendar, on the VT Markets website and mobile app, offers real-time updates and custom alerts. The tool excels with its simple, beginner-friendly filters, helping you focus on key events.

Interpreting it is simple. Each event lists the name (e.g., “US Federal Reserve Interest Rate Decision”), date, time, currency, and impact level. High-impact events, like Federal Reserve decisions, drive big moves; medium-impact ones, like UK retail sales, are milder; low-impact events, like regional surveys, barely shift markets. Expected versus actual data triggers reactions—a stronger US jobs report might lift USD/JPY.

To use VT Markets’ calendar, filter for high-impact events or currencies (e.g., USD for USD/JPY trades). Set alerts for 2025 events, like the US Federal Reserve’s 10 June rate decision. Check time zones—US releases at 8:30 AM EST are 1:30 PM GMT. A trader might filter for USD events, planning a USD/JPY trade.

Using VT Markets’ economic calendar to trade in 2025 is about preparation and discipline. Here’s how to get started:

Consider this example: A trader checks VT Markets’ calendar and sees a US non-farm payrolls release on 7 March 2025. Expecting strong data, they buy USD 1,000 of USD/JPY at 150.00, setting a 10-pip stop-loss. The pair rises to 150.20 (20 pips) after a robust report, earning USD 13, while the stop-loss caps risk at USD 6.50.

This disciplined approach, guided by VT Markets’ calendar, turns news into opportunity. In 2025, events like Federal Reserve rate decisions or US tariff updates will offer similar chances to profit.

While VT Markets’ economic calendar is a powerful tool, beginners can trip up if they are not careful. Here are common mistakes and how to avoid them:

For example, a trader ignores VT Markets’ impact filter and trades AUD/USD during a low-impact Australian report, losing USD 50 on small moves. By refocusing on high-impact US data, they avoid unnecessary losses. In 2025, with volatility expected from US policy shifts and trade tensions, these precautions are critical.

In 2025, VT Markets’ economic calendar is your key to navigating the trading world with confidence. By helping you anticipate market-moving events, plan strategic trades, and manage risks, it levels the playing field for beginners.

With global markets buzzing from Federal Reserve decisions, US-China trade talks, and Bank of England policies, there’s no better time to start. Begin by exploring VT Markets’ calendar on our platform or app, filtering for high-impact events like the next US jobs report. Practice on a demo account to build skills, then take the leap.

Ready to trade 2025’s biggest market events? Open a live account with VT Markets to access our powerful economic calendar and start trading with confidence. Your journey to smarter trading begins now—let VT Markets guide you every step of the way.