To be short, the answer is “currencies”.

When we want to talk about different types of currencies, we use three-letter symbols to represent them. The first two letters in the symbol tell us which country the currency comes from, and the third letter tells us the name of the currency. For example, USD stands for United States Dollar. These codes are called ISO 4217 Currency Codes.

The most actively traded currencies are the US Dollar (USD), Euro (EUR), Japanese Yen (JPY), British Pound (GBP), Australian Dollar (AUD), Swiss Franc (CHF), Canadian Dollar (CAD), and New Zealand Dollar (NZD). These currencies are often referred to as the “majors” and are traded in high volumes due to their liquidity and stability.

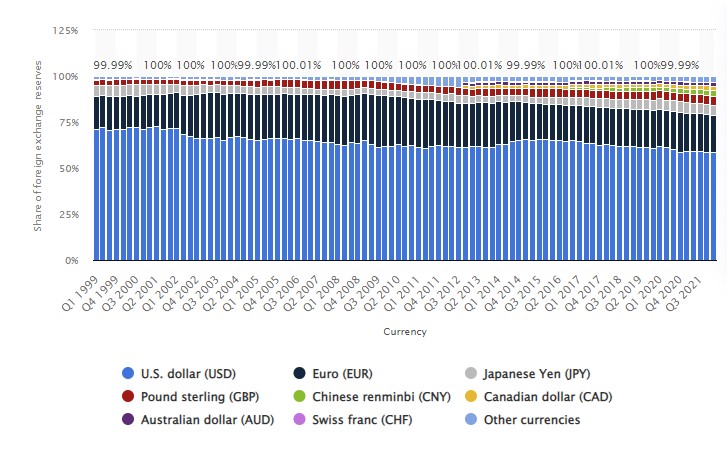

The US Dollar plays a central role in the Forex market, with over 50% of the trades involving it.

The US Dollar is crucial in the global economy for several reasons. Firstly, it has the largest economy and most liquid financial markets globally, making it a powerhouse for international trade. Secondly, it is the primary global reserve currency and is used in half of all international loans and bonds and in cross-border transactions, including petrodollars. Lastly, the US’s stable political system and sole military superpower status make it a safe haven for investors.

It is important to understand that currencies are always traded in pairs. A currency pair is the exchange rate between two different currencies. For example, the EUR/USD currency pair represents the exchange rate between the Euro and the US Dollar.

There are three main categories of currency pairs: the “majors”, the “crosses”, and the “exotics”. The popularity of currency pairs can vary depending on market conditions, so it’s important for traders to stay informed about which pairs are currently in demand.

While there are eight major currencies, only seven major currency pairs exist. That is because US Dollar must always be present in the pair. This currency group involve EUR/USD, USD/JPY, GBP/USD, USD/CHF, USD/CAD, AUD/USD, and NZD/USD. The last three pairs are also called commodity currency pairs. The “majors” are usually the easiest for beginners to trade.

The “crosses” are currency pairs that do not involve the US Dollar. Cross-currency pairs consist of two major currencies: the Euro and the Japanese Yen (EUR/JPY) or the British Pound and the Japanese Yen (GBP/JPY). Crosses are typically less liquid than the majors, but they can still provide opportunities for profitable trades.

The “exotics” are currency pairs that involve a major currency paired with a currency from an emerging or developing country. Exotic currency pairs are considered more volatile and less liquid than the majors and crosses. Examples of exotic pairs include the USD/MXN (US Dollar/Mexican Peso) and the USD/ZAR (US Dollar/South African Rand).

Understanding currency pairs is crucial for forex trading because buying one currency means simultaneously selling another. For example, if you buy the EUR/USD currency pair, you are essentially buying Euros and selling US Dollars. Trading currency pairs allows traders to speculate on the exchange rate between two currencies and potentially profit from the difference in price.

Forex speculation is the practice of buying and selling currency pairs in order to profit from the fluctuations in their exchange rates. Speculators aim to buy currencies when they are undervalued and sell them when they are overvalued, making a profit on the difference in the exchange rate.

Exchange rates are the values at which one currency can be exchanged for another. These rates are determined by the supply and demand of each currency in the market. When demand for a currency is high, its value increases, and when demand is low, its value decreases. Exchange rates are expressed as a ratio, such as 1.20 EUR/USD, which means that one euro is worth 1.20 US dollars.

There are several factors that can affect exchange rates, including:

Economic Factors: The state of a country’s economy can have a significant impact on its currency’s value. Factors such as inflation, interest rates, and economic growth can all affect exchange rates.

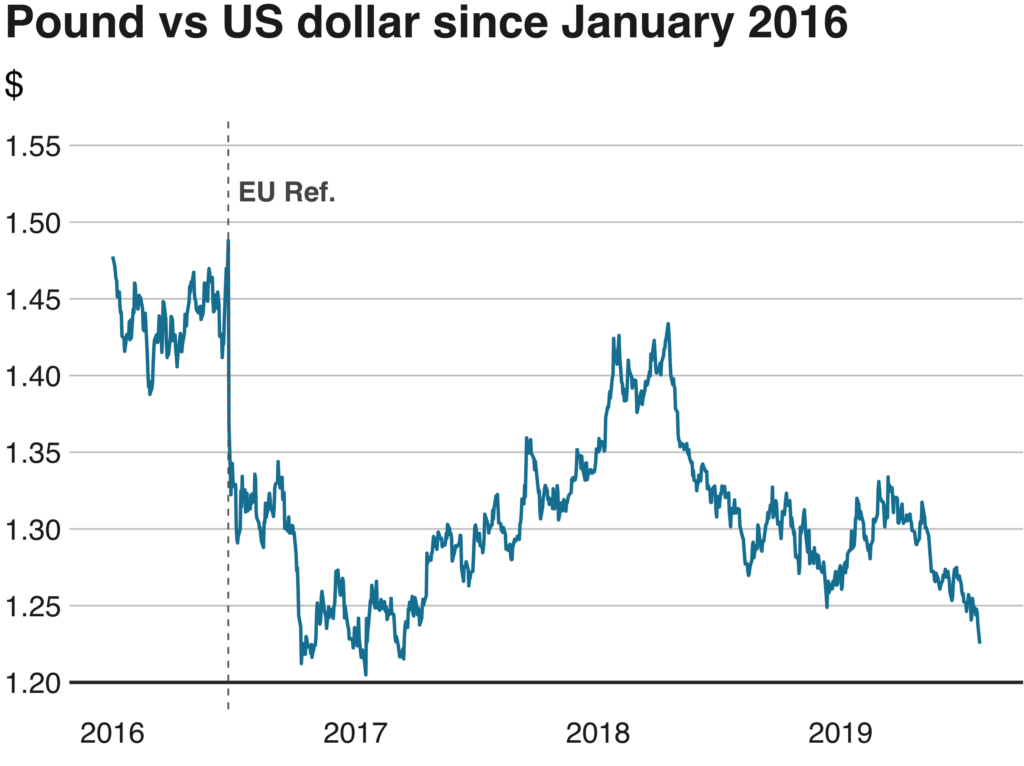

Political Factors: Political stability and government policies can also affect exchange rates. For example, a country with a stable government and sound economic policies may have a stronger currency than a country with political turmoil and uncertain economic policies.

Market Sentiment: The mood of the market can also influence exchange rates. If traders are optimistic about a currency’s prospects, its value may increase, while pessimistic sentiment can lead to a decline in value.

Brexit is a prime example of how political events impact a nation’s currency exchange rate. The UK’s decision to leave the EU in 2016 resulted in uncertainty and instability, leading to a decline in the value of the British pound. Before the referendum, the pound traded at 1.50 USD, but after the decision, it fell to 1.30 USD. Prolonged negotiations between the UK and the EU added to the volatility, further weakening the pound against other currencies.

Understanding these basics of Forex trading is essential for anyone looking to enter the market. VT Markets provides its clients with daily market analysis to keep them up to date with the latest news and help make informed decisions about their investments.