Global debt has exploded to an eye-watering USD 324 trillion—three times the size of the entire world economy. Behind the headline: a toxic mix of government overspending, corporate borrowing, and rising interest rates. It’s fuelling turbulence across currencies, bonds, and equity markets.

For traders, this isn’t just noise—it’s opportunity. Volatility is back, and those who can read the debt signals are positioned to move fast and trade smart. As the IMF flags growing risks from protectionist policies and ballooning deficits, markets are becoming more reactive—and more rewarding for those with a plan.

In this article, we’ll unpack the global debt surge, highlight where the biggest risks and rewards are, and show you how to navigate the uncertainty with trading strategies available through VT Markets.

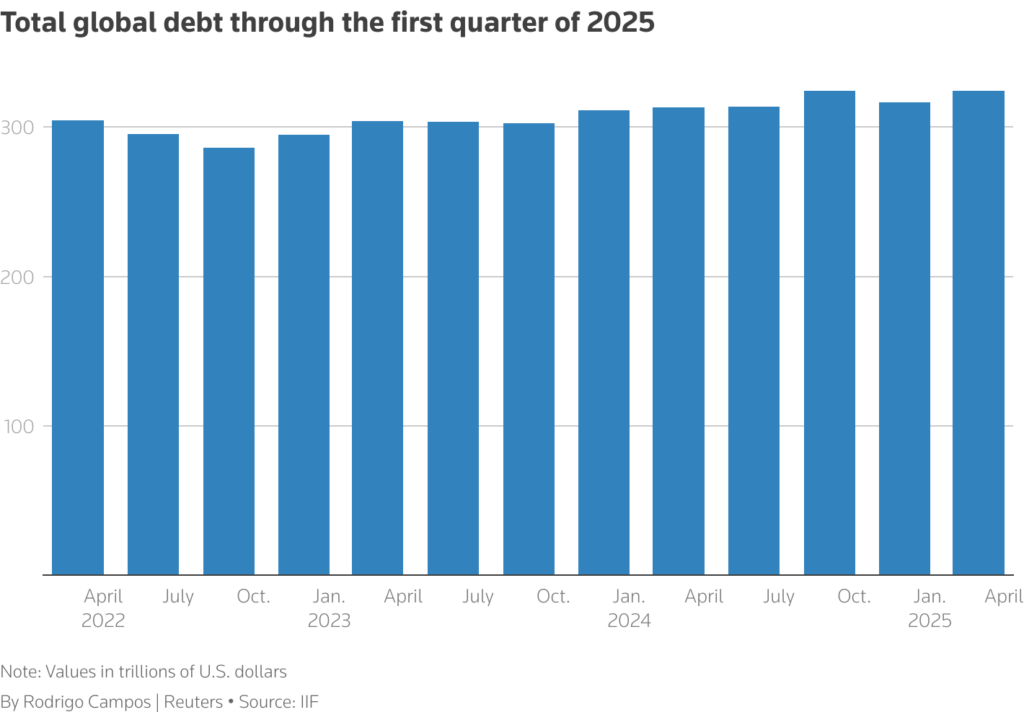

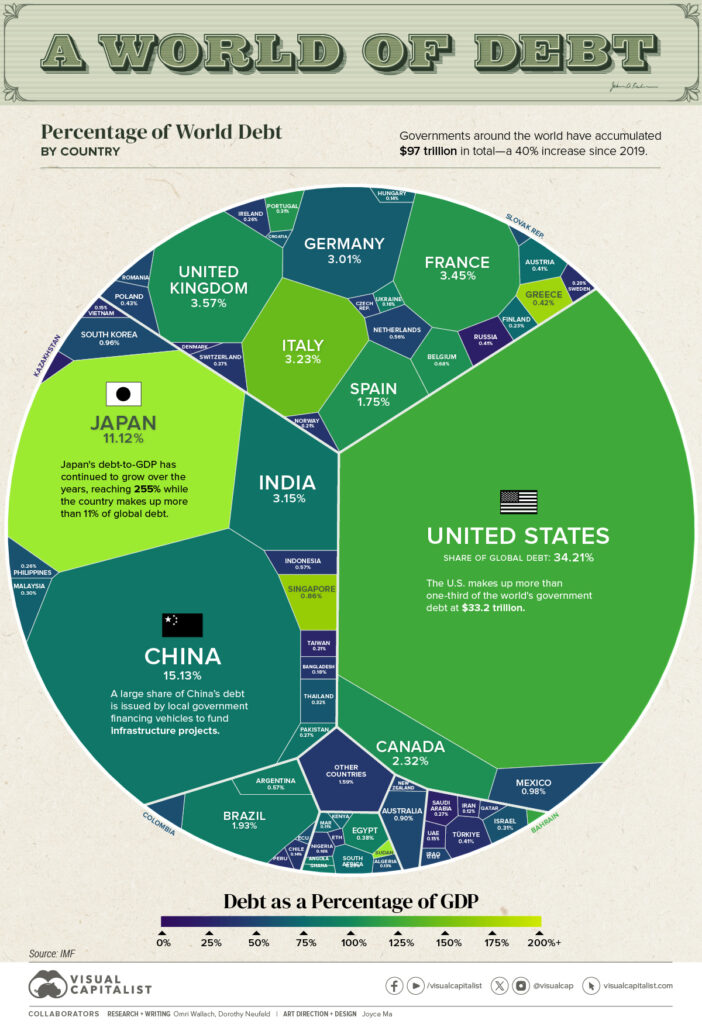

Global debt—covering governments, households, and companies—has hit historic highs. According to the IIF Global Debt Monitor (2025), governments now hold around one-third of the world’s debt, households a smaller portion, and corporations the lion’s share.

China alone added USD 2 trillion recently, followed by France and Germany. Meanwhile, debt levels eased in Canada, the UAE, and Turkey. Emerging markets now face a debt-to-GDP ratio of 245%, meaning their total debt is over double their annual economic output.

To put this in perspective, imagine earning USD 50,000 a year, but owing USD 162,500—that’s 3.25 times your income, roughly matching the global ratio.

A weaker US dollar has added complexity. It’s inflated debt denominated in other currencies, such as the Chinese yuan. Yet for some emerging economies, a softer dollar has also provided relief amid rising US tariff threats.

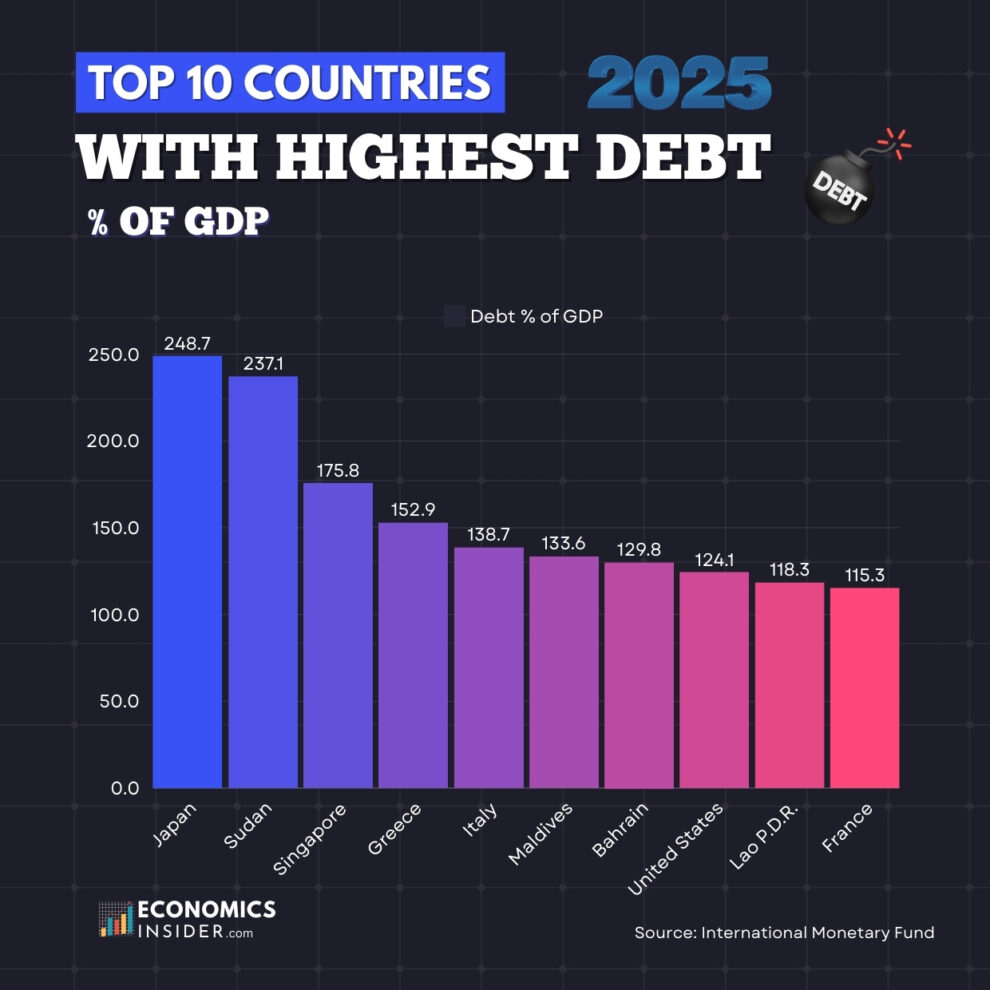

The IMF warns that global public debt now stands at 93% of GDP, up from 78% a decade ago. This growing burden increases the risk of bond market instability—especially as emerging markets must repay USD 7 trillion in bonds and loans in 2025 alone.

Debt isn’t just a problem for governments—it shapes how currencies, bonds, and stocks behave.

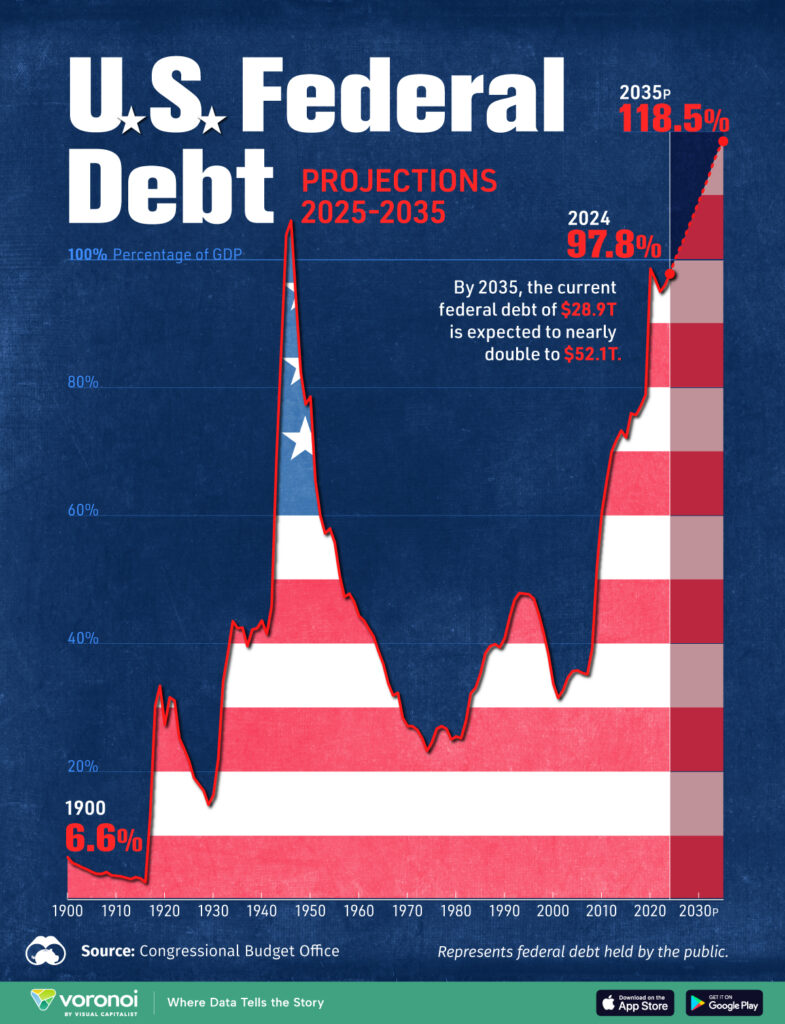

Take the US dollar, for example. Concerns over rising US debt and a Moody’s credit rating downgrade have pushed the dollar lower, boosting currencies like the euro. If you’re trading EUR/USD, this creates an opportunity: a long position could gain from a stronger euro.

But markets can turn quickly. In April 2025, yields on 10-year US Treasury notes rose to 4.31%, then surged to 4.51%, sparking volatility. Traders caught on the wrong side of these moves may suffer losses.

Equity markets have also taken a hit. The MSCI Emerging Markets Index fell 7.9% on 7 April 2025, its worst day since 2008, as debt fears and trade tensions escalated. Meanwhile, investors pulled USD 215 million from the iShares J.P. Morgan USD Emerging Markets Bond ETF.

Emerging market currencies are particularly exposed. Countries like Pakistan, already facing steep tariffs, could see further pressure on the rupee, affecting forex and commodity trades.

Where there’s risk, there’s also reward—if you know where to look.

Key risks:

Opportunities for traders:

To navigate the debt-driven landscape, apply these practical tips:

Spread your capital across forex, equities, and safe-haven assets. A mix of gold, currency pairs, and bonds can buffer you from sudden swings in any one market.

Watch indicators like US Treasury yields and currencies such as the Brazilian real or Indian rupee. These often reflect broader market stress and can signal when to enter or exit trades.

Protect your downside. For instance, place a 2% stop-loss below your entry when trading EUR/USD. This limits potential losses from unexpected moves like yield spikes.

Keep up with VT Markets’ blog, plus reports from the IMF and IIF. These provide essential context for debt-related market shifts. Knowing what’s coming helps you act with confidence.

Example strategy: A trader with USD 10,000 might allocate USD 3,000 to gold, USD 4,000 to a diversified equity ETF, and USD 3,000 to EUR/USD—using stop-losses to cap risk at 3% per trade. VT Markets’ real-time charts help monitor yield changes and price movements.

The global debt boom, driven by major economies and trade tensions, creates a volatile yet opportunity-rich market. Emerging markets’ hefty repayments and rising US Treasury yields highlight risks, from currency swings to equity sell-offs.

Yet, safe-haven assets like gold, currency pairs like EUR/USD, and select emerging market bonds offer profitable paths. By diversifying, monitoring indicators, using stop-losses, and staying informed, you can trade confidently in this uncertain landscape.

Ready to profit from this uncertainty? Open a live account with VT Markets to access cutting-edge tools for trading currency pairs, gold, and bonds, and stay ahead with real-time market insights. Visit VT Markets’ blog for ongoing updates on global trends to fuel your trading journey. Global debt poses challenges, but with the right tools, you can turn risks into rewards.