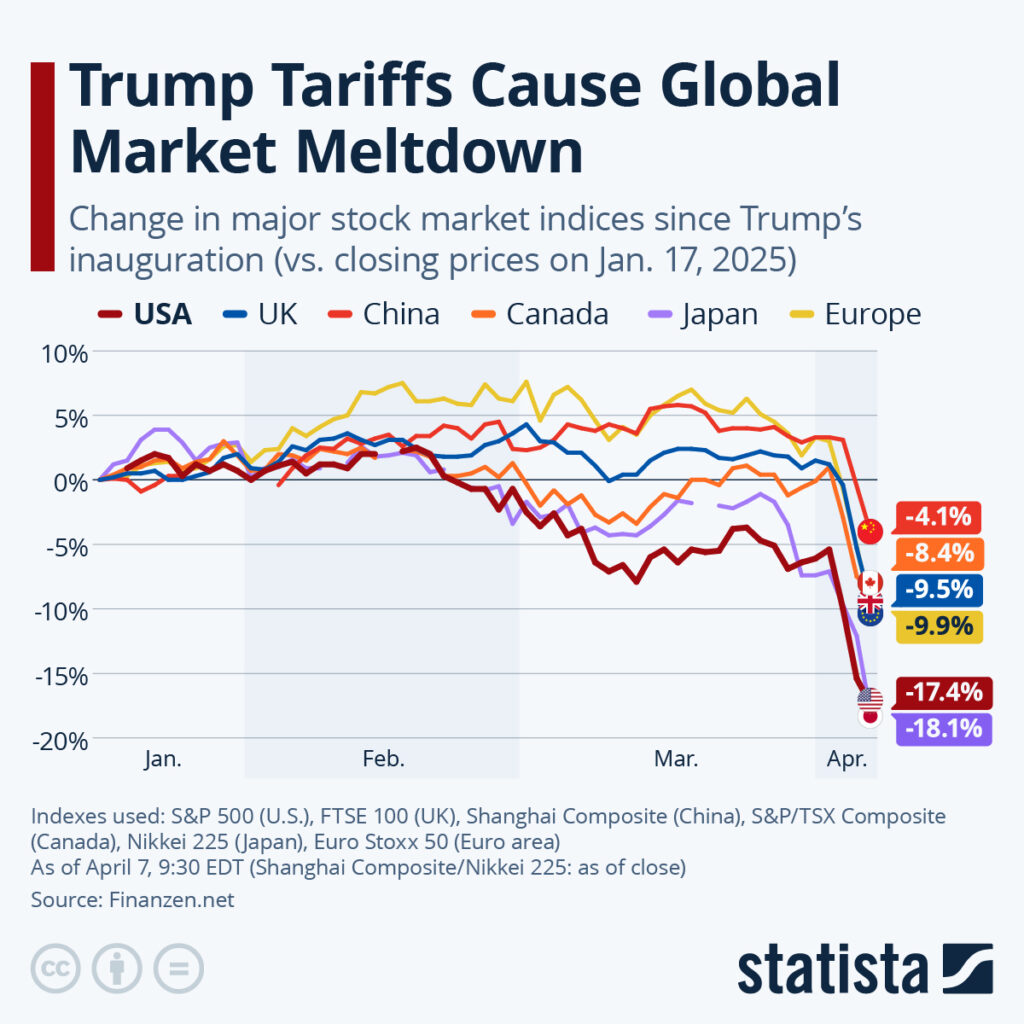

Seventy-eight days into Donald Trump’s second term, global markets are already rattled by his aggressive trade stance. From day one, the US has imposed a wave of tariffs, triggering a fresh and unpredictable trade war.

The financial world is now grappling with sharp asset declines, unusual alliances among major economies like Japan, China, and South Korea, and a surge in market volatility.

Traders face one of the most uncertain environments in recent memory. So, how do you navigate this tariff-fuelled chaos?

In this guide, we’ll break down how Trump’s tariffs are reshaping trading strategies, explore potential recession risks, and examine whether assets like Bitcoin might rebound. Let’s dive into what traders should watch — and how they can stay ahead.

US stocks: Market conditions and risks

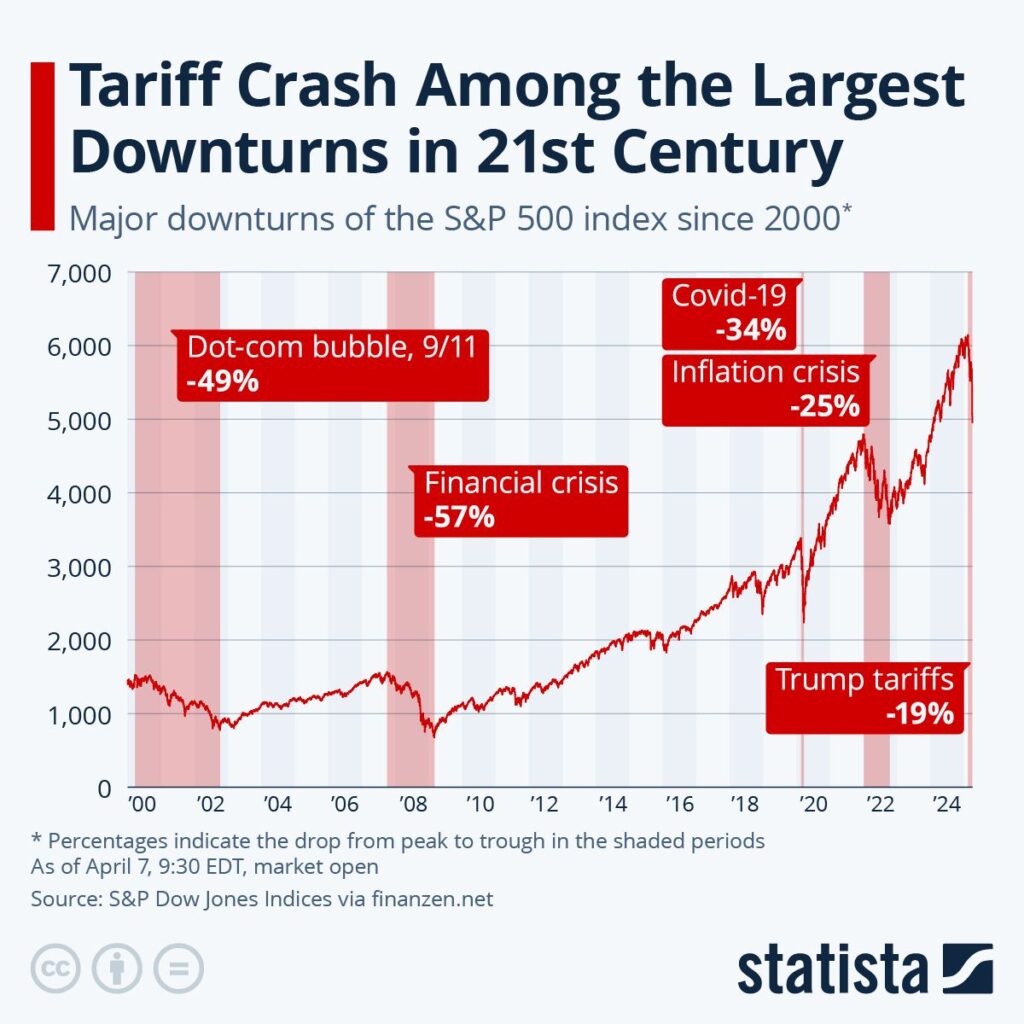

As of April 2025, US equities are under heavy pressure. The S&P 500 has dropped by 21.3%, while the Nasdaq Composite is down 25.6% — both firmly in bear market territory.

While these levels often indicate recession, there have been exceptions (e.g. 1962, 1987, 2022). Still, the spike in the VIX — Wall Street’s volatility index — is sounding alarm bells.

On 7 April, the VIX hit 60.13 and closed at 46.93 the next day — levels not seen since the 2008 and 2020 crashes. This signals extreme market fear, typically observed near bottoms.

Yet history shows that while VIX spikes above 50 can lead to short-term rebounds, they don’t always prevent deeper declines. In 2008 and 2020, markets kept falling even after fear peaked.

Should traders short stocks now?

There could still be room for further downside. If recession fears escalate or corporate earnings disappoint, markets may slip lower. However, much of the negativity appears to be priced in already.

For traders, timing is everything — it’s wise to watch for signs of economic stabilisation or shifts in policy before holding onto short positions too long.

The outlook for US Treasuries has shifted, with the 10-year yield falling to around 4.0% — its lowest since October 2024.

This drop reflects a classic “flight to safety” amid growing recession fears. The yield curve remains inverted, with short-term yields above long-term ones — a pattern that has reliably preceded past recessions.

Should traders short bonds?

Shorting bonds looks increasingly risky. With investors flocking to safe assets, bond prices are rising and yields could fall even more. Unless inflation unexpectedly surges, the environment now favours long bond positions.

The likelihood of additional Fed rate cuts and moderate inflation expectations further reduce the appeal of bond shorts. A cautious, defensive bond strategy appears more suitable for current conditions.

The risk of a US recession continues to climb, with several leading indicators flashing warning signs.

Key recession indicators:

Investment banks are raising their recession probabilities: Goldman Sachs now sees a 45% chance, while J.P. Morgan puts it at 60%. If trade tensions escalate further, those odds could increase.

Conclusion on recession

Although the data points to higher recession risk, a soft landing remains possible. Traders should monitor economic releases closely as we move through Q2 2025. While a shallow recession may be on the horizon, successfully navigating it will require agility and close attention to market signals.

Bitcoin’s recent price performance

In April 2025, Bitcoin (BTC) opened near USD 85,227 but slipped 13% to a low of USD 74,496. It has since rebounded slightly, trading around USD 80,858.

These moves are occurring against a backdrop of broad market uncertainty, and Bitcoin continues to show a strong correlation with traditional indices like the S&P 500.

Fundamentals and sentiment

Despite recent volatility, Bitcoin futures open interest remains robust, suggesting institutional players are still active.

Meanwhile, the M2 money supply is expanding, and stablecoin market capitalisation is on the rise — both signs of increasing liquidity. A growing supply of stablecoins may provide support for crypto assets going forward.

However, Bitcoin is still subject to macroeconomic trends, such as global risk appetite and economic policy shifts. While short-term pressure remains, the medium-term outlook could improve if liquidity continues to grow and risk sentiment stabilises.

Conclusion on Bitcoin recovery

Bitcoin’s path back to USD 100k may not be straightforward, but it remains plausible. As liquidity increases and global markets adjust to the new economic regime, there could be room for recovery.

Traders should track macro factors such as inflation, rate policy, and market volatility to assess when bullish momentum may return.

Trump’s tariffs have reignited a global trade war and sparked exceptional market turbulence. Whether you’re trading stocks, bonds, or Bitcoin, the key is staying agile and informed.

Shorting may still offer opportunities — especially if recession risks deepen — but the landscape demands caution. With economic signals shifting and sentiment fragile, traders must manage risk wisely and avoid overexposure.

At VT Markets, we equip you with the tools, analysis, and support to navigate volatile markets confidently. Stay informed, stay prepared, and trade smarter — even in uncertain times.

Ready to take control of your strategy? Open a live account with VT Markets today and unlock smarter trading in volatile times.