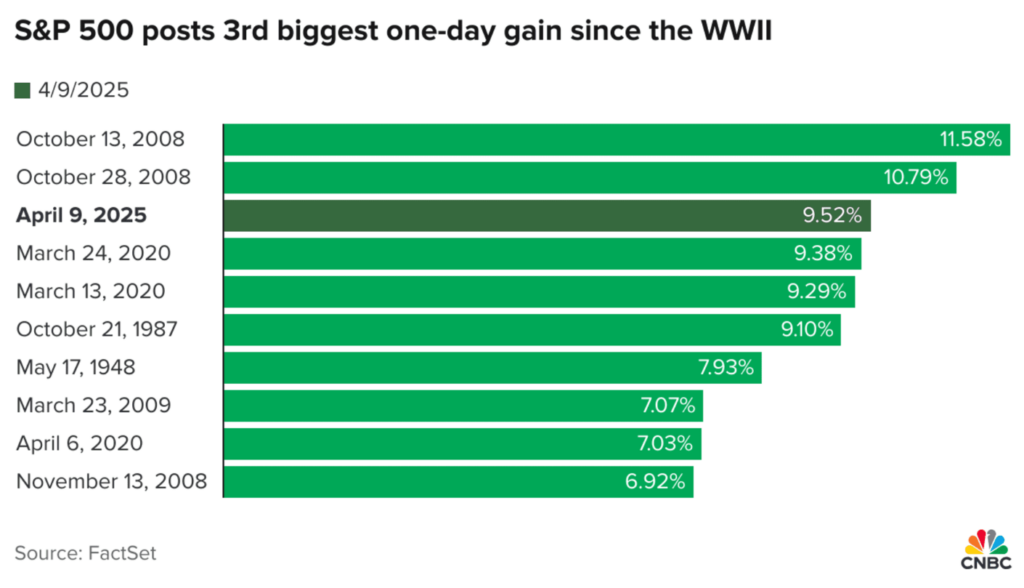

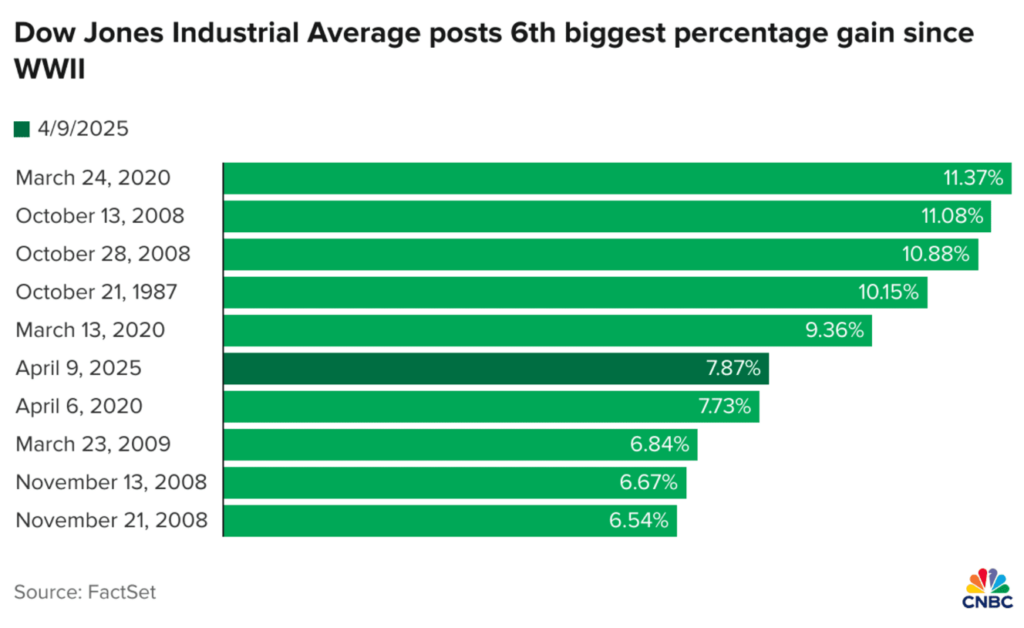

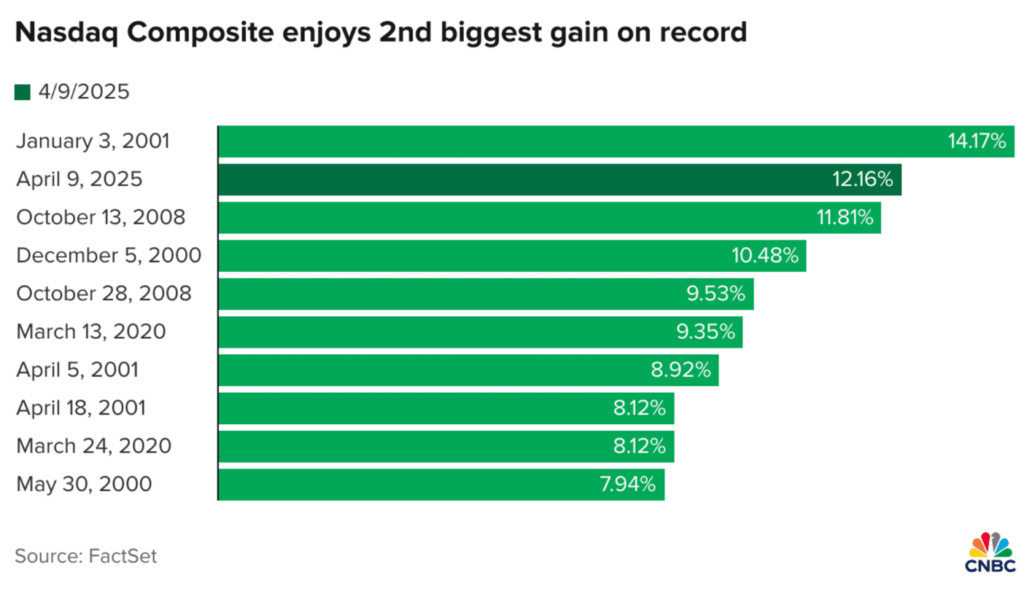

On April 9, 2025, Donald Trump pulled a U-turn on his tariff threats—sparing most countries, though not China—and markets went wild. The S&P 500 rocketed 5.2% in a single day, its biggest leap since November 2008, as trillions poured back into global stocks overnight.

From Tokyo’s Nikkei jumping nearly 2% to Europe’s STOXX 600 climbing 1.8%, indices rallied, the US dollar steadied, and even luxury stocks soared. It was a global sigh of relief after days of tension—until the next twist, of course.

How can everyday traders like you make sense of this madness—and maybe even profit from it? In this article, we’ll break down why markets flipped and share simple, practical steps to ride these waves. It’s the kind of day that keeps traders on their toes, but with a plan, you can stay ahead.

Tariffs are import taxes—simple as that. When Trump threatened them, companies braced for higher costs, supply chains wobbled, and stocks sank. His pause signalled smoother trade, and markets roared back.

The S&P 500’s 5.2% jump led the charge, but it wasn’t a solo act. Europe’s STOXX 600 rose 1.8%, Japan’s Nikkei gained nearly 2%, and even emerging markets like India’s Sensex saw a lift—all in a day. It’s a global game of trust: when the US, the world’s biggest economy, steadies the rules, everyone breathes easier.

Specific sectors felt the shift too. Autos, pharma, and luxury giants—like Tesla, Pfizer, or LVMH—spiked as trade fears eased, with some stocks gaining 7-10% in hours.

The US dollar held firm as investors cheered stability, while gold, a classic safe haven, dipped slightly from USD 2,650/oz to USD 2,630 as panic faded. Rewind to April 8, though, and it was grim—the Dow shed 300 points, and Asian markets closed jittery on tariff dread.

Picture this: you’d bought shares in Tesla on April 8 when markets dipped, spooked by tariff talk. You nabbed them at USD 420 a share with a USD 200 stake—about half a share. Post-U-turn, Tesla soared 7% to USD 449 by April 10. That half-share would’ve earned you roughly USD 14 overnight—not a fortune, but a tidy win for spotting the dip.

That’s the power of policy shifts: fear one day, fortune the next. Markets are like a global pulse—when the US sneezes, everyone feels it. For traders, it’s a wake-up call: big news doesn’t just nudge prices; it can send them soaring or crashing. The key is understanding the chaos and acting before the dust settles.

So, how do you turn chaos into opportunity? Here are some practical moves—no crystal ball needed, just a few smart habits to keep in your back pocket.

1. Stay informed

News moves markets, full stop. Trump’s pause leaked hours before trading began—apps like Reuters, Bloomberg, or CNBC could’ve tipped you off. On April 9, early birds caught the rally’s start, buying into the S&P 500 or Nikkei as they climbed.

Lesson? Check headlines daily; a free news alert could be your edge. For a sharper view, tap into VT Markets’ daily market analysis and Economic Calendar—packed with insights on what’s driving prices and key events to watch, like tariff updates or rate decisions.

It’s not about obsessing over every tweet—just knowing when a U-turn or rate cut hits. A five-minute scroll, plus a quick peek at VT Markets’ tools, could’ve had you ready while others scrambled. Set push notifications for keywords like “Trump” or “trade”—it’s free and takes seconds.

2. Use stop-loss orders

Volatility’s a double-edged sword. Before the U-turn, markets wobbled—perfect stop-loss territory. Set one to cap losses—say, 2% of your USD 500 pot (USD 10).

Imagine you’d bet on the euro dropping against the dollar on tariff fears, entering EUR/USD at 1.0850 with USD 200. The dollar’s post-pause strength pushed it to 1.0870—a stop-loss would’ve cut your loss at USD 5, saving most of your stake.

It’s like a safety net: you might not win every trade, but you won’t lose your shirt. Platforms like VT Markets make it easy—set it once, and it triggers automatically if prices turn sour.

3. Diversify with safe havens

When uncertainty reigns, gold or bonds steady the ship. On April 8, gold held at USD 2,650/oz as stocks slid—then dipped to USD 2,630 as the rally hit. A USD 100 gold ETF buy pre-U-turn could’ve been a calm buffer, sold for a USD 1-2 profit or kept as insurance. Bonds worked too—US Treasuries saw demand before the pause, then eased as stocks rebounded.

It’s about balance: stocks for gains, safe havens for sleep. Before the rally, investors flocked to safety; post-pause, they pivoted back. A small stake in both worlds keeps you grounded when headlines flip.

Trump’s tariff U-turn flipped markets from gloom to boom—the S&P 500’s 5.2% surge, the Dow’s rebound from a 300-point drop, and global gains proved policy matters. One day it’s trillions lost, the next it’s a trillion-dollar rally.

Stay sharp: watch the news, protect your downside with stop-losses, and lean on gold when it’s choppy. You won’t nail every move, but you’ll dodge the worst and catch some wins.

Ready to test the waters? Practice on VT Markets’ demo account—try a USD 100 Tesla trade or a gold buy without risking a penny. Feeling confident? Open a live account with VT Markets today and start small—turn the next headline into your first real win.

Markets love a drama, but with a bit of prep, you can steal the show. Chaos isn’t the enemy—it’s opportunity in disguise. Grab your phone, set those alerts, and get ready for the next twist. You’ve got this.